In today’s rapidly evolving tech landscape, cybersecurity remains a top priority for businesses. I’m comparing two prominent players in the cloud security space: CrowdStrike Holdings, Inc. and Zscaler, Inc. Both companies operate within the software infrastructure industry, focusing on innovative security solutions that protect against emerging threats. By examining their strategies and market positions, I aim to help you identify which company might be the most compelling investment opportunity. Let’s dive in and uncover the insights that matter for your portfolio.

Table of contents

Company Overview

CrowdStrike Holdings, Inc. Overview

CrowdStrike Holdings, Inc. is a leading player in the cybersecurity space, specializing in cloud-delivered endpoint protection and cyber threat intelligence. Founded in 2011 and headquartered in Austin, Texas, CrowdStrike offers its innovative Falcon platform, which provides comprehensive security across endpoints, cloud workloads, and identities. The company’s subscription-based model allows clients to leverage advanced threat hunting, log management, and Zero Trust identity protection. With a market cap of approximately $121.55B, CrowdStrike has established itself as a go-to solution for organizations looking to bolster their cybersecurity posture in an increasingly digital world.

Zscaler, Inc. Overview

Zscaler, Inc. operates in the cloud security domain, providing secure access to applications and data for organizations worldwide. Founded in 2007 and based in San Jose, California, Zscaler’s offerings include the Zscaler Internet Access and Zscaler Private Access solutions, facilitating safe access to both externally managed and internally hosted applications. The company emphasizes a zero-trust security framework and user experience measurement through its Zscaler Digital Experience platform. With a market cap of about $42.46B, Zscaler is well-positioned to meet the growing demands for secure digital transformation across various industries.

Both companies focus on cloud-based security solutions and cater to enterprises needing robust protection against cyber threats. However, while CrowdStrike emphasizes endpoint protection and threat intelligence, Zscaler focuses on secure access to applications, highlighting their differing approaches within the cybersecurity landscape.

Income Statement Comparison

The following table provides a detailed comparison of the income statements for CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) for their most recent fiscal years.

| Metric | CrowdStrike (CRWD) | Zscaler (ZS) |

|---|---|---|

| Revenue | 3.95B | 2.67B |

| EBITDA | 294.80M | 112.41M |

| EBIT | 80.85M | -8.77M |

| Net Income | -19.27M | -41.48M |

| EPS | -0.08 | -0.27 |

Interpretation of Income Statement

In the most recent year, CrowdStrike experienced a notable increase in revenue to 3.95B, up from 3.06B in the previous year, indicating strong demand for its offerings. However, the net income remained negative at -19.27M, reflecting ongoing investments in growth and development. Zscaler, on the other hand, also posted revenue growth to 2.67B, yet its net income of -41.48M suggests persistent challenges in achieving profitability. Both companies are investing heavily in R&D and marketing, which may pressure margins; however, the revenue growth indicates a positive long-term trajectory if they can manage costs effectively.

Financial Ratios Comparison

The table below presents a comparative analysis of key financial ratios for CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) as of the most recent fiscal year.

| Metric | CRWD | ZS |

|---|---|---|

| ROE | -0.59% | -2.31% |

| ROIC | 0.70% | -7.21% |

| P/E | -5055.66 | -1063.01 |

| P/B | 29.71 | 24.51 |

| Current Ratio | 1.67 | 1.94 |

| Quick Ratio | 1.67 | 1.94 |

| D/E | 0.24 | 0.99 |

| Debt-to-Assets | 9.07% | 27.98% |

| Interest Coverage | -4.58 | -13.49 |

| Asset Turnover | 0.45 | 0.42 |

| Fixed Asset Turnover | 4.76 | 4.22 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit negative return metrics, indicating challenges in profitability. CRWD’s current and quick ratios suggest sufficient liquidity, while ZS’s higher debt ratios raise potential concerns about financial stability. Notably, both companies have not paid dividends, reflecting a focus on reinvestment rather than shareholder payouts, which is common in growth-oriented firms. Therefore, while CRWD demonstrates slightly better financial health, both companies face significant risks that investors should consider.

Dividend and Shareholder Returns

Both CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) do not pay dividends, reflecting their focus on reinvestment for growth. CRWD has a negative net income and is in a high-growth phase, prioritizing research and development. ZS similarly avoids dividends, channeling funds into expansion. Both companies engage in share buybacks, which can enhance shareholder value but carry risks if done excessively. This focus on reinvestment appears to support long-term value creation, though potential volatility remains a concern.

Strategic Positioning

CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) are prominent players in the cloud security market, each holding significant market shares. CRWD, with a market cap of $121.55B, offers a comprehensive suite of security services, making it a strong competitor. Meanwhile, ZS, valued at $42.46B, focuses on secure access solutions, facing intense competitive pressure. Both companies must navigate rapid technological advancements while maintaining their positions amidst increasing market disruption.

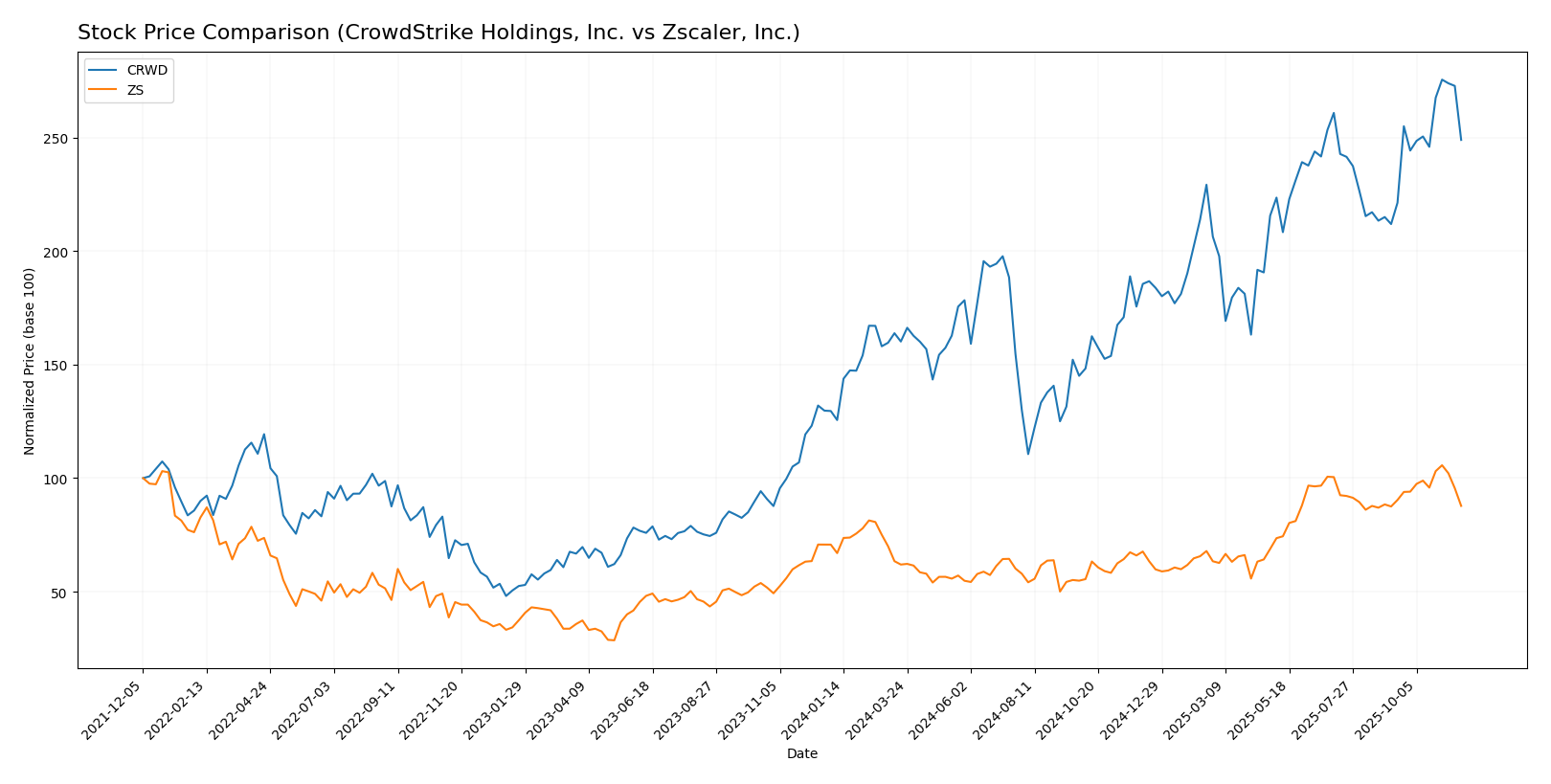

Stock Comparison

Over the past year, both CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) have demonstrated significant price movements, reflecting the dynamic trading environment within the cybersecurity sector.

Trend Analysis

CrowdStrike Holdings, Inc. (CRWD) has experienced a remarkable price change of +92.18% over the past year. This strong bullish trend is supported by an acceleration in price movement, with notable highs reaching $543.01 and lows at $217.89. The recent trend also shows a +17.49% increase from September 7, 2025, to November 23, 2025, indicating sustained upward momentum. The standard deviation of 37.66 suggests moderate volatility, reinforcing the need for careful risk management in trading this stock.

Zscaler, Inc. (ZS) has shown a solid price increase of +24.12% over the last year, marking a bullish trend with acceleration. The stock has fluctuated between a high of $331.14 and a low of $156.78. However, in the recent analysis period from September 7, 2025, to November 23, 2025, the price change was minimal at +0.3%, indicating a neutral trend during this timeframe. The standard deviation of 17.44 suggests lower volatility compared to CRWD, which may provide a more stable trading environment for investors.

Analyst Opinions

Recent analyst recommendations for CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) indicate a cautious stance, with both companies receiving a rating of C-. Analysts highlight concerns regarding their return on equity and overall financial stability. Given these ratings and the current market conditions, the consensus leans towards a “hold” for both stocks. Analysts suggest maintaining positions but advise investors to stay alert for any significant changes in performance or market trends.

Stock Grades

In the current market landscape, it’s crucial to evaluate stock grades to make informed investment decisions. Here are the latest ratings for CrowdStrike Holdings, Inc. and Zscaler, Inc.

CrowdStrike Holdings, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2025-11-21 |

| Truist Securities | maintain | Buy | 2025-11-18 |

| Rosenblatt | maintain | Buy | 2025-11-18 |

| Mizuho | maintain | Neutral | 2025-11-17 |

| Stifel | maintain | Buy | 2025-11-17 |

| Barclays | maintain | Overweight | 2025-11-14 |

| Baird | maintain | Neutral | 2025-11-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-13 |

| BTIG | maintain | Buy | 2025-11-04 |

| Oppenheimer | maintain | Outperform | 2025-10-17 |

Zscaler, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-18 |

| Mizuho | maintain | Neutral | 2025-11-17 |

| Morgan Stanley | maintain | Overweight | 2025-11-13 |

| Barclays | maintain | Overweight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

| RBC Capital | maintain | Outperform | 2025-10-02 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

| JMP Securities | maintain | Market Outperform | 2025-09-03 |

| Evercore ISI Group | maintain | Outperform | 2025-09-03 |

| Needham | maintain | Buy | 2025-09-03 |

Overall, both CrowdStrike and Zscaler have received positive ratings, with multiple grading companies maintaining their grades at “Buy” and “Outperform.” This trend indicates a strong confidence in their performance and potential for growth in the market.

Target Prices

The latest consensus target prices for CrowdStrike Holdings, Inc. and Zscaler, Inc. indicate positive outlooks from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 430 | 541.57 |

| Zscaler, Inc. | 350 | 300 | 326.13 |

For CrowdStrike, the consensus target price of 541.57 suggests a potential upside from the current price of 490.67. Similarly, Zscaler’s target of 326.13 indicates a favorable outlook compared to its current price of 275.01.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) based on recent financial data.

| Criterion | CrowdStrike Holdings, Inc. | Zscaler, Inc. |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong | Strong |

| Global presence | Strong | Strong |

| Market Share | Growing | Growing |

| Debt level | Low | Moderate |

Key takeaways: Both companies exhibit strong innovation and global presence, but they face profitability challenges. CrowdStrike has a lower debt level, which may appeal to risk-averse investors.

Risk Analysis

Below is a table summarizing key risks associated with CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS):

| Metric | CRWD | ZS |

|---|---|---|

| Market Risk | Moderate | Moderate |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Medium |

Both companies face significant regulatory risk due to the nature of their operations in cybersecurity, where compliance with data protection laws is critical. The impact of geopolitical tensions on global operations also poses a noteworthy risk.

Which one to choose?

When comparing CrowdStrike (CRWD) and Zscaler (ZS), I observe that both companies exhibit a bullish trend in their stock performance with CRWD showing a significant price increase of 92.18% over the past year, compared to ZS’s 24.12%. However, CRWD has a higher market cap at 97.4B versus ZS’s 44.1B, indicating stronger overall market presence.

In terms of profitability, CRWD faced challenges with a net profit margin of -0.0049, while ZS reported a slightly better margin of -0.0155. Both companies carry a “C-” rating, reflecting their ongoing struggles with profitability. CRWD has a better Gross Profit Margin (74.9%) compared to ZS (76.9%), but ZS shows a more favorable debt-to-equity ratio of 0.999 compared to CRWD’s 0.241.

For growth-focused investors, Zscaler may be the preferred option given its relatively higher gross margins, while those seeking stability might lean toward CrowdStrike due to its more substantial market cap and upward price momentum. Both companies face significant risks, particularly related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Zscaler, Inc. to enhance your investment decisions: