Arqit Quantum Inc. is redefining cybersecurity by leveraging cutting-edge quantum technology to secure communication in our increasingly digital world. With its innovative QuantumCloud platform, Arqit enables devices to generate encryption keys seamlessly, setting a new standard in data protection. As a key player in the software infrastructure sector, the company has earned a reputation for its quality and market influence. However, as I evaluate its current market valuation and future growth potential, I must ask: do the fundamentals still support a strong investment case?

Table of contents

Company Description

Arqit Quantum Inc. is a pioneering player in the cybersecurity sector, specializing in advanced encryption technologies through both satellite and terrestrial platforms. Founded in 2021 and headquartered in London, UK, Arqit operates primarily in the United Kingdom, offering its flagship product, QuantumCloud, which allows any device to generate encryption keys securely. With a market cap of approximately $402M, the company positions itself as an innovator in the Software – Infrastructure industry. Arqit’s strategic focus on enhancing cybersecurity through quantum technology places it at the forefront of transforming security practices, ensuring robust protection against emerging digital threats.

Fundamental Analysis

In this section, I will analyze Arqit Quantum Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and performance.

Income Statement

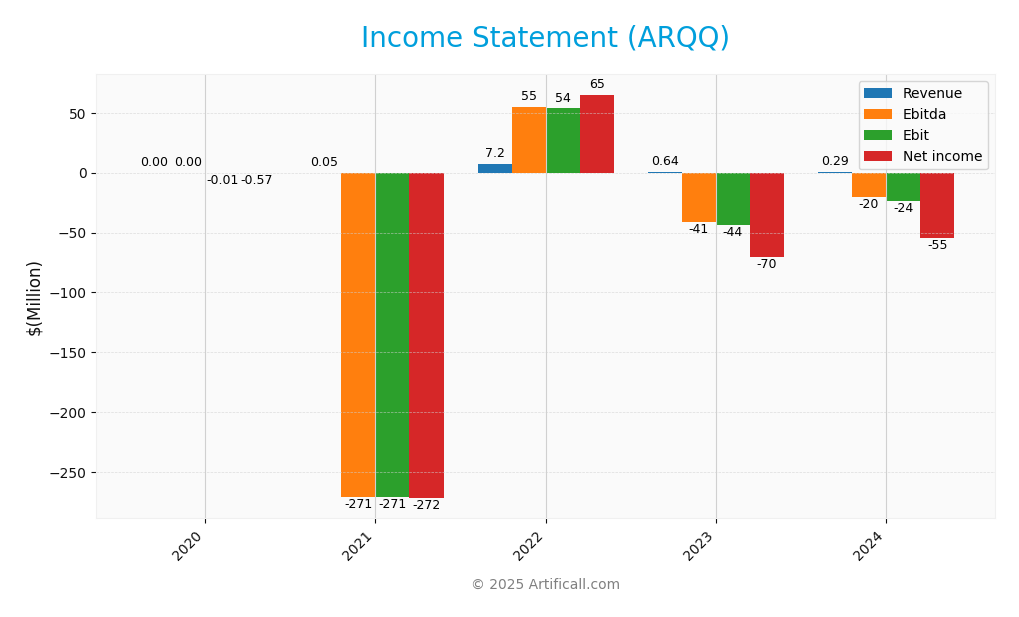

The income statement provides a snapshot of Arqit Quantum Inc.’s financial performance over the past five fiscal years, highlighting revenue, expenses, and net income.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 0 | 48.91K | 7.21M | 640K | 293K |

| Cost of Revenue | 159K | 187K | 1.29M | 2.29M | 1.88M |

| Operating Expenses | 650K | 172.61M | 70.98M | 82.80M | 23.10M |

| Gross Profit | -159K | -139K | 5.92M | -1.65M | -1.59M |

| EBITDA | 0 | -270.60M | 54.92M | -41.20M | -20.19M |

| EBIT | -5K | -270.65M | 53.63M | -43.83M | -23.75M |

| Interest Expense | 393K | 1.08M | 221K | 284K | 223K |

| Net Income | -568K | -271.73M | 65.08M | -70.39M | -54.58M |

| EPS | -0.24 | -99.42 | 13.43 | -13.39 | -10.79 |

| Filing Date | 2020-09-30 | 2021-12-16 | 2022-12-14 | 2023-11-21 | 2024-12-05 |

Interpretation of Income Statement

Over the five-year period, Arqit Quantum Inc.’s revenue peaked in 2022 at 7.21M before declining sharply to 640K in 2023 and further to 293K in 2024, indicating significant challenges in maintaining sales. Net income followed a similar trajectory, moving from a positive 65.08M in 2022 to a notable loss of 54.58M in 2024. The gross profit margins have deteriorated, reflecting increased costs. The latest year showcases a continued decline in both revenue and net income, signaling potential operational inefficiencies and necessitating a cautious approach for investors considering future investments.

Financial Ratios

The following table summarizes the financial ratios for Arqit Quantum Inc. (ARQQ) over the last few fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0% | -5671.66% | 9.02% | -109.99% | -186.28% |

| ROE | -61.01% | 8.03% | 0.83% | -1.06% | -4.62% |

| ROIC | -5.84% | -1.79% | -0.51% | -0.75% | -1.67% |

| P/E | -1001.41 | -5.05 | 10.55 | -1.11 | -0.53 |

| P/B | 610.96 | -40.52 | 8.74 | 1.17 | 2.44 |

| Current Ratio | 0.06 | 5.29 | 2.38 | 3.22 | 1.94 |

| Quick Ratio | 0.08 | 5.16 | 2.38 | 3.22 | 1.94 |

| D/E | 5.86 | 0 | 0.10 | 0.13 | 0.08 |

| Debt-to-Assets | 58.64% | 0% | 6.33% | 8.42% | 3.71% |

| Interest Coverage | -2.06 | 0 | -235.74 | -191.93 | -110.72 |

| Asset Turnover | 0 | 0.0004 | 0.058 | 0.0064 | 0.011 |

| Fixed Asset Turnover | 0 | 0.24 | 0.86 | 0.079 | 0.272 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Arqit Quantum Inc. (ARQQ) for FY 2024 reveals significant challenges in financial health. The liquidity ratios are relatively strong, with a current ratio of 1.94 and a cash ratio of 1.53, indicating adequate liquidity to cover short-term obligations. However, solvency is concerning, as evidenced by a solvency ratio of -3.42, highlighting a precarious financial structure. Profitability ratios are alarming, with net profit margin at -186.28% and EBIT margin at -81.07%, indicating substantial losses. Efficiency ratios, such as the asset turnover of 0.01, suggest inefficiency in using assets to generate revenue. Overall, while liquidity is acceptable, the company’s profitability and solvency present serious concerns for potential investors.

Evolution of Financial Ratios

Over the past five years, ARQQ’s financial ratios have shown a deteriorating trend, particularly in profitability metrics. The current ratio has decreased from 5.29 in FY 2021 to 1.94 in FY 2024, highlighting declining liquidity, while profitability margins have shifted dramatically from positive to severely negative values, indicating worsening financial performance.

Distribution Policy

Arqit Quantum Inc. (ARQQ) does not pay dividends, a decision likely rooted in its ongoing high-growth phase and the need for capital to reinvest into research and development. The company’s focus on innovation over immediate shareholder returns suggests a strategy aimed at long-term value creation. Additionally, ARQQ has been active in share buybacks, which signals management’s confidence despite the lack of dividend payouts. However, the absence of dividends and ongoing losses may pose risks to sustainable value creation for shareholders.

Sector Analysis

Arqit Quantum Inc. operates in the Software – Infrastructure sector, offering innovative cybersecurity solutions through its QuantumCloud platform, facing competition from established firms while leveraging cutting-edge quantum encryption technology.

Strategic Positioning

Arqit Quantum Inc. (ARQQ) currently holds a niche position within the cybersecurity sector, specifically through its innovative QuantumCloud technology. As a provider of advanced encryption services via satellite and terrestrial platforms, the company faces competitive pressure from established cybersecurity firms and emerging tech disruptors. With a market cap of $402M and a beta of 2.353, ARQQ exhibits volatility, suggesting higher risk but also potential for significant returns. The ongoing technological disruption in cybersecurity emphasizes the need for robust encryption solutions, positioning Arqit strategically for growth in a rapidly evolving market.

Key Products

Arqit Quantum Inc. offers innovative products that enhance cybersecurity through advanced quantum technology. Below are some key products provided by the company:

| Product | Description |

|---|---|

| QuantumCloud | A cloud-based service allowing devices to generate encryption keys securely through a lightweight software agent. |

| QuantumKey | A specialized key generation service that uses quantum technology to provide unbreakable encryption. |

| Satellite Encryption | A service that utilizes satellite technology to ensure secure communication for devices in remote locations. |

| Terrestrial Platform | A ground-based solution that complements satellite services, providing robust security for urban and rural environments. |

Main Competitors

No verified competitors were identified from available data. However, I can provide an overview of Arqit Quantum Inc.’s competitive position. Arqit operates in the cybersecurity sector, specifically focusing on quantum encryption technologies. Its market share is not clearly defined due to the lack of reliable competitor data, but it occupies a unique niche within the broader technology sector, particularly in the United Kingdom. The company’s innovative approach places it at the forefront of advancements in secure communication technologies.

Competitive Advantages

Arqit Quantum Inc. (ARQQ) holds a competitive edge in the cybersecurity market with its innovative QuantumCloud technology, allowing seamless encryption key generation across devices. This positions the company favorably in an era increasingly focused on data security. Looking ahead, Arqit is poised to explore new markets and develop additional products that leverage its quantum technology, enhancing its service offerings and expanding its customer base. With a growing emphasis on cybersecurity globally, Arqit stands to capitalize on emerging opportunities, ensuring its relevance and resilience in the evolving tech landscape.

SWOT Analysis

This analysis aims to identify the strengths, weaknesses, opportunities, and threats facing Arqit Quantum Inc. (ARQQ) to inform strategic decision-making.

Strengths

- Innovative technology

- Strong market potential

- Experienced leadership

Weaknesses

- High beta risk

- Limited market presence

- No dividend payouts

Opportunities

- Growing cybersecurity demand

- Expansion in international markets

- Strategic partnerships

Threats

- Intense competition

- Regulatory challenges

- Rapid technological changes

The overall SWOT assessment indicates that while Arqit has a solid foundation with innovative offerings, it must navigate significant risks and competition. The company should focus on capitalizing on emerging market opportunities while managing its weaknesses effectively to enhance its strategic position.

Stock Analysis

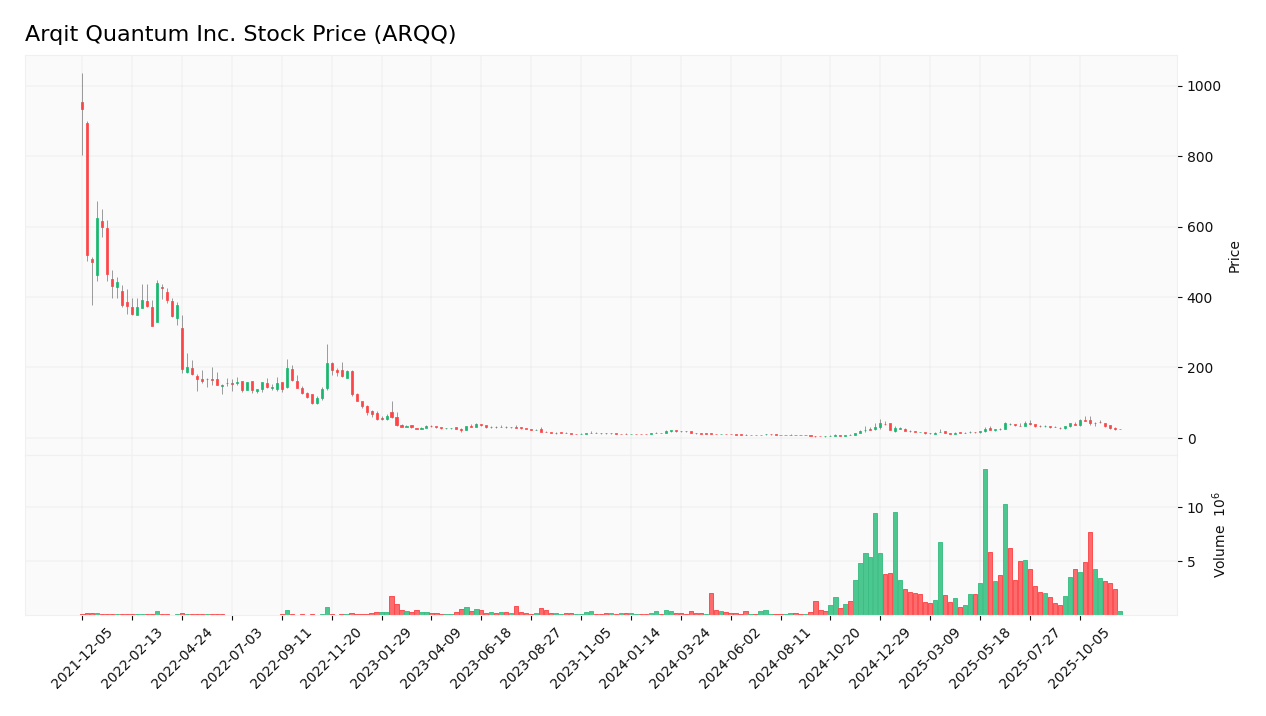

Over the past year, Arqit Quantum Inc. (ARQQ) has exhibited significant price movements and trading dynamics, culminating in a notable bullish trend despite recent fluctuations.

Trend Analysis

Analyzing the stock’s performance over the past year reveals a substantial price change of +161.59%. This strong increase indicates a bullish trend for ARQQ. However, it’s worth noting that in the recent period from September 14, 2025, to November 30, 2025, the stock experienced a decline of -22.01%, suggesting a deceleration in momentum. The stock reached a high of 49.92 and a low of 4.19, with a standard deviation of 11.81 indicating moderate volatility in its price movements.

Volume Analysis

In terms of trading volume over the last three months, ARQQ has seen a total volume of approximately 220.06M shares, with 55.58% attributed to buyer activity. The volume trend is increasing, which suggests growing interest among investors. However, the recent period indicates a slight shift towards seller dominance, with buyers accounting for only 40.7% of the most recent trades. This change in volume dynamics suggests cautious investor sentiment as the market assesses the recent price movements.

Analyst Opinions

Recent analyst recommendations for Arqit Quantum Inc. (ARQQ) show a cautious stance. The overall rating is a “C,” reflecting mixed sentiments. Analysts suggest a “hold” recommendation, citing concerns over low return on equity (1) and return on assets (1), which indicates inefficiencies in generating profit. However, a stronger debt-to-equity score (3) suggests manageable leverage. Given these factors, the consensus for this year leans towards a hold rather than a buy or sell. I advise monitoring the company closely for any shifts in these metrics.

Stock Grades

Arqit Quantum Inc. (ARQQ) has received consistent ratings from HC Wainwright & Co., indicating a stable outlook for the stock. Below are the most recent grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Overall, the grades for ARQQ showcase a strong and consistent “Buy” recommendation, reflecting confidence among analysts in the company’s future performance. This trend suggests that investors may find it prudent to consider ARQQ for their portfolios, given its maintained positive outlook.

Target Prices

The consensus target price for Arqit Quantum Inc. (ARQQ) is quite optimistic.

| Target High | Target Low | Consensus |

|---|---|---|

| 60 | 60 | 60 |

Analysts collectively expect the stock to reach a target price of 60, reflecting strong confidence in its potential performance.

Consumer Opinions

Consumer sentiment around Arqit Quantum Inc. (ARQQ) reveals a blend of optimism and concern, showcasing the company’s potential alongside some areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative technology with strong future potential. | High stock volatility makes it a risky investment. |

| Excellent customer support and communication. | Some products are still in development and not market-ready. |

| Strong commitment to security and privacy. | Limited awareness and understanding of quantum encryption among consumers. |

Overall, consumer feedback highlights Arqit Quantum’s innovative technology and customer support as strengths, while concerns about stock volatility and product readiness remain significant weaknesses.

Risk Analysis

In evaluating Arqit Quantum Inc. (ARQQ), it is essential to consider the various risks that could impact the company’s performance and stock value. Below is a summary of the key risks associated with ARQQ.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in technology sector demand. | High | High |

| Regulatory Risk | Changes in regulations affecting quantum technology. | Medium | High |

| Competition | Increasing number of competitors in the quantum space. | High | Medium |

| Technological Risk | Potential for technological obsolescence. | Medium | High |

| Financial Risk | Dependency on funding for R&D and operations. | Medium | Medium |

The most significant risks for ARQQ include high market volatility and regulatory changes, which can considerably affect growth and investor confidence.

Should You Buy Arqit Quantum Inc.?

Arqit Quantum Inc. has demonstrated a negative net margin of -186.28% and continues to face significant challenges, as indicated by its unfavorable profitability metrics. The company’s debt levels are manageable, with a debt-to-equity ratio of 0.084, suggesting a generally low reliance on debt, yet its overall financial fundamentals are evolving negatively, reflected in its current rating of C.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals Arqit Quantum Inc. has a negative net margin of -186.28%, indicating substantial financial losses. The company is experiencing a negative trend, with a recent price change of -22.01% and a seller volume exceeding buyer volume in the recent period, suggesting a bearish sentiment among investors. Additionally, the firm has a high beta of 2.353, indicating significant volatility compared to the market.

Conclusion Given the negative net margin and unfavorable trend, it might be prudent to wait for more favorable market conditions or signs of recovery before considering any investment in Arqit Quantum Inc.

Additional Resources

- Arqit launches SKA Central Controller to simplify quantum-safe network deployments for Managed Service Providers – Arqit Quantum Inc. (ARQQ) (Nov 11, 2025)

- Arqit Quantum (ARQQ) Announces that Fabric Networks Purchases Full Commercial PI License for Arqit’s NetworkSecure™ Platform – Yahoo Finance (Oct 04, 2025)

- Arqit Quantum: Exponential Revenue Growth (NASDAQ:ARQQ) – Seeking Alpha (Oct 20, 2025)

- Arqit Quantum Inc. Announces Financial Results for First Half of Fiscal Year 2025 – GlobeNewswire (May 22, 2025)

- Fabric Networks purchases commercial license from Arqit to deploy quantum‑safe networks at scale – Arqit Quantum Inc. (ARQQ) (Sep 16, 2025)

For more information about Arqit Quantum Inc., please visit the official website: arqit.uk