In the ever-evolving landscape of technology, Datadog, Inc. and Zscaler, Inc. stand out as key players in their respective domains of application monitoring and cloud security. Both companies operate within the technology sector, yet they tackle distinct challenges and innovations that overlap in the realm of digital transformation. As we delve into their business models, growth strategies, and market performance, I aim to guide you in determining which company may be the more compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Datadog, Inc. Overview

Datadog, Inc. is a leading provider of monitoring and analytics solutions for cloud applications, catering to developers, IT operations teams, and business users globally. Founded in 2010 and headquartered in New York City, Datadog offers a comprehensive SaaS platform that integrates infrastructure monitoring, application performance monitoring, log management, and security monitoring. This enables real-time observability across technology stacks, enhancing user experience and operational efficiency. With a market cap of approximately $55.2B and a workforce of 6.5K employees, Datadog is well-positioned in the software application industry, continually innovating to meet the evolving needs of its customers.

Zscaler, Inc. Overview

Zscaler, Inc. is a prominent cloud security company, headquartered in San Jose, California, and incorporated in 2007. It specializes in providing secure access to external and internal applications through its Zscaler Internet Access and Zscaler Private Access solutions. These offerings empower organizations to seamlessly secure their operations in a cloud-first environment. With a market cap of around $42.5B and employing 7.3K personnel, Zscaler serves a diverse range of industries, ensuring compliance, security, and an enhanced digital experience for users worldwide.

Key Similarities and Differences

Both Datadog and Zscaler operate within the technology sector, focusing on cloud solutions. However, Datadog emphasizes observability and monitoring, while Zscaler specializes in cloud security. Their differing business models cater to distinct aspects of cloud infrastructure, appealing to different segments of the market.

Income Statement Comparison

The following table presents a comparative analysis of key income metrics for Datadog, Inc. and Zscaler, Inc. for their most recent fiscal years.

| Metric | Datadog, Inc. | Zscaler, Inc. |

|---|---|---|

| Revenue | 2.68B | 2.67B |

| EBITDA | 318M | 112M |

| EBIT | 211M | -9M |

| Net Income | 184M | -41M |

| EPS | 0.55 | -0.27 |

Interpretation of Income Statement

In reviewing the income statements of Datadog and Zscaler, a clear disparity in performance emerges. Datadog achieved significant revenue growth from 2.13B in 2023 to 2.68B in 2024, demonstrating a robust upward trend. Conversely, Zscaler’s revenue also increased but at a slower pace, moving from 2.17B in 2024 to 2.67B in 2025. Datadog’s net income rose sharply to 184M, showcasing solid profitability, while Zscaler continues to experience losses, albeit with a slight improvement compared to previous years. This suggests Datadog is enhancing its margins, while Zscaler must address its operational challenges to turn around its financial performance.

Financial Ratios Comparison

The following table compares key financial metrics and ratios for Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) based on the most recent available data.

| Metric | [DDOG] | [ZS] |

|---|---|---|

| ROE | 6.77% | -2.31% |

| ROIC | 1.07% | -7.21% |

| P/E | 261.42 | -1063.01 |

| P/B | 17.70 | 24.51 |

| Current Ratio | 2.64 | 1.94 |

| Quick Ratio | 2.64 | 1.94 |

| D/E | 0.68 | 1.00 |

| Debt-to-Assets | 31.84% | 27.98% |

| Interest Coverage | 7.68 | -13.49 |

| Asset Turnover | 0.46 | 0.42 |

| Fixed Asset Turnover | 6.72 | 4.22 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Datadog exhibits stronger financial health compared to Zscaler, particularly with a positive ROE and higher interest coverage, indicating better profitability and ability to service debt. Zscaler’s negative ratios raise concerns, especially with its reliance on debt and inability to generate profits, suggesting higher risk for investors. Caution is advised when considering Zscaler for investment.

Dividend and Shareholder Returns

Neither Datadog, Inc. (DDOG) nor Zscaler, Inc. (ZS) currently pays dividends, reflecting their strategy of reinvesting profits into growth and innovation. This approach is common in high-growth tech sectors, where capital is prioritized for research and development over shareholder distributions. Both companies engage in share buybacks, which can enhance shareholder value by reducing share dilution. However, the lack of dividends may raise questions about long-term value creation sustainability. Investors should assess whether these strategies align with their investment goals.

Strategic Positioning

Datadog, Inc. (DDOG) holds a strong position in the application monitoring market, with a market cap of $55.2B. Its comprehensive SaaS platform competes effectively against Zscaler, Inc. (ZS), which specializes in cloud security solutions. Both companies face competitive pressure from emerging tech firms and established players that are rapidly innovating. Technological disruptions, such as advancements in AI and machine learning, continually reshape their landscape, requiring ongoing adaptation and strategic agility to maintain market share.

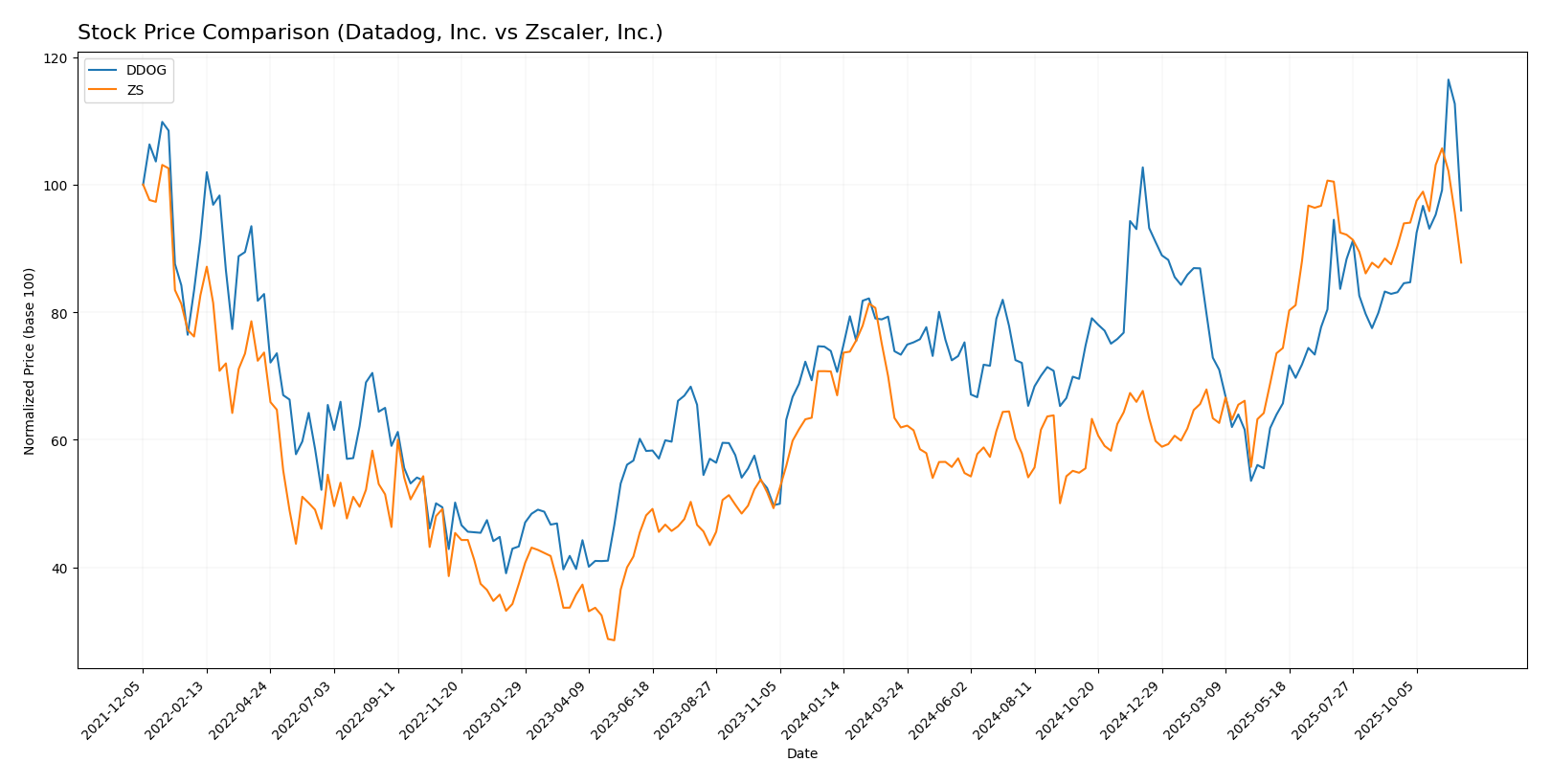

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) over the past year, highlighting key price fluctuations and overall trends.

Trend Analysis

Datadog, Inc. (DDOG) Over the past year, DDOG has exhibited a 29.8% increase in its stock price, indicating a bullish trend. The stock has shown acceleration in its growth, with notable highs of $191.24 and lows of $87.93. The standard deviation of 18.15 suggests a moderate level of volatility. In the recent trend from September 7, 2025, to November 23, 2025, DDOG recorded a 15.78% increase, confirming the bullish momentum with a trend slope of 4.08.

Zscaler, Inc. (ZS) ZS has also demonstrated a 24.12% price increase over the last year, classifying it as a bullish trend as well. The stock’s price reached a high of $331.14 and a low of $156.78, with a standard deviation of 47.23, indicating higher volatility compared to DDOG. However, the recent trend from September 7, 2025, to November 23, 2025, has shown a minimal increase of 0.3%, reflecting a neutral trend with a trend slope of 1.96.

In summary, DDOG is currently on an upward trajectory with significant acceleration, while ZS has experienced a stable growth trend but has recently plateaued in its price movement.

Analyst Opinions

Recent analyst recommendations for Datadog, Inc. (DDOG) indicate a cautious stance with a rating of C+. Analysts highlight strong discounted cash flow and return on equity scores, suggesting potential growth despite some concerns over price-to-earnings metrics. Conversely, Zscaler, Inc. (ZS) has a lower rating of C-, driven by weak performance in key financial ratios, which raises red flags for future profitability. Overall, the consensus for both stocks leans towards a hold in the current year, reflecting uncertainty in market conditions.

Stock Grades

As we analyze the current ratings for Datadog, Inc. and Zscaler, Inc., we can see a consistent sentiment from reputable grading companies.

Datadog, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Goldman Sachs | maintain | Buy | 2025-11-07 |

| Rosenblatt | maintain | Buy | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| DA Davidson | maintain | Buy | 2025-11-07 |

| BMO Capital | maintain | Outperform | 2025-11-07 |

| Keybanc | upgrade | Overweight | 2025-11-07 |

| Canaccord Genuity | maintain | Buy | 2025-11-07 |

| Wells Fargo | maintain | Overweight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-07 |

Zscaler, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-18 |

| Mizuho | maintain | Neutral | 2025-11-17 |

| Morgan Stanley | maintain | Overweight | 2025-11-13 |

| Barclays | maintain | Overweight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

| RBC Capital | maintain | Outperform | 2025-10-02 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

| JMP Securities | maintain | Market Outperform | 2025-09-03 |

| Evercore ISI Group | maintain | Outperform | 2025-09-03 |

| Needham | maintain | Buy | 2025-09-03 |

Overall, both Datadog and Zscaler exhibit a favorable outlook from analysts, with multiple “Buy” and “Outperform” ratings across various firms. Zscaler, while maintaining some “Neutral” ratings, also shows strong support from analysts indicating confidence in its growth trajectory.

Target Prices

The current consensus among analysts indicates promising targets for both Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 179.25 |

| Zscaler, Inc. | 350 | 300 | 326.13 |

For Datadog, the consensus target of 179.25 is higher than its current price of 157.55, suggesting potential upside. Similarly, Zscaler’s target consensus of 326.13 exceeds its current trading price of 275.01, reflecting a favorable outlook according to analysts.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) based on the most recent data.

| Criterion | Datadog, Inc. (DDOG) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Moderate | Moderate |

| Profitability | Low | Low |

| Innovation | High | High |

| Global presence | Strong | Strong |

| Market Share | Growing | Growing |

| Debt level | Moderate | High |

Key takeaways indicate that both companies exhibit strong innovation and global presence, but they face challenges in profitability, with Zscaler having a higher debt level than Datadog.

Risk Analysis

In the following table, I summarize the key risks associated with Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS) to help you assess their investment viability.

| Metric | Datadog, Inc. | Zscaler, Inc. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Low | Moderate |

Both companies face notable risks, particularly in market volatility and regulatory challenges. Zscaler’s high regulatory risk stems from its positioning in the cloud security sector, which is heavily scrutinized. Datadog, while also exposed to market fluctuations, has a somewhat stronger operational framework.

Which one to choose?

When comparing Datadog, Inc. (DDOG) and Zscaler, Inc. (ZS), I find that Datadog shows stronger fundamentals with a market cap of approximately $48B, a gross profit margin of 80.76%, and a favorable revenue growth trajectory. Its stock trend is bullish, having experienced a 29.8% price increase recently, and analysts rate it as C+, indicating moderate performance. In contrast, Zscaler, with a market cap of around $44B, has a lower gross profit margin of 76.87% and a C- rating, suggesting more significant challenges.

For growth-oriented investors, Datadog appears more favorable, while those focused on stability might consider Zscaler, albeit with caution due to its higher volatility and recent price stagnation.

Investors should be mindful of risks such as competition and market dependence, which could impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Datadog, Inc. and Zscaler, Inc. to enhance your investment decisions: