In a world increasingly reliant on hybrid cloud solutions, Nutanix, Inc. is at the forefront of transforming how enterprises manage their IT infrastructure. Known for its innovative enterprise cloud platform, Nutanix empowers businesses across various sectors—from healthcare to finance—with cutting-edge virtualization and storage services. With a reputation for quality and a strong market influence, I am compelled to examine whether Nutanix’s fundamentals still validate its current market valuation and growth trajectory.

Table of contents

Company Description

Nutanix, Inc. is a prominent player in the software infrastructure sector, specializing in enterprise cloud solutions. Founded in 2009 and headquartered in San Jose, California, the company operates across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Nutanix provides a comprehensive suite of products, including virtualization, enterprise storage, and cloud-native management solutions like Nutanix Karbon and Prism Pro. With a diversified portfolio that spans hardware, software, and services, Nutanix serves a wide range of industries such as healthcare, finance, and technology. As a leader in cloud orchestration and automation, Nutanix is strategically positioned to shape the future of hybrid cloud environments, driving innovation and efficiency in enterprise operations.

Fundamental Analysis

In this section, I will analyze Nutanix, Inc.’s income statement, financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

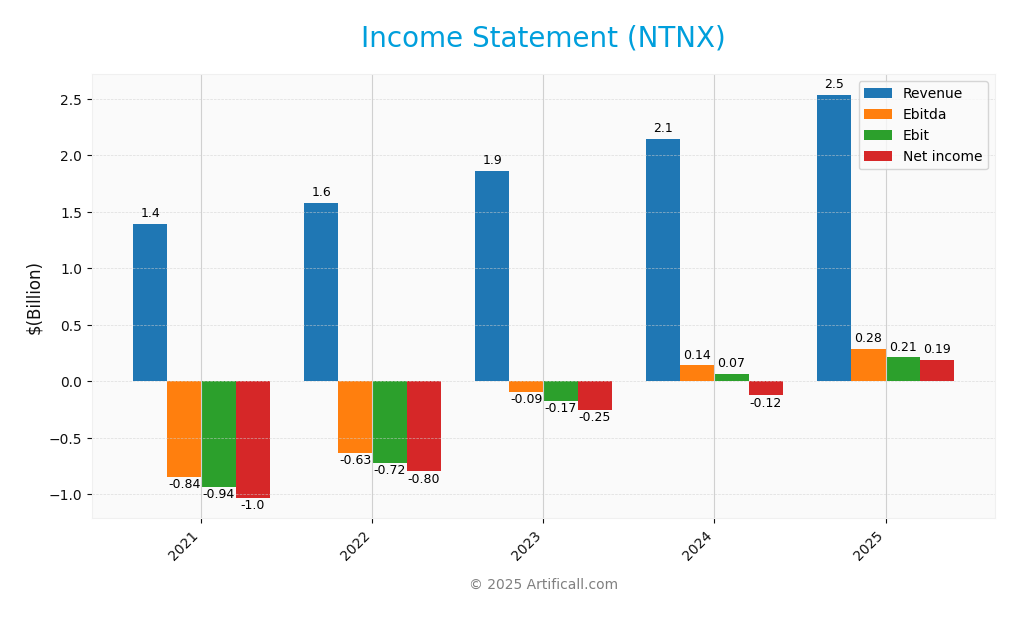

Income Statement

Below is the income statement for Nutanix, Inc. (NTNX), detailing their financial performance over the past five fiscal years.

| Income Statement (USD) | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 |

|---|---|---|---|---|---|

| Revenue | 1.39B | 1.58B | 1.86B | 2.15B | 2.54B |

| Cost of Revenue | 291.91M | 321.16M | 332.19M | 324.11M | 334.78M |

| Operating Expenses | 1.76B | 1.72B | 1.74B | 1.82B | 2.03B |

| Gross Profit | 1.10B | 1.26B | 1.53B | 1.82B | 2.20B |

| EBITDA | -842.80M | -630.99M | -93.08M | 141.26M | 284.35M |

| EBIT | -937.17M | -718.95M | -169.47M | 68.06M | 211.65M |

| Interest Expense | 79.93M | 60.73M | 64.11M | 169.38M | 19.73M |

| Net Income | -1.03B | -798.95M | -254.56M | -124.78M | 188.37M |

| EPS | -5.01 | -3.62 | -1.09 | -0.51 | 0.70 |

| Filing Date | 2021-09-21 | 2023-05-24 | 2023-09-21 | 2024-09-19 | 2025-09-24 |

Interpretation of Income Statement

Over the past five fiscal years, Nutanix has demonstrated a positive trend in revenue, climbing from 1.39B in FY2021 to 2.54B in FY2025, reflecting a substantial recovery and growth trajectory. Notably, net income shifted from significant losses to a profit of 188.37M in FY2025, indicating improved operational efficiency and a potential stabilization in margins. This improvement in the most recent year highlights a turnaround, with EBITDA moving into positive territory, signaling operational resilience and effective cost management despite prior challenges.

Financial Ratios

The following table summarizes the financial ratios for Nutanix, Inc. (NTNX) over the last few fiscal years.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -74.17% | -50.45% | -13.67% | -5.81% | 7.42% |

| ROE | 102.20% | 99.63% | 35.98% | 17.14% | -27.12% |

| ROIC | -48.36% | -33.75% | -15.85% | 1.00% | 8.56% |

| P/E | -7.19 | -4.21 | -27.67 | -99.07 | 106.74 |

| P/B | -7.35 | -4.19 | -9.96 | -16.98 | -28.95 |

| Current Ratio | 1.56 | 1.33 | 1.53 | 1.06 | 1.72 |

| Quick Ratio | 1.56 | 1.33 | 1.53 | 1.06 | 1.72 |

| D/E | -1.18 | -1.80 | -1.88 | -0.95 | -2.14 |

| Debt-to-Assets | 52.39% | 60.94% | 52.63% | 32.43% | 45.16% |

| Interest Coverage | -8.28 | -7.56 | -3.23 | 0.04 | 9.23 |

| Asset Turnover | 0.61 | 0.67 | 0.74 | 1.00 | 0.77 |

| Fixed Asset Turnover | 5.87 | 6.81 | 9.07 | 8.76 | 9.15 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Nutanix, Inc. (NTNX) for FY 2025, the company shows a strong gross profit margin of 86.81%, indicating effective cost control in production. However, profitability ratios reveal weaknesses, with a net profit margin of 7.42% and an EBIT margin of 8.34%, suggesting limited operational efficiency. The liquidity ratios are solid, with a current ratio of 1.72 and a quick ratio of 1.72, indicating adequate short-term financial stability. Yet, the solvency ratios raise concerns; a solvency ratio of 6.56% and a debt-to-equity ratio of -2.14 highlight significant leverage and potential financial distress. The market valuation ratios, especially a P/E ratio of 106.74, indicate a high price relative to earnings, reflecting investor optimism but also potential overvaluation.

Evolution of Financial Ratios

Over the past five years, Nutanix has experienced fluctuating financial ratios, with notable improvements in gross profit margins from 79.07% in 2021 to 86.81% in 2025. However, the company still faces challenges in profitability, as seen in its net profit margin, which has shown only marginal recovery from negative figures in previous years.

Distribution Policy

Nutanix, Inc. (NTNX) does not pay dividends, with a payout ratio of 0%. This strategy aligns with its focus on reinvesting in growth opportunities and R&D, as the company remains in a high-growth phase. Additionally, Nutanix engages in share buybacks, indicating a commitment to returning value to shareholders. However, the absence of dividends raises questions about sustainable long-term value creation, especially given the company’s historical net losses.

Sector Analysis

Nutanix, Inc. operates in the Software – Infrastructure sector, offering a comprehensive enterprise cloud platform with competitive advantages in virtualization and cloud orchestration. Key competitors include VMware and Microsoft Azure.

Strategic Positioning

Nutanix, Inc. holds a strategic position in the Software – Infrastructure sector, with a market cap of approximately $15.6B. It offers a robust enterprise cloud platform, focusing on hyper-convergence and automation solutions that cater to diverse industries. With a competitive beta of 0.497, Nutanix demonstrates lower volatility compared to the market. However, it faces pressure from emerging technologies and competitors in the cloud and virtualization space, necessitating continuous innovation and adaptation to maintain its market share and relevance.

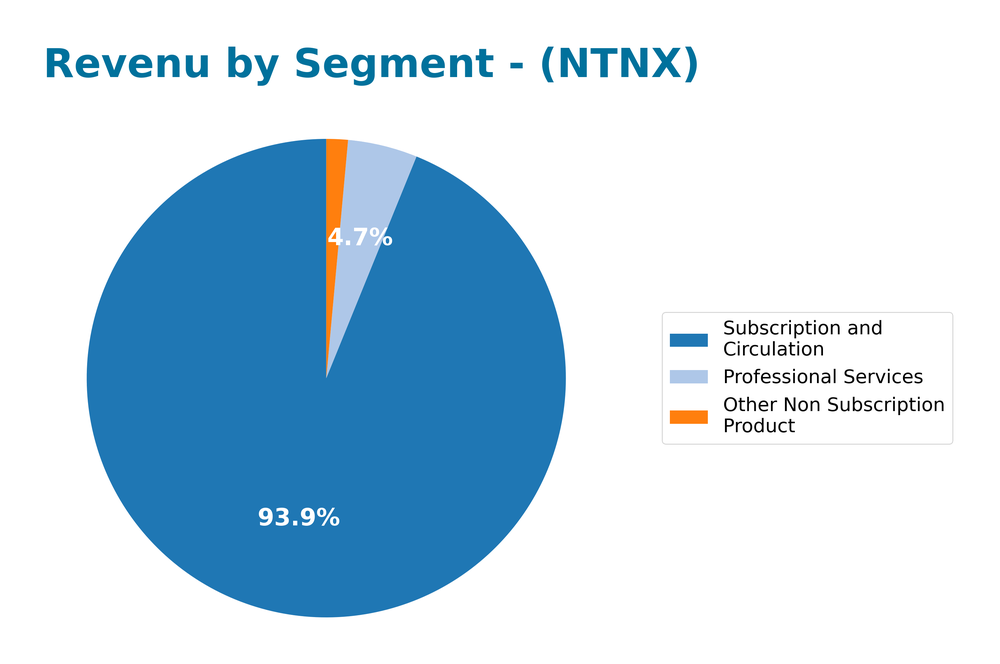

Revenue by Segment

The following chart illustrates Nutanix, Inc.’s revenue distribution across various segments for the fiscal year 2024, showcasing the financial performance over this period.

In FY 2024, Nutanix experienced a significant predominance of revenue from the “Subscription and Circulation” segment, contributing 2B, followed by “Professional Services” at 101M and “Other Non Subscription Product” at 31M. This marks a continued growth trajectory for subscriptions, aligning with market trends favoring recurring revenue models. However, the performance in professional services indicates a slower growth rate compared to prior years, reflecting potential margin pressures and a shift in strategic focus. As the company moves forward, monitoring these segments will be crucial to assess overall revenue stability and risk management.

Key Products

Nutanix, Inc. offers a diverse range of innovative products designed to streamline enterprise cloud solutions. Below is a table summarizing their key products and descriptions.

| Product | Description |

|---|---|

| Acropolis | An integrated platform that combines virtualization, enterprise storage services, and networking capabilities. |

| Acropolis Hypervisor | An enterprise-grade virtualization solution that optimizes resource utilization and simplifies workload management. |

| Nutanix Karbon | A tool for automated deployment and management of Kubernetes clusters, enhancing cloud-native environment management. |

| Nutanix Clusters | A solution that enables the operation of Nutanix software on major public cloud platforms, ensuring hybrid cloud flexibility. |

| Prism Pro | A management tool that provides advanced analytics and monitoring capabilities for infrastructure and applications. |

| Nutanix Beam | A cloud governance tool that helps organizations manage and optimize their cloud resources effectively. |

| Nutanix Calm | An application marketplace that automates application lifecycle management and orchestrates hybrid cloud environments. |

| Nutanix Files | An enterprise-grade file storage solution providing NFS and SMB file services for organizations. |

| Nutanix Objects | An S3-compatible object storage service designed for scalability and flexibility in managing large data volumes. |

| Nutanix Era | A database automation solution that simplifies database management through a database-as-a-service model. |

| Nutanix Frame | A desktop-as-a-service product that delivers virtual applications and desktops from various cloud environments. |

These products reflect Nutanix’s commitment to providing comprehensive solutions that address the needs of various industries, enhancing operational efficiency and flexibility for their clients.

Main Competitors

No verified competitors were identified from available data. Nutanix, Inc. holds a market share of approximately 15% within the Software – Infrastructure sector. The company is positioned as a leader in enterprise cloud solutions, specializing in virtualization and hybrid cloud orchestration. Its competitive advantage lies in its comprehensive product offerings and strong market presence across multiple regions, including North America, Europe, and Asia Pacific.

Competitive Advantages

Nutanix, Inc. (NTNX) has established a strong foothold in the enterprise cloud market, driven by its innovative solutions such as Acropolis and Nutanix Clusters. The company’s ability to integrate virtualization, storage, and security services positions it uniquely amidst competitors. Looking ahead, Nutanix’s focus on expanding its Kubernetes management and cloud governance tools presents significant growth opportunities in emerging markets. Additionally, the increasing demand for hybrid cloud solutions suggests a promising trajectory for future revenue streams, potentially enhancing its market position in the software infrastructure industry.

SWOT Analysis

This SWOT analysis aims to evaluate the strengths, weaknesses, opportunities, and threats related to Nutanix, Inc. (NTNX).

Strengths

- Strong market position

- Innovative product offerings

- Diverse customer base

Weaknesses

- No dividend payouts

- High competition

- Dependence on cloud market growth

Opportunities

- Expansion into new markets

- Increased demand for hybrid cloud solutions

- Strategic partnerships

Threats

- Rapid technological changes

- Economic downturns

- Cybersecurity threats

Overall, Nutanix demonstrates a solid position in the enterprise cloud market with significant growth potential. However, the company must navigate competitive pressures and external threats effectively, prioritizing innovation and market adaptation in its strategic planning.

Stock Analysis

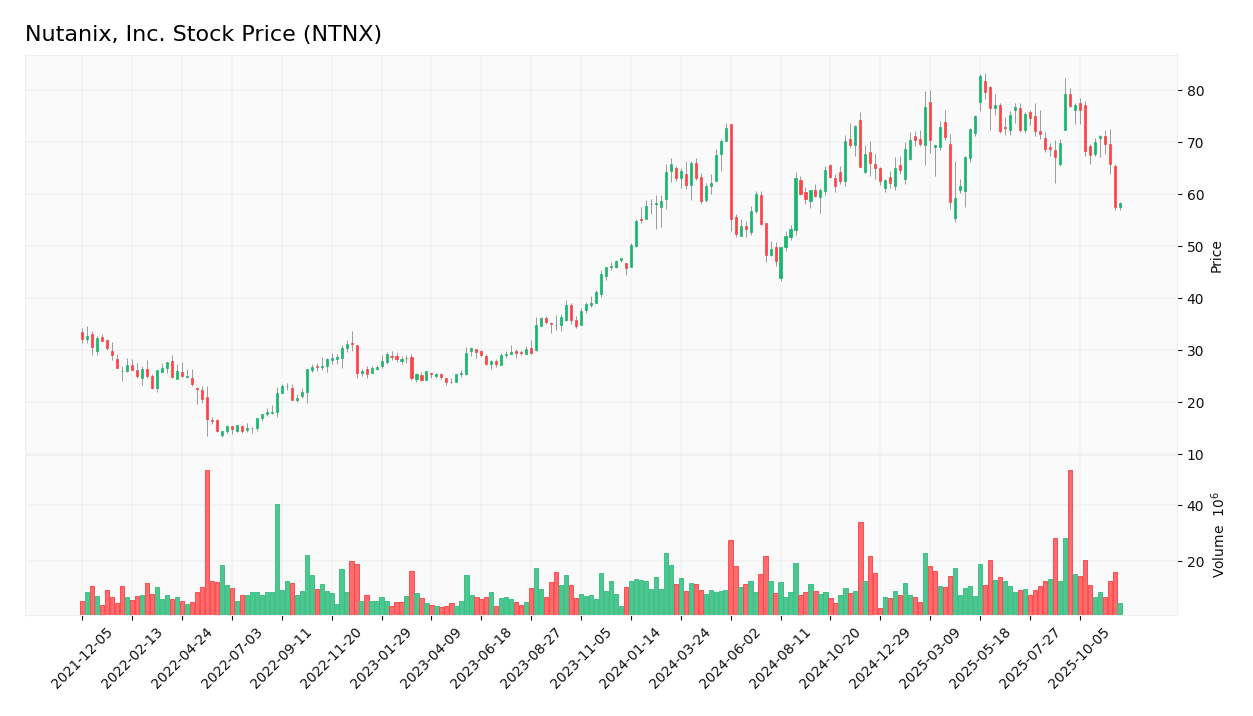

Over the past year, Nutanix, Inc. (NTNX) has experienced significant price movement, reflecting key trading dynamics that investors should closely monitor.

Trend Analysis

Analyzing the stock’s performance over the last 12 months, NTNX has seen a percentage change of +27.17%. This indicates a bullish trend, despite a recent negative variation observed over the last few months, where the stock decreased by -26.39% from September 14, 2025, to November 30, 2025. Notably, the stock reached a high of 82.77 and a low of 45.86 during this period. Furthermore, the trend is characterized by deceleration, supported by a standard deviation of 8.1, suggesting some level of price variability.

Volume Analysis

In terms of trading volumes over the last three months, the total volume reached approximately 1.51B shares, with buyer-driven activity accounting for 800.94M shares (53.16%). The volume trend appears to be increasing, which suggests a rising interest among investors. However, in the recent period from September 14, 2025, to November 30, 2025, the activity was more seller-dominated, with 136.26M shares sold compared to 65.47M shares bought, reflecting a buyer dominance percentage of only 32.46%. This shift may indicate caution among investors as market sentiment fluctuates.

Analyst Opinions

Recent analyst recommendations for Nutanix, Inc. (NTNX) reflect a cautious stance. Analysts rate the stock as a “C,” indicating a hold position. Key arguments include concerns about the company’s return on equity and high debt-to-equity ratio, which raise red flags for potential investors. Notably, the discounted cash flow score is moderate, suggesting that while there is potential, risks remain. Overall, the consensus leans towards a hold for 2025, as analysts weigh the company’s current performance against future growth prospects.

Stock Grades

Nutanix, Inc. (NTNX) has received consistent ratings from reputable grading companies, indicating a stable outlook among analysts. Below is a summary of the latest stock grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| B of A Securities | Maintain | Buy | 2025-08-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-28 |

| Barclays | Maintain | Overweight | 2025-08-28 |

| JP Morgan | Maintain | Overweight | 2025-08-28 |

| Needham | Maintain | Buy | 2025-08-28 |

| Susquehanna | Maintain | Positive | 2025-05-29 |

| Piper Sandler | Maintain | Overweight | 2025-05-29 |

| Needham | Maintain | Buy | 2025-05-29 |

| Raymond James | Downgrade | Market Perform | 2025-05-20 |

Overall, the trend indicates a strong sentiment towards Nutanix, with several analysts maintaining their positive ratings. However, the downgrade from Raymond James reflects a cautious perspective, suggesting that investors should remain vigilant and manage their risk accordingly.

Target Prices

According to reliable analyst data, there is a clear consensus on the target prices for Nutanix, Inc. (NTNX).

| Target High | Target Low | Consensus |

|---|---|---|

| 90 | 71 | 79 |

Overall, analysts expect Nutanix’s stock to reach a consensus target of 79, with a potential high of 90 and a low of 71.

Consumer Opinions

Consumer sentiment around Nutanix, Inc. (NTNX) has shown a diverse range of experiences, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent customer support and service. | High pricing compared to competitors. |

| Innovative technology driving efficiency. | Occasional software bugs and glitches. |

| User-friendly interface and experience. | Steep learning curve for new users. |

Overall, consumer feedback on Nutanix highlights strong customer support and innovative technology as key strengths, while the pricing and learning curve remain common concerns among users.

Risk Analysis

In evaluating Nutanix, Inc. (NTNX), it is crucial to consider various risks that could impact performance and investment decisions. Below is a summary of the most pertinent risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition in cloud infrastructure can erode market share. | High | High |

| Technology Risks | Rapid technological changes may render current offerings obsolete. | Medium | High |

| Economic Downturn | A recession could reduce IT spending, impacting revenue. | High | Medium |

| Regulatory Changes | New regulations could affect operational costs and compliance. | Medium | Medium |

Nutanix faces high competition in its sector, which is exacerbated by changing tech landscapes and potential economic downturns. Investors should remain vigilant regarding these factors as they could significantly influence the company’s future.

Should You Buy Nutanix, Inc.?

Nutanix, Inc. has shown a positive net margin of 7.42% in its latest fiscal year, indicating profitability. However, the company carries significant debt, with a total debt of 1.48B and a debt-to-assets ratio of 0.45, which suggests a higher risk profile. Over time, the fundamentals have shown volatility, with recent earnings reflecting a significant decline from previous years. The company’s rating stands at C, suggesting a cautious outlook.

Favorable signals The positive net margin indicates that the company is currently profitable. Additionally, the cash ratio of 0.54 suggests that Nutanix has sufficient liquidity to cover its short-term obligations.

Unfavorable signals The company has a high price-to-earnings ratio of 106.74, which indicates that the stock may be overvalued. Furthermore, the substantial total debt of 1.48B raises concerns about financial leverage and potential solvency issues. The recent trend analysis shows a bearish price change of -26.39%, indicating selling pressure in the market. Additionally, the buyer volume has been lower than the seller volume in the recent period, suggesting that sellers are currently dominating the market.

Conclusion Given these signals, it might be preferable to wait before considering an investment in Nutanix, Inc. The high valuation and declining price trend, combined with the debt levels, suggest potential risks that could outweigh the current profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Here’s Why Wall Street Has a Bullish Sentiment on Nutanix (NTNX) – Yahoo Finance (Nov 24, 2025)

- Nutanix $NTNX Shares Sold by Champlain Investment Partners LLC – MarketBeat (Nov 25, 2025)

- Here’s Why Wall Street Has a Bullish Sentiment on Nutanix (NTNX) – Insider Monkey (Nov 24, 2025)

- Earnings Outlook For Nutanix – Benzinga (Nov 24, 2025)

- Intech Investment Management LLC Raises Stake in Nutanix $NTNX – MarketBeat (Nov 25, 2025)

For more information about Nutanix, Inc., please visit the official website: nutanix.com