In today’s rapidly evolving technology landscape, CDW Corporation and Zscaler, Inc. stand out as key players in the information technology sector. Both companies are at the forefront of innovation, albeit in different realms—CDW specializes in comprehensive IT solutions, while Zscaler focuses on cloud security. With overlapping market interests and a shared commitment to delivering cutting-edge services, I aim to dissect their strengths and weaknesses. Together, we will uncover which company presents the more compelling investment opportunity.

Table of contents

Company Overview

CDW Overview

CDW Corporation is a leading provider of information technology (IT) solutions, operating mainly in the U.S., U.K., and Canada. Founded in 1984 and headquartered in Vernon Hills, Illinois, CDW serves a diverse clientele, including government, education, healthcare, and various business sectors. The company offers a comprehensive range of products and services that encompass hardware, software, and integrated IT solutions, addressing the needs for on-premise, hybrid, and cloud capabilities. With a market capitalization of approximately $18.25B, CDW stands out for its advisory and managed services, enabling clients to optimize their IT environments.

Zscaler Overview

Zscaler, Inc. is recognized as a pioneer in cloud security, with a focus on securing internet access and private application access for users worldwide. Established in 2007 and headquartered in San Jose, California, Zscaler operates in the Software – Infrastructure segment, boasting a market capitalization of around $42.46B. The company’s core offerings, including Zscaler Internet Access and Zscaler Private Access, empower organizations to securely connect users and devices to applications, whether hosted in data centers or on public clouds. Zscaler’s innovative approach to security helps mitigate risks and enhance user experiences across various industries.

Key similarities between CDW and Zscaler include their strong foothold in the technology sector and their commitment to providing integrated solutions for businesses. However, while CDW emphasizes a broad range of IT products and services, Zscaler specializes in cloud security solutions, reflecting differing focal points within the IT landscape.

Income Statement Comparison

The table below provides a concise comparison of the most recent income statements for CDW Corporation and Zscaler, Inc., focusing on key financial metrics.

| Metric | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Revenue | 20.99B | 2.67B |

| EBITDA | 1.93B | 112M |

| EBIT | 1.65B | -8.77M |

| Net Income | 1.08B | -41.48M |

| EPS | 8.06 | -0.27 |

Interpretation of Income Statement

In the latest fiscal year, CDW demonstrated stability with a slight decline in revenue and net income compared to the previous year, indicating a potential contraction in market share. Despite this, EBITDA margins remain healthy, suggesting effective cost management. Conversely, Zscaler is experiencing significant challenges, reflected in negative net income and operating losses, underscoring the need for strategic adjustments. The growth in revenue is promising but insufficient to offset rising expenses, indicating a potential need for a reassessment of operational efficiencies to improve profitability.

Financial Ratios Comparison

The following table presents a comparison of the most recent financial ratios for CDW Corporation and Zscaler, Inc. This analysis will help investors evaluate the financial health and performance of these companies.

| Metric | CDW | Zscaler |

|---|---|---|

| ROE | 45.81% | -2.31% |

| ROIC | 13.13% | -7.21% |

| P/E | 21.61 | -1063.01 |

| P/B | 9.90 | 24.51 |

| Current Ratio | 1.35 | 1.94 |

| Quick Ratio | 1.24 | 1.94 |

| D/E | 2.55 | 0.99 |

| Debt-to-Assets | 40.82% | 27.98% |

| Interest Coverage | 7.70 | -13.49 |

| Asset Turnover | 1.43 | 0.42 |

| Fixed Asset Turnover | 67.26 | 4.22 |

| Payout Ratio | 30.81% | 0% |

| Dividend Yield | 1.43% | 0% |

Interpretation of Financial Ratios

CDW exhibits strong financial health with high ROE and ROIC, indicating effective use of equity and invested capital. Its manageable debt levels and positive interest coverage suggest stability. In contrast, Zscaler faces significant challenges, reflected by its negative earnings and low asset turnover. The zero dividend payout indicates a focus on reinvestment rather than returning capital to shareholders, which may concern investors seeking income.

Dividend and Shareholder Returns

CDW Corporation offers a dividend with a payout ratio of approximately 30.8%, reflecting a stable annual dividend yield of 1.43%. The company also engages in share buyback programs, which can enhance shareholder value. In contrast, Zscaler, Inc. does not pay dividends due to its reinvestment strategy aimed at supporting high growth. Although it does not distribute cash to shareholders, Zscaler actively repurchases shares, indicating a commitment to enhancing long-term value. Overall, CDW’s approach may provide immediate returns, while Zscaler’s strategy could yield future growth potential.

Strategic Positioning

CDW Corporation holds a significant market share in the IT solutions sector, focusing on hardware, software, and integrated IT services. With a market cap of 18.25B, it faces competitive pressure from Zscaler, Inc., which specializes in cloud security solutions and boasts a market cap of 42.46B. Both companies are subject to technological disruptions, particularly as businesses increasingly adopt cloud-based services and cybersecurity measures. As such, effective risk management strategies will be crucial for maintaining their respective market positions.

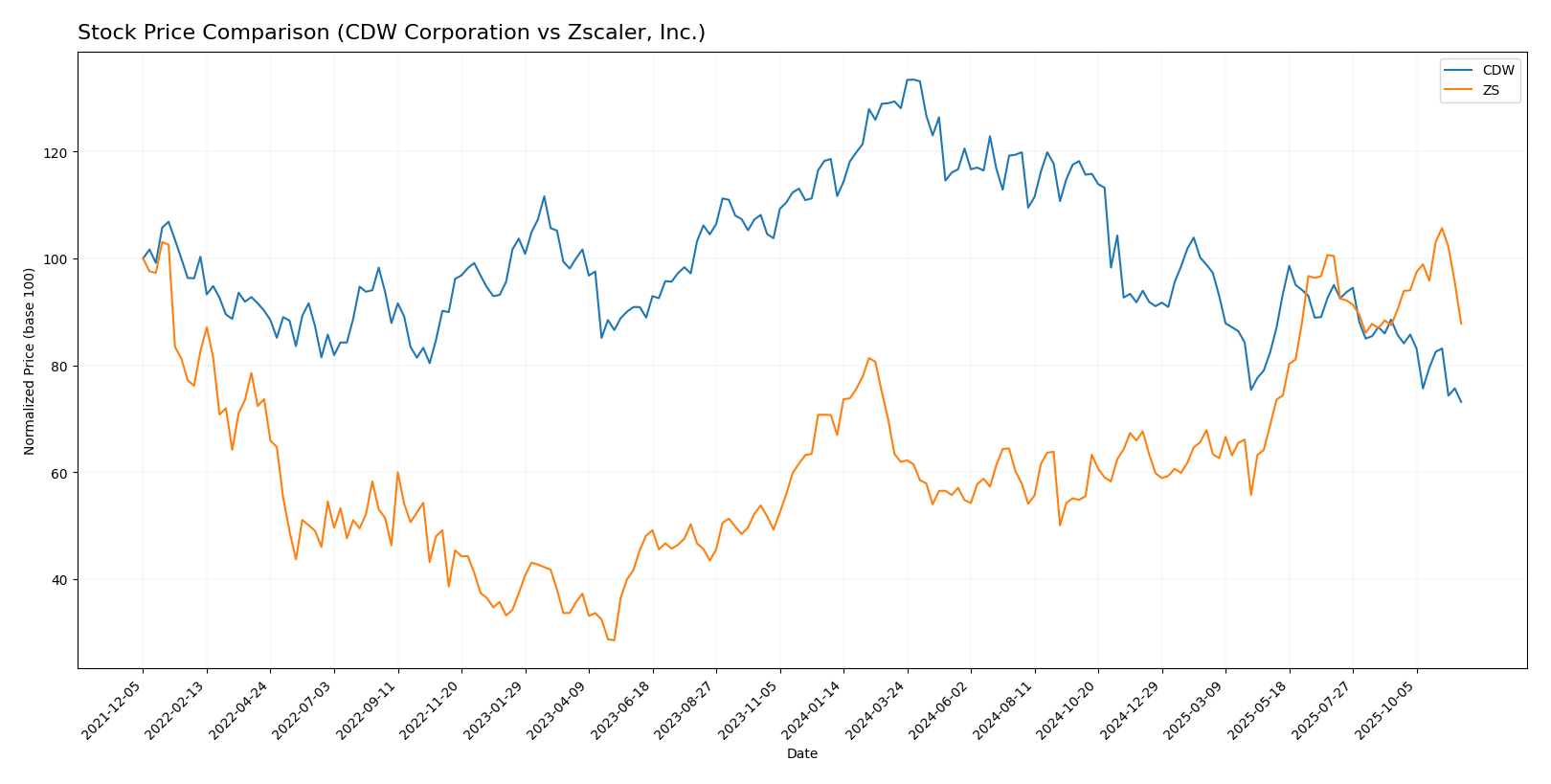

Stock Comparison

In this analysis, I will examine the stock price movements and trading dynamics of CDW Corporation and Zscaler, Inc. over the past year, highlighting key price changes and market behavior.

Trend Analysis

CDW Corporation (CDW) Over the past year, CDW has experienced a significant decline in its stock price, with a total percentage change of -38.32%. This indicates a bearish trend, characterized by deceleration in price movement. The stock reached a notable high of 255.78 and a low of 140.2, reflecting considerable volatility with a standard deviation of 32.02. In the recent period from September 7, 2025, to November 23, 2025, the stock saw a slight decline of -17.4% with a standard deviation of 9.39, indicating a trend slope of -2.27.

Zscaler, Inc. (ZS) In contrast, Zscaler has shown a strong performance over the past year, with a percentage change of +24.12%, indicating a bullish trend with acceleration. The stock recorded a high of 331.14 and a low of 156.78, accompanied by a higher standard deviation of 47.23, suggesting increased volatility. During the recent analysis period from September 7, 2025, to November 23, 2025, Zscaler’s stock experienced a minimal increase of +0.3%, with a standard deviation of 17.44 and a trend slope of 1.96, indicating stability in the current upward trajectory.

Analyst Opinions

Recent analyst recommendations for CDW Corporation indicate a positive outlook, with a rating of B+ reflecting strong performance in return on equity and assets. Analysts suggest a “buy” rating, emphasizing its solid financial health and growth potential. In contrast, Zscaler, Inc. received a C- rating, with analysts recommending a “sell” due to weak performance metrics in key areas like return on equity and assets. For the current year, the consensus leans towards a “buy” for CDW and a “sell” for Zscaler.

Stock Grades

In the ever-evolving world of investments, having access to reliable stock grades can significantly inform our decision-making process. Here’s a look at the most recent grades for two companies: CDW Corporation and Zscaler, Inc.

CDW Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-20 |

| Barclays | Maintain | Equal Weight | 2025-08-07 |

| UBS | Maintain | Buy | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

| Citigroup | Maintain | Neutral | 2025-07-11 |

| Citigroup | Maintain | Neutral | 2025-05-08 |

| UBS | Maintain | Buy | 2025-05-08 |

| Barclays | Maintain | Equal Weight | 2025-05-08 |

Zscaler, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-18 |

| Mizuho | Maintain | Neutral | 2025-11-17 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| Barclays | Maintain | Overweight | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-10-02 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

| JMP Securities | Maintain | Market Outperform | 2025-09-03 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-03 |

| Needham | Maintain | Buy | 2025-09-03 |

Overall, the trend for both CDW and Zscaler shows a consistent maintenance of grades across several reputable grading companies, indicating stable confidence in their performance. Investors may find this encouraging as they consider their positions in these stocks.

Target Prices

The current consensus target prices for CDW Corporation and Zscaler, Inc. indicate optimistic growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CDW Corporation | 190 | 148 | 169 |

| Zscaler, Inc. | 350 | 300 | 326.13 |

For CDW, the target consensus of 169 represents a potential upside from its current price of 140.2. Similarly, Zscaler’s consensus target of 326.13 suggests positive expectations compared to its current market price of 275.01.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of CDW Corporation and Zscaler, Inc., based on the most recent financial data.

| Criterion | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Positive margins | Negative margins |

| Innovation | Moderate | High |

| Global presence | Strong | Moderate |

| Market Share | Significant | Emerging |

| Debt level | High | Moderate |

Key takeaways indicate that CDW has a strong market presence and profitability, but it carries significant debt. In contrast, Zscaler shows high innovation and growth potential but struggles with profitability at this stage.

Risk Analysis

In the following table, I present a detailed risk analysis for two companies: CDW Corporation and Zscaler, Inc. This evaluation focuses on various risk factors that could impact their performance.

| Metric | CDW Corporation | Zscaler, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face distinct risks, with Zscaler experiencing higher operational and market risks due to its reliance on the competitive cloud security sector. Notably, Zscaler’s profitability margins are currently negative, indicating potential challenges ahead.

Which one to choose?

When comparing CDW Corporation (CDW) and Zscaler, Inc. (ZS), the fundamentals suggest a clear distinction in performance and outlook. CDW boasts a solid B+ rating with a market cap of approximately 23.3B and a net profit margin of 5.1%. Its stock trend remains bearish, with a recent price decline of 38.32%. On the other hand, ZS, rated C-, has a market cap of about 44.1B but operates at a loss, evidenced by its negative net profit margin and worsening financial ratios.

For growth-oriented investors, ZS could seem appealing due to its bullish trend, while those prioritizing stability may favor CDW for its profitability and better financial ratios. However, ZS faces significant risks related to market dependence and competition in the cybersecurity space, while CDW must navigate its recent bearish market trend.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of CDW Corporation and Zscaler, Inc. to enhance your investment decisions: