In the dynamic landscape of the Communication Services sector, two prominent players, Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR), stand at the forefront. Netflix revolutionized entertainment with its streaming powerhouse, while Charter excels in broadband and cable services. This comparison is crucial as both companies vie for consumer attention in overlapping markets through innovative strategies. Join me as we explore which of these companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Netflix, Inc. Overview

Netflix, Inc. is a leader in the entertainment industry, primarily known for its subscription-based streaming service that offers a diverse array of TV series, documentaries, feature films, and mobile games. With approximately 222M paid members across 190 countries, Netflix has positioned itself as a global powerhouse in the digital content arena. Founded in 1997 and headquartered in Los Gatos, California, the company continually innovates to enhance user experience through advanced technology, allowing streaming on a variety of internet-connected devices. Despite facing increasing competition in the streaming sector, Netflix’s commitment to original content and user engagement remains a cornerstone of its strategy.

Charter Communications, Inc. Overview

Charter Communications, Inc. operates as a prominent broadband connectivity and cable operator, serving both residential and commercial customers in the United States. With a strong presence in the telecommunications sector, Charter provides subscription-based video services, high-speed internet, and voice communications, reaching approximately 32M customers across 41 states. Founded in 1993 and based in Stamford, Connecticut, the company combines traditional cable services with innovative internet solutions, focusing on delivering high-performance connectivity and a broad range of entertainment options. Charter’s strategic initiatives also include advertising services and mobile offerings, enhancing its competitive edge in a rapidly evolving industry.

Key Similarities and Differences

Both Netflix and Charter Communications operate within the communication services sector, yet they have distinct business models. Netflix focuses on content creation and streaming, emphasizing original programming to attract subscribers. In contrast, Charter offers a comprehensive suite of telecommunications services, including cable, internet, and voice solutions. While Netflix’s revenue primarily stems from subscription fees, Charter diversifies its income through multiple service offerings, including advertising and business solutions.

Income Statement Comparison

The following table summarizes the income statement metrics for Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR) for the most recent fiscal year, highlighting their financial performance.

| Metric | NFLX | CHTR |

|---|---|---|

| Revenue | 39B | 55B |

| EBITDA | 26B | 21B |

| EBIT | 10.7B | 12.7B |

| Net Income | 8.7B | 5.1B |

| EPS | 2.03 | 35.53 |

Interpretation of Income Statement

In the latest fiscal year, Netflix experienced a notable increase in revenue to 39B, up from 33.7B, indicating a strong growth trajectory. However, Charter Communications also showed robust revenue at 55B, reflecting its competitive position. While NFLX’s net income rose to 8.7B, CHTR’s net income was slightly lower at 5.1B. Interestingly, CHTR’s EBITDA margin remains stable, showcasing effective cost management, while NFLX’s margins have improved due to efficient operational strategies. Overall, both companies maintain healthy financials, but NFLX is demonstrating stronger growth dynamics.

Financial Ratios Comparison

The table below provides a comparative look at the most recent financial ratios for Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR).

| Metric | NFLX | CHTR |

|---|---|---|

| ROE | 35.21% | 32.61% |

| ROIC | 20.20% | 7.43% |

| P/E | 4.39 | 12.73 |

| P/B | 1.55 | 5.23 |

| Current Ratio | 1.22 | 0.31 |

| Quick Ratio | 1.22 | 0.31 |

| D/E | 0.73 | 8.86 |

| Debt-to-Assets | 33.55% | 66.72% |

| Interest Coverage | 14.49 | 2.53 |

| Asset Turnover | 0.73 | 0.37 |

| Fixed Asset Turnover | 24.47 | 1.28 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

In analyzing the financial ratios, Netflix shows stronger performance indicators compared to Charter. With a higher ROE and ROIC, Netflix demonstrates efficient capital use. However, Charter’s significantly higher debt-to-equity ratio raises concerns about its leverage and financial risk. Additionally, Netflix’s current and quick ratios indicate better liquidity management, which is crucial for operational stability.

Dividend and Shareholder Returns

Both Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR) do not pay dividends. Their focus on reinvesting earnings supports growth strategies and research, which may enhance long-term shareholder value. Notably, both companies engage in share buybacks, providing a potential return on investment. However, this approach carries risks, including the potential for unsustainable buyback levels amid fluctuating cash flows. Overall, while their strategies aim for future value creation, the lack of immediate returns could be a concern for some investors.

Strategic Positioning

In the competitive landscape of entertainment and telecommunications, Netflix, Inc. (NFLX) holds a significant market share with approximately 222M subscribers globally, reinforcing its dominance in streaming services. However, it faces increasing pressure from competitors like Charter Communications, Inc. (CHTR), which provides a robust broadband and cable offering to 32M customers. Both companies are navigating technological disruptions, with Netflix investing heavily in content creation and CHTR enhancing its service offerings to retain market share amidst evolving consumer preferences.

Stock Comparison

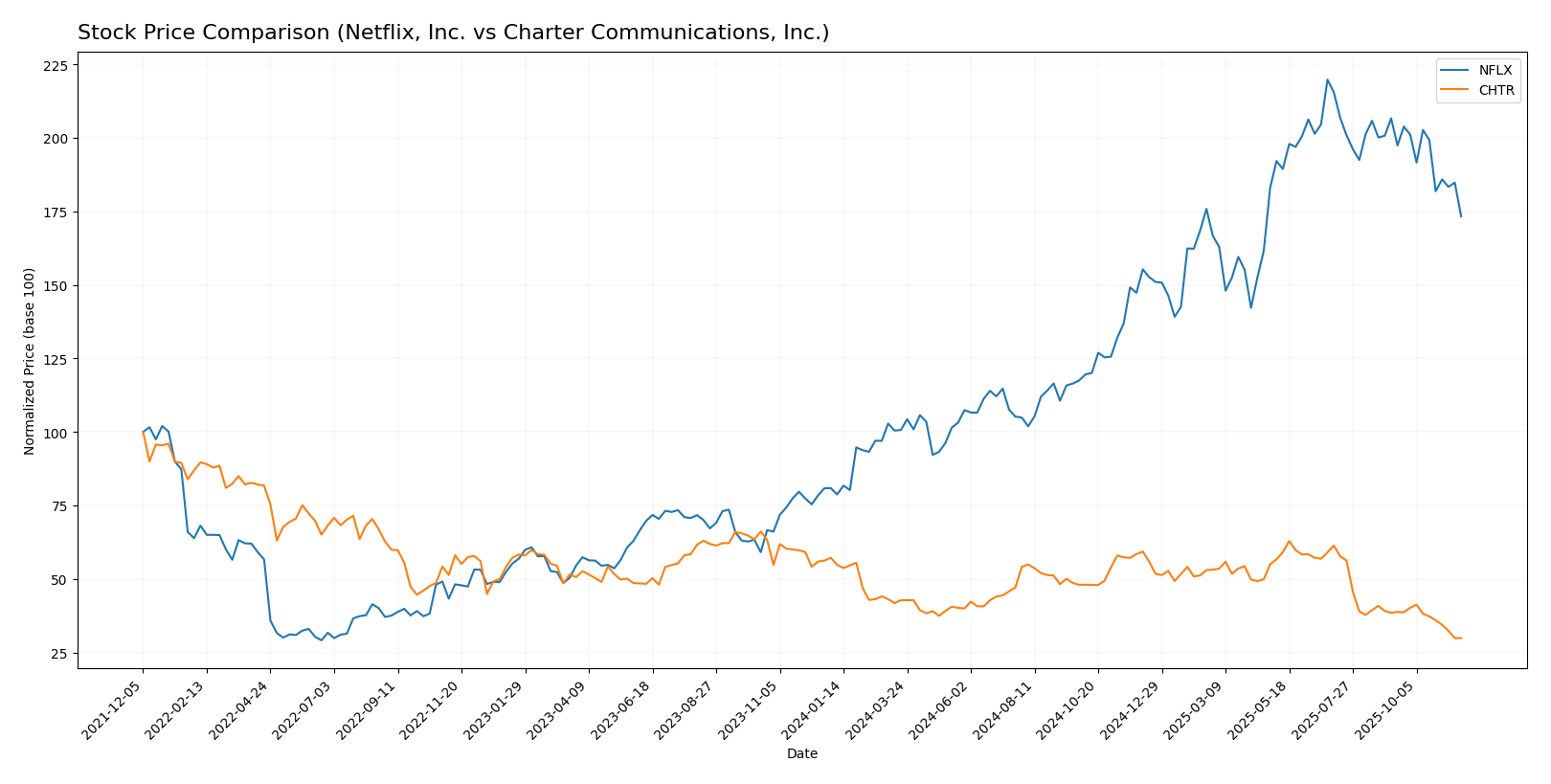

In the past year, Netflix, Inc. (NFLX) has experienced significant price movements, culminating in a notable bullish trend overall, despite recent fluctuations. Charter Communications, Inc. (CHTR), on the other hand, has faced a pronounced bearish trend, reflecting a challenging market environment.

Trend Analysis

Netflix, Inc. (NFLX)

- Percentage change over the past year: +114.23%

- Trend direction: Bullish

- Notable highs/lows: Highest price at 132.31, lowest price at 47.41

- Acceleration status: Deceleration

- Recent movement (from 2025-09-07 to 2025-11-23): -16.14%

- Volatility: Standard deviation of 6.13

Charter Communications, Inc. (CHTR)

- Percentage change over the past year: -47.77%

- Trend direction: Bearish

- Notable highs/lows: Highest price at 427.25, lowest price at 203.0

- Acceleration status: Deceleration

- Recent movement (from 2025-09-07 to 2025-11-23): -22.37%

- Volatility: Standard deviation of 24.96

In summary, while NFLX shows resilience with a strong overall gain, it has faced recent setbacks. Conversely, CHTR is on a downward trajectory, reflecting significant challenges in the market. As always, I recommend carefully considering these trends alongside your risk management strategies before making investment decisions.

Analyst Opinions

Recent analyst recommendations for Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR) show a consensus rating of “A-,” indicating strong potential. Analysts highlight NFLX’s robust return on equity (5) and assets (5), despite a lower debt-to-equity score (2). CHTR mirrors this strength with a high discounted cash flow score (5) and solid returns. Both analysts suggest a buy, emphasizing the companies’ resilience and growth prospects in the streaming and telecommunications sectors. Given the current analysis, I recommend considering both stocks for a growth-oriented portfolio.

Stock Grades

In this section, I will present the latest stock grades for Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR), based on reliable grading data.

Netflix, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-11-18 |

| Barclays | maintain | Equal Weight | 2025-11-18 |

| KGI Securities | upgrade | Outperform | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-10-22 |

| Wells Fargo | maintain | Overweight | 2025-10-22 |

| Needham | maintain | Buy | 2025-10-22 |

| Wedbush | maintain | Outperform | 2025-10-22 |

| Piper Sandler | maintain | Overweight | 2025-10-22 |

| Guggenheim | maintain | Buy | 2025-10-22 |

Charter Communications, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Underweight | 2025-11-03 |

| Benchmark | maintain | Buy | 2025-11-03 |

| Bernstein | downgrade | Market Perform | 2025-11-03 |

| Wells Fargo | maintain | Equal Weight | 2025-11-03 |

| Keybanc | downgrade | Sector Weight | 2025-11-03 |

| Citigroup | maintain | Buy | 2025-11-03 |

| RBC Capital | maintain | Sector Perform | 2025-11-03 |

| Keybanc | maintain | Overweight | 2025-10-03 |

| B of A Securities | maintain | Buy | 2025-09-24 |

| Bernstein | maintain | Outperform | 2025-09-10 |

Overall, I observe a stable trend for Netflix with several maintain ratings, indicating consistent confidence among analysts. Charter Communications shows a mix of maintain and downgrade actions, particularly with Bernstein and Keybanc adjusting their ratings, suggesting a more cautious outlook on this stock.

Target Prices

According to the latest data, here are the target prices from analysts for Netflix, Inc. and Charter Communications, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Netflix, Inc. (NFLX) | 1500 | 1100 | 1399.55 |

| Charter Communications, Inc. (CHTR) | 500 | 200 | 326.6 |

Analysts have set a consensus target price of approximately 1.4K for Netflix, significantly higher than its current price of 104.31. For Charter, the consensus target of about 326.6 suggests a potential upside from its current price of 203.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR) based on recent financial performance metrics.

| Criterion | Netflix, Inc. (NFLX) | Charter Communications, Inc. (CHTR) |

|---|---|---|

| Diversification | Limited content genres; focus on streaming | Broad range of telecommunications services |

| Profitability | Net profit margin: 22.34% | Net profit margin: 9.23% |

| Innovation | High investment in original content | Moderate improvements in service offerings |

| Global presence | 190 countries with 222M subscribers | Primarily U.S.-based operations with 32M customers |

| Market Share | Significant in streaming | Strong presence in broadband/cable |

| Debt level | Debt-to-equity ratio: 0.73 | Debt-to-equity ratio: 6.14 |

Key takeaways indicate that Netflix excels in profitability and innovation, making it a strong contender in streaming. Conversely, Charter has a diversified service portfolio but faces challenges with high debt levels.

Risk Analysis

In this section, I present a comparison of potential risks facing Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR). Understanding these risks can help investors make informed decisions.

| Metric | NFLX | CHTR |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market risks, primarily due to fluctuating demand and competition. Additionally, regulatory and operational risks are heightened for Charter, given its extensive infrastructure and service obligations.

Which one to choose?

When comparing Netflix, Inc. (NFLX) and Charter Communications, Inc. (CHTR), both companies present unique investment profiles. NFLX has shown a positive revenue growth trend, with a market cap of $38.3B and a P/E ratio of 4.39, suggesting potential undervaluation. Its operating profit margin stands at 26.7%, reflecting efficient cost management. However, its recent price trend has been bearish, with a -16.1% change in the last three months.

On the other hand, CHTR carries a market cap of $49.0B but has encountered a significant -47.8% price drop over the past year, indicating market challenges. Its P/E ratio is higher at 9.65, which may reflect conservative investor sentiment due to its high debt levels.

For growth-oriented investors, NFLX appears favorable due to its strong fundamentals and lower valuation ratios. In contrast, income-focused investors might lean towards CHTR, given its higher revenue but should be cautious of its debt levels.

Both companies face risks such as intense competition and market dependence, which may impact their future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Netflix, Inc. and Charter Communications, Inc. to enhance your investment decisions: