In the rapidly evolving semiconductor industry, two giants stand out: Intel Corporation (INTC) and Arm Holdings plc (ARM). This comparison is crucial as both firms play pivotal roles in shaping technological advancements, yet they adopt distinct innovation strategies. Intel, with its extensive product range, focuses on manufacturing, while Arm specializes in licensing its architecture to a diverse array of clients. Join me as we explore which of these companies presents the most compelling investment opportunity for savvy investors like you.

Table of contents

Company Overview

Intel Corporation Overview

Intel Corporation, a leading technology company based in Santa Clara, California, is primarily engaged in the design, manufacture, and sale of computer products and technologies globally. Founded in 1968, Intel operates through multiple segments, including Client Computing, Data Center, and Internet of Things, among others. The company is renowned for its innovative central processing units (CPUs) and chipsets, as well as advanced solutions for sectors like healthcare and autonomous driving. With a market capitalization of approximately $151.73B, Intel remains a key player in the semiconductor industry, continuously adapting to the evolving needs of cloud service providers and original equipment manufacturers.

Arm Holdings plc Overview

Arm Holdings plc, headquartered in Cambridge, UK, specializes in architecture, development, and licensing of CPU products and related technologies. Established in 1990, Arm’s solutions are pivotal for semiconductor companies and OEMs, particularly in automotive, IoT, and consumer technology markets. With a market cap of around $138.94B, Arm’s products, which include microprocessors and graphics processing units, are integral to a wide array of applications. As a subsidiary of Kronos II LLC, Arm is positioned as a crucial innovator in the semiconductor landscape.

Key similarities between Intel and Arm include their focus on semiconductor technologies and serving OEMs. However, Intel is primarily a manufacturer, while Arm operates on a licensing model, enabling broader partnerships and applications across various markets.

Income Statement Comparison

In the following table, I present a comparative analysis of the income statements for Intel Corporation and Arm Holdings for their most recent fiscal years.

| Metric | Intel Corporation (INTC) | Arm Holdings (ARM) |

|---|---|---|

| Revenue | 53.1B | 4.0B |

| EBITDA | 1.2B | 902.9M |

| EBIT | -10.2B | 720.0M |

| Net Income | -18.8B | 792.0M |

| EPS | -4.38 | 0.75 |

Interpretation of Income Statement

Looking at the most recent fiscal year, Intel reported a significant decline in both revenue and net income compared to previous years, reflecting ongoing operational challenges. The company is experiencing a negative EBIT, indicating struggles in profitability despite high revenues. In contrast, Arm has demonstrated solid revenue growth and positive net income, reflecting effective cost management and operational efficiency. The margins for Arm are stable, while Intel’s margins have deteriorated, signaling a need for strategic adjustments to regain profitability.

Financial Ratios Comparison

The table below presents the most recent revenue and key financial ratios for Intel Corporation (INTC) and Arm Holdings (ARM). This comparison can assist investors in evaluating the financial health and performance of these companies.

| Metric | Intel Corporation (INTC) | Arm Holdings (ARM) |

|---|---|---|

| ROE | -18.89% | 11.58% |

| ROIC | -12.18% | 11.31% |

| P/E | -4.63 | 141.58 |

| P/B | 0.88 | 16.40 |

| Current Ratio | 1.33 | 5.20 |

| Quick Ratio | 0.98 | 5.20 |

| D/E | 0.50 | 0.05 |

| Debt-to-Assets | 25.45% | 3.99% |

| Interest Coverage | -14.17 | 0 |

| Asset Turnover | 0.27 | 0.45 |

| Fixed Asset Turnover | 0.49 | 5.61 |

| Payout ratio | -8.53% | 0 |

| Dividend yield | 1.84% | 0% |

Interpretation of Financial Ratios

Intel’s financial ratios indicate significant challenges, particularly with a negative ROE and ROIC, highlighting underlying operational issues. The high P/E ratio for Arm suggests a premium valuation despite strong profitability metrics. Conversely, Arm’s impressive current and quick ratios signal robust liquidity, while Intel’s declining performance raises red flags for potential investors. In summary, while Arm exhibits stronger fundamentals, Intel’s current state reflects potential risks.

Dividend and Shareholder Returns

Intel Corporation (INTC) pays dividends with a recent yield of 1.84%. However, the payout ratio is concerning at -8.5%, indicating unsustainable distributions due to negative net income. Despite this, Intel engages in share buybacks, but excessive repurchases may pose risks. In contrast, Arm Holdings (ARM) does not pay dividends, as it focuses on reinvestment for growth, aligning with long-term value creation. Both companies’ strategies reflect differing approaches to shareholder returns, with Intel facing potential risks.

Strategic Positioning

Intel Corporation (INTC) holds a significant market share in the semiconductor sector, particularly in central processing units (CPUs) and related technologies, with a market cap of $151.7B. However, it faces intense competitive pressure from Arm Holdings (ARM), which focuses on CPU architecture and licensing, boasting a market cap of $138.9B. The industry is also undergoing technological disruption, with both companies innovating to maintain their competitive edge in areas like artificial intelligence and IoT. Such dynamics highlight the importance of strategic positioning and adaptability in this rapidly evolving market.

Stock Comparison

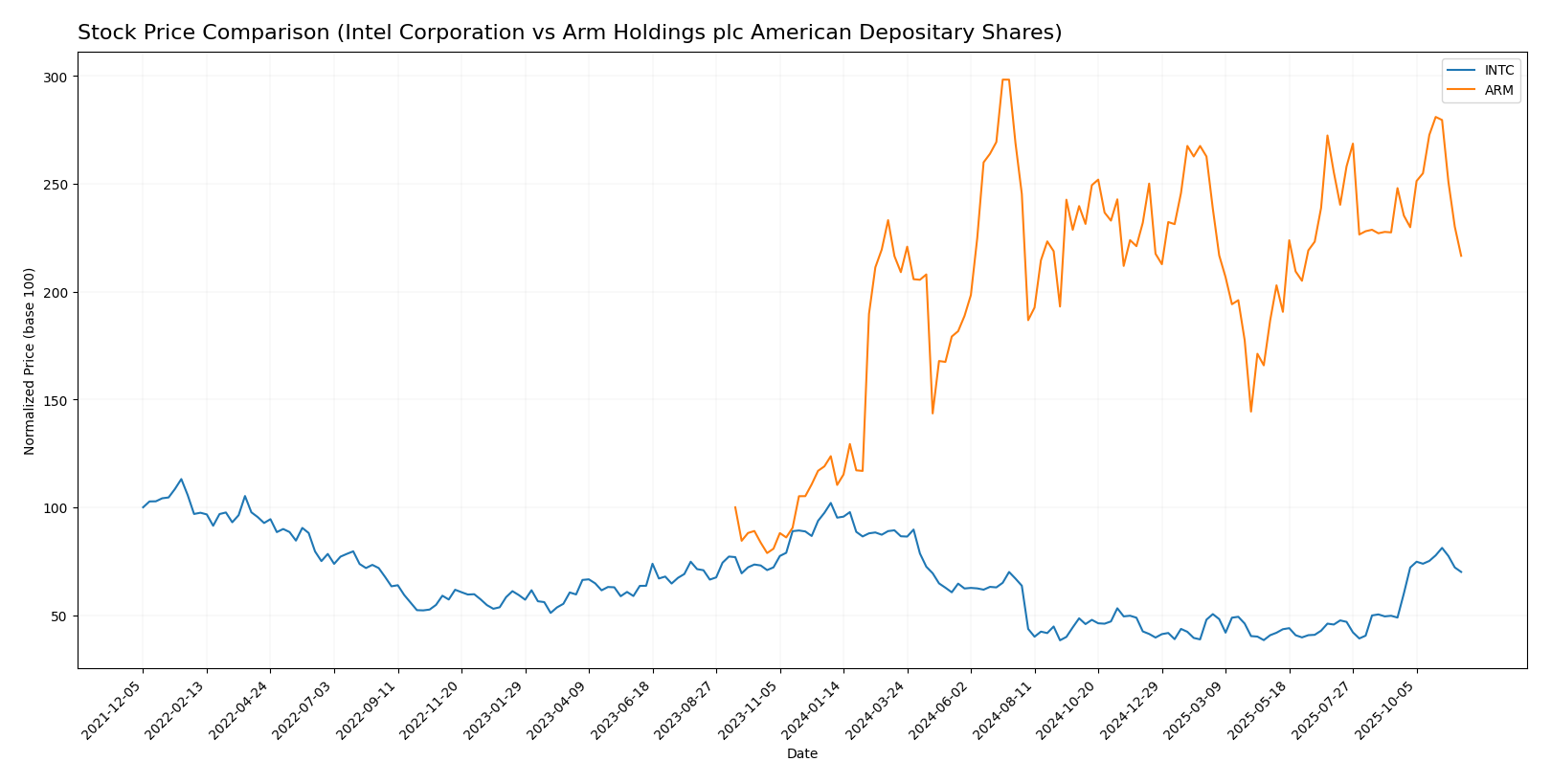

In this section, I will analyze the weekly stock price movements and trading dynamics for Intel Corporation (INTC) and Arm Holdings plc (ARM) over the past year, highlighting key price changes and trends.

Trend Analysis

Intel Corporation (INTC) Over the past year, INTC has experienced a significant price change of -31.34%, indicating a bearish trend. The stock has shown acceleration in this downward movement, with notable highs reaching $50.25 and lows at $18.89. The standard deviation of 8.72 suggests a relatively high volatility during this period. More recently, from September 7, 2025, to November 23, 2025, the stock price has increased by 40.87%, although this recent trend still falls under a higher standard deviation of 5.06, indicating fluctuating price behavior.

Arm Holdings plc (ARM) In contrast, ARM has reported a remarkable price increase of 75.08% over the last year, marking a bullish trend. The stock has also demonstrated acceleration, with highs of $181.19 and lows of $67.05. The standard deviation of 24.15 points to significant volatility in its price movements. However, in the recent period from September 7, 2025, to November 23, 2025, ARM’s price has decreased by 4.78%, while maintaining a standard deviation of 12.37, indicating some fluctuations but overall stability in the short term.

Analyst Opinions

Recent analyst recommendations for Intel Corporation (INTC) indicate a cautious stance, with a rating of C+. Analysts highlight concerns over its price-to-earnings and discounted cash flow scores. Conversely, Arm Holdings plc (ARM) holds a more favorable B- rating, driven by solid return on assets and equity metrics. Overall, the consensus for INTC remains a hold, while ARM leans toward a buy due to its stronger fundamentals. As an investor, I suggest weighing these ratings carefully before making any decisions.

Stock Grades

In the current market landscape, it’s essential to understand how analysts are grading stocks. Below are the latest grades for Intel Corporation and Arm Holdings plc.

Intel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | maintain | Buy | 2025-11-04 |

| Barclays | maintain | Equal Weight | 2025-10-27 |

| Mizuho | maintain | Neutral | 2025-10-24 |

| Wedbush | maintain | Neutral | 2025-10-24 |

| Wells Fargo | maintain | Equal Weight | 2025-10-24 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-24 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-24 |

| Truist Securities | maintain | Hold | 2025-10-24 |

| Rosenblatt | maintain | Sell | 2025-10-24 |

| JP Morgan | maintain | Underweight | 2025-10-24 |

Arm Holdings plc Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Needham | maintain | Hold | 2025-11-06 |

| Wells Fargo | maintain | Overweight | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Benchmark | maintain | Hold | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

Overall, Intel Corporation’s grades show a mix of holds and neutral ratings, reflecting a cautious outlook, while Arm Holdings plc maintains a more favorable view with multiple “Buy” and “Overweight” ratings, indicating positive sentiment among analysts.

Target Prices

The current consensus target prices for Intel Corporation (INTC) and Arm Holdings plc (ARM) reflect optimistic expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intel Corporation (INTC) | 52 | 20 | 35.22 |

| Arm Holdings plc (ARM) | 210 | 190 | 200 |

Analysts anticipate a significant upside for both companies. Intel’s current price of 34.5 is below the consensus, suggesting potential growth, while Arm’s price of 131.57 is also well below its consensus target.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Intel Corporation and Arm Holdings plc, providing a clear comparison to assist in your investment decisions.

| Criterion | Intel Corporation (INTC) | Arm Holdings plc (ARM) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Weak (Net Margin: 3.1%) | Strong (Net Margin: 19.8%) |

| Innovation | Moderate | High |

| Global presence | Strong | Strong |

| Market Share | Significant | Growing |

| Debt level | Moderate (Debt/Equity: 0.47) | Low (Debt/Equity: 0.05) |

Key takeaways from the analysis indicate that Arm Holdings exhibits stronger profitability and a lower debt level compared to Intel, making it an attractive investment option in the semiconductor sector.

Risk Analysis

In the table below, I outline the primary risks associated with Intel Corporation (INTC) and Arm Holdings (ARM). Understanding these risks can help you make informed investment decisions.

| Metric | Intel Corporation (INTC) | Arm Holdings (ARM) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | High | Moderate |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | High | Moderate |

Both companies face significant market risk due to the volatile nature of the semiconductor industry, compounded by geopolitical tensions affecting supply chains. Recent global events underline the urgency for robust risk management strategies.

Which one to choose?

When comparing Intel Corporation (INTC) and Arm Holdings plc (ARM), both companies exhibit distinct characteristics and performance metrics. Intel has recently faced significant challenges, posting a net loss of 18.8B with a bearish stock trend showing a -31.34% price change over the past year. Key ratios indicate a C+ rating, with elevated debt levels impacting its financial stability. In contrast, Arm demonstrates a robust performance with a bullish trend and a 75.08% price increase, earning a B- rating. Despite a recent dip of 4.78%, its profitability measures and lower debt ratio highlight a more favorable financial position.

Investors focused on growth may prefer Arm for its positive momentum and profitability, while those prioritizing stability might lean towards Intel, although it carries more risk due to its recent performance and debt levels.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Intel Corporation and Arm Holdings plc American Depositary Shares to enhance your investment decisions: