In today’s rapidly evolving technology landscape, Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) stand out as key players in the electronic design automation (EDA) sector. Both companies excel in providing innovative software solutions for integrated circuit design, yet they adopt distinct strategies that influence their market positions. This comparison will reveal which company offers a more compelling investment opportunity. Join me as we delve into the nuances of their operations and performance to uncover the most intriguing choice for investors.

Table of contents

Company Overview

Synopsys, Inc. Overview

Synopsys, Inc. is a leader in electronic design automation (EDA), specializing in software solutions for designing and testing integrated circuits. Founded in 1986 and headquartered in Mountain View, California, the company offers a comprehensive portfolio including its Fusion Design Platform and Verification Continuum Platform. These platforms enable engineers to design, verify, and optimize complex semiconductor chips across various industries such as automotive, healthcare, and energy. With a market cap of approximately $72.1B, Synopsys is committed to innovation, helping customers navigate the challenges of advanced technology development.

Cadence Design Systems, Inc. Overview

Cadence Design Systems, Inc., established in 1987 and based in San Jose, California, provides a robust suite of software, hardware, and services for integrated circuit design. The company’s products, including its emulation and prototyping solutions, are essential for functional verification in the semiconductor industry. Cadence serves diverse markets such as aerospace, automotive, and mobile communications, boasting a market cap of around $81.8B. The company’s focus on enhancing design efficiency and delivering high-quality products aligns with the rapid evolution of technology in the digital age.

Key Similarities and Differences

Both Synopsys and Cadence operate within the EDA sphere, offering software solutions that facilitate semiconductor design and verification. However, while Synopsys emphasizes a broader range of design automation tools and security solutions, Cadence focuses more on verification and custom IC design services. This distinction highlights their unique strategies within the same industry, catering to different aspects of the semiconductor lifecycle.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS), highlighting key financial metrics.

| Metric | Synopsys, Inc. (SNPS) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Revenue | 6.13B | 4.64B |

| EBITDA | 1.94B | 1.67B |

| EBIT | 1.55B | 1.47B |

| Net Income | 2.26B | 1.06B |

| EPS | 14.78 | 3.89 |

Interpretation of Income Statement

In the latest fiscal year, Synopsys demonstrated robust revenue growth, increasing from 5.33B to 6.13B, alongside net income rising from 1.23B to 2.26B. This indicates solid operational efficiency, with margins improving significantly; EBITDA margin increased, reflecting effective cost management. Conversely, Cadence also showed healthy growth, with revenue climbing from 4.09B to 4.64B, albeit at a slower pace. Their net income increase from 1.04B to 1.06B suggests stability but less aggressive growth compared to Synopsys. Overall, both companies are in a solid financial position, but Synopsys outpaces Cadence in growth trajectory and profitability metrics.

Financial Ratios Comparison

In this section, I present a comparative analysis of the financial ratios for Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) based on the most recent fiscal year data.

| Metric | SNPS | CDNS |

|---|---|---|

| ROE | 25.17% | 22.58% |

| ROIC | 12.04% | 13.43% |

| P/E | 34.75 | 70.47 |

| P/B | 8.75 | 21.55 |

| Current Ratio | 2.44 | 2.93 |

| Quick Ratio | 2.30 | 2.74 |

| D/E | 0.08 | 0.22 |

| Debt-to-Assets | 5.24% | 13.48% |

| Interest Coverage | 38.56 | 17.77 |

| Asset Turnover | 0.47 | 0.52 |

| Fixed Asset Turnover | 5.43 | 7.68 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The analysis reveals that both companies exhibit strong financial health, with Synopsys showing a superior return on equity (ROE) and interest coverage ratio, indicating better profitability and capacity to cover interest expenses. However, Cadence has a higher return on invested capital (ROIC) and asset turnover, suggesting more efficient use of its assets. The significant P/E and P/B ratios for Cadence may raise concerns about overvaluation. Overall, I recommend a cautious approach, balancing growth potential with valuation metrics.

Dividend and Shareholder Returns

Both Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) do not pay dividends, reflecting a focus on reinvestment strategies to fuel growth. They are in high-growth phases, prioritizing R&D and acquisitions over immediate shareholder returns. However, both companies engage in share buyback programs, which can enhance shareholder value by reducing share dilution. This strategy may support sustainable long-term value creation, provided they maintain healthy cash flows and prudent capital management.

Strategic Positioning

In the electronic design automation (EDA) market, Synopsys, Inc. (SNPS) holds a significant market share with a market cap of approximately $72.1B, while Cadence Design Systems, Inc. (CDNS) follows closely at around $81.8B. Both companies face competitive pressure from each other, as well as emerging players driven by technological disruptions in AI and machine learning. Their ability to innovate and adapt to these changes will be crucial for maintaining their market positions.

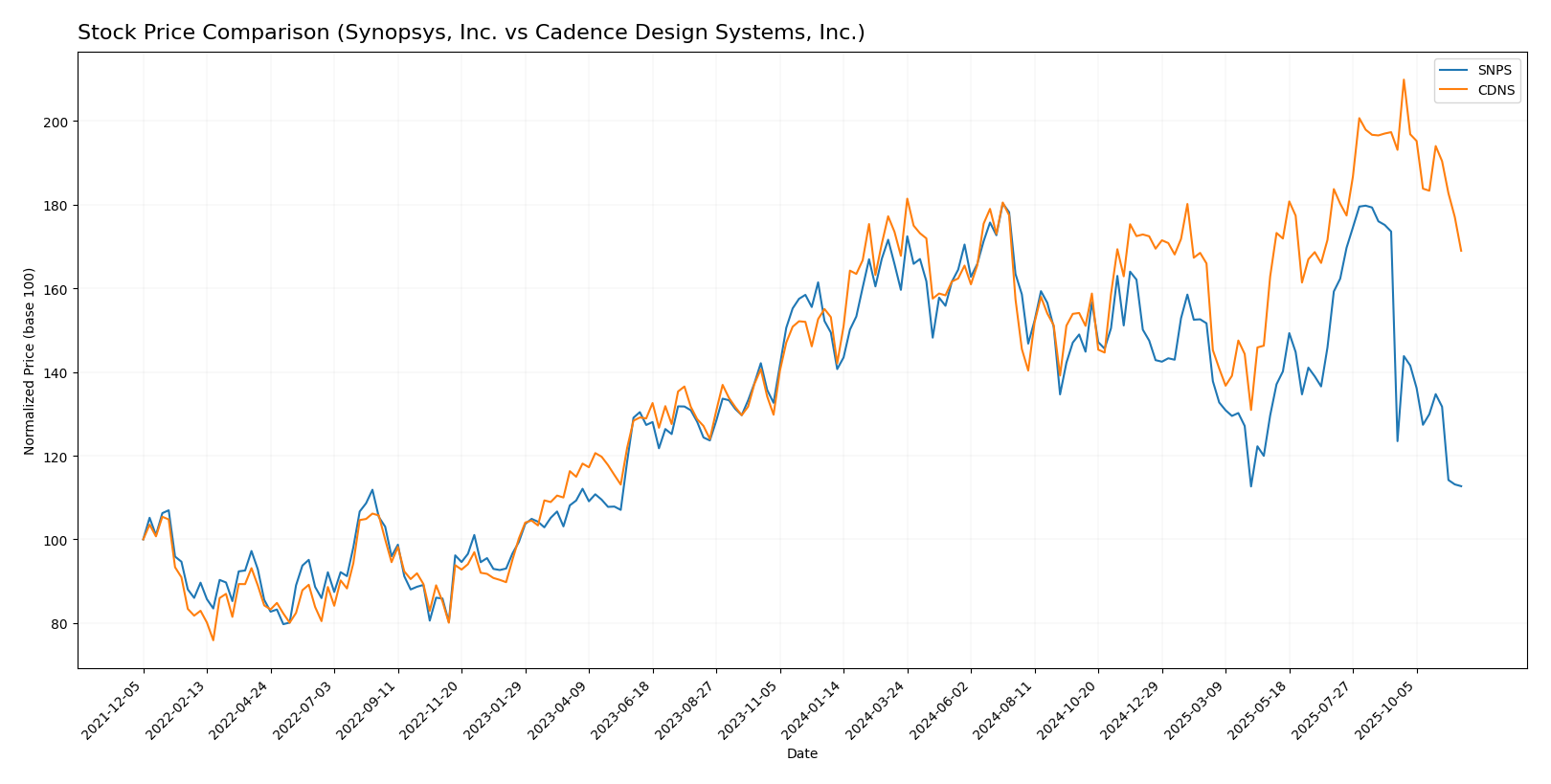

Stock Comparison

In this analysis, I will compare the stock performance of Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) over the past year, highlighting key price movements and trading dynamics.

Trend Analysis

Synopsys, Inc. (SNPS) Over the past year, SNPS has experienced a price change of -24.58%. This indicates a bearish trend, further compounded by a recent decline of -35.07% from September 7, 2025, to November 23, 2025. The stock reached a high of 621.3 and a low of 388.13 during this period. The trend shows deceleration, and the high standard deviation of 57.55 suggests notable volatility in SNPS’s price movements.

Cadence Design Systems, Inc. (CDNS) In contrast, CDNS has recorded a price change of +10.36% over the past year, reflecting a bullish trend. However, a recent decline of -14.37% from September 7, 2025, to November 23, 2025, indicates a potential short-term correction. The stock achieved a high of 373.35 and a low of 232.88, with a standard deviation of 29.22, indicating moderate volatility. Additionally, the trend is showing signs of deceleration.

In summary, while SNPS is experiencing a significant downturn, CDNS remains in a bullish position overall despite recent setbacks. Investors should weigh these dynamics carefully in their decision-making process.

Analyst Opinions

Recent analyst recommendations for Synopsys, Inc. (SNPS) reflect a cautious stance, with a rating of B- indicating a hold. Analysts note strong return metrics but highlight concerns about high debt levels. In contrast, Cadence Design Systems, Inc. (CDNS) has a solid B rating, supported by robust return on assets and equity, suggesting a favorable buy recommendation. Overall, the consensus for SNPS is a hold, while CDNS leans towards a buy, indicating a more favorable outlook for that stock in 2025.

Stock Grades

In the ever-evolving landscape of investments, understanding stock ratings can provide valuable insights for traders and investors. Below are the latest grades for Synopsys, Inc. and Cadence Design Systems, Inc., as provided by reputable grading companies.

Synopsys, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-09-11 |

| Morgan Stanley | Maintain | Overweight | 2025-09-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-10 |

| Piper Sandler | Maintain | Overweight | 2025-09-10 |

| JP Morgan | Maintain | Overweight | 2025-09-10 |

| Keybanc | Maintain | Overweight | 2025-09-10 |

| Goldman Sachs | Maintain | Buy | 2025-09-10 |

| Stifel | Maintain | Buy | 2025-09-10 |

| B of A Securities | Downgrade | Underperform | 2025-09-10 |

| Baird | Downgrade | Neutral | 2025-09-10 |

Cadence Design Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-07-29 |

| JP Morgan | Maintain | Overweight | 2025-07-29 |

| Stifel | Maintain | Buy | 2025-07-29 |

The grades for both companies reflect a generally positive outlook, with several maintain ratings indicating stability. However, the downgrades for Synopsys, specifically from B of A Securities and Baird, suggest there are areas of concern that investors should monitor closely. Overall, these ratings can help guide investment decisions amidst the current market dynamics.

Target Prices

The latest consensus target prices from analysts suggest positive expectations for both Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. (SNPS) | 630 | 425 | 546.67 |

| Cadence Design Systems, Inc. (CDNS) | 418 | 355 | 396.14 |

For Synopsys, the consensus target price of 546.67 indicates a significant upside potential compared to its current price of 388.36. Similarly, Cadence Design Systems has a consensus target of 396.14, suggesting room for growth from its current price of 300.58. Overall, analysts are optimistic about the future performance of both companies.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS), two prominent companies in the technology sector.

| Criterion | Synopsys, Inc. (SNPS) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Diversification | Strong focus on EDA and IP solutions | Broad range of IC design and verification tools |

| Profitability | High net profit margin at 36.9% | Good profitability with a net margin of 25.5% |

| Innovation | Leading in EDA software innovation | Strong R&D investment for continuous improvement |

| Global presence | Operates in various global markets | Well-established internationally |

| Market Share | Significant share in EDA market | Strong position in IC design/verification market |

| Debt level | Low debt-to-equity ratio (0.076) | Moderate debt-to-equity ratio (0.553) |

Key takeaways indicate that while both companies exhibit strong profitability and innovation, Synopsys benefits from lower debt levels, making it a potentially safer investment in a volatile market.

Risk Analysis

In this section, I will outline the key risks associated with Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) to help you understand their potential impact on investment decisions.

| Metric | Synopsys, Inc. | Cadence Design Systems, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | Low |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face notable risks, particularly in market and regulatory contexts. The semiconductor and design sectors are experiencing volatility due to geopolitical tensions and regulatory changes. For instance, export restrictions on technology can significantly impact operations and revenue streams.

Which one to choose?

In comparing Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS), both companies are strong contenders in the electronic design automation (EDA) sector, but their financials tell different stories. SNPS shows robust margins, with a net profit margin of 36.94% and a solid return on equity of 25.17%, but is currently facing a bearish trend with a 24.58% decline in stock price over the past year. Meanwhile, CDNS has a commendable net profit margin of 22.74% and an impressive return on equity of 22.58%, alongside a bullish price trend of 10.36%. Analysts rate SNPS a B- and CDNS a B, indicating a slight edge for CDNS in terms of overall performance and market sentiment.

For growth-oriented investors, CDNS appears more favorable due to its current upward price trend and overall stability, while those seeking value might consider SNPS, albeit with a cautionary note on its recent stock performance. Both companies face industry risks such as competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Synopsys, Inc. and Cadence Design Systems, Inc. to enhance your investment decisions: