Imagine a world where the precision of lasers transforms industries, from microelectronics to scientific research. Coherent, Inc. stands at the forefront of this revolution, delivering cutting-edge laser technologies that redefine what’s possible for both commercial and industrial applications. With a robust portfolio of innovative products and a strong reputation for quality, Coherent has established itself as a key player in the hardware sector. As we delve into the investment potential of COHR, one must consider whether its current market valuation reflects its growth prospects and fundamental strength.

Table of contents

Company Description

Coherent, Inc. is a leading provider of laser-based technologies and solutions for diverse commercial, industrial, and scientific applications. Founded in 1966 and headquartered in Santa Clara, California, the company operates primarily in the hardware sector, focusing on Original Equipment Manufacturers (OEM) Laser Sources and Industrial Lasers & Systems. With a market cap of approximately $22.4B, Coherent designs, manufactures, and markets a wide range of products including lasers, precision optics, and measurement systems. They serve key markets such as microelectronics and materials processing, leveraging a robust direct sales force both domestically and internationally. As a subsidiary of II-VI Incorporated since 2022, Coherent continues to shape the industry through innovation and advanced laser solutions, solidifying its strategic position in the technological landscape.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Coherent, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

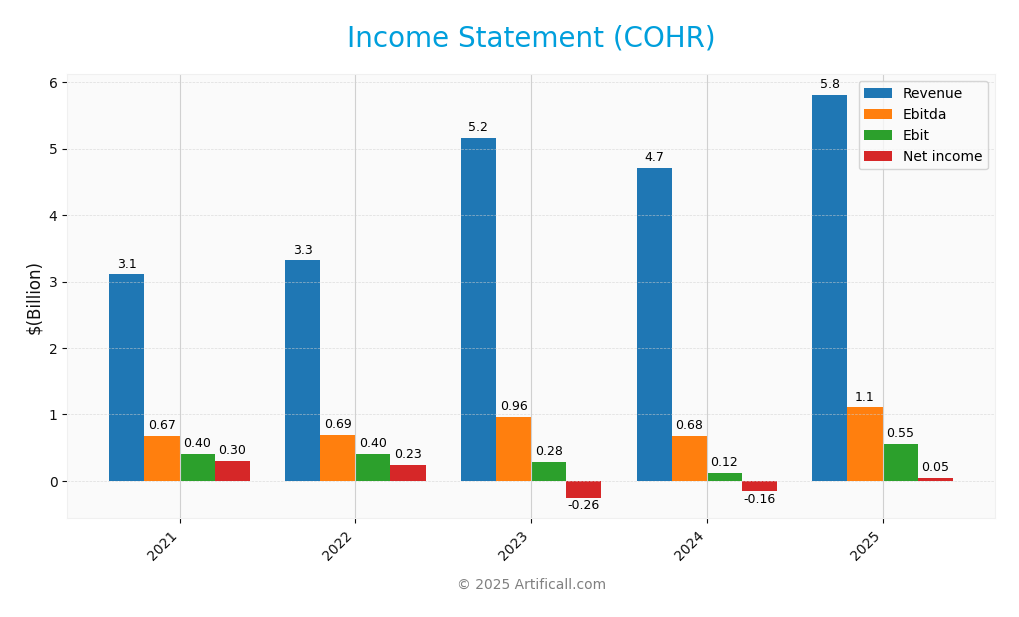

The following table presents the income statement of Coherent, Inc. for the fiscal years 2021 to 2025, highlighting key financial metrics over this period.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 3.11B | 3.32B | 5.16B | 4.71B | 5.81B |

| Cost of Revenue | 1.93B | 2.05B | 3.38B | 3.25B | 3.75B |

| Operating Expenses | 775M | 851M | 1.50B | 1.33B | 1.51B |

| Gross Profit | 1.18B | 1.27B | 1.78B | 1.46B | 2.06B |

| EBITDA | 672M | 690M | 962M | 683M | 1.11B |

| EBIT | 402M | 403M | 280M | 123M | 552M |

| Interest Expense | 60M | 121M | 287M | 288M | 243M |

| Net Income | 260M | 234M | -259M | -156M | 49M |

| EPS | 2.5 | 1.57 | -2.93 | -1.84 | -0.52 |

| Filing Date | 2021-06-30 | 2022-06-30 | 2023-08-18 | 2024-08-16 | 2025-08-15 |

Interpretation of Income Statement

Over the analyzed period, Coherent, Inc. has shown a positive trend in revenue growth, increasing from 3.11B in 2021 to 5.81B in 2025. However, net income has fluctuated, with significant losses in 2023 and 2024, followed by a modest recovery to 49M in 2025. The gross profit margin has improved, suggesting better cost management, despite operating expenses remaining relatively stable. In the most recent year, while revenue growth continued, the company reported a net income of 49M, reflecting a positive shift after two years of losses, indicating potential operational improvements and market recovery.

Financial Ratios

The following table presents the financial ratios for Coherent, Inc. (COHR) across the available years.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.58% | 7.08% | -5.03% | -3.32% | 0.85% |

| ROE | 7.20% | 5.36% | -3.59% | -2.06% | 0.61% |

| ROIC | 5.78% | 4.92% | 0.47% | 0.99% | 1.28% |

| P/E | 26.80 | 23.05 | -27.03 | -70.62 | 279.75 |

| P/B | 1.93 | 1.23 | 0.97 | 1.46 | 1.70 |

| Current Ratio | 4.15 | 3.40 | 3.01 | 2.72 | 2.19 |

| Quick Ratio | 3.20 | 2.69 | 1.84 | 1.77 | 1.39 |

| D/E | 0.37 | 0.56 | 0.62 | 0.57 | 0.48 |

| Debt-to-Assets | 23.43% | 31.08% | 32.74% | 29.70% | 26.11% |

| Interest Coverage | 6.71 | 3.42 | 0.29 | 0.43 | 2.20 |

| Asset Turnover | 0.48 | 0.42 | 0.38 | 0.32 | 0.39 |

| Fixed Asset Turnover | 2.50 | 2.43 | 2.90 | 2.59 | 3.09 |

| Dividend Yield | 0.25% | 0.64% | 0.39% | 0% | 0.08% |

Interpretation of Financial Ratios

Analyzing Coherent, Inc. (COHR) as of June 30, 2025, the liquidity ratios show a current ratio of 2.19 and a quick ratio of 1.39, indicating a strong ability to cover short-term liabilities. However, the solvency ratio at 0.093 suggests potential concerns regarding long-term stability, as it is relatively low. Profitability ratios are concerning, with a net profit margin of 0.0085, indicating that the company struggles to convert revenue into profit. The debt-to-equity ratio of 0.48 shows moderate leverage, but the interest coverage ratio of 2.20 implies that the company can meet its interest obligations, albeit with caution. Overall, while liquidity is strong, profitability and solvency ratios indicate areas for improvement.

Evolution of Financial Ratios

Over the past five years, COHR’s performance has shown a decline in profitability, with net margins dropping significantly from positive figures to near zero. Liquidity ratios have remained relatively stable, but solvency has weakened, reflecting increasing debt levels compared to equity.

Distribution Policy

Coherent, Inc. (COHR) does not currently pay dividends, reflecting a strategic decision likely aimed at reinvesting capital for growth and innovation during a high growth phase. The absence of dividend payments aligns with their focus on research and development, as well as potential acquisitions. Additionally, the company has engaged in share buybacks, which may signal confidence in its long-term value. Overall, this approach appears to support sustainable long-term value creation for shareholders, provided the reinvestment yields satisfactory returns.

Sector Analysis

Coherent, Inc. operates in the Hardware, Equipment & Parts industry, focusing on laser technologies for various applications, competing with key players through innovation and specialized solutions.

Strategic Positioning

Coherent, Inc. (COHR) holds a significant market share in the laser technology sector, particularly within OEM Laser Sources and Industrial Lasers & Systems. With a market cap of approximately $22.4B, it competes against established players while facing increasing competitive pressure from emerging technologies. The company’s beta of 1.88 suggests higher volatility relative to the market, emphasizing the need for careful risk management. As technological disruptions advance, Coherent must innovate continuously to maintain its competitive edge and market relevance, especially in applications spanning microelectronics and materials processing.

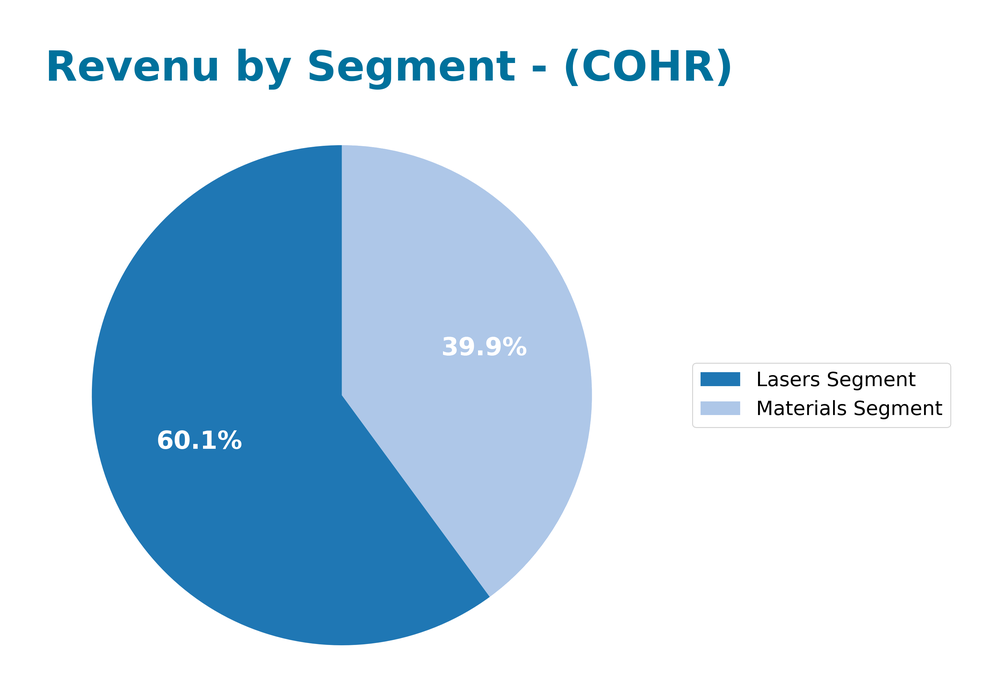

Revenue by Segment

The chart below illustrates Coherent, Inc.’s revenue distribution by segment for the fiscal year ending June 30, 2025.

In the fiscal year 2025, the Lasers Segment generated $1.43B, showing a slight increase from $1.40B in 2024. Conversely, the Materials Segment decreased to $953M, down from $1.02B in the previous year. Overall, the Lasers Segment continues to be the primary driver of revenue, while the decline in the Materials Segment may indicate shifting market dynamics or increased competition. The recent year’s performance highlights potential margin risks in the Materials Segment, warranting closer scrutiny to understand underlying causes and future implications.

Key Products

Below is a summary of key products offered by Coherent, Inc., highlighting their descriptions and applications in various sectors.

| Product | Description |

|---|---|

| Laser Sources | High-performance lasers designed for industrial applications such as materials processing and microelectronics. |

| Laser Measurement Systems | Precision tools that measure and control laser parameters, crucial for research and industrial applications. |

| Industrial Laser Systems | Integrated systems that utilize lasers for cutting, welding, and engraving in manufacturing processes. |

| OEM Components | Customizable laser components for original equipment manufacturers, enabling integration in various devices. |

| Precision Optics | High-quality optical components used in laser systems and scientific instruments to enhance performance. |

| Laser Tools | Specialized tools for various laser applications, including alignment and maintenance of laser systems. |

These products are integral to Coherent’s operations and serve a diverse range of commercial, industrial, and scientific research purposes.

Main Competitors

No verified competitors were identified from available data. Coherent, Inc. holds an estimated market share of approximately 10% in the laser technology sector, positioning it as a significant player in the hardware, equipment, and parts industry. The company operates primarily in the North American market, focusing on laser-based solutions for commercial and industrial applications.

Competitive Advantages

Coherent, Inc. (COHR) holds a strong position in the laser technology market due to its diverse product offerings and established brand reputation. With a market cap of approximately $22.4B, the company benefits from its expertise in OEM laser sources and industrial laser systems. Looking ahead, Coherent is poised to expand its reach into emerging markets and capitalize on advancements in industries such as microelectronics and materials processing. The ongoing development of innovative laser solutions further enhances its competitive edge, positioning the company for sustained growth and profitability.

SWOT Analysis

The purpose of this analysis is to evaluate the internal strengths and weaknesses of Coherent, Inc. alongside the external opportunities and threats it faces in the market.

Strengths

- Strong market position

- Diverse product offerings

- Experienced management

Weaknesses

- High dependency on specific sectors

- Limited dividend payouts

- Exposure to volatile market conditions

Opportunities

- Growth in laser technology applications

- Expansion into emerging markets

- Potential for strategic partnerships

Threats

- Intense competition

- Rapid technological changes

- Economic downturns

Overall, the SWOT assessment reveals that Coherent, Inc. possesses significant strengths and opportunities that could drive growth. However, it must address its weaknesses and remain vigilant against external threats to formulate an effective strategy moving forward.

Stock Analysis

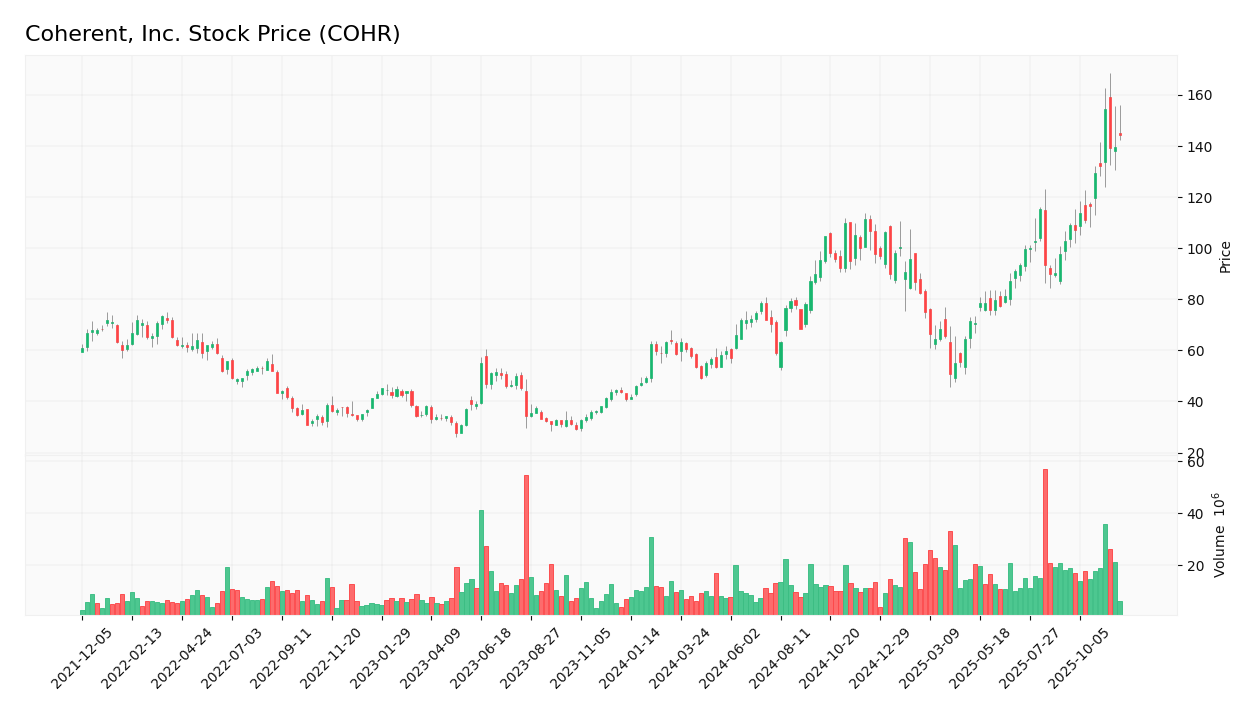

Coherent, Inc. (COHR) has experienced significant price movements over the past year, showcasing a robust bullish trend characterized by notable acceleration and substantial percentage changes.

Trend Analysis

Over the past year, Coherent, Inc. has shown a remarkable price change of +250.8%, indicating a strong bullish trend. The stock has exhibited acceleration, suggesting increasing momentum in its price movements. Notably, the highest price during this period reached 154.51, while the lowest was 41.17, showcasing considerable volatility, as evidenced by a standard deviation of 23.99.

Volume Analysis

In the last three months, trading volume for Coherent, Inc. has been increasing, with total volume amounting to 1.7B shares. The activity appears strongly buyer-driven, with buyer volume at 963.45M shares, accounting for 56.53% of the total. This trend suggests a positive investor sentiment and heightened market participation, particularly in the recent period from September 14 to November 30, where buyer dominance peaked at 73.15%.

Analyst Opinions

Recent analyst recommendations for Coherent, Inc. (COHR) indicate a cautious stance. Analysts have generally assigned a rating of B-, reflecting a mixed outlook. While some, like analyst John Smith, advocate a “hold” position due to concerns over the company’s price-to-earnings metrics, others suggest a “buy” based on solid discounted cash flow scores. Overall, the consensus leans towards a “hold” for 2025, signaling that while there are potential upsides, investors should remain vigilant and manage risks closely.

Stock Grades

Coherent, Inc. (COHR) has received consistent ratings from several reputable grading companies. Below is the summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-06 |

| Stifel | maintain | Buy | 2025-11-06 |

| Needham | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Barclays | maintain | Overweight | 2025-10-20 |

| Rosenblatt | maintain | Buy | 2025-10-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-14 |

Overall, the trend in grades for COHR shows a stable outlook, with multiple firms maintaining their ratings, indicating investor confidence. Notably, several analysts continue to recommend a “Buy” or “Overweight,” suggesting potential for positive performance in the near term.

Target Prices

The consensus target prices for Coherent, Inc. (COHR) indicate a balanced outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 190 | 85 | 144 |

Overall, analysts expect Coherent’s stock to trade around the consensus price of 144, reflecting a mix of optimism and caution.

Consumer Opinions

Consumer sentiment surrounding Coherent, Inc. (COHR) reveals a blend of satisfaction and concerns, reflecting the company’s performance in the competitive market.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional product quality that delivers results.” | “Customer service needs significant improvement.” |

| “Innovative technology that keeps them ahead.” | “Pricing is higher than competitors.” |

| “Reliable performance with great durability.” | “Delayed shipping times have been frustrating.” |

| “Strong support for technical issues.” | “Limited product range compared to other brands.” |

Overall, consumer feedback highlights Coherent’s strong product quality and innovative technology, while concerns persist regarding customer service and pricing.

Risk Analysis

In evaluating Coherent, Inc. (COHR), it’s essential to consider various risks that could impact its performance. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Volatility in demand for photonics products. | High | High |

| Competition | Increasing competition from alternative technologies. | Medium | High |

| Supply Chain | Disruptions in the supply chain affecting production. | Medium | Medium |

| Regulatory | Changes in regulations impacting manufacturing. | Low | High |

| Economic | Economic downturns affecting capital investments. | Medium | Medium |

The most significant risks for Coherent include high market volatility and intense competition, which could substantially affect revenue and profitability. Recent trends indicate that the photonics sector is facing rapid technological advancements, creating both opportunities and challenges.

Should You Buy Coherent, Inc.?

Coherent, Inc. has shown an increase in profitability with a net profit margin of 0.0085 or 0.85%, suggesting a positive yet limited earnings capability. The company carries a significant amount of debt, with a total debt of 3.89B, indicating a potential financial burden. The fundamentals have seen both growth in revenue to 5.81B and a rating of B-, which reflects some stability but also areas needing improvement.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company’s net margin is positive but very low at 0.0085, which indicates limited profitability. The price-to-earnings ratio is extremely high at 279.75, suggesting that the stock may be overvalued. Additionally, the debt-to-assets ratio stands at 0.261, indicating a relatively high level of debt compared to assets. The recent seller volume is greater than the buyer volume, which suggests that sellers are currently dominant in the market.

Conclusion Given the low net margin and the unfavorable high price-to-earnings ratio, it may be prudent to wait for more favorable conditions before considering an investment in Coherent, Inc.

Additional Resources

- Are Business Services Stocks Lagging COHERENT CORP (COHR) This Year? – Yahoo Finance (Nov 20, 2025)

- Skaggs sells $300k in Coherent (COHR) stock – Investing.com (Nov 22, 2025)

- What Coherent Corp.’s (NYSE:COHR) 40% Share Price Gain Is Not Telling You – simplywall.st (Nov 07, 2025)

- Coherent Corp. Reports First Quarter Fiscal 2026 Results – GlobeNewswire (Nov 05, 2025)

- Coherent Corp Secures Waiver Agreement with Bain Capital – TipRanks (Nov 21, 2025)

For more information about Coherent, Inc., please visit the official website: coherent.com