In today’s fast-paced technology landscape, two giants stand out: Intel Corporation (INTC) and Synopsys, Inc. (SNPS). While both companies operate within the technology sector, they focus on different aspects of the semiconductor industry—Intel in hardware and Synopsys in software solutions for electronic design automation. This comparison highlights their innovative strategies and market dynamics, providing valuable insights for investors. Join me as we explore which of these companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Intel Corporation Overview

Intel Corporation (ticker: INTC) is a leader in the semiconductor industry, focusing on the design, manufacture, and sale of a wide range of computer products and technologies. Founded in 1968 and headquartered in Santa Clara, California, Intel operates through multiple segments, including Client Computing, Data Center, Internet of Things, and Mobileye, among others. The company’s mission centers on driving innovation in computing and artificial intelligence, with products ranging from central processing units (CPUs) to advanced solutions for cloud service providers and autonomous driving technologies. With a market cap of approximately $151.73B, Intel remains a key player in the tech sector, emphasizing high-performance computing and strategic partnerships to enhance its offerings.

Synopsys, Inc. Overview

Synopsys, Inc. (ticker: SNPS) specializes in electronic design automation (EDA) software, providing essential tools and solutions for designing and testing integrated circuits. Established in 1986, Synopsys is headquartered in Mountain View, California, and offers a comprehensive portfolio that includes the Fusion Design Platform and Verification Continuum Platform, which cater to digital design implementation and verification needs. The company serves diverse sectors, including electronics, automotive, and medicine, aiming to facilitate efficient and secure software development processes. With a market cap of approximately $72.14B, Synopsys positions itself as a vital partner in the semiconductor design landscape, focusing on innovation and security in technology.

Key similarities between Intel and Synopsys include their presence in the technology sector and focus on innovation. However, they diverge in their business models: Intel primarily manufactures hardware components, while Synopsys emphasizes software solutions for integrated circuit design and testing. This distinction shapes their market strategies and customer engagements, reflecting their unique roles within the tech ecosystem.

Income Statement Comparison

The following table presents a comparative analysis of the income statements for Intel Corporation and Synopsys, Inc. for the most recent fiscal year, highlighting key financial metrics.

| Metric | Intel Corporation (INTC) | Synopsys, Inc. (SNPS) |

|---|---|---|

| Revenue | 53.1B | 6.1B |

| EBITDA | 1.2B | 1.9B |

| EBIT | -10.2B | 1.5B |

| Net Income | -18.8B | 2.3B |

| EPS | -4.38 | 14.78 |

Interpretation of Income Statement

In 2024, Intel Corporation reported a significant decline in revenue to 53.1B, down from 54.2B in 2023, alongside a drastic negative net income of -18.8B. This downturn reflects challenges in maintaining profitability and escalating operational costs. Conversely, Synopsys, Inc. demonstrated robust growth with a revenue increase to 6.1B and net income of 2.3B, indicating strong demand for its products and effective cost management. This stark contrast illustrates Intel’s ongoing struggles amid industry pressures, while Synopsys capitalizes on its market position, emphasizing the importance of strategic choices in investment portfolios.

Financial Ratios Comparison

The following table provides a comparison of key financial metrics for Intel Corporation (INTC) and Synopsys, Inc. (SNPS) based on the most recent available data.

| Metric | [Company A: INTC] | [Company B: SNPS] |

|---|---|---|

| ROE | -18.89% | 25.17% |

| ROIC | -12.18% | 12.04% |

| P/E | -4.63 | 34.75 |

| P/B | 0.88 | 8.75 |

| Current Ratio | 1.33 | 2.44 |

| Quick Ratio | 0.98 | 2.30 |

| D/E | 0.50 | 0.08 |

| Debt-to-Assets | 0.25 | 0.05 |

| Interest Coverage | -14.17 | 38.56 |

| Asset Turnover | 0.27 | 0.47 |

| Fixed Asset Turnover | 0.49 | 5.43 |

| Payout Ratio | -8.53% | 0% |

| Dividend Yield | 1.84% | 0% |

Interpretation of Financial Ratios

The comparison highlights significant differences between the two companies. Intel’s negative ROE and ROIC indicate poor profitability, while Synopsys shows strong returns with a high ROE of 25.17%. Intel’s P/E ratio suggests it is undervalued, but the negative earnings raise concerns. Synopsys demonstrates robust liquidity with higher current and quick ratios, while its low debt levels indicate a solid financial position. However, the lack of dividends from Synopsys may concern income-focused investors.

Dividend and Shareholder Returns

Intel Corporation (INTC) currently maintains a dividend yield of 1.84% with a payout ratio of 1.83, indicating a potential risk of unsustainable distributions amidst recent negative net income. In contrast, Synopsys, Inc. (SNPS) does not pay dividends, focusing instead on reinvestment strategies to fuel growth, which aligns with long-term shareholder value creation. Both companies engage in share buybacks, supporting shareholder returns despite the differing approaches to dividends. Ultimately, these strategies reflect their commitment to sustainable long-term value creation for shareholders.

Strategic Positioning

In the semiconductor market, Intel Corporation (INTC) holds a significant market share, primarily through its comprehensive product portfolio that includes CPUs and system-on-chip solutions. However, it faces increasing competitive pressure from companies like Synopsys, Inc. (SNPS), which specializes in electronic design automation software. Technological disruptions, particularly in AI and machine learning, are reshaping both companies’ landscapes, pushing them to innovate continuously to maintain relevance and competitive advantage.

Stock Comparison

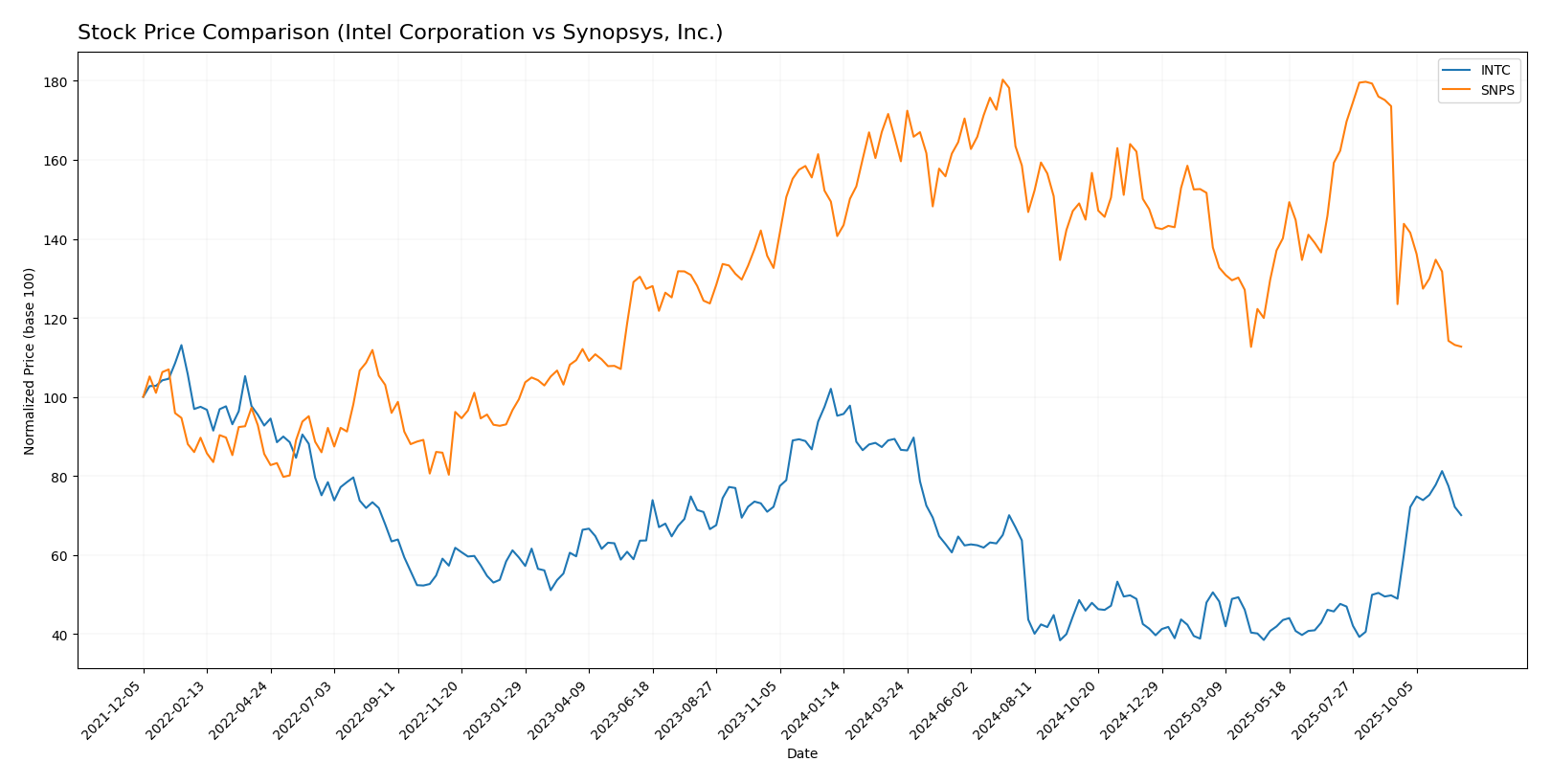

In this section, I will analyze the weekly stock price movements of Intel Corporation (INTC) and Synopsys, Inc. (SNPS) over the past year, highlighting key price dynamics and trading behavior.

Trend Analysis

Intel Corporation (INTC) Over the past year, INTC has experienced a significant price change of -31.34%, indicating a bearish trend. The stock has seen notable volatility with a standard deviation of 8.72, and the price has fluctuated between a high of 50.25 and a low of 18.89. The recent performance from September 7, 2025, to November 23, 2025, shows an upward movement of 40.87%, but the overall trend remains bearish due to the substantial decline over the longer period. The acceleration status indicates that this bearish trend is accelerating.

Synopsys, Inc. (SNPS) SNPS has also demonstrated a bearish trend with a price change of -24.58% over the past year. This stock exhibits even higher volatility, with a standard deviation of 57.55, and fluctuated between a high of 621.3 and a low of 388.13. In the recent analysis period from September 7, 2025, to November 23, 2025, SNPS has seen a further decline of 35.07%, indicating a decelerating trend. Notably, the trend slope is negative at -12.3, reinforcing the bearish outlook.

In summary, both INTC and SNPS are currently experiencing bearish trends, with significant declines over the past year and notable volatility in their price movements.

Analyst Opinions

Recent analyst recommendations for Intel Corporation (INTC) show a cautious stance, with a rating of C+ reflecting concerns about its financial metrics. Analysts highlight a lower score in price-to-earnings and discounted cash flow, suggesting a hold for now. In contrast, Synopsys, Inc. (SNPS) has garnered a B- rating, driven by strong return on assets and equity, leading analysts to recommend a buy. Overall, the consensus for SNPS leans towards buy, while INTC remains a hold as of 2025.

Stock Grades

In the current market landscape, I have gathered insightful stock ratings from reliable grading companies for two key players: Intel Corporation (INTC) and Synopsys, Inc. (SNPS).

Intel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | maintain | Buy | 2025-11-04 |

| Barclays | maintain | Equal Weight | 2025-10-27 |

| Mizuho | maintain | Neutral | 2025-10-24 |

| Wedbush | maintain | Neutral | 2025-10-24 |

| Wells Fargo | maintain | Equal Weight | 2025-10-24 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-24 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-24 |

| Truist Securities | maintain | Hold | 2025-10-24 |

| Rosenblatt | maintain | Sell | 2025-10-24 |

| JP Morgan | maintain | Underweight | 2025-10-24 |

Synopsys, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-09-11 |

| Morgan Stanley | maintain | Overweight | 2025-09-11 |

| Wells Fargo | maintain | Equal Weight | 2025-09-10 |

| Piper Sandler | maintain | Overweight | 2025-09-10 |

| JP Morgan | maintain | Overweight | 2025-09-10 |

| Keybanc | maintain | Overweight | 2025-09-10 |

| Goldman Sachs | maintain | Buy | 2025-09-10 |

| Stifel | maintain | Buy | 2025-09-10 |

| B of A Securities | downgrade | Underperform | 2025-09-10 |

| Baird | downgrade | Neutral | 2025-09-10 |

Overall, the trends in grades for both companies indicate a stable outlook, with Intel maintaining a mix of hold and neutral ratings, while Synopsys shows a strong performance with multiple maintain ratings, though there were some downgrades that investors should consider. It is essential to keep a close eye on these developments as market conditions evolve.

Target Prices

The following target prices have been established by analysts for Intel Corporation and Synopsys, Inc., providing a consensus on expected stock performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intel Corporation | 52 | 20 | 35.22 |

| Synopsys, Inc. | 630 | 425 | 546.67 |

For Intel Corporation, the target consensus is 35.22, suggesting potential growth from the current price of 34.5. In contrast, Synopsys has a higher target consensus of 546.67 compared to its price of 388.36, indicating strong bullish sentiment among analysts.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Intel Corporation (INTC) and Synopsys, Inc. (SNPS) based on the latest financial data.

| Criterion | Intel Corporation (INTC) | Synopsys, Inc. (SNPS) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (Net Profit Margin: 3.1%) | High (Net Profit Margin: 36.9%) |

| Innovation | Moderate | High |

| Global presence | Strong | Strong |

| Market Share | Moderate | High |

| Debt level | Moderate (Debt to Equity: 0.47) | Low (Debt to Equity: 0.08) |

Key takeaways: Synopsys demonstrates superior profitability and innovation along with a solid market presence, while Intel’s strengths lie in its global reach despite facing profitability challenges.

Risk Analysis

The table below outlines key risks associated with Intel Corporation (INTC) and Synopsys, Inc. (SNPS):

| Metric | Intel Corporation (INTC) | Synopsys, Inc. (SNPS) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | High | Moderate |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | High | Moderate |

In assessing the risks, Intel faces significant market and operational risks due to its heavy reliance on semiconductor demand and competitive pressures. Conversely, Synopsys enjoys a more stable operational environment, albeit with some exposure to market fluctuations.

Which one to choose?

When comparing Intel Corporation (INTC) and Synopsys, Inc. (SNPS), it’s clear that they operate in different segments of the technology sector. Intel faces significant challenges with a bearish stock trend, marked by a price drop of 31.34% over the past year and a C+ rating. Its fundamentals show a troubling net profit margin of -35.32% and a high debt-to-equity ratio of 0.50, indicating financial stress.

In contrast, Synopsys has demonstrated greater resilience, with a B- rating and a net profit margin of 36.94%. However, it too has seen a bearish trend, with a price decrease of 24.58%. Despite this, its robust operating metrics, such as a current ratio of 2.44 and a return on equity of 25.17%, suggest a more stable investment.

Recommendation: Investors focused on growth may prefer Synopsys for its strong profitability and operational efficiency, while those prioritizing stability may still consider Intel, albeit with caution due to its current challenges.

Both companies face risks including competition and market dependence, impacting their future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Intel Corporation and Synopsys, Inc. to enhance your investment decisions: