In a world where data drives decisions, MongoDB, Inc. stands at the forefront of the software infrastructure industry, transforming how businesses manage and utilize data. With its innovative database solutions like MongoDB Atlas and Enterprise Advanced, the company empowers organizations to harness the full potential of their data, whether in the cloud or on-premises. As I examine MongoDB’s current market position and growth trajectory, I question whether its strong fundamentals still align with its elevated market valuation and potential for future expansion.

Table of contents

Company Description

MongoDB, Inc. is a prominent player in the software infrastructure sector, specializing in general-purpose database solutions. Founded in 2007 and headquartered in New York City, the company offers a range of products, including MongoDB Enterprise Advanced for enterprise clients, MongoDB Atlas as a multi-cloud database-as-a-service, and Community Server for developers. With a market capitalization of approximately $26.7B, MongoDB has established itself as a leader in the database technology landscape, catering to diverse geographic markets worldwide. The company emphasizes innovation and adaptability, shaping its industry by providing flexible, scalable solutions that meet the evolving needs of modern data management.

Fundamental Analysis

In this section, I will analyze MongoDB, Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

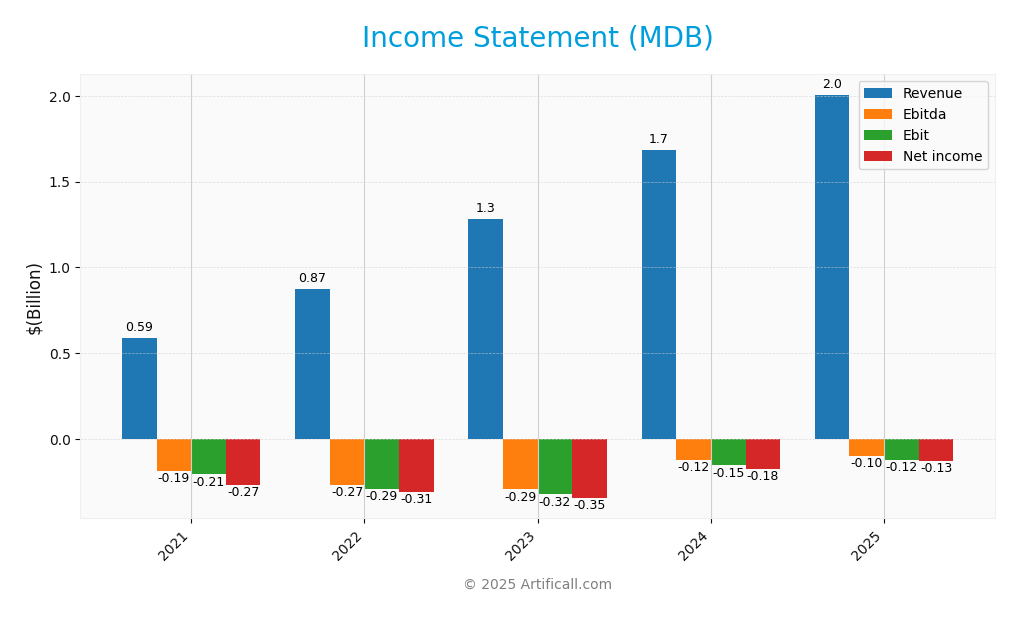

The following table presents MongoDB, Inc.’s income statement for the fiscal years 2021 to 2025, reflecting key financial metrics that are essential for assessing the company’s performance over time.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 590M | 874M | 1.28B | 1.68B | 2.01B |

| Cost of Revenue | 177M | 259M | 349M | 424M | 535M |

| Operating Expenses | 623M | 904M | 1.28B | 1.49B | 1.69B |

| Gross Profit | 413M | 614M | 935M | 1.26B | 1.47B |

| EBITDA | -186M | -267M | -294M | -122M | -97M |

| EBIT | -207M | -292M | -323M | -154M | -124M |

| Interest Expense | 51M | 11M | 10M | 9M | 8M |

| Net Income | -267M | -307M | -345M | -177M | -129M |

| EPS | -4.53 | -4.75 | -5.03 | -2.48 | -1.73 |

| Filing Date | 2021-03-22 | 2022-03-18 | 2023-03-17 | 2024-03-15 | 2025-03-21 |

Interpretation of Income Statement

Over the five-year period, MongoDB, Inc. has demonstrated consistent revenue growth, climbing from 590M in 2021 to 2.01B in 2025, indicating a strong market demand for its services. However, net income remains negative, although losses have narrowed from -267M in 2021 to -129M in 2025, suggesting improved operational efficiency and cost management. The gross profit margin has stabilized, reflecting the company’s ability to manage costs relative to its growing revenues. In 2025, while revenue growth continues, the EBITDA loss has decreased, indicating a trend towards improved profitability, though the company still faces challenges in achieving a positive net income.

Financial Ratios

The following table summarizes the key financial ratios for MongoDB, Inc. (MDB) across the last few fiscal years.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -45.22% | -35.12% | -26.90% | -10.49% | -6.43% |

| ROE | 53.04% | -46.03% | -46.71% | -16.52% | -4.64% |

| ROIC | -20.15% | -15.18% | -17.88% | -10.90% | -7.36% |

| P/E | -82.83 | -39.23 | -42.56 | -161.59 | -157.88 |

| P/B | -4393.32 | 39.23 | 19.88 | 26.69 | 7.32 |

| Current Ratio | 3.22 | 4.02 | 3.80 | 4.40 | 5.20 |

| Quick Ratio | 3.22 | 4.02 | 3.80 | 4.40 | 5.20 |

| D/E | -194.55 | 1.77 | 1.60 | 1.11 | 0.01 |

| Debt-to-Assets | 69.57% | 48.31% | 45.77% | 41.26% | 1.06% |

| Interest Coverage | -3.73 | -25.57 | -35.38 | -24.90 | -26.70 |

| Asset Turnover | 0.42 | 0.36 | 0.50 | 0.59 | – |

| Fixed Asset Turnover | 6.09 | 8.37 | 12.97 | 18.62 | 24.78 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing MongoDB, Inc.’s financial ratios for FY 2025 reveals a mixed picture. The liquidity ratios are strong, with a current ratio of 5.20 and a quick ratio also at 5.20, indicating ample short-term liquidity. However, profitability ratios are concerning, as the net profit margin stands at -6.43%, reflecting ongoing losses. The solvency ratio is negative at -0.16, raising questions about the company’s long-term viability, especially considering its debt-to-equity ratio of 0.01, which suggests minimal leverage. Efficiency is moderate, with a receivables turnover of 5.10, but the company must improve its inventory management, as the inventory turnover remains at zero. Overall, while liquidity is solid, the persistent losses and negative solvency raise significant concerns for investors.

Evolution of Financial Ratios

Over the past five years, MongoDB’s financial ratios have shown a trend towards improving liquidity, with the current ratio increasing from 3.22 in FY 2021 to 5.20 in FY 2025. However, profitability has consistently remained negative, indicating ongoing challenges in achieving sustainable earnings.

Distribution Policy

MongoDB, Inc. (MDB) does not pay dividends, reflecting its strategy of reinvesting in growth opportunities during its high-growth phase. The company prioritizes research and development over shareholder distributions, which is common among tech firms aiming for expansion. While MDB engages in share buybacks, the absence of dividends raises questions about immediate returns for investors. Overall, this approach may foster long-term value creation, provided the company effectively leverages its investments for sustained growth.

Sector Analysis

MongoDB, Inc. operates in the Software – Infrastructure industry, offering a versatile database platform that competes with major players like Oracle and Microsoft. Its strengths include a robust cloud service and an open-source model, while key challenges involve market competition and scalability risks.

Strategic Positioning

MongoDB, Inc. (MDB) holds a significant position in the software infrastructure market, with a current market capitalization of approximately $26.7B. The company has carved out a strong market share through its innovative database solutions, particularly MongoDB Atlas, which is gaining traction against competitors. However, it faces increasing competitive pressure from established players and emerging technologies that threaten to disrupt its offerings. With a beta of 1.446, the stock exhibits higher volatility, indicating potential risks associated with market fluctuations. As an investor, I remain cautious and focused on monitoring these dynamics closely.

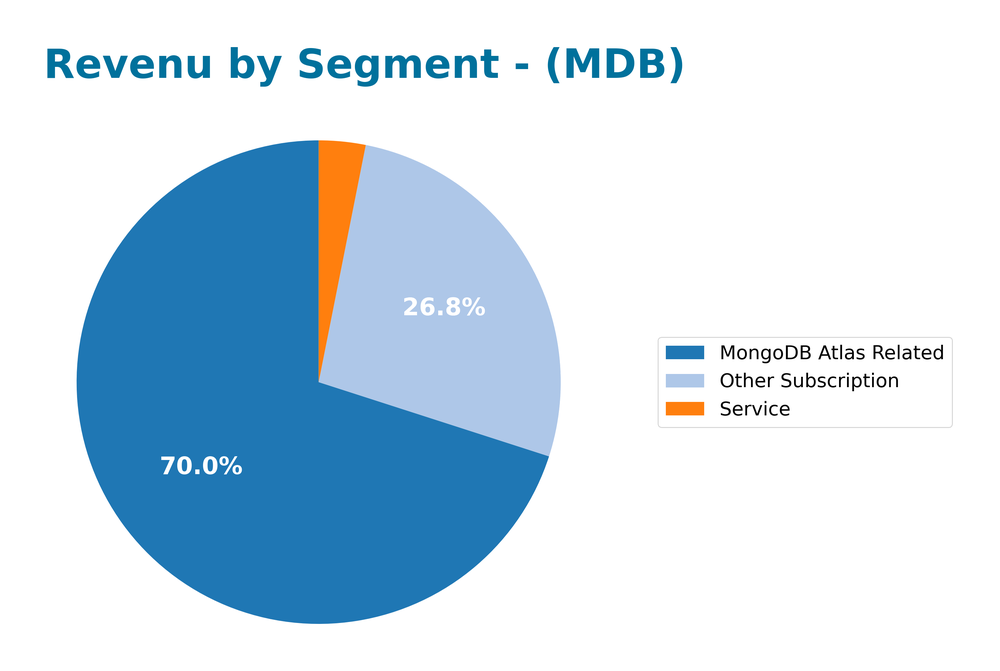

Revenue by Segment

The pie chart illustrates MongoDB, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the performance of its key product lines.

In 2025, MongoDB Atlas Related continued to dominate revenue, generating $1.41B, up from $1.11B in 2024, signifying robust growth in cloud services. Other Subscription also saw growth, reaching $538.7M, while Service revenue increased modestly to $62.6M. The most recent year indicates a sustained acceleration in Atlas revenue, reflecting strong demand for cloud-based database solutions. However, concentration risks remain, as the majority of revenue stems from the Atlas segment, necessitating careful monitoring of market dynamics and competitive pressures.

Key Products

Below is a summary of MongoDB, Inc.’s key products that cater to a range of database needs for businesses.

| Product | Description |

|---|---|

| MongoDB Enterprise Advanced | A commercial database server designed for enterprise customers, offering flexibility to run in cloud, on-premise, or hybrid environments. |

| MongoDB Atlas | A hosted multi-cloud database-as-a-service solution, enabling easy deployment and scalability across various cloud providers. |

| Community Server | A free-to-download version of MongoDB, which includes essential functionalities for developers looking to get started with the platform. |

| Professional Services | Services including consulting and training to help organizations maximize their use of MongoDB products effectively. |

These products position MongoDB as a key player in the software infrastructure industry, providing robust solutions for diverse database requirements.

Main Competitors

No verified competitors were identified from available data. MongoDB, Inc. holds an estimated market share of approximately 20% in the cloud database sector, positioning itself as a strong player within the software infrastructure industry. Its competitive position is characterized by a robust product offering, including MongoDB Atlas, which caters to a diverse range of enterprise customers globally.

Competitive Advantages

MongoDB, Inc. (MDB) holds significant competitive advantages in the rapidly evolving database software market. Its unique offerings, such as MongoDB Atlas, provide a robust multi-cloud database-as-a-service that appeals to enterprise clients seeking flexibility and scalability. The company’s focus on continuous innovation suggests a promising outlook, with potential expansions into new markets and the development of advanced features that enhance user experience. Additionally, as businesses increasingly adopt cloud solutions, MongoDB is well-positioned to capture a larger share of this growing demand, making it an attractive consideration for investors.

SWOT Analysis

This SWOT analysis aims to identify MongoDB, Inc.’s internal strengths and weaknesses, as well as external opportunities and threats that may impact its strategic direction.

Strengths

- Strong brand recognition

- Innovative product offerings

- Scalable infrastructure

Weaknesses

- No dividend payments

- High beta indicates volatility

- Limited market penetration in some regions

Opportunities

- Growing demand for cloud services

- Expansion into emerging markets

- Increasing adoption of NoSQL databases

Threats

- Intense competition in the software industry

- Economic downturns affecting IT budgets

- Regulatory changes impacting data management

Overall, MongoDB, Inc. demonstrates significant strengths and opportunities that can drive growth. However, the company must navigate its weaknesses and external threats carefully to ensure stability and sustained success in the competitive technology landscape.

Stock Analysis

Over the past year, MongoDB, Inc. (MDB) has experienced significant price movements, marked by a bearish trend characterized by notable highs and lows. The stock reached a peak of 500.9 and a low of 154.39, indicating considerable volatility in its trading dynamics.

Trend Analysis

Analyzing the stock’s performance over the past year, I observed a percentage change of -9.51%. This decline clearly indicates a bearish trend. Furthermore, the acceleration status of the trend suggests increasing downward momentum, supported by a standard deviation of 74.29, which reflects high volatility.

In the recent period from September 14, 2025, to November 30, 2025, the stock has shown a minimal percentage change of 0.16%, indicating a neutral trend in this short timeframe. The trend slope of 2.01 suggests slight upward movement, but it remains essential to consider the broader bearish context.

Volume Analysis

In terms of trading volumes over the last three months, total volume reached approximately 1.06B, with 540.8M attributed to buyers and 516.0M to sellers. This indicates a slight buyer dominance of 50.94%. The volume trend has been increasing, suggesting heightened market participation.

In the recent period, buyer volume was 52.0M compared to seller volume of 44.9M, further reinforcing the slightly buyer-dominant sentiment with a buyer dominance percentage of 53.67%. This ongoing buyer-driven activity, despite the bearish price trend, may reflect cautious optimism among investors.

Analyst Opinions

Recent analyst recommendations for MongoDB, Inc. (MDB) indicate a cautious stance, with an overall rating of “C.” Analysts highlight concerns regarding the company’s return on equity (1) and price-to-earnings ratio (1), suggesting potential valuation issues. However, the debt-to-equity ratio (3) is viewed positively, indicating manageable leverage. Notable analysts recommend a “hold” position, reflecting uncertainty in growth prospects. As of 2025, the consensus leans towards a “hold,” urging investors to monitor developments closely before making any significant moves.

Stock Grades

MongoDB, Inc. (MDB) has received consistent ratings from multiple credible grading companies, indicating a strong sentiment among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-20 |

| Guggenheim | Maintain | Buy | 2025-11-18 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| RBC Capital | Maintain | Outperform | 2025-11-04 |

| Citizens | Maintain | Market Outperform | 2025-11-04 |

| Truist Securities | Maintain | Buy | 2025-11-04 |

| BMO Capital | Maintain | Outperform | 2025-11-04 |

| DA Davidson | Maintain | Buy | 2025-11-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-22 |

| Needham | Maintain | Buy | 2025-09-19 |

The overall trend reveals a strong consensus among analysts, with multiple firms maintaining their “Buy” ratings for MongoDB. This suggests a positive outlook for the company, with several analysts indicating it may outperform the market in the near term.

Target Prices

The consensus target prices for MongoDB, Inc. (MDB) indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 430 | 375 | 405 |

Analysts expect the stock to reach a consensus price of 405, reflecting a solid range of expectations between 375 and 430.

Consumer Opinions

Consumer sentiment regarding MongoDB, Inc. reflects a mix of enthusiasm for its innovative database solutions and concerns about certain aspects of its service.

| Positive Reviews | Negative Reviews |

|---|---|

| “MongoDB has revolutionized our data management!” | “The pricing can be quite steep for small startups.” |

| “User-friendly interface and excellent support.” | “Performance issues during peak loads.” |

| “Great flexibility for scaling applications.” | “Documentation could be more comprehensive.” |

Overall, consumer feedback indicates that while MongoDB is praised for its user-friendly design and scalability, concerns about pricing and documentation persist.

Risk Analysis

In evaluating MongoDB, Inc. (MDB), it’s essential to consider the various risks that could impact its performance and investment potential. Below is a synthesized risk assessment:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the tech sector affecting growth. | High | High |

| Competition | Intense competition from established players and startups. | High | High |

| Regulatory Risk | Potential changes in data privacy laws impacting operations. | Medium | Medium |

| Cybersecurity | Threat of data breaches that could harm reputation. | High | High |

| Economic Downturn | General economic slowdown affecting client budgets. | Medium | High |

The most significant risks for MDB include intense market competition and cybersecurity threats, both of which can substantially impact the company’s growth trajectory and reputation.

Should You Buy MongoDB, Inc.?

MongoDB, Inc. (ticker: MDB) is currently reporting a negative net margin of -6.43%, indicating a loss in profitability. The company holds a minimal debt level with a debt-to-equity ratio of 0.013, suggesting a strong balance sheet. However, the overall fundamentals reflect ongoing challenges, as evidenced by the negative trends in profitability and cash flow. The company’s rating stands at C, indicating average performance relative to its peers.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The company is experiencing a negative trend in profitability with a net margin of -6.43% and a return on invested capital (ROIC) of -7.36%, which is below the weighted average cost of capital (WACC) at 10.45%, indicating value destruction. The stock is also rated C, suggesting average performance, and the overall trend has been bearish with a price change of -9.51%. Additionally, the recent seller volume exceeds recent buyer volume, reflecting a lack of demand.

Conclusion Given the negative net margin and the destruction of value indicated by the ROIC being lower than the WACC, it might be prudent to wait for more favorable conditions before considering an investment in MongoDB, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Strong Results Lifted MongoDB (MDB) in Q3 – Yahoo Finance (Nov 25, 2025)

- Prudential PLC Sells 1,830 Shares of MongoDB, Inc. $MDB – MarketBeat (Nov 25, 2025)

- MongoDB (MDB) Expected to Beat Earnings Estimates: What to Know Ahead of Q3 Release – Finviz (Nov 24, 2025)

- MongoDB, Inc. $MDB Shares Acquired by DNB Asset Management AS – MarketBeat (Nov 25, 2025)

- Citigroup Maintains MongoDB (MDB) Buy Recommendation – Nasdaq (Nov 20, 2025)

For more information about MongoDB, Inc., please visit the official website: mongodb.com