In the rapidly evolving tech landscape, Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM) stand out as key players within the software and semiconductor industries, respectively. Both companies are at the forefront of innovation, focusing on advanced technologies that drive market growth. By comparing their approaches to design, development, and market penetration, this article aims to shed light on which company presents a more compelling investment opportunity. Are you ready to discover the potential hidden in these tech giants?

Table of contents

Company Overview

Cadence Design Systems, Inc. Overview

Cadence Design Systems, Inc. (CDNS) is a leading provider of software, hardware, services, and reusable integrated circuit (IC) design blocks. Established in 1987 and headquartered in San Jose, California, Cadence specializes in functional verification, digital IC design, and custom IC design. Its comprehensive portfolio includes advanced solutions for 5G communications, automotive, aerospace, and healthcare markets. With a market capitalization of approximately $82B, the company leverages its extensive expertise to support semiconductor companies in reducing design time and enhancing product reliability.

Arm Holdings plc American Depositary Shares Overview

Arm Holdings plc (ARM), founded in 1990 and based in Cambridge, UK, is a prominent player in the semiconductor industry, focusing on the architecture and licensing of microprocessors and systems intellectual property. The company’s products are integral to a wide array of sectors, including automotive and IoT. With a market capitalization around $139B, Arm’s innovative technologies enable original equipment manufacturers to develop cutting-edge products, solidifying its position as a vital contributor to the global tech ecosystem.

Key similarities and differences in their business models: Both Cadence and Arm operate within the technology sector, providing essential tools for semiconductor design and development. However, while Cadence emphasizes software and services for IC design and verification, Arm focuses on licensing semiconductor architecture and related technologies. This distinction highlights their complementary roles in the semiconductor supply chain.

Income Statement Comparison

The table below provides a comparison of the income statements for Cadence Design Systems, Inc. and Arm Holdings plc for their most recent fiscal years, highlighting key financial metrics.

| Metric | Cadence Design Systems, Inc. (CDNS) | Arm Holdings plc (ARM) |

|---|---|---|

| Revenue | 4.64B | 4.01B |

| EBITDA | 1.67B | 902M |

| EBIT | 1.47B | 720M |

| Net Income | 1.06B | 792M |

| EPS | 3.89 | 0.75 |

Interpretation of Income Statement

In the most recent fiscal year, Cadence Design Systems reported a revenue increase to 4.64B from the previous year’s 4.09B, indicating a strong growth trajectory. Net income also rose slightly, reflecting solid profitability at 1.06B. In contrast, Arm Holdings experienced robust revenue growth from 3.23B to 4.01B, with net income rising to 792M, showcasing improved operational efficiency. Both companies showed stable margins; however, Cadence maintained higher profitability levels, suggesting effective cost management strategies compared to Arm. Overall, both companies are performing well, yet Cadence demonstrates stronger financial health and stability.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial ratios for Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM) based on the most recent fiscal data.

| Metric | CDNS | ARM |

|---|---|---|

| ROE | 22.58% | 11.58% |

| ROIC | 13.43% | 11.31% |

| P/E | 77.20 | 141.58 |

| P/B | 17.44 | 16.40 |

| Current Ratio | 2.93 | 5.20 |

| Quick Ratio | 2.74 | 5.20 |

| D/E | 0.55 | 0.05 |

| Debt-to-Assets | 0.29 | 0.04 |

| Interest Coverage | 17.77 | N/A |

| Asset Turnover | 0.52 | 0.45 |

| Fixed Asset Turnover | 7.68 | 5.61 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

In comparing CDNS with ARM, CDNS exhibits stronger profitability with a higher ROE and ROIC, indicating better efficiency in generating profit from equity and invested capital. However, ARM’s current and quick ratios suggest superior liquidity, which is a strong point for managing short-term obligations. The high P/E and P/B ratios for ARM indicate that it may be overvalued relative to its earnings and book value compared to CDNS. Overall, while CDNS shows strong profitability, ARM’s liquidity presents a potential advantage, albeit with higher valuation concerns.

Dividend and Shareholder Returns

Cadence Design Systems, Inc. (CDNS) does not pay dividends, choosing instead to reinvest earnings for growth. This strategy aligns with its high-growth business model, focusing on R&D and acquisitions, aiming to enhance long-term shareholder value. They do engage in share buybacks, which can provide support for share prices.

In contrast, Arm Holdings plc (ARM) also does not distribute dividends. The company is in a growth phase and prioritizes R&D investments. However, it conducts share buybacks, which may help in returning value to shareholders.

Both companies’ approaches reflect a focus on sustainable long-term value creation rather than immediate cash distributions.

Strategic Positioning

Cadence Design Systems (CDNS) holds a significant market share in the software application sector, particularly in functional verification and IC design, with a market cap of $81.8B. Arm Holdings (ARM), with a market cap of $138.9B, leads in semiconductor technology, providing crucial microprocessor designs. Both companies face competitive pressure from emerging tech firms and established players. Additionally, ongoing technological disruptions, especially in AI and IoT, necessitate continuous innovation and adaptation to maintain their market positions.

Stock Comparison

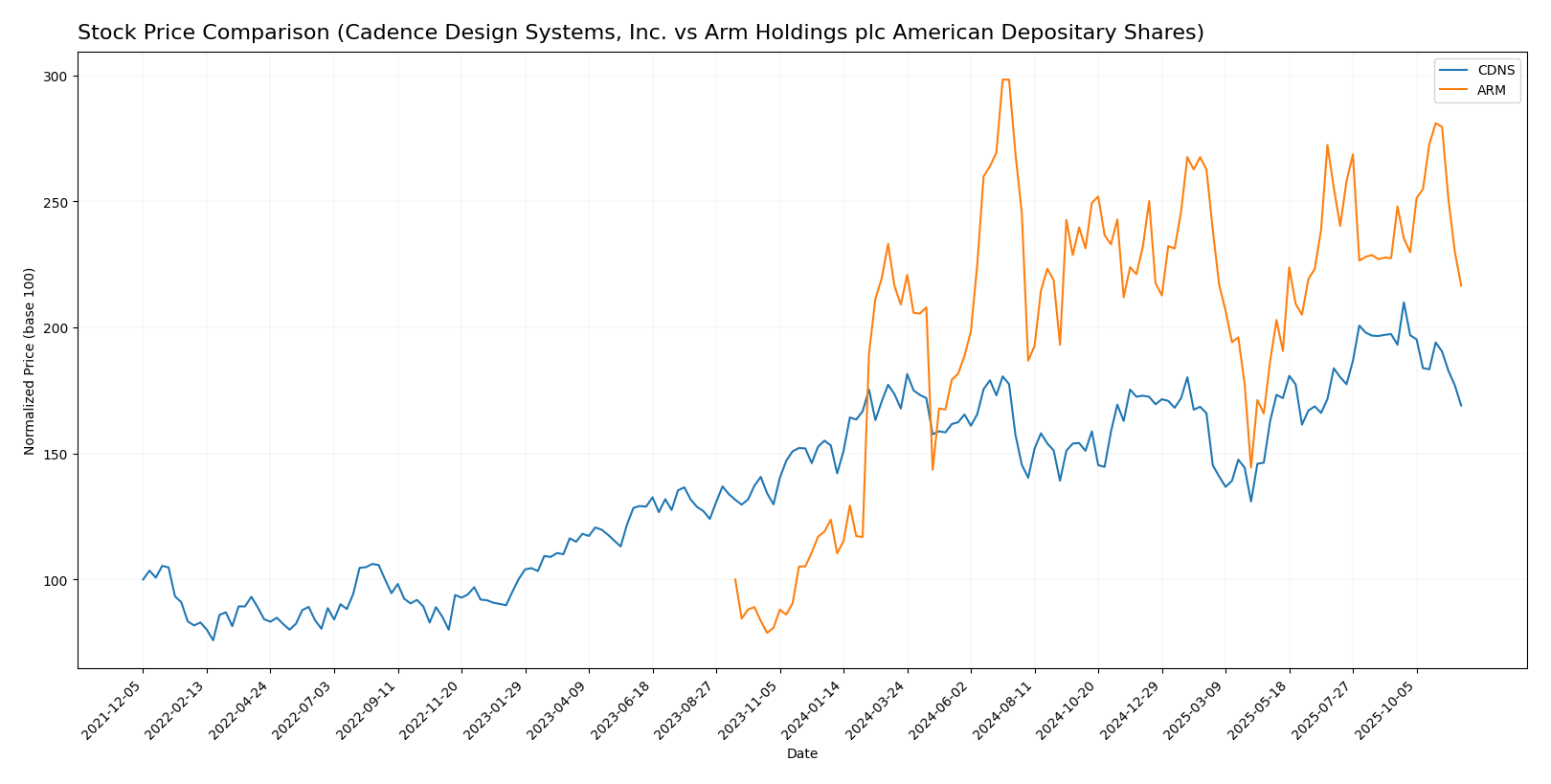

Over the past year, both Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM) have experienced notable price movements, reflecting dynamic trading conditions and investor sentiment.

Trend Analysis

Cadence Design Systems, Inc. (CDNS) has seen a price increase of 10.36% over the last year. Despite this overall bullish trend, recent performance from September 7, 2025, to November 23, 2025, reveals a decline of -14.37%, indicating a bearish phase in the short term. The highest price reached was 373.35, while the lowest was 232.88. The acceleration status shows deceleration, suggesting that the upward momentum may be slowing down. Volatility is measured with a standard deviation of 29.22, indicating significant price fluctuations.

Arm Holdings plc (ARM) has demonstrated an impressive price increase of 75.08% over the past year, confirming a strong bullish trend. However, in the recent period, the stock has experienced a -4.78% decrease from September 7, 2025, to November 23, 2025, indicating short-term bearish behavior. The stock hit a high of 181.19 and a low of 67.05 during the year. The trend shows acceleration, which might suggest a potential rebound in the future. The standard deviation of 24.15 indicates moderate volatility within the stock price.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for the two companies. For Cadence Design Systems, Inc. (CDNS), analysts have rated it a “B,” reflecting solid financial health with particularly strong return on assets. Conversely, Arm Holdings plc (ARM) received a “B-” rating, indicating some caution due to lower scores in discounted cash flow and price-to-earnings metrics. The consensus for CDNS leans towards a buy, while ARM is more neutral, suggesting a hold strategy for this year. Analysts emphasize the importance of monitoring market conditions closely.

Stock Grades

I have gathered the latest stock grades from reliable grading companies for two companies, Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM). Here’s a breakdown of their current ratings.

Cadence Design Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-10-28 |

| Rosenblatt | maintain | Neutral | 2025-10-28 |

| Needham | maintain | Buy | 2025-10-28 |

| Wells Fargo | maintain | Overweight | 2025-10-28 |

| Oppenheimer | maintain | Underperform | 2025-10-28 |

| Baird | maintain | Outperform | 2025-10-28 |

| Rosenblatt | maintain | Neutral | 2025-10-22 |

| Keybanc | maintain | Overweight | 2025-07-29 |

| JP Morgan | maintain | Overweight | 2025-07-29 |

| Stifel | maintain | Buy | 2025-07-29 |

Arm Holdings plc Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Needham | maintain | Hold | 2025-11-06 |

| Wells Fargo | maintain | Overweight | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Benchmark | maintain | Hold | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

Overall, both companies show a trend of maintaining their grades, with CDNS receiving a mix of positive and neutral ratings while ARM has a strong showing in the buy category. This consistency in ratings suggests a stable outlook for both stocks, but investors should always consider market conditions and their risk tolerance before making investment decisions.

Target Prices

The latest consensus target prices for Cadence Design Systems, Inc. and Arm Holdings plc indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cadence Design Systems, Inc. | 418 | 355 | 396.14 |

| Arm Holdings plc | 210 | 190 | 200 |

For Cadence Design Systems, the consensus target price of 396.14 suggests a significant upside from its current price of 300.58. Similarly, Arm Holdings has a target consensus of 200, which also indicates a potential for growth from its current price of 131.57. Overall, these targets present a favorable outlook for both companies.

Strengths and Weaknesses

In this section, I will outline the strengths and weaknesses of Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM) to assist you in making informed investment decisions.

| Criterion | Cadence Design Systems (CDNS) | Arm Holdings (ARM) |

|---|---|---|

| Diversification | Strong presence in multiple technological sectors, including automotive, healthcare, and consumer electronics. | Focused on semiconductor technology but expanding into various markets like IoT and automotive. |

| Profitability | High net profit margin at 25.5% (2023) with consistent revenue growth. | Lower profitability with a net profit margin of 19.8% (2025), but improving. |

| Innovation | Robust R&D investment, leading to cutting-edge design tools and solutions. | Strong focus on innovation in CPU architecture and AI applications, though recent profitability metrics reflect challenges. |

| Global presence | Operates globally with significant reach in North America and Asia. | International presence, particularly strong in Europe and Asia, but less established in North America. |

| Market Share | Holds a leading position in electronic design automation (EDA) software. | Significant market share in mobile and embedded systems, but faces competition from Intel and AMD. |

| Debt level | Moderate debt-to-equity ratio of 0.55, indicating manageable debt levels. | Very low debt-to-equity ratio of 0.05, suggesting a strong balance sheet and low financial risk. |

Key takeaways indicate that while Cadence Design Systems exhibits stronger profitability and innovation, Arm Holdings shows promise with its low debt levels and expanding market presence. Investors should weigh these factors when considering their next investment moves.

Risk Analysis

This table summarizes the key risks associated with two significant technology companies, Cadence Design Systems (CDNS) and Arm Holdings (ARM), based on the most recent data.

| Metric | Cadence Design Systems (CDNS) | Arm Holdings (ARM) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and geopolitical risks. Arm, with its heavy reliance on semiconductor demand and international markets, is particularly vulnerable to supply chain disruptions and regulatory changes. Recent geopolitical tensions have heightened these risks, especially in the technology sector.

Which one to choose?

When comparing Cadence Design Systems, Inc. (CDNS) and Arm Holdings plc (ARM), CDNS exhibits stronger fundamentals with a gross profit margin of 86% and a net profit margin of 22.7%, while ARM’s margins are notably lower at 94.9% and 19.8%, respectively. CDNS also shows superior metrics in terms of return on equity at 22.6%, compared to ARM’s 11.6%. However, ARM has demonstrated a substantial stock price growth of 75.08% and a bullish trend in its stock performance, suggesting strong market momentum.

Investors focused on growth may prefer ARM due to its rapid price appreciation and higher revenue trajectory, while those prioritizing stability might find CDNS more appealing due to its robust profit margins and financial ratios. It’s essential to consider the industry risks, including competition and market dependence, which can impact both companies’ futures.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cadence Design Systems, Inc. and Arm Holdings plc American Depositary Shares to enhance your investment decisions: