In the rapidly evolving tech landscape, Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM) emerge as two titans in the software and semiconductor industries respectively. Both companies are at the forefront of innovation, shaping the future of electronic design and processing technologies. While their market segments differ, they share a commitment to advancing technology solutions that drive performance and efficiency. In this article, I will analyze these two companies to help you determine which one presents the most compelling investment opportunity.

Table of contents

Company Overview

Synopsys, Inc. Overview

Synopsys, Inc. (SNPS) is a leading provider of electronic design automation (EDA) software, instrumental in shaping the semiconductor industry. Founded in 1986 and headquartered in Mountain View, California, Synopsys empowers engineers to design and test integrated circuits through its comprehensive Fusion Design Platform and Verification Continuum Platform. The company serves a diverse range of sectors, including automotive, healthcare, and energy, focusing on providing innovative solutions that enhance design efficiency and security. With a market capitalization of approximately $72.1B, Synopsys remains a pivotal player in the technology sector.

Arm Holdings plc Overview

Arm Holdings plc (ARM) is a globally recognized leader in semiconductor technology, specializing in the development and licensing of CPU products and related technologies. Established in 1990 and headquartered in Cambridge, UK, Arm’s architecture is fundamental to a myriad of applications, from automotive to the Internet of Things. The company operates on a model that emphasizes partnerships with semiconductor manufacturers and OEMs, enabling them to create cutting-edge products. With a substantial market capitalization of around $138.9B, Arm is a key player in the rapidly evolving tech landscape.

Key similarities between Synopsys and Arm include their focus on the technology sector and offering products that aid in semiconductor design and development. However, their business models differ; Synopsys provides EDA software primarily, while Arm licenses its CPU designs and architectures to third parties.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Synopsys, Inc. and Arm Holdings plc, highlighting key financial metrics that can aid in investment decisions.

| Metric | Synopsys, Inc. (SNPS) | Arm Holdings plc (ARM) |

|---|---|---|

| Revenue | 6.13B | 4.01B |

| EBITDA | 1.94B | 902M |

| EBIT | 1.55B | 720M |

| Net Income | 2.26B | 792M |

| EPS | 14.78 | 0.75 |

Interpretation of Income Statement

In the most recent year, Synopsys demonstrated a robust revenue growth of approximately 11% year-over-year, significantly outpacing Arm’s 24% growth. However, Arm’s net income growth is noteworthy, with a marked increase from 306M to 792M, indicating improved operational efficiency. Synopsys maintained strong profit margins, with an EBITDA margin of 31.7%, while Arm’s EBITDA margin stands at 22.5%. Overall, Synopsys remains a strong performer, but Arm is showing promising signs of scalability and profitability, making it an attractive investment option.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM). This will provide you with insights into their financial health and performance.

| Metric | Synopsys, Inc. (SNPS) | Arm Holdings plc (ARM) |

|---|---|---|

| ROE | 25.17% | 11.58% |

| ROIC | 12.04% | 11.31% |

| P/E | 34.75 | 141.58 |

| P/B | 8.75 | 16.40 |

| Current Ratio | 2.44 | 5.20 |

| Quick Ratio | 2.30 | 5.20 |

| D/E | 0.08 | 0.05 |

| Debt-to-Assets | 5.24% | 3.99% |

| Interest Coverage | 38.56 | N/A |

| Asset Turnover | 0.47 | 0.45 |

| Fixed Asset Turnover | 5.43 | 5.61 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios indicate that Synopsys demonstrates strong returns on equity (ROE) and invested capital (ROIC) compared to Arm. However, Arm’s higher current and quick ratios suggest better short-term liquidity. The high P/E ratio for Arm indicates that investors expect significant growth, but it also raises concerns about overvaluation. Both companies have a low debt-to-equity ratio, indicating conservative leverage, which is a positive sign for risk management.

Dividend and Shareholder Returns

Synopsys, Inc. (SNPS) does not pay dividends, reflecting a focus on reinvestment for growth rather than immediate shareholder returns. This aligns with its high net profit margins (approx. 37%) and robust cash flow, allowing for strategic investments. Additionally, SNPS engages in share buybacks, enhancing shareholder value.

In contrast, Arm Holdings (ARM) also refrains from paying dividends, prioritizing growth and R&D. While both companies lack dividend distributions, their reinvestment strategies appear to support long-term value creation for shareholders.

Strategic Positioning

In the competitive landscape of technology, Synopsys, Inc. (SNPS) holds a significant market share in electronic design automation software, catering to a diverse range of industries. Its robust offerings, including the Fusion Design Platform, position it well against competitors. Conversely, Arm Holdings plc (ARM) dominates the semiconductor sector, providing critical CPU architectures and IP solutions for various applications. Both companies face intense competitive pressure and must navigate technological disruptions, particularly in AI and IoT, to maintain their market positions.

Stock Comparison

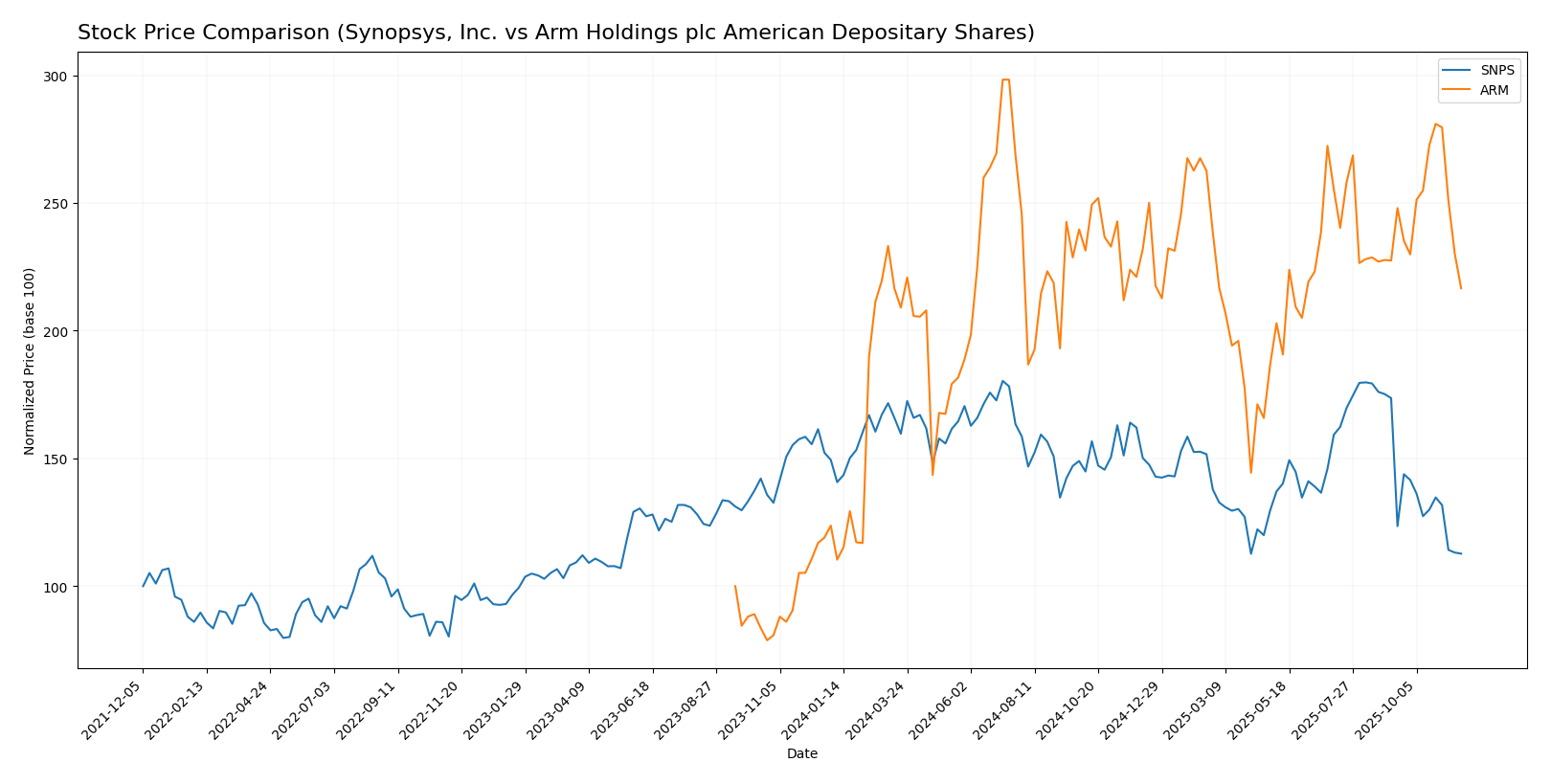

In this section, I will analyze the weekly stock price movements of Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM) over the past year, highlighting significant price fluctuations and trading dynamics.

Trend Analysis

Synopsys, Inc. (SNPS) Over the past year, SNPS has experienced a percentage change of -24.58%, indicating a bearish trend. The stock has shown notable deceleration in its price movements, with a highest price of 621.3 and a lowest price of 388.13. The standard deviation of 57.55 suggests considerable volatility in its trading activity. Recently, from September 7, 2025, to November 23, 2025, the stock has declined further by -35.07%, with a trend slope of -12.3 and a standard deviation of 55.64, reinforcing the bearish outlook.

Arm Holdings plc (ARM) In contrast, ARM has demonstrated a robust bullish trend over the past year, with a remarkable percentage change of +75.08%. The stock is currently in a phase of acceleration, with a highest price of 181.19 and a lowest price of 67.05. The standard deviation of 24.15 reflects moderate volatility. However, in the recent period from September 7, 2025, to November 23, 2025, ARM’s price has slightly decreased by -4.78%, with a trend slope of 0.39, indicating a neutral trend in the short term.

In summary, while SNPS is facing significant challenges with a bearish trend, ARM shows a strong overall performance despite a minor recent pullback. Careful consideration of these trends is essential for making informed investment decisions.

Analyst Opinions

Recent recommendations for Synopsys, Inc. (SNPS) show a rating of B-, indicating a cautious approach with a consensus leaning toward a hold. Analysts appreciate its strong return on assets but highlight concerns about its price-to-earnings ratio. For Arm Holdings plc (ARM), the rating is also B-, with analysts recommending a hold due to similar concerns about valuation metrics. Overall, the consensus for both companies suggests a cautious stance, reflecting a balanced view of potential risks and rewards in the current market environment.

Stock Grades

In the current market, reliable stock grades provide valuable insights for investors. Here’s a breakdown of the latest grades for Synopsys, Inc. and Arm Holdings plc.

Synopsys, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-09-11 |

| Morgan Stanley | maintain | Overweight | 2025-09-11 |

| Wells Fargo | maintain | Equal Weight | 2025-09-10 |

| Piper Sandler | maintain | Overweight | 2025-09-10 |

| JP Morgan | maintain | Overweight | 2025-09-10 |

| Keybanc | maintain | Overweight | 2025-09-10 |

| Goldman Sachs | maintain | Buy | 2025-09-10 |

| Stifel | maintain | Buy | 2025-09-10 |

| B of A Securities | downgrade | Underperform | 2025-09-10 |

| Baird | downgrade | Neutral | 2025-09-10 |

Arm Holdings plc American Depositary Shares Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Needham | maintain | Hold | 2025-11-06 |

| Wells Fargo | maintain | Overweight | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Benchmark | maintain | Hold | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

Overall, both Synopsys and Arm Holdings present a strong consensus among analysts, with most grades reflecting stability and continued positive outlooks. However, investors should note the downgrades for Synopsys by B of A Securities and Baird, which may suggest caution in the short term.

Target Prices

The current consensus among analysts suggests optimistic target prices for both Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 630 | 425 | 546.67 |

| Arm Holdings plc | 210 | 190 | 200 |

For Synopsys, the consensus target price of 546.67 indicates a significant upside potential compared to its current price of 388.36. Meanwhile, Arm’s consensus of 200 also reflects a positive outlook relative to its current price of 131.57, suggesting room for growth in both stocks.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM) based on recent data.

| Criterion | Synopsys, Inc. (SNPS) | Arm Holdings plc (ARM) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (37% net margin) | Moderate (20% net margin) |

| Innovation | Leading in EDA tech | Strong in CPU design |

| Global presence | Strong (US, Europe, Asia) | Strong (Global) |

| Market Share | Leading in EDA market | Strong in semiconductor |

| Debt level | Low (5% debt-to-assets) | Low (4% debt-to-assets) |

Key takeaways indicate that Synopsys leads in profitability and innovation in the electronic design automation sector, while Arm has a solid global presence and is strong in CPU design. Both companies maintain low debt levels, highlighting their financial stability.

Risk Analysis

The table below outlines the key risks associated with Synopsys, Inc. and Arm Holdings plc, evaluated for the most recent year.

| Metric | Synopsys, Inc. | Arm Holdings plc |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

In reviewing the risks for both companies, market and regulatory risks appear to be the most significant. Arm’s exposure to geopolitical tensions, especially given its international operations, could impact performance and stability, while Synopsys faces moderate regulatory challenges in the tech industry.

Which one to choose?

In comparing Synopsys, Inc. (SNPS) and Arm Holdings plc (ARM), several fundamental metrics stand out. SNPS boasts higher profitability margins with a net profit margin of 36.9% compared to ARM’s 19.8%. However, ARM shows impressive revenue growth, reflected in a substantial increase in stock price by 75.08% recently, indicating strong market sentiment. Analyst ratings are tied at B-, suggesting moderate performance expectations for both.

Investors focused on stability and profitability may prefer SNPS, given its solid margins and lower debt levels. Conversely, those seeking growth potential might favor ARM due to its recent bullish trend and higher revenue growth rates.

It’s important to remain cautious, as both companies face risks related to market competition and valuation volatility.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Synopsys, Inc. and Arm Holdings plc American Depositary Shares to enhance your investment decisions: