In today’s fast-paced technology landscape, Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) stand as titans in their respective fields. Both companies operate within the technology sector, yet they focus on distinct areas: Cisco in communication equipment and Palo Alto in cybersecurity solutions. This comparison highlights their innovative strategies and market overlap, particularly in security offerings. As we delve into their performance and potential, I’ll help you uncover which company could be the more compelling addition to your investment portfolio.

Table of contents

Company Overview

Cisco Systems, Inc. Overview

Cisco Systems, Inc. operates as a global leader in networking and cybersecurity technologies. Founded in 1984 and headquartered in San Jose, California, Cisco designs, manufactures, and sells Internet Protocol-based networking solutions. The company’s mission emphasizes creating a connected future through innovative communication and information technology. Cisco’s extensive portfolio includes products for enterprise routing, switching, collaboration, and security, serving a diverse clientele that ranges from small businesses to large governmental organizations. With a market capitalization of approximately 300.7B, Cisco maintains a strong foothold in the communication equipment sector.

Palo Alto Networks, Inc. Overview

Palo Alto Networks, Inc., established in 2005 and based in Santa Clara, California, specializes in cybersecurity solutions, providing advanced firewall and security management technologies. The company’s mission is to protect digital environments through innovative cybersecurity products and services. With a market cap of around 122.3B, Palo Alto Networks focuses on delivering robust security solutions for enterprises and governmental entities across various industries. Their offerings include threat prevention, cloud security, and threat intelligence services, establishing them as a significant player in the software infrastructure industry.

Key similarities between Cisco and Palo Alto Networks include their focus on technology and security solutions, catering primarily to enterprise clients. However, their business models diverge, as Cisco emphasizes a broader range of networking products alongside security features, while Palo Alto Networks concentrates exclusively on cybersecurity solutions.

Income Statement Comparison

The following table summarizes the latest income statement metrics for Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) for the fiscal year 2025.

| Metric | CSCO | PANW |

|---|---|---|

| Revenue | 56.65B | 9.22B |

| EBITDA | 15.38B | 1.94B |

| EBIT | 12.52B | 1.60B |

| Net Income | 10.18B | 1.13B |

| EPS | 2.56 | 1.71 |

Interpretation of Income Statement

In 2025, CSCO’s revenue slightly decreased from 2024, reflecting a challenging market environment, while PANW experienced significant revenue growth, up from 8.03B in 2024. CSCO’s net income remained relatively stable, but margins saw a decline, indicating increased costs. PANW’s net income also improved, highlighting effective cost management strategies. Both companies exhibit solid earnings per share (EPS), but CSCO’s decreased margin suggests potential areas for operational improvement, while PANW’s growth trajectory indicates a strong market position and robust demand for its cybersecurity solutions.

Financial Ratios Comparison

The table below provides a comparative analysis of key financial ratios for Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) for the fiscal year 2025.

| Metric | CSCO | PANW |

|---|---|---|

| ROE | 21.73% | 14.49% |

| ROIC | 11.62% | 5.67% |

| P/E | 26.83 | 101.43 |

| P/B | 5.83 | 14.70 |

| Current Ratio | 0.998 | 0.889 |

| Quick Ratio | 0.908 | 0.889 |

| D/E | 0.633 | 0.043 |

| Debt-to-Assets | 0.242 | 0.014 |

| Interest Coverage | 7.38 | 414.30 |

| Asset Turnover | 0.463 | 0.391 |

| Fixed Asset Turnover | 16.59 | 12.56 |

| Payout ratio | 63.23% | 0% |

| Dividend yield | 2.36% | 0% |

Interpretation of Financial Ratios

Cisco shows stronger profitability and efficiency metrics, particularly in ROE and ROIC, indicating effective use of equity and capital. However, its higher P/E ratio suggests that investors may be paying a premium for growth. Conversely, Palo Alto Networks presents a concerningly high P/E ratio coupled with a lack of dividends, which may indicate overvaluation and potential risk. The low debt levels in PANW are a positive, but the overall ratios suggest caution in investing in PANW compared to CSCO.

Dividend and Shareholder Returns

Cisco Systems, Inc. (CSCO) offers a dividend with a payout ratio of approximately 63% and a yield of 2.36%, indicating a commitment to returning value to shareholders. The company also engages in share buybacks, which can enhance shareholder returns but may pose risks if conducted excessively.

In contrast, Palo Alto Networks, Inc. (PANW) does not pay dividends, focusing instead on reinvestment for growth, particularly in R&D and acquisitions. This strategy aims to create long-term shareholder value, although it lacks immediate cash returns. The absence of dividends may be justified if it results in substantial future growth potential.

Overall, Cisco’s balanced approach with dividends and buybacks seems more supportive of sustainable value creation, while Palo Alto’s growth-focused strategy may pay off in the long run.

Strategic Positioning

Cisco Systems, Inc. (CSCO) holds a significant market share in the communication equipment sector, leveraging its comprehensive product offerings in networking and security solutions. With a market cap of $300.7B, it faces competitive pressure from Palo Alto Networks, Inc. (PANW), which specializes in cybersecurity with a market cap of $122.3B. Both companies are navigating technological disruptions, necessitating continuous innovation to maintain their positions. As they adapt to market dynamics, risk management remains crucial for investors considering their potential.

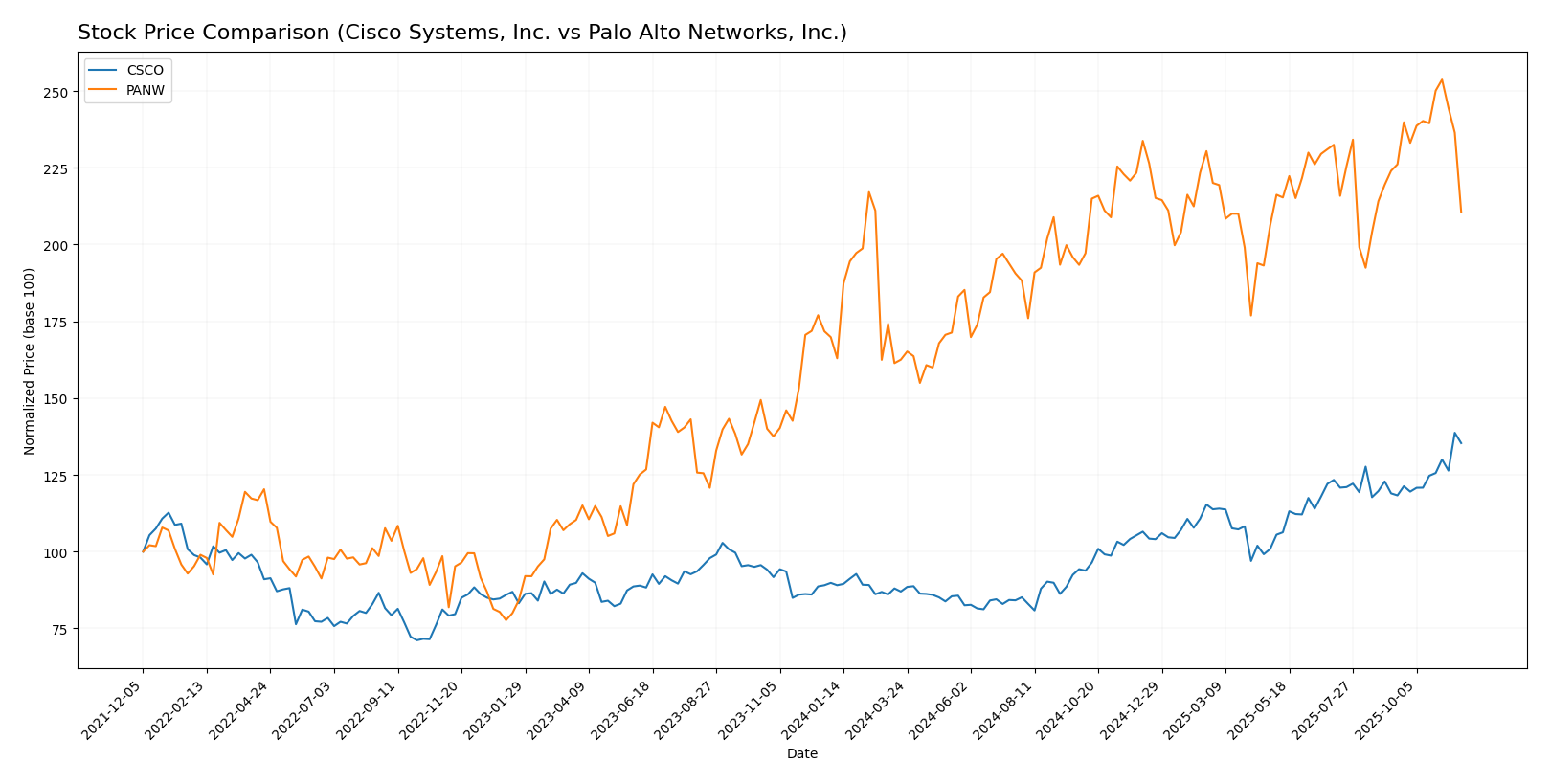

Stock Comparison

In the past year, Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) have exhibited significant price movements and trading dynamics, reflecting the contrasting market sentiments towards these companies.

Trend Analysis

Cisco Systems, Inc. (CSCO)

Over the past year, CSCO has demonstrated a price change of +50.63%, indicating a bullish trend. Notably, the stock has experienced acceleration in its upward movement, with a standard deviation of 8.48, suggesting moderate volatility. The stock reached a high of 78.0 and a low of 45.47 during this period. Recently, from September 7, 2025, to November 23, 2025, CSCO’s price increased by +13.75% with a standard deviation of 3.56, maintaining a positive trend slope of 0.92.

Palo Alto Networks, Inc. (PANW)

In contrast, PANW has shown a price change of +24.05% over the past year, also indicating a bullish trend but with deceleration evident in its recent performance. The standard deviation of 20.4 implies higher volatility compared to CSCO. The stock peaked at 220.24 and fell to a low of 134.51. However, in the latest analysis period from September 7, 2025, to November 23, 2025, PANW experienced a decline of -5.94%, with a standard deviation of 9.79, and a trend slope of 0.35, suggesting a weakening momentum.

In summary, while both stocks have shown positive annual growth, CSCO’s recent performance reflects a stronger upward momentum compared to PANW’s recent downturn.

Analyst Opinions

Recent analyst ratings indicate a consensus “Buy” for both Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW). Analysts have given CSCO a “B” rating, highlighting strong scores in discounted cash flow and return on equity. Meanwhile, PANW shares the same rating, with solid performance in return on assets and discounted cash flow as well. Notable analysts supporting these ratings include those from leading financial institutions, emphasizing the potential growth and stability of both companies in the current market environment.

Stock Grades

In analyzing the most recent stock grades, I found reliable ratings from reputable grading companies for both Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW).

Cisco Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-13 |

| B of A Securities | maintain | Buy | 2025-11-13 |

| Evercore ISI Group | maintain | In Line | 2025-11-13 |

| Barclays | maintain | Equal Weight | 2025-11-13 |

| UBS | maintain | Buy | 2025-11-13 |

| Morgan Stanley | maintain | Overweight | 2025-11-13 |

| Piper Sandler | maintain | Neutral | 2025-11-13 |

| Wells Fargo | maintain | Overweight | 2025-11-13 |

| Keybanc | maintain | Overweight | 2025-11-13 |

| JP Morgan | maintain | Overweight | 2025-11-13 |

Palo Alto Networks, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HSBC | downgrade | Reduce | 2025-11-21 |

| Goldman Sachs | maintain | Buy | 2025-11-21 |

| Bernstein | maintain | Outperform | 2025-11-20 |

| DA Davidson | maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-20 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| Wedbush | maintain | Outperform | 2025-11-20 |

| BTIG | maintain | Buy | 2025-11-20 |

| WestPark Capital | maintain | Hold | 2025-11-20 |

| Piper Sandler | maintain | Overweight | 2025-11-20 |

Overall, Cisco maintains a strong performance with consistent “Buy” and “Overweight” ratings, indicating investor confidence. Conversely, Palo Alto Networks shows mixed signals with a downgrade from HSBC, yet retains several “Buy” ratings from other analysts, reflecting a cautious yet potentially favorable outlook.

Target Prices

The current consensus target prices for Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) suggest potential upside from their respective stock prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cisco Systems, Inc. (CSCO) | 88 | 69 | 76.75 |

| Palo Alto Networks, Inc. (PANW) | 250 | 157 | 228.83 |

For Cisco, the consensus target price of 76.75 is in line with its current trading price of 76.1, indicating modest growth potential. Conversely, Palo Alto Networks shows a consensus of 228.83 against its current price of 182.9, reflecting a more substantial upside potential.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW).

| Criterion | Cisco Systems, Inc. (CSCO) | Palo Alto Networks, Inc. (PANW) |

|---|---|---|

| Diversification | Strong portfolio in networking and cybersecurity | Focused primarily on cybersecurity solutions |

| Profitability | Net profit margin: 17.97% | Net profit margin: 12.30% |

| Innovation | High investment in R&D | Rapid development in cloud security |

| Global presence | Significant international reach | Growing global customer base |

| Market Share | 25% in communication equipment | 10% in cybersecurity |

| Debt level | Moderate (Debt/Equity: 0.63) | Low (Debt/Equity: 0.04) |

In summary, Cisco Systems leverages strong diversification and profitability, while Palo Alto Networks excels in innovation and maintains low debt levels. Both companies hold significant market positions but cater to different aspects of the technology sector.

Risk Analysis

In the following table, I outline the key risks associated with Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW) as of 2025.

| Metric | CSCO | PANW |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, especially in the volatile tech sector. Cisco’s lower operational and environmental risks contrast with Palo Alto’s higher exposure, particularly in cybersecurity. This highlights the importance of considering these factors in investment decisions.

Which one to choose?

In evaluating Cisco Systems, Inc. (CSCO) and Palo Alto Networks, Inc. (PANW), both companies exhibit solid fundamentals but cater to different investor needs. Cisco boasts a robust net profit margin of 17.97% and a price-to-earnings (P/E) ratio of 26.83, indicating steady profitability and reasonable valuation. Its stock trend shows a bullish movement with a 50.63% price increase over the year. Conversely, Palo Alto has a much higher P/E ratio of 101.43, reflecting its aggressive growth strategy but also higher risk due to valuation concerns.

For growth-focused investors, PANW may seem appealing due to its higher revenue growth rates, while those prioritizing stability and dividends may prefer CSCO, which has a consistent dividend yield of 2.36%.

However, both companies face risks, including competition and market dependency that could impact their future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cisco Systems, Inc. and Palo Alto Networks, Inc. to enhance your investment decisions: