In today’s dynamic technology landscape, two notable players stand out: Cognizant Technology Solutions (CTSH) and CrowdStrike Holdings (CRWD). Both companies operate within the technology sector, but they focus on different aspects of innovation—Cognizant excels in IT services and consulting, while CrowdStrike leads in cybersecurity solutions. As they both compete for market share, understanding their strategies and performance can guide investors in making informed decisions. Join me as we explore which company presents the more compelling investment opportunity.

Table of contents

Company Overview

Cognizant Technology Solutions Corporation Overview

Cognizant Technology Solutions Corporation (CTSH) is a leading professional services company that specializes in consulting, technology, and outsourcing services. With a market capitalization of approximately $37.3B, Cognizant operates across diverse sectors, including Financial Services, Healthcare, and Communications, Media, and Technology. The company focuses on enhancing customer experiences through innovative solutions such as robotic process automation, analytics, and artificial intelligence. Founded in 1994 and headquartered in Teaneck, New Jersey, Cognizant aims to drive operational improvements and deliver integrated, seamless experiences for its clients across various industries.

CrowdStrike Holdings, Inc. Overview

CrowdStrike Holdings, Inc. (CRWD) is a prominent player in cybersecurity, providing cloud-delivered protection across endpoints and cloud workloads. With a market cap of around $121.6B, the company focuses on offering advanced threat intelligence and managed security services via its Falcon platform. Founded in 2011 and based in Austin, Texas, CrowdStrike is known for its innovative approach to cybersecurity, leveraging a subscription model that allows for scalable solutions tailored to client needs. As a key contender in the software infrastructure industry, it emphasizes Zero Trust identity protection and proactive threat hunting.

Key Similarities and Differences

Both Cognizant and CrowdStrike operate in the technology sector but target different market needs. Cognizant focuses on consulting and operational improvement across various industries, while CrowdStrike specializes in cybersecurity solutions delivered via a subscription model. Their business models reflect distinctive approaches: Cognizant emphasizes a broader range of services, whereas CrowdStrike concentrates on advanced security technologies.

Income Statement Comparison

The following table presents the most recent income statement figures for Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD) for a direct comparison of their financial performance.

| Metric | CTSH | CRWD |

|---|---|---|

| Revenue | 19.74B | 3.95B |

| EBITDA | 3.53B | 294M |

| EBIT | 2.99B | 80.85M |

| Net Income | 2.24B | -19.27M |

| EPS | 4.52 | -0.08 |

Interpretation of Income Statement

Cognizant’s revenue has shown consistent growth, increasing from 19.35B to 19.74B, while CrowdStrike’s revenue surged significantly, up from 3.06B to 3.95B. However, CrowdStrike reported a net loss in the most recent year, contrasting with Cognizant’s robust net income of 2.24B. Margins for Cognizant remained stable, while CrowdStrike’s operating loss indicates challenges in managing expenses relative to its rapid revenue growth. The latest results suggest that while Cognizant maintains profitability, CrowdStrike may need to address its cost structure to improve overall financial health.

Financial Ratios Comparison

The following table provides a comparative analysis of key financial ratios for Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD) as of their most recent fiscal year.

| Metric | CTSH | CRWD |

|---|---|---|

| ROE | 15.55% | -0.59% |

| ROIC | 13.24% | 0.70% |

| P/E | 17.03 | N/A |

| P/B | 2.65 | 29.71 |

| Current Ratio | 2.09 | 1.67 |

| Quick Ratio | 2.09 | 1.67 |

| D/E | 0.10 | 0.34 |

| Debt-to-Assets | 7.53% | 15.59% |

| Interest Coverage | 53.56 | -4.58 |

| Asset Turnover | 0.99 | 0.45 |

| Fixed Asset Turnover | 12.77 | 4.76 |

| Payout Ratio | 26.79% | 0% |

| Dividend Yield | 1.57% | 0% |

Interpretation of Financial Ratios

Cognizant (CTSH) exhibits strong financial health with solid profitability metrics (ROE and ROIC) and a low debt-to-equity ratio, indicating effective leverage management. In contrast, CrowdStrike (CRWD) faces significant challenges, evidenced by negative profitability and high price-to-book ratios, suggesting overvaluation relative to its asset base. Investors should approach CRWD with caution due to its current financial instability.

Dividend and Shareholder Returns

Cognizant Technology Solutions (CTSH) pays dividends with a current yield of 1.57% and a payout ratio of approximately 27%. This indicates a sustainable distribution, supported by strong cash flow coverage. On the other hand, CrowdStrike (CRWD) does not pay dividends, focusing instead on reinvestment for growth, given its negative net income. However, CRWD engages in share buybacks, suggesting a commitment to shareholder returns. Overall, CTSH’s dividends appear supportive of long-term value, while CRWD’s strategy may be more suited for aggressive growth.

Strategic Positioning

Cognizant Technology Solutions (CTSH) holds a significant market share in the information technology services sector, competing effectively against other major players. The company benefits from a diverse service portfolio, including AI and automation, but faces competitive pressure from agile firms leveraging technological disruption. On the other hand, CrowdStrike (CRWD), a leader in cloud-based cybersecurity, maintains a strong position in the software infrastructure market with its Falcon platform, though it must continuously innovate to stay ahead of emerging threats and competitors.

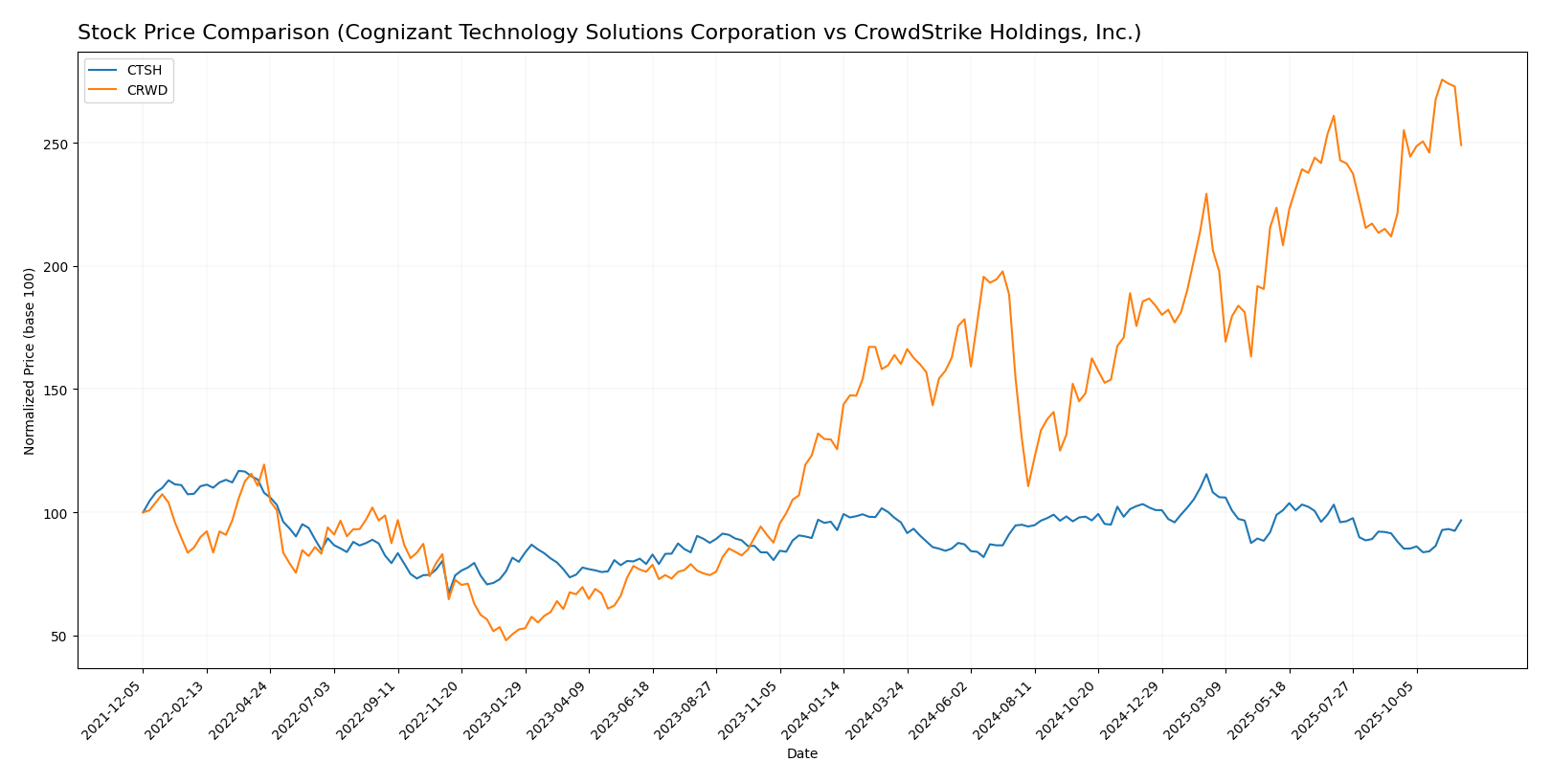

Stock Comparison

In this section, I will analyze the stock price performance of Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD) over the past year, focusing on key price movements and trading dynamics.

Trend Analysis

Cognizant Technology Solutions Corporation (CTSH)

Over the past year, CTSH has experienced a price change of +0.6%. This slight increase indicates a neutral trend, as it falls within the range of -2% to +2%. Notably, the stock hit a high of 90.7 and a low of 64.26, demonstrating some volatility with a standard deviation of 5.2. Recently, from September 7, 2025, to November 23, 2025, CTSH’s price surged by 5.79%, reflecting an acceleration in upward momentum with a standard deviation of 3.24.

CrowdStrike Holdings, Inc. (CRWD)

CRWD has shown significant strength over the past year, with a remarkable price change of +92.18%, which categorizes it as a bullish trend. The stock has fluctuated between a high of 543.01 and a low of 217.89, indicating substantial volatility, supported by a standard deviation of 79.27. In the recent period from September 7, 2025, to November 23, 2025, CRWD’s price has increased by 17.49%, further confirming the acceleration of this bullish trend, albeit with a higher standard deviation of 37.66.

In summary, while CTSH shows a neutral trend with modest price fluctuations, CRWD has emerged as a strong performer with significant upward momentum, reflecting robust investor interest and market confidence.

Analyst Opinions

Recent analyst recommendations reflect a cautious stance towards Cognizant Technology Solutions (CTSH) and CrowdStrike Holdings (CRWD). Analysts favor CTSH, rating it as an “A” with solid scores in return on assets (5) and overall performance (4). In contrast, CRWD has received a “C-” rating, citing concerns over its return on equity (1) and overall financial health (1). The consensus for CTSH is a “buy”, while CRWD leans more towards a “hold” given its current challenges.

Stock Grades

In this section, I’ll present the most recent stock ratings for Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD), providing insights into their current market positions.

Cognizant Technology Solutions Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | upgrade | Outperform | 2025-11-21 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

| RBC Capital | maintain | Sector Perform | 2025-10-30 |

| Guggenheim | maintain | Buy | 2025-10-21 |

| JP Morgan | maintain | Overweight | 2025-08-20 |

| JP Morgan | maintain | Overweight | 2025-07-31 |

| JP Morgan | maintain | Overweight | 2025-07-28 |

| Guggenheim | upgrade | Buy | 2025-07-18 |

CrowdStrike Holdings, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Buy | 2025-11-18 |

| Rosenblatt | maintain | Buy | 2025-11-18 |

| Stifel | maintain | Buy | 2025-11-17 |

| Mizuho | maintain | Neutral | 2025-11-17 |

| Barclays | maintain | Overweight | 2025-11-14 |

| Baird | maintain | Neutral | 2025-11-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-13 |

| BTIG | maintain | Buy | 2025-11-04 |

| Oppenheimer | maintain | Outperform | 2025-10-17 |

| WestPark Capital | maintain | Hold | 2025-10-15 |

Overall, both companies show a trend of maintaining positive grades, with Cognizant receiving an upgrade from William Blair to “Outperform.” CrowdStrike continues to hold strong with multiple “Buy” ratings, indicating a solid outlook from analysts.

Target Prices

Based on the latest analyses, here are the reliable target prices for Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cognizant Technology Solutions | 85 | 78 | 82.8 |

| CrowdStrike Holdings | 706 | 430 | 541.57 |

For CTSH, the target consensus of 82.8 suggests analysts expect a potential upside from the current price of 75.98. In contrast, CRWD’s consensus of 541.57 indicates strong bullish sentiment compared to its current price of 490.67, reflecting significant growth expectations from analysts.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD).

| Criterion | Cognizant Technology Solutions (CTSH) | CrowdStrike Holdings (CRWD) |

|---|---|---|

| Diversification | Strong across multiple sectors | Focused on cybersecurity |

| Profitability | Profit margins of 11.35% | Negative operating margins |

| Innovation | Advanced in AI & automation | Leading in cybersecurity tech |

| Global presence | Significant international footprint | Expanding globally |

| Market Share | Solid presence in IT services | Growing in cybersecurity |

| Debt level | Low debt-to-equity ratio (0.10) | Moderate debt level (0.24) |

Key takeaways: Cognizant shows strong profitability and diversification, while CrowdStrike excels in innovation but faces challenges with profitability. Investors should consider these factors when evaluating their potential in the market.

Risk Analysis

The following table outlines the key risks associated with two companies, Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD).

| Metric | Cognizant Technology Solutions (CTSH) | CrowdStrike Holdings (CRWD) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Cognizant appears to be better positioned against market and regulatory risks, while CrowdStrike faces significant challenges in these areas, impacting its overall stability. Notably, CrowdStrike’s operational margin is currently negative, highlighting a critical risk that could deter investors.

Which one to choose?

In comparing Cognizant Technology Solutions Corporation (CTSH) and CrowdStrike Holdings, Inc. (CRWD), the fundamental analysis suggests a clear distinction between the two companies. CTSH shows strong financial health with a market cap of $38.1B, a solid net profit margin of 11.35%, and an A rating, indicating robust operational efficiency. In contrast, CRWD, despite its impressive price performance (92.18% increase), has a market cap of $97.4B but operates at a loss, reflected in its C- rating and negative profit margins. Analysts generally favor CTSH for long-term investments due to its stability and growth prospects.

For investors focused on growth, CRWD might appeal despite its risks, while those prioritizing stability and financial health may prefer CTSH. Both companies face competitive pressures in their respective industries, which could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cognizant Technology Solutions Corporation and CrowdStrike Holdings, Inc. to enhance your investment decisions: