In today’s fast-paced economy, understanding the strengths and strategies of leading companies is crucial for savvy investors. I will compare Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM), both of which operate in overlapping sectors but with distinct focuses—ADP in staffing and employment services and Atlassian in software applications. By exploring their innovation strategies and market positions, I aim to help you determine which company could be the more compelling investment opportunity. Let’s dive into the details!

Table of contents

Company Overview

Automatic Data Processing, Inc. Overview

Automatic Data Processing, Inc. (ADP) is a prominent player in the staffing and employment services sector, recognized for its comprehensive suite of cloud-based human capital management solutions. Founded in 1949 and headquartered in Roseland, New Jersey, ADP primarily operates through two segments: Employer Services and Professional Employer Organization (PEO). Its offerings encompass payroll processing, benefits administration, and HR outsourcing, catering to a diverse clientele that includes small to mid-sized businesses. With a market capitalization of approximately $102.37B, ADP continues to innovate in the HR technology space, striving to enhance workforce management and compliance for its clients.

Atlassian Corporation Overview

Atlassian Corporation, established in 2002 and based in Sydney, Australia, specializes in software applications designed for collaboration and project management. Its flagship products include Jira Software, Confluence, and Trello, which facilitate seamless teamwork across technical and business domains. With a market capitalization of around $38.39B, Atlassian is recognized for fostering agility and productivity within organizations by providing tools that enhance communication and project tracking. The company’s strong focus on innovation has made it a key player in the software industry, particularly within the realm of enterprise solutions.

Key Similarities and Differences

Both ADP and Atlassian operate in service-oriented sectors, emphasizing technology to streamline processes. However, ADP focuses on HR management and payroll services, while Atlassian is centered on software solutions for project management and collaboration. This distinction highlights ADP’s emphasis on human capital and compliance, compared to Atlassian’s focus on enhancing team productivity and workflow efficiency.

Income Statement Comparison

The following table provides a comparison of key income statement metrics for Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM) for the fiscal year ending June 30, 2025.

| Metric | ADP | TEAM |

|---|---|---|

| Revenue | 20.56B | 5.22B |

| EBITDA | 6.24B | 24M |

| EBIT | 5.76B | -68M |

| Net Income | 4.08B | -257M |

| EPS | 10.02 | -0.98 |

Interpretation of Income Statement

In 2025, ADP showed strong revenue growth to 20.56B, reflecting a solid demand for its services, while TEAM’s revenue increased to 5.22B but still recorded a net loss of 257M. ADP’s EBITDA margin was robust at 30.3%, indicating effective cost management, whereas TEAM struggled with negative EBIT, highlighting operational challenges. Compared to the previous year, ADP’s net income grew significantly, suggesting improved profitability, while TEAM’s performance continued to decline, raising concerns about its long-term viability.

Financial Ratios Comparison

The table below presents a comparative analysis of the most recent financial ratios for Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM).

| Metric | ADP | TEAM |

|---|---|---|

| ROE | 65.93% | -19.08% |

| ROIC | 24.66% | -11.63% |

| P/E | 30.77 | -207.13 |

| P/B | 20.29 | 39.51 |

| Current Ratio | 1.05 | 1.22 |

| Quick Ratio | 1.05 | 1.22 |

| D/E | 1.46 | 0.92 |

| Debt-to-Assets | 16.99% | 23.97% |

| Interest Coverage | 11.87 | -4.27 |

| Asset Turnover | 0.39 | 0.86 |

| Fixed Asset Turnover | 19.97 | 19.02 |

| Payout Ratio | 58.80% | 0.00% |

| Dividend Yield | 1.91% | 0.00% |

Interpretation of Financial Ratios

ADP exhibits robust financial health with strong return metrics (ROE and ROIC), indicating effective management and profitability. In contrast, TEAM’s negative ROE and low interest coverage signal significant financial distress and high risk for investors. The current and quick ratios suggest both companies are able to cover short-term obligations, but TEAM’s higher debt levels may pose a potential concern for sustainability. Overall, ADP appears to be a stronger and safer investment option.

Dividend and Shareholder Returns

Automatic Data Processing, Inc. (ADP) maintains a robust dividend policy with a payout ratio of approximately 58.8%, yielding about 1.91%. The company also engages in share buybacks, which suggests a commitment to returning value to shareholders. In contrast, Atlassian Corporation (TEAM) does not distribute dividends, reflecting its focus on reinvestment for growth during its high-growth phase. While ADP’s approach supports long-term value creation, TEAM’s strategy may align with future value potential depending on successful execution of its growth initiatives.

Strategic Positioning

Automatic Data Processing, Inc. (ADP) commands a strong market share in the human capital management sector, leveraging its extensive Employer Services and Professional Employer Organization (PEO) offerings. With a market cap of $102B, ADP faces moderate competitive pressure from emerging HR tech startups but remains resilient due to its established brand and comprehensive solutions. Atlassian Corporation (TEAM), with a market cap of $38B, leads in the software application industry, facing intense competition from agile project management tools. Both companies must navigate technological disruptions to maintain their competitive edge.

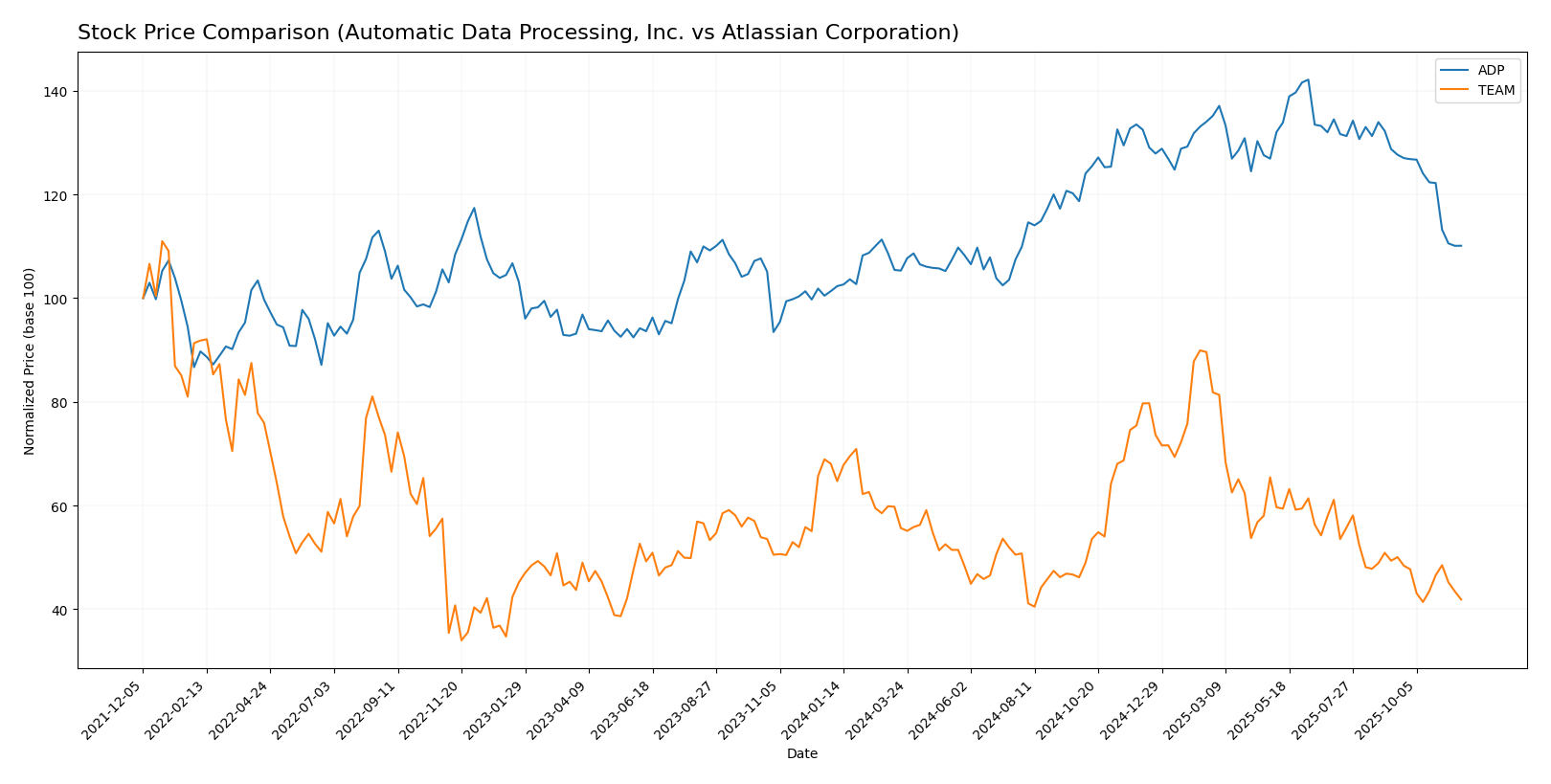

Stock Comparison

In this section, I will analyze the weekly stock price movements for Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM) over the past year, highlighting key trends and trading dynamics.

Trend Analysis

Automatic Data Processing, Inc. (ADP) Over the past year, ADP’s stock price has increased by 8.65%. This figure indicates a bullish trend, although the acceleration has shown signs of deceleration. The highest price recorded was $326.81, while the lowest was $232.97. The stock has experienced a notable standard deviation of 26.79, reflecting some volatility.

In the recent analysis period from September 7, 2025, to November 23, 2025, the stock price has decreased by 14.48%, which suggests a negative trend slope of -4.51. The standard deviation during this period was 16.61, indicating moderate volatility.

Atlassian Corporation (TEAM) In contrast, TEAM’s stock has seen a significant decline of -38.5% over the past year, categorizing its trend as bearish with deceleration in price movements. The highest price was $314.28, and the lowest reached $141.43. The standard deviation of 39.96 highlights a higher level of volatility compared to ADP.

During the recent period from September 7, 2025, to November 23, 2025, TEAM’s stock price has decreased by 15.17%, with a trend slope of -1.8 and a standard deviation of 10.21, indicating a less volatile environment compared to the overall yearly trend.

In summary, while ADP shows potential for recovery with a bullish yearly trend, TEAM faces challenges with a marked decline and negative sentiment. Investors should weigh these factors carefully when considering their next moves.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM). Analysts have rated ADP with a B+ and suggest a “buy” due to strong financial metrics, particularly in return on equity and assets. In contrast, TEAM has received a C rating, leading to a “hold” recommendation, as analysts cite concerns over its lower performance scores in key areas. The consensus for ADP is a buy, while TEAM’s consensus remains neutral with a hold.

Stock Grades

In the current landscape of stock evaluations, I have analyzed the grades provided by reputable grading companies for two companies: Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM).

Automatic Data Processing, Inc. (ADP) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

| Stifel | maintain | Hold | 2025-07-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-17 |

| Mizuho | maintain | Outperform | 2025-06-13 |

| UBS | maintain | Neutral | 2025-06-13 |

| RBC Capital | maintain | Sector Perform | 2025-06-05 |

| TD Securities | maintain | Hold | 2025-05-21 |

Atlassian Corporation (TEAM) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | maintain | Outperform | 2025-11-18 |

| Macquarie | maintain | Outperform | 2025-11-03 |

| Mizuho | maintain | Outperform | 2025-10-31 |

| Bernstein | maintain | Outperform | 2025-10-31 |

| TD Cowen | maintain | Hold | 2025-10-27 |

| BMO Capital | maintain | Outperform | 2025-10-24 |

| UBS | maintain | Neutral | 2025-10-24 |

| Keybanc | maintain | Overweight | 2025-10-23 |

| Canaccord Genuity | maintain | Buy | 2025-10-22 |

| BWG Global | upgrade | Positive | 2025-10-14 |

Overall, ADP’s grades indicate a consistent stance of caution among analysts, with a predominance of “Underweight” and “Neutral” ratings. On the other hand, TEAM enjoys a more favorable outlook, with many firms maintaining “Outperform” ratings, suggesting a stronger positive sentiment in its direction.

Target Prices

The consensus target prices for the companies reviewed indicate a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Automatic Data Processing, Inc. (ADP) | 290 | 245 | 278.25 |

| Atlassian Corporation (TEAM) | 300 | 185 | 232.85 |

For ADP, the current stock price of 253.12 is below the consensus target of 278.25, suggesting potential upside. Meanwhile, TEAM’s stock is currently at 146.28, significantly lower than its consensus target of 232.85, indicating strong growth potential as well.

Strengths and Weaknesses

In the following table, I present the strengths and weaknesses of two companies, Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM). This comparison aims to assist investors in making informed decisions.

| Criterion | ADP | TEAM |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (19.84%) | Negative (-4.92%) |

| Innovation | Steady growth | Rapid growth |

| Global presence | Extensive | Growing |

| Market Share | Leading | Emerging |

| Debt level | Manageable | High |

Key takeaways indicate that ADP exhibits strong profitability and market leadership, while TEAM, despite its innovation and growth potential, struggles with profitability and high debt levels. This suggests a more cautious investment approach with TEAM compared to ADP.

Risk Analysis

In the table below, I outline key risks associated with Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM) to help you understand their potential vulnerabilities.

| Metric | ADP | TEAM |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Low | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | High |

Both companies face unique risks. ADP has a stable market risk profile with low operational and regulatory risks, while TEAM is highly susceptible to market volatility and operational challenges, particularly given its recent financial performance.

Which one to choose?

When comparing Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM), ADP shows stronger fundamentals. ADP has a market cap of approximately 126B, with a net profit margin of 19.8% and a solid return on equity (ROE) of 66%. In contrast, TEAM has a market cap around 53B, but it struggles with negative profitability and a low return on equity of -19%.

ADP’s B+ rating reflects its robust financial health, while TEAM’s C rating indicates underlying challenges, particularly in operational performance. Analysts have noted ADP as a better long-term investment due to its consistent revenue growth and manageable debt levels, whereas TEAM faces risks from a bearish market trend and high valuation metrics.

Investors focused on stability and consistent growth may prefer ADP, while those seeking higher risk may consider TEAM for potential upside. However, be cautious of TEAM’s financial instability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Automatic Data Processing, Inc. and Atlassian Corporation to enhance your investment decisions: