In the rapidly evolving technology landscape, two companies stand out: CDW Corporation and Datadog, Inc. Both operate within the tech sector but cater to distinct needs—CDW focuses on IT solutions while Datadog offers an innovative monitoring platform. Their overlapping presence in the information technology services market makes for an intriguing comparison. In this article, I will explore which of these companies presents a more compelling investment opportunity for savvy investors like you.

Table of contents

Company Overview

CDW Overview

CDW Corporation operates as a leading provider of information technology (IT) solutions across North America, with a focus on corporate, small business, and public sector customers. Established in 1984 and headquartered in Vernon Hills, Illinois, CDW offers a comprehensive range of products and services including hardware, software, and integrated IT solutions that encompass on-premise, hybrid, and cloud technologies. Their offerings span data center and networking solutions, digital workspaces, and security services, catering to a diverse clientele from government to healthcare sectors. With a market capitalization of approximately $18.25B, CDW is committed to delivering tailored IT solutions that enhance operational efficiency.

Datadog Overview

Datadog, Inc. is a prominent player in the cloud monitoring and analytics space, providing a software-as-a-service (SaaS) platform that delivers real-time observability for IT operations and developers. Founded in 2010 and headquartered in New York City, Datadog integrates various monitoring capabilities—including infrastructure, application performance, and security monitoring—into a cohesive platform. This enables organizations to gain insights into their technology stacks and streamline incident management. With a market cap of around $55.25B, Datadog has positioned itself as an essential tool for businesses navigating the complexities of modern cloud environments.

Key Similarities and Differences

Both CDW and Datadog operate within the technology sector, focusing on enhancing IT operations for businesses. However, CDW primarily provides hardware and integrated IT solutions, while Datadog specializes in cloud-based monitoring and analytics. This distinction in their business models highlights CDW’s strength in end-to-end IT services compared to Datadog’s focus on observability and performance management.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for CDW Corporation and Datadog, Inc., highlighting key financial metrics for investors.

| Metric | CDW | Datadog |

|---|---|---|

| Revenue | 20.99B | 2.68B |

| EBITDA | 1.93B | 318M |

| EBIT | 1.65B | 211M |

| Net Income | 1.08B | 184M |

| EPS | 8.06 | 0.55 |

Interpretation of Income Statement

In the latest fiscal year, CDW reported a slight decline in revenue to 20.99B, reflecting a continuing trend of decreasing income from the previous year. Notably, CDW’s net income also decreased to 1.08B, indicating pressure on profitability. In contrast, Datadog exhibited significant revenue growth, reaching 2.68B, and improved its net income to 184M, marking a positive turn in performance. The margins for CDW have shown slight contraction, while Datadog’s margins are expanding, showcasing its operational effectiveness. Overall, CDW appears to be facing challenges, whereas Datadog demonstrates robust growth potential, which may attract investors seeking upward momentum.

Financial Ratios Comparison

In this section, I will provide a comparative analysis of key financial ratios for CDW Corporation and Datadog, Inc. This will help in understanding their financial health and performance metrics.

| Metric | CDW | Datadog |

|---|---|---|

| ROE | 45.81% | 6.77% |

| ROIC | 13.13% | 1.07% |

| P/E | 21.61 | 261.42 |

| P/B | 9.90 | 17.70 |

| Current Ratio | 1.35 | 2.64 |

| Quick Ratio | 1.24 | 2.64 |

| D/E | 2.55 | 0.68 |

| Debt-to-Assets | 40.82% | 31.84% |

| Interest Coverage | 7.70 | 7.68 |

| Asset Turnover | 1.43 | 0.46 |

| Fixed Asset Turnover | 67.26 | 6.72 |

| Payout Ratio | 30.81% | 0% |

| Dividend Yield | 1.43% | 0% |

Interpretation of Financial Ratios

CDW exhibits significantly stronger financial metrics compared to Datadog, particularly in ROE and asset efficiency ratios, indicating robust profitability and effective asset utilization. Datadog, however, shows a solid current and quick ratio, suggesting better short-term liquidity management. Potential concerns for Datadog lie in its high P/E ratio, reflecting investor expectations that may be difficult to meet, and its lack of dividend payments, which may deter income-focused investors.

Dividend and Shareholder Returns

CDW Corporation pays a dividend of $2.48 per share, with a payout ratio of approximately 31%. The annual dividend yield stands at 1.43%, supported by strong free cash flow. CDW’s share buyback programs further enhance shareholder returns, but caution is warranted as high payout ratios can pose risks if earnings fluctuate.

On the other hand, Datadog, Inc. does not pay dividends, opting instead to reinvest profits into growth opportunities. This strategy, while lacking immediate cash returns, aims at long-term value creation, supported by share buybacks. Overall, CDW’s dividends and Datadog’s growth strategy present contrasting approaches to shareholder value.

Strategic Positioning

In the competitive landscape of the technology sector, CDW Corporation (CDW) and Datadog, Inc. (DDOG) hold distinct market positions. CDW, with a market cap of 18.25B, focuses on IT solutions for a broad customer base, driving significant hardware and software sales. In contrast, Datadog, valued at 55.25B, excels in providing cloud monitoring services, benefiting from increased demand for observability tools. Both companies face competitive pressures from emerging technologies and must continuously innovate to maintain their market shares.

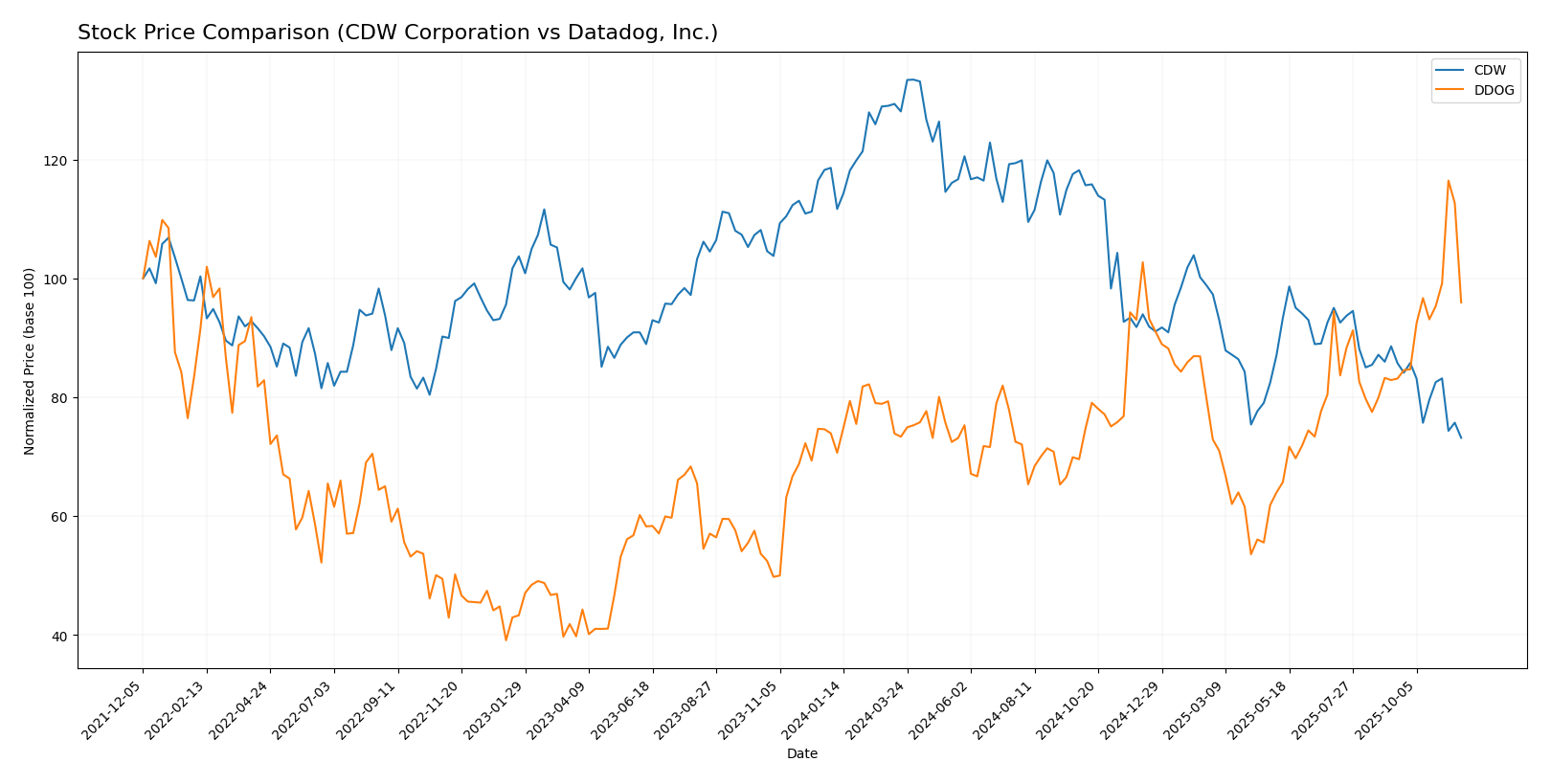

Stock Comparison

In this section, I will provide an analysis of the stock price movements and trading dynamics for CDW Corporation (CDW) and Datadog, Inc. (DDOG) over the past year, highlighting significant trends and price fluctuations.

Trend Analysis

CDW Corporation (CDW) Over the past year, CDW’s stock has experienced a price change of -38.32%, indicating a bearish trend. The highest price reached was $255.78, while the lowest was $140.20. The trend shows deceleration, with a recent decline of -17.4% from September 7, 2025, to November 23, 2025. The standard deviation of 32.02 suggests a high level of volatility in the stock’s price.

Datadog, Inc. (DDOG) In contrast, DDOG’s stock has demonstrated a price change of +29.8%, reflecting a bullish trend. The stock reached a peak of $191.24 and a low of $87.93. The trend is characterized by acceleration, with a recent increase of +15.78% over the same period. The standard deviation of 18.15 indicates moderate volatility, supporting a positive outlook for the stock.

In summary, while CDW is currently facing challenges with a significant downward trend, DDOG shows strong upward momentum, making it an attractive candidate for investors looking to enhance their portfolios.

Analyst Opinions

Recent analyst recommendations for CDW Corporation (CDW) indicate a strong buy sentiment, with an overall rating of B+ based on solid financial metrics such as a high return on equity score of 5. Analysts highlight its strong cash flow and manageable debt levels as key strengths. In contrast, Datadog, Inc. (DDOG) holds a C+ rating, reflecting a more cautious outlook. Analysts cite its lower return on equity and high debt-to-equity ratio as concerns. Overall, the consensus leans towards a buy for CDW and a hold for DDOG this year.

Stock Grades

In the current market landscape, analyzing stock grades from reputable sources can provide valuable insights for informed investment decisions. Below are the latest grades for CDW Corporation and Datadog, Inc., reflecting a consensus among established grading companies.

CDW Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Buy | 2025-11-05 |

| Barclays | maintain | Equal Weight | 2025-11-05 |

| Evercore ISI Group | maintain | Outperform | 2025-10-20 |

| Barclays | maintain | Equal Weight | 2025-08-07 |

| UBS | maintain | Buy | 2025-08-07 |

| JP Morgan | maintain | Neutral | 2025-07-17 |

| Citigroup | maintain | Neutral | 2025-07-11 |

| Citigroup | maintain | Neutral | 2025-05-08 |

| UBS | maintain | Buy | 2025-05-08 |

| Barclays | maintain | Equal Weight | 2025-05-08 |

Datadog, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Goldman Sachs | maintain | Buy | 2025-11-07 |

| Rosenblatt | maintain | Buy | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| DA Davidson | maintain | Buy | 2025-11-07 |

| BMO Capital | maintain | Outperform | 2025-11-07 |

| Keybanc | upgrade | Overweight | 2025-11-07 |

| Canaccord Genuity | maintain | Buy | 2025-11-07 |

| Wells Fargo | maintain | Overweight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-07 |

The overall trend for CDW Corporation shows consistent maintenance of grades across several reputable firms, indicating stability in investor sentiment. Meanwhile, Datadog, Inc. demonstrates a strong rating with multiple “Buy” recommendations, suggesting positive market expectations and confidence in its growth potential.

Target Prices

The consensus target prices from analysts indicate positive expectations for both CDW Corporation and Datadog, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CDW Corporation | 190 | 148 | 169 |

| Datadog, Inc. | 215 | 105 | 179.25 |

Analysts expect CDW to reach a consensus of 169, while Datadog has a higher consensus target of 179.25. Both targets suggest potential upside compared to their current stock prices of 140.2 for CDW and 157.55 for Datadog.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of CDW Corporation and Datadog, Inc. based on the most recent data.

| Criterion | CDW Corporation | Datadog, Inc. |

|---|---|---|

| Diversification | Strong across IT solutions in multiple sectors | Focused on cloud monitoring and analytics |

| Profitability | Moderate (Net Profit Margin: 5.13%) | Low to negative, with recent margins under pressure |

| Innovation | Steady improvements in IT solutions | High innovation in cloud monitoring technologies |

| Global presence | Operates in the US, UK, Canada | Expanding globally but primarily US-centric |

| Market Share | Strong in IT services | Growing, but niche compared to larger competitors |

| Debt level | High (Debt to Equity: 2.54) | Moderate (Debt to Equity: 0.68) |

Key takeaways: CDW shows strength in diversification and profitability, albeit with high debt levels. Datadog excels in innovation but faces challenges with profitability and market share as it seeks global expansion.

Risk Analysis

The following table summarizes the key risks associated with each company:

| Metric | CDW Corporation | Datadog, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In analyzing these risks, I find that Datadog, Inc. faces higher operational and market risks compared to CDW Corporation. This is particularly concerning given Datadog’s high valuation metrics, which may amplify the impact of market fluctuations.

Which one to choose?

When comparing CDW Corporation (CDW) and Datadog, Inc. (DDOG), the fundamental analysis suggests that CDW is currently more stable, with a market cap of $23.29B and a B+ rating from analysts, indicating strong performance metrics like return on equity (ROE) of 45.81% and a solid net profit margin of 5.13%. In contrast, DDOG, with a market cap of $48.04B, carries a C+ rating, reflecting challenges such as a net income margin of 6.85% but a high price-to-earnings ratio of 261.42, suggesting overvaluation relative to earnings.

For growth-oriented investors, DDOG may look appealing due to its bullish stock trend, with a recent 29.8% price increase. However, investors focusing on stability and income might prefer CDW, which has a better risk profile and consistent profitability.

Specific risks include competition in the tech sector and potential supply chain vulnerabilities.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of CDW Corporation and Datadog, Inc. to enhance your investment decisions: