In today’s fast-evolving tech landscape, cybersecurity is paramount, making it crucial to examine key players in this field. I will compare Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS), both leaders in software infrastructure focused on innovative security solutions. Despite their overlapping markets, each company adopts distinct strategies and offerings that appeal to different segments of the industry. Join me as I analyze which of these companies presents the most compelling investment opportunity for the savvy investor.

Table of contents

Company Overview

Palo Alto Networks, Inc. Overview

Palo Alto Networks (PANW) is a leading cybersecurity company committed to delivering advanced security solutions. Founded in 2005 and headquartered in Santa Clara, California, PANW offers a wide range of products and services, including firewall appliances, threat intelligence, and cloud security solutions. The company serves medium to large enterprises across various sectors, including healthcare, finance, and government. With a market capitalization of approximately $122.3B, Palo Alto Networks positions itself as a key player in the cybersecurity infrastructure industry, emphasizing innovation and comprehensive threat prevention strategies.

Zscaler, Inc. Overview

Zscaler (ZS) is a prominent cloud security firm that specializes in secure access to external applications and data through its innovative platform. Established in 2007 and based in San Jose, California, Zscaler’s solutions, such as Zscaler Internet Access and Zscaler Private Access, cater to businesses seeking secure connectivity for their SaaS applications and internal resources. With a market capitalization of around $42.5B, Zscaler is recognized for its focus on cloud-native security, enabling organizations to enhance their digital experience while maintaining robust protection against cyber threats.

Key similarities in their business models include a focus on cybersecurity and a commitment to serving a diverse range of industries. However, while Palo Alto Networks offers a broader array of traditional hardware and software solutions, Zscaler emphasizes its cloud-based security services, highlighting a distinct approach to securing networks.

Income Statement Comparison

The following table compares the income statements of Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS) for the fiscal year 2025, highlighting key financial metrics.

| Metric | PANW | ZS |

|---|---|---|

| Revenue | 9.22B | 2.67B |

| EBITDA | 1.94B | 112M |

| EBIT | 1.60B | -8.77M |

| Net Income | 1.13B | -41M |

| EPS | 1.71 | -0.27 |

Interpretation of Income Statement

In 2025, Palo Alto Networks experienced significant revenue growth, increasing to 9.22B, which marks a healthy trend compared to previous years. Conversely, Zscaler recorded a revenue of 2.67B, indicating steady growth but with continued operating losses reflected in its negative EBIT and net income. PANW’s EBITDA margin is robust, suggesting effective cost management, while ZS’s negative earnings signal ongoing challenges in operational efficiency despite revenue growth. Overall, PANW shows strong financial health, while Zscaler needs to address its profitability issues to enhance investor confidence.

Financial Ratios Comparison

Below is a comparative table of the most recent financial metrics for Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS) as of the fiscal year 2025.

| Metric | PANW | ZS |

|---|---|---|

| ROE | 14.49% | -2.31% |

| ROIC | 5.67% | -7.21% |

| P/E | 101.43 | N/A |

| P/B | 14.70 | 24.51 |

| Current Ratio | 0.89 | 1.94 |

| Quick Ratio | 0.89 | 1.94 |

| D/E | 0.043 | 0.999 |

| Debt-to-Assets | 1.43% | 27.98% |

| Interest Coverage | 414.30 | -13.49 |

| Asset Turnover | 0.39 | 0.42 |

| Fixed Asset Turnover | 12.56 | 4.22 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Palo Alto Networks demonstrates stronger financial health with a positive ROE and high interest coverage, indicating effective use of equity and strong earnings relative to interest obligations. In contrast, Zscaler shows negative ROE and interest coverage, raising concerns about its profitability and debt management. The current and quick ratios suggest that Zscaler has better liquidity, but its higher debt-to-assets ratio indicates higher financial risk. Overall, PANW appears to be a safer investment option compared to ZS.

Dividend and Shareholder Returns

Both Palo Alto Networks (PANW) and Zscaler (ZS) do not pay dividends, reflecting a focus on growth and reinvestment strategies. PANW has shown significant improvements in revenue, with a net profit margin of 12.3% in 2025, supported by share buyback programs, which indicate commitment to shareholder value. Similarly, ZS is in a high-growth phase, prioritizing R&D over distributions. While both companies’ lack of dividends may raise concerns, their strategies align with long-term value creation focused on expansion and innovation.

Strategic Positioning

Palo Alto Networks (PANW) holds a substantial market share in the cybersecurity sector, reflecting its strong product portfolio that includes advanced firewall solutions and threat intelligence services. Zscaler (ZS), with its innovative cloud security offerings, poses competitive pressure, particularly in secure access and digital experience measurement. Both companies face ongoing technological disruption, necessitating continuous innovation to maintain their market positions. As an investor, I recognize the importance of these dynamics in assessing future growth potential and risks.

Stock Comparison

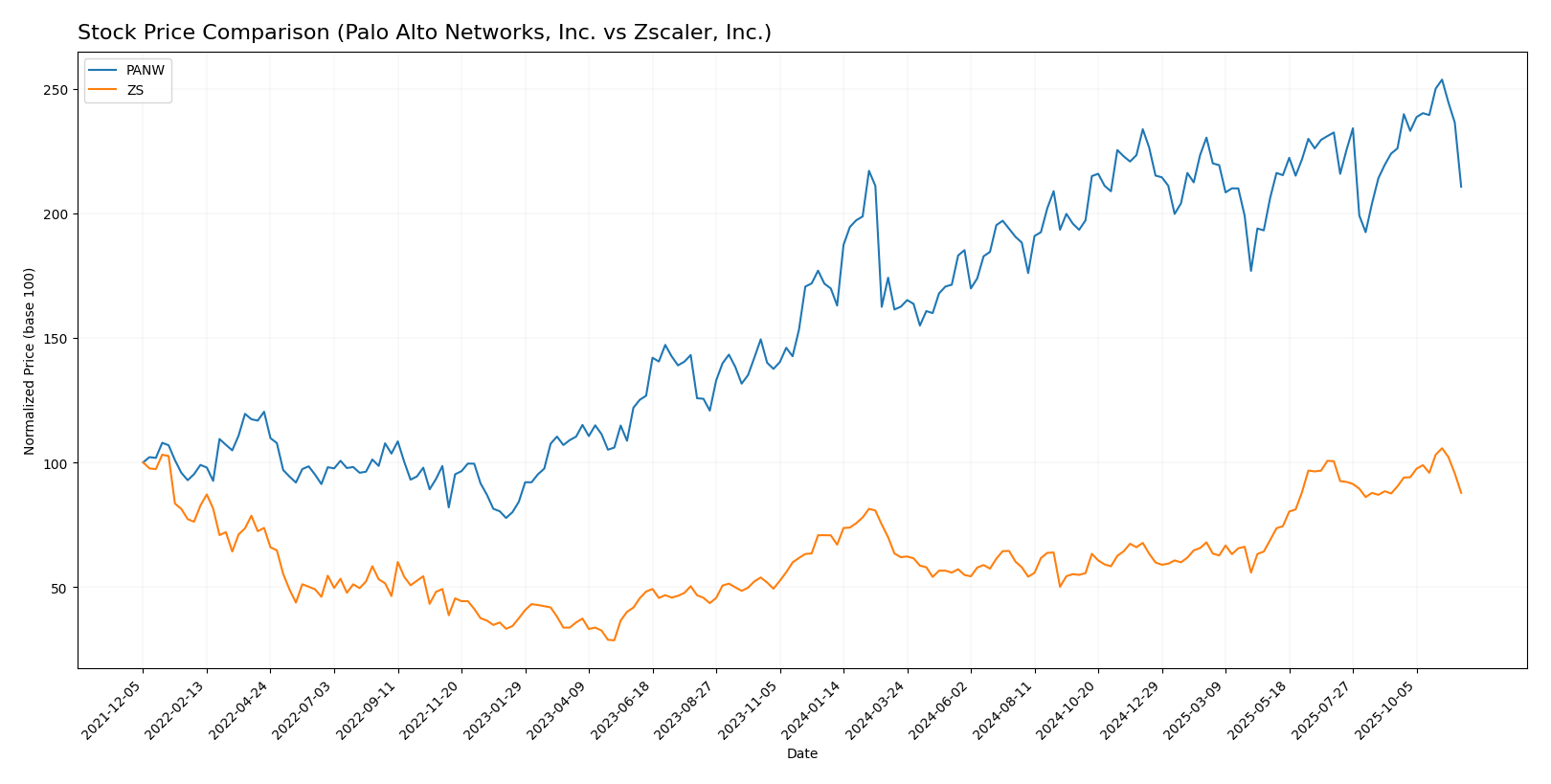

In this section, I will analyze the stock price movements of Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS) over the past year, highlighting key dynamics and trading behaviors.

Trend Analysis

Palo Alto Networks, Inc. (PANW) has experienced a price change of 24.05% over the past year, indicating a bullish trend despite a recent decline of -5.94% since September 7, 2025. The stock has seen notable highs at 220.24 and lows at 134.51. The trend shows deceleration, supported by a standard deviation of 20.4, implying increased volatility in its price movements.

Zscaler, Inc. (ZS) has shown a similar price change of 24.12% over the last year, also reflecting a bullish trend. Recently, however, the stock has maintained a more stable position with a minimal increase of 0.3% since September 7, 2025. The highest price recorded is 331.14, with a low of 156.78. The trend is characterized by acceleration, with a standard deviation of 47.23, indicating a higher volatility level compared to PANW.

Both stocks exhibit different dynamics in their recent trends, which is crucial for investors to consider when making portfolio decisions.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS). Analysts have rated PANW with a “B” due to strong performance in discounted cash flow and returns on equity and assets, suggesting a buy consensus. Conversely, ZS received a “C-” rating, primarily reflecting concerns over its low scores in return on equity and assets, leaning towards a hold recommendation. Overall, the consensus for PANW is buy, while ZS remains more cautious with a sell sentiment.

Stock Grades

In this section, I’ll provide the latest stock ratings for two companies, Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS), based on recent evaluations from reputable grading companies.

Palo Alto Networks, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-20 |

| Rosenblatt | Maintain | Buy | 2025-11-20 |

| Wedbush | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-20 |

| Piper Sandler | Maintain | Overweight | 2025-11-20 |

Zscaler, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-18 |

| Mizuho | Maintain | Neutral | 2025-11-17 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| Barclays | Maintain | Overweight | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-10-02 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

| JMP Securities | Maintain | Market Outperform | 2025-09-03 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-03 |

| Needham | Maintain | Buy | 2025-09-03 |

Overall, the trend for both companies shows a mix of maintenance of ratings, with some minor downgrades for Palo Alto Networks. While Zscaler maintains a strong outlook with multiple “buy” ratings, investors should remain cautious about the downgrade from HSBC for PANW, indicating a need for careful risk management.

Target Prices

The consensus target prices for Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS) reflect optimistic growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 250 | 157 | 228.83 |

| Zscaler, Inc. | 350 | 300 | 326.13 |

For Palo Alto Networks, the current stock price of 182.9 is significantly below the consensus target of 228.83, indicating potential upside. Zscaler’s current price of 275.01 is also below its consensus target of 326.13, suggesting a favorable outlook as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Palo Alto Networks, Inc. (PANW) and Zscaler, Inc. (ZS) based on their most recent financial data.

| Criterion | Palo Alto Networks, Inc. | Zscaler, Inc. |

|---|---|---|

| Diversification | Strong focus on cybersecurity solutions across various sectors | Focused on cloud security solutions |

| Profitability | Net Profit Margin: 12.3% | Net Profit Margin: -1.6% |

| Innovation | High investment in R&D | Rapidly evolving product offerings |

| Global presence | Established in multiple regions | Growing international footprint |

| Market Share | Significant player in cybersecurity | Increasing share in cloud security |

| Debt level | Low debt-to-equity ratio (0.043) | Moderate debt-to-equity ratio (0.999) |

Key takeaways indicate that Palo Alto Networks demonstrates strong profitability and low debt levels, making it a robust candidate for investment. In contrast, Zscaler shows promise in innovation but struggles with profitability and higher debt, suggesting a more cautious approach.

Risk Analysis

In the following table, I outline the key risks associated with each company to provide you with a clearer understanding of their potential vulnerabilities.

| Metric | Palo Alto Networks, Inc. (PANW) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Low | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Medium |

Both companies face significant market and operational risks, particularly in the rapidly evolving cybersecurity landscape. Zscaler’s high operational risk is largely tied to its reliance on cloud-based services, which can be vulnerable to outages or security breaches. Conversely, Palo Alto Networks has a broader portfolio, mitigating some risks, but still faces medium market and geopolitical risks due to regulatory scrutiny and competitive pressures.

Which one to choose?

In comparing Palo Alto Networks (PANW) and Zscaler (ZS), several key factors emerge. PANW holds a stronger market cap of $115B versus ZS’s $44B, and exhibits superior margins, such as a gross profit margin of 73.4% compared to ZS’s 76.9%. However, PANW boasts a rating of B against ZS’s C-, indicating better overall performance metrics. Analyst price targets suggest PANW may have more room for growth despite its higher valuation ratios, such as a P/E ratio of 101.4 versus ZS’s negative earnings metrics.

Investors focused on growth may prefer PANW due to its better financial metrics and ratings, while those prioritizing potential high-reward may find ZS appealing, albeit with higher risks. Notably, both companies face competitive pressures in a rapidly evolving cybersecurity landscape.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and Zscaler, Inc. to enhance your investment decisions: