In the fast-evolving semiconductor industry, two companies stand out: Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM). Both firms operate within the same sector but focus on different aspects of semiconductor technology, with Microchip concentrating on embedded control solutions and Arm specializing in CPU architectures. Their innovative strategies and market positions make them compelling candidates for comparison. As we delve deeper into their financials and growth prospects, I invite you to discover which company might be the more intriguing investment opportunity for your portfolio.

Table of contents

Company Overview

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (MCHP) is a leading provider of smart, connected, and secure embedded control solutions. Established in 1989 and headquartered in Chandler, Arizona, the company develops a broad range of microcontrollers, microprocessors, and associated development tools essential for various applications, including automotive and industrial sectors. With a market capitalization of approximately $27.4B, Microchip is well-positioned in the semiconductor industry, focusing on delivering reliable products that enable system designers to innovate. Their offerings also include memory products and a suite of engineering services, illustrating their commitment to quality and customer satisfaction.

Arm Holdings plc American Depositary Shares Overview

Arm Holdings plc, founded in 1990 and based in Cambridge, UK, is a prominent player in the semiconductor space, specializing in the architecture, development, and licensing of CPU products and related technologies. With a market cap of about $139B, Arm provides essential microprocessors and intellectual property that empower semiconductor companies and original equipment manufacturers across diverse sectors, including automotive and IoT. The company stands out for its innovative approach to chip design, ensuring their products meet the evolving demands of the global tech landscape.

Key similarities between Microchip and Arm include their focus on the semiconductor industry and their roles in providing essential components for technological advancements. However, while Microchip emphasizes embedded solutions and microcontrollers for various sectors, Arm concentrates on CPU architecture and licensing, catering to a broader range of applications. This distinction shapes their respective business models and market strategies.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Microchip Technology Inc. (MCHP) and Arm Holdings plc (ARM), highlighting key financial metrics.

| Metric | MCHP | ARM |

|---|---|---|

| Revenue | 4.40B | 4.01B |

| EBITDA | 1.04B | 902M |

| EBIT | 290M | 720M |

| Net Income | -500K | 792M |

| EPS | -0.005 | 0.75 |

Interpretation of Income Statement

In the latest fiscal year, MCHP reported a significant decline in revenue and a net loss, contrasting with ARM’s robust performance, achieving a notable increase in both revenue and net income. MCHP’s EBITDA margin has contracted, indicating operational challenges, while ARM’s margins have improved due to effective cost management. The performance in 2025 reflects a cautious outlook for MCHP, which may require strategic adjustments to regain profitability, while ARM appears well-positioned for continued growth moving forward.

Financial Ratios Comparison

In this section, I will compare the financial ratios of Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM) based on the most recent data.

| Metric | MCHP | ARM |

|---|---|---|

| ROE | -0.00007 | 0.1158 |

| ROIC | -0.00027 | 0.1131 |

| P/E | -52021.39 | 141.58 |

| P/B | 3.67 | 16.40 |

| Current Ratio | 2.59 | 5.20 |

| Quick Ratio | 1.47 | 5.20 |

| D/E | 0.80 | 0.05 |

| Debt-to-Assets | 0.37 | 0.04 |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.45 |

| Fixed Asset Turnover | 3.72 | 5.61 |

| Payout ratio | -1951.40 | 0 |

| Dividend yield | 3.75% | 0% |

Interpretation of Financial Ratios

MCHP exhibits significant weaknesses, particularly with a negative ROE and P/E ratio, indicating challenges in profitability and valuation. The company’s high debt levels compared to assets raise concerns about financial stability. Conversely, ARM shows a robust current ratio and low debt-to-equity ratio, signaling strong liquidity and lower risk. However, its high P/E ratio suggests potential overvaluation, warranting caution. Investors should weigh these factors carefully before making decisions.

Dividend and Shareholder Returns

Microchip Technology Incorporated (MCHP) distributes dividends with a payout ratio of 48%, yielding 1.87%. The company’s free cash flow comfortably covers its dividend, although there’s potential risk due to its fluctuating profitability. In contrast, Arm Holdings (ARM) does not pay dividends, focusing on reinvestment for growth. Despite this, ARM is actively engaging in share buybacks, which could enhance shareholder value. Ultimately, MCHP’s dividends and ARM’s buyback strategy both aim to foster long-term shareholder returns, albeit through different approaches.

Strategic Positioning

Microchip Technology (MCHP) holds a market cap of 27.4B and focuses on a diverse array of embedded control solutions, securing a significant share in automotive and industrial applications. In contrast, Arm Holdings (ARM), with a market cap of 138.9B, dominates the CPU architecture landscape, particularly in consumer tech and IoT, leveraging its robust licensing model. Both companies face competitive pressure from emerging technologies and evolving market demands, necessitating continuous innovation to maintain their positions.

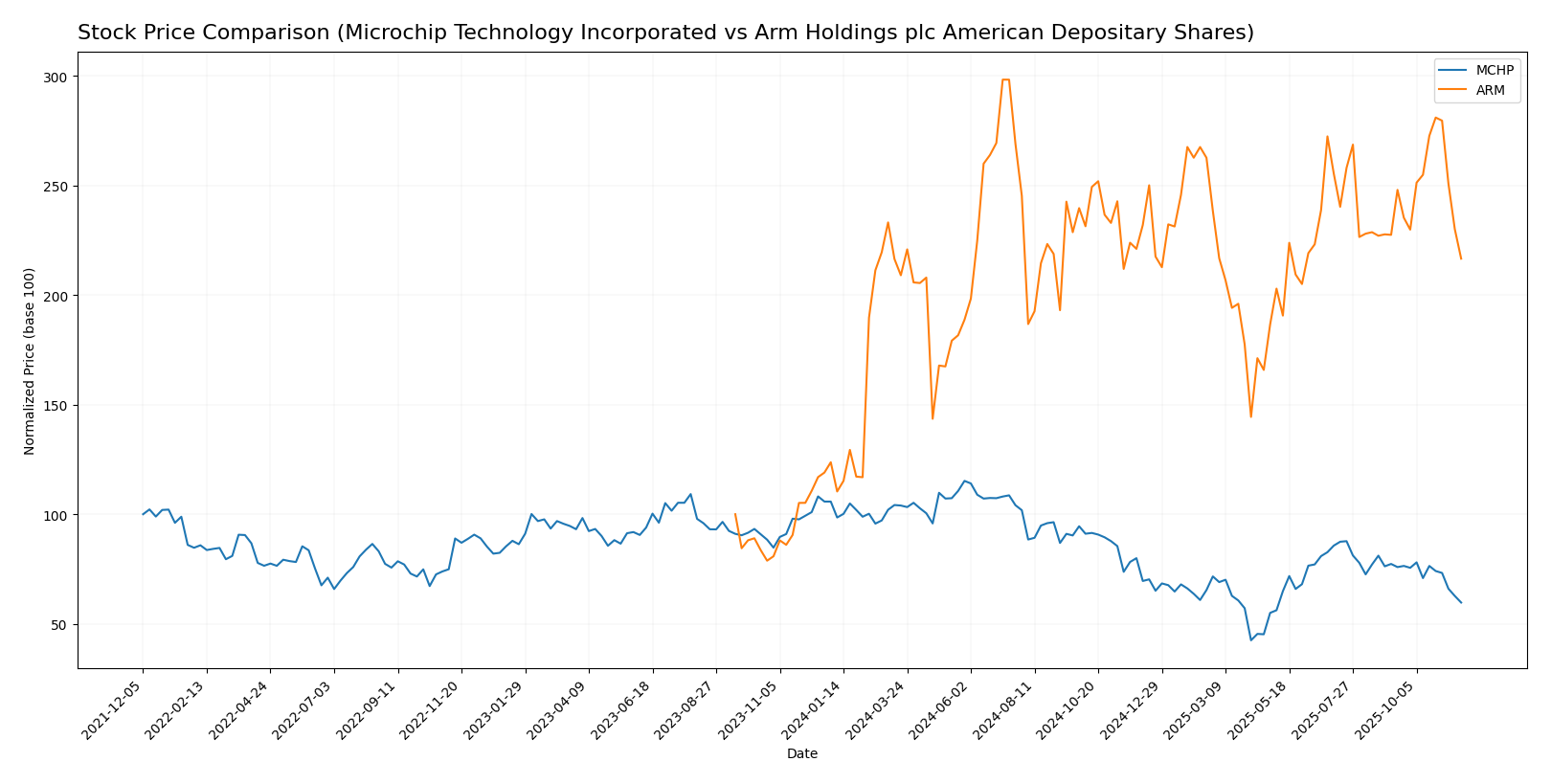

Stock Comparison

In this section, I will analyze the weekly stock price movements of Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM) over the past year, highlighting key price dynamics and trends.

Trend Analysis

Microchip Technology Incorporated (MCHP) Over the past year, MCHP has experienced a significant price change of -43.56%, indicating a bearish trend. The stock displayed notable volatility with a standard deviation of 14.88. The highest price reached was 98.23, while the lowest was 36.22. The recent period from September 7 to November 23, 2025, shows a further decline of -22.79%, with a standard deviation of 4.99, suggesting deceleration in the downward trend.

Arm Holdings plc (ARM) In contrast, ARM has shown a robust price change of +75.08% over the past year, reflecting a bullish trend. The stock’s volatility is captured by a standard deviation of 24.15. ARM’s highest price was 181.19, and the lowest was 67.05. However, in the more recent analysis period from September 7 to November 23, 2025, ARM’s price declined slightly by -4.78%, with a standard deviation of 12.37, indicating some deceleration in the upward trend.

Analyst Opinions

Recent analyst recommendations for Microchip Technology Incorporated (MCHP) indicate a cautious stance, with a rating of C- reflecting concerns over its financial metrics, particularly in return on equity and debt levels. Analysts suggest a hold strategy, emphasizing the need for improved performance. On the other hand, Arm Holdings plc (ARM) has garnered a more favorable B- rating, with analysts recommending a buy due to its strong return on assets and equity. The consensus for MCHP leans towards a hold, while ARM enjoys a consensus buy for the current year.

Stock Grades

In this section, I present the latest stock ratings for two companies: Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM). Let’s take a closer look at the grades provided by recognized grading companies.

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-11-07 |

| Susquehanna | maintain | Positive | 2025-11-07 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Citigroup | maintain | Buy | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

| Raymond James | maintain | Strong Buy | 2025-08-08 |

Arm Holdings plc Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Needham | maintain | Hold | 2025-11-06 |

| Wells Fargo | maintain | Overweight | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Benchmark | maintain | Hold | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

Overall, the stock grades for both MCHP and ARM indicate a stable outlook, with a mix of “Buy” and “Hold” ratings. Notably, MCHP has maintained strong grades such as “Buy” and “Strong Buy,” while ARM shows consistent support with several “Overweight” ratings. This suggests a favorable sentiment for both stocks in the current market environment.

Target Prices

The consensus target prices for both Microchip Technology and Arm Holdings indicate positive growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology | 83 | 60 | 71.33 |

| Arm Holdings | 210 | 190 | 200 |

Analysts expect Microchip Technology’s stock to reach a consensus of 71.33, which is significantly above its current price of 50.9. For Arm Holdings, the consensus target of 200 also suggests potential upside from its current price of 131.57.

Strengths and Weaknesses

The following table outlines key strengths and weaknesses of Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM), which can aid in evaluating their investment potential.

| Criterion | Microchip Technology (MCHP) | Arm Holdings (ARM) |

|---|---|---|

| Diversification | Moderate (semiconductors) | High (various tech sectors) |

| Profitability | Low (net margin: -0.0001) | Moderate (net margin: 0.198) |

| Innovation | Strong (various products) | Strong (leading IP technology) |

| Global presence | Strong (operates globally) | Strong (international reach) |

| Market Share | Moderate (semiconductors) | High (dominant in CPU tech) |

| Debt level | Moderate (debt-to-equity: 0.80) | Very low (debt-to-equity: 0.05) |

In summary, while Arm Holdings shows stronger profitability and a robust market position, Microchip Technology has a diversified product range but struggles with profitability. Assessing these factors can guide investment choices.

Risk Analysis

The table below outlines various risks associated with Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM).

| Metric | MCHP | ARM |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant risks, notably in market and operational areas. MCHP’s high market risk is influenced by its volatility (beta of 1.451), while ARM’s operational risks stem from its expansive international operations, especially in politically sensitive regions.

Which one to choose?

When comparing Microchip Technology (MCHP) and Arm Holdings (ARM), I find that Arm emerges as the stronger candidate for potential investment. Arm’s gross profit margin is notably high at 95%, contributing to a robust net profit margin of 20%. In contrast, MCHP’s net profit margin is negative, reflecting recent challenges.

From a valuation perspective, MCHP’s price-to-earnings ratio is significantly higher at approximately 141, indicating potential overvaluation compared to Arm’s more reasonable 118. Analysts have rated Arm with a B- compared to MCHP’s lower C- rating, further supporting Arm’s position.

Investors focused on aggressive growth might prefer Arm, while those interested in a value play with current challenges may still consider MCHP. However, both companies face industry risks such as competition and supply chain disruptions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Arm Holdings plc American Depositary Shares to enhance your investment decisions: