In the fast-evolving landscape of technology and business services, Workday, Inc. (WDAY) and Paychex, Inc. (PAYX) stand out as key players. Both companies operate within the realm of human capital management but cater to different market segments and offer distinct solutions. Workday focuses on enterprise cloud applications for large organizations, while Paychex specializes in HR and payroll services for small to medium-sized businesses. I invite you to explore this comparison to identify which company may present the more compelling opportunity for your investment portfolio.

Table of contents

Company Overview

Workday, Inc. Overview

Workday, Inc. is a leading provider of enterprise cloud applications, specializing in financial management and human capital management solutions. Founded in 2005 and headquartered in Pleasanton, California, Workday aims to help organizations manage their business operations through a comprehensive suite of applications that enhance financial processes and human resources management. With a market cap of approximately $60.1B, Workday serves various industries, including professional services, healthcare, and education, allowing businesses to streamline operations and gain real-time insights into their financial and workforce data.

Paychex, Inc. Overview

Paychex, Inc. offers integrated human capital management solutions primarily for small to medium-sized businesses across the United States and abroad. Established in 1971 and headquartered in Rochester, New York, Paychex provides a wide range of services, including payroll processing, HR solutions, and compliance assistance. With a market cap of about $40.1B, the company focuses on alleviating the administrative burdens of HR and payroll for its clients, enabling them to concentrate on their core business activities while ensuring compliance with evolving regulations.

Key similarities between Workday and Paychex include their focus on human capital management and their cloud-based service delivery. However, while Workday emphasizes enterprise-level financial and operational solutions, Paychex primarily caters to the payroll and HR needs of smaller businesses.

Income Statement Comparison

In the following table, I present the income statements for Workday, Inc. (WDAY) and Paychex, Inc. (PAYX) for their most recent fiscal years, allowing for a direct comparison of their financial performance.

| Metric | Workday, Inc. (WDAY) | Paychex, Inc. (PAYX) |

|---|---|---|

| Revenue | 8.42B | 5.57B |

| EBITDA | 1.08B | 2.49B |

| EBIT | 752M | 2.28B |

| Net Income | 526M | 1.66B |

| EPS | 1.98 | 4.60 |

Interpretation of Income Statement

In the most recent fiscal year, Workday’s revenue increased to 8.42B, up from 7.20B in 2024, indicating a strong growth trajectory. However, its net income declined significantly from 1.38B to 526M, reflecting challenges in profitability. In contrast, Paychex showed consistent revenue growth from 5.28B to 5.57B, with net income also rising from 1.69B to 1.66B, showcasing stable margins. This trend suggests that while Paychex maintains profitability and solid operational performance, Workday faces challenges that could impact its future growth and investment appeal.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent financial ratios for Workday, Inc. (WDAY) and Paychex, Inc. (PAYX).

| Metric | WDAY | PAYX |

|---|---|---|

| ROE | 5.82% | 40.15% |

| ROIC | 3.22% | 16.77% |

| P/E | 132.15 | 34.32 |

| P/B | 7.69 | 13.78 |

| Current Ratio | 1.85 | 1.28 |

| Quick Ratio | 1.85 | 1.28 |

| D/E | 0.37 | 1.22 |

| Debt-to-Assets | 0.19 | 0.30 |

| Interest Coverage | 4.30 | 20.95 |

| Asset Turnover | 0.47 | 0.34 |

| Fixed Asset Turnover | 5.34 | 9.68 |

| Payout Ratio | 0.00 | 87.40% |

| Dividend Yield | 0.00% | 2.55% |

Interpretation of Financial Ratios

In comparing WDAY and PAYX, PAYX demonstrates significantly stronger profitability metrics, notably a much higher ROE of 40.15%, indicating efficient management of equity. WDAY’s high P/E suggests overvaluation, while PAYX’s P/E is more reasonable at 34.32. WDAY exhibits higher liquidity ratios, which is a positive sign, but its high leverage (D/E ratio of 0.37) raises concerns about financial risk. PAYX’s strong interest coverage ratio reflects its ability to meet debt obligations comfortably. Overall, while WDAY shows liquidity strength, PAYX stands out in profitability and efficiency.

Dividend and Shareholder Returns

Workday, Inc. (WDAY) does not pay dividends, reflecting a strategy focused on reinvestment for growth rather than distributing profits. This approach is typical for companies in high-growth phases. However, WDAY engages in share buybacks, which could enhance shareholder value by reducing share dilution.

Conversely, Paychex, Inc. (PAYX) provides a dividend yield of approximately 2.54% with a payout ratio of about 77.8%, indicating a commitment to returning cash to shareholders. This balance supports sustainable long-term value creation for PAYX investors while maintaining ample cash flow for operational needs.

Strategic Positioning

In the competitive landscape of enterprise solutions, Workday, Inc. (WDAY) commands a market share focused on cloud applications for finance and human capital management, positioning itself as a leader among tech firms. Paychex, Inc. (PAYX), operating in the staffing and employment services sector, serves small to medium-sized businesses and faces competitive pressure from emerging HR technology startups. Both companies must navigate technological disruptions and evolving customer needs to retain their market positions while managing operational risks effectively.

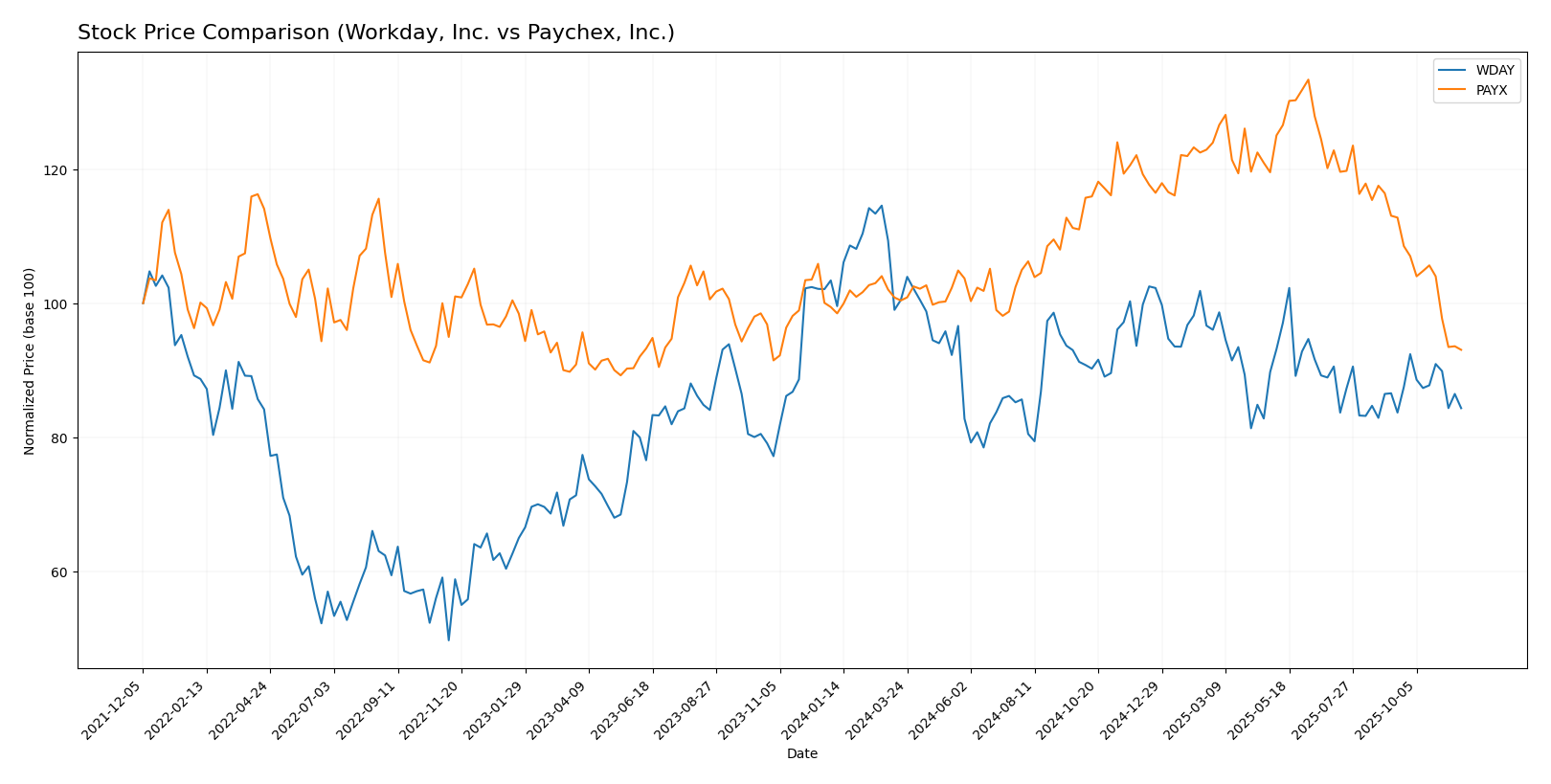

Stock Comparison

In this analysis, I will examine the weekly stock price movements of Workday, Inc. (WDAY) and Paychex, Inc. (PAYX) over the past year, highlighting notable price dynamics and volatility patterns.

Trend Analysis

Workday, Inc. (WDAY) Over the past year, WDAY experienced a price change of -18.45%, indicating a bearish trend. The stock has shown acceleration in its decline, with a standard deviation of 21.79, reflecting significant volatility. The highest price recorded was 305.88, while the lowest was 209.48.

In the recent period from September 7, 2025, to November 23, 2025, the stock declined by -2.57%, and the trend slope is negative at -0.25. The standard deviation during this timeframe was lower at 6.86, suggesting reduced volatility compared to the overall trend.

Paychex, Inc. (PAYX) PAYX has seen a negative price change of -6.42% over the past year, also indicating a bearish trend. The trend shows deceleration, with a standard deviation of 12.3, signaling moderate volatility. The stock reached a high of 159.78 and a low of 111.46.

From September 7, 2025, to November 23, 2025, PAYX reported a sharp decline of -17.71% with a trend slope of -2.28. The standard deviation during this recent period was 8.2, indicating some volatility, though less severe than WDAY.

Both stocks reflect challenging market conditions, with WDAY exhibiting greater volatility and a more pronounced decline compared to PAYX. As I analyze these trends, I remain cautious about the risks associated with investing in these stocks given their current trajectories.

Analyst Opinions

Recent analyst recommendations for Workday, Inc. (WDAY) and Paychex, Inc. (PAYX) indicate a consensus of “Buy” for both companies. Analysts have rated WDAY with a “B” due to strong discounted cash flow and return on assets scores, although concerns about its price-to-earnings ratio persist. In contrast, PAYX received a “B+” rating, benefiting from high scores in return on equity and return on assets, suggesting robust financial health. Notable analysts have highlighted these strengths as key drivers for investment potential in the current year.

Stock Grades

In the current market landscape, I’ve gathered the latest stock grades from reliable grading companies for two companies: Workday, Inc. and Paychex, Inc.

Workday, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Neutral | 2025-11-03 |

| DA Davidson | maintain | Neutral | 2025-09-19 |

| Barclays | maintain | Overweight | 2025-09-18 |

| Guggenheim | upgrade | Buy | 2025-09-18 |

| RBC Capital | maintain | Outperform | 2025-09-17 |

| JMP Securities | maintain | Market Outperform | 2025-09-17 |

| Guggenheim | upgrade | Buy | 2025-09-17 |

| Needham | maintain | Buy | 2025-09-17 |

| Evercore ISI Group | maintain | Outperform | 2025-09-17 |

| TD Cowen | maintain | Buy | 2025-09-17 |

Paychex, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-10-20 |

| BMO Capital | maintain | Market Perform | 2025-10-01 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-01 |

| Stifel | maintain | Hold | 2025-09-22 |

| UBS | maintain | Neutral | 2025-09-17 |

| Citigroup | maintain | Neutral | 2025-08-21 |

| JP Morgan | maintain | Underweight | 2025-08-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-27 |

| Jefferies | maintain | Hold | 2025-06-26 |

| UBS | maintain | Neutral | 2025-06-26 |

Overall, the grades for both companies exhibit a trend of maintaining existing ratings, with Workday receiving a notable upgrade to ‘Buy’ from Guggenheim. For Paychex, the sentiment remains stable, with several firms maintaining a ‘Hold’ or ‘Equal Weight’ stance, indicating a cautious but steady outlook.

Target Prices

The consensus target prices from analysts for the selected companies indicate a positive outlook.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Workday, Inc. | 304 | 235 | 272.45 |

| Paychex, Inc. | 165 | 128 | 142.56 |

For Workday, the target consensus of 272.45 suggests an upside potential from the current price of 225.14. Similarly, Paychex’s target consensus of 142.56 indicates a favorable outlook compared to its current price of 111.46.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Workday, Inc. (WDAY) and Paychex, Inc. (PAYX) based on recent financial data.

| Criterion | Workday, Inc. (WDAY) | Paychex, Inc. (PAYX) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low | High |

| Innovation | High | Moderate |

| Global presence | Moderate | High |

| Market Share | Moderate | High |

| Debt level | Moderate | Low |

Key takeaways from this analysis indicate that while Workday excels in innovation, it struggles with profitability. Conversely, Paychex demonstrates strong profitability and market presence, making it a more stable option for investors seeking lower risk.

Risk Analysis

In this section, I present a comparative risk analysis of Workday, Inc. and Paychex, Inc. The table below outlines various risks that could impact these companies.

| Metric | Workday, Inc. | Paychex, Inc. |

|---|---|---|

| Market Risk | Medium | Medium |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | Low |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Low |

Both companies face significant market and regulatory risks. Workday, being in the tech sector, is particularly susceptible to regulatory scrutiny and market volatility. Paychex, on the other hand, has a more stable operational risk profile but remains exposed to regulatory challenges in HR and payroll services.

Which one to choose?

When comparing Workday, Inc. (WDAY) and Paychex, Inc. (PAYX), both companies exhibit strengths, but there are notable distinctions. WDAY has a high gross profit margin of 75.4% but struggles with a high price-to-earnings (P/E) ratio of 132.15, indicating potential overvaluation. On the other hand, PAYX shows robust operational efficiency with an operating profit margin of 39.6% and a more reasonable P/E of 34.32, suggesting solid earnings potential.

Analyst ratings are slightly better for PAYX with a grade of B+ compared to WDAY’s B. Additionally, PAYX offers a dividend yield of 3.1%, providing investors with regular income.

Investors prioritizing growth may prefer WDAY, while those seeking stable returns and dividends could favor PAYX. Both companies face risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Workday, Inc. and Paychex, Inc. to enhance your investment decisions: