In the fast-paced world of semiconductors, two companies stand out: Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP). Both are key players in the technology sector, competing in overlapping markets while employing distinct innovation strategies. Intel, a giant in chip manufacturing, contrasts with Microchip’s focus on smart, embedded control solutions. As I delve into their financial health and growth prospects, I aim to help you identify which company might be the more compelling investment opportunity.

Table of contents

Company Overview

Intel Corporation Overview

Intel Corporation (ticker: INTC) is a leading semiconductor company headquartered in Santa Clara, California. Founded in 1968, Intel designs and manufactures a broad array of computing products, including central processing units (CPUs), chipsets, and system-on-chip solutions. The company operates through multiple segments such as Client Computing, Data Center, and Internet of Things, among others. With a market capitalization of approximately $151.7B, Intel positions itself as a key player in the technology sector, catering to both original equipment manufacturers (OEMs) and cloud service providers. The firm also focuses on advanced applications in artificial intelligence and autonomous driving technologies, highlighting its commitment to innovation and market leadership.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (ticker: MCHP) specializes in developing and manufacturing secure, connected embedded control solutions. Incorporated in 1989 and based in Chandler, Arizona, Microchip offers a diverse portfolio of microcontrollers, analog products, and memory solutions. With a market capitalization of about $27.4B, the company serves a wide range of industries, including automotive, industrial, and communications. Its robust product line includes specialized microcontrollers and development tools designed to enable advanced applications. Microchip’s focus on embedded technologies positions it as a vital player in the semiconductor industry, particularly in the realm of smart devices and connectivity.

Key similarities between Intel and Microchip include their focus on the semiconductor sector and their commitment to innovation in technology. However, they differ significantly in their business models: Intel primarily emphasizes high-performance computing and data centers, while Microchip specializes in embedded control solutions and microcontrollers for diverse applications.

Income Statement Comparison

The table below illustrates the most recent income statements of Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP), allowing for a direct financial performance comparison.

| Metric | Intel Corporation (INTC) | Microchip Technology (MCHP) |

|---|---|---|

| Revenue | 53.1B | 4.4B |

| EBITDA | 1.2B | 1.0B |

| EBIT | -10.2B | 0.3B |

| Net Income | -18.8B | -0.0005M |

| EPS | -4.38 | -0.005 |

Interpretation of Income Statement

In the most recent fiscal year, Intel experienced a substantial decline in revenue, dropping from 54.2B to 53.1B, and recorded a significant net loss of 18.8B. Conversely, Microchip saw a decrease in revenue from 7.6B to 4.4B, ending the year with a modest net loss. Both companies faced challenges in maintaining profitability, with Intel’s EBIT reflecting deep operational losses. However, Microchip managed to maintain positive EBITDA, indicating healthier operational margins despite revenue challenges. Overall, the financial landscape suggests heightened operational risks for both companies, particularly for Intel, which is grappling with substantial losses and declining revenues.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial ratios for Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP). This will help us assess their financial health and investment potential.

| Metric | Intel (INTC) | Microchip (MCHP) |

|---|---|---|

| ROE | -18.89% | -0.0071% |

| ROIC | -12.18% | -0.0267% |

| P/E | -4.63 | 20.61 |

| P/B | 0.88 | 7.08 |

| Current Ratio | 1.33 | 2.59 |

| Quick Ratio | 0.98 | 1.47 |

| D/E | 0.50 | 0.80 |

| Debt-to-Assets | 0.25 | 0.40 |

| Interest Coverage | -14.17 | 15.28 |

| Asset Turnover | 0.27 | 0.51 |

| Fixed Asset Turnover | 0.49 | 7.16 |

| Payout Ratio | -8.53% | 31.07% |

| Dividend Yield | 1.84% | 1.87% |

Interpretation of Financial Ratios

The financial ratios indicate significant differences in performance between Intel and Microchip. Intel shows weak returns on equity and invested capital, along with negative earnings, which raises concerns about its profitability. Conversely, Microchip demonstrates a stronger current ratio and a positive interest coverage ratio, suggesting better short-term liquidity and ability to meet obligations. However, both companies exhibit high price-to-book ratios, indicating potential overvaluation. Investors should be cautious and weigh these factors carefully before making decisions.

Dividend and Shareholder Returns

Intel Corporation (INTC) offers dividends with a current yield of 1.84% and a payout ratio indicating cautious distribution, as it faces negative net income. The trend shows a dividend per share of $0.37, but risks include potential unsustainable payouts.

Conversely, Microchip Technology Incorporated (MCHP) also pays dividends with a yield of 1.51% and a payout ratio of about 31%. This suggests a balanced approach to shareholder returns while maintaining capital for growth initiatives. Both companies are engaging in share buybacks, reinforcing their commitment to shareholder value. Overall, these distributions appear to support sustainable long-term value creation.

Strategic Positioning

Intel Corporation (INTC) holds a significant market share in the semiconductor industry, with a market cap of $151.7B, but faces intense competitive pressure from companies like Microchip Technology Incorporated (MCHP), which has a market cap of $27.4B. Technological disruptions, particularly in AI and embedded solutions, are reshaping market dynamics. Intel’s broad product range contrasts with Microchip’s specialized offerings, indicating varying strategic focuses that investors should consider when evaluating potential investments.

Stock Comparison

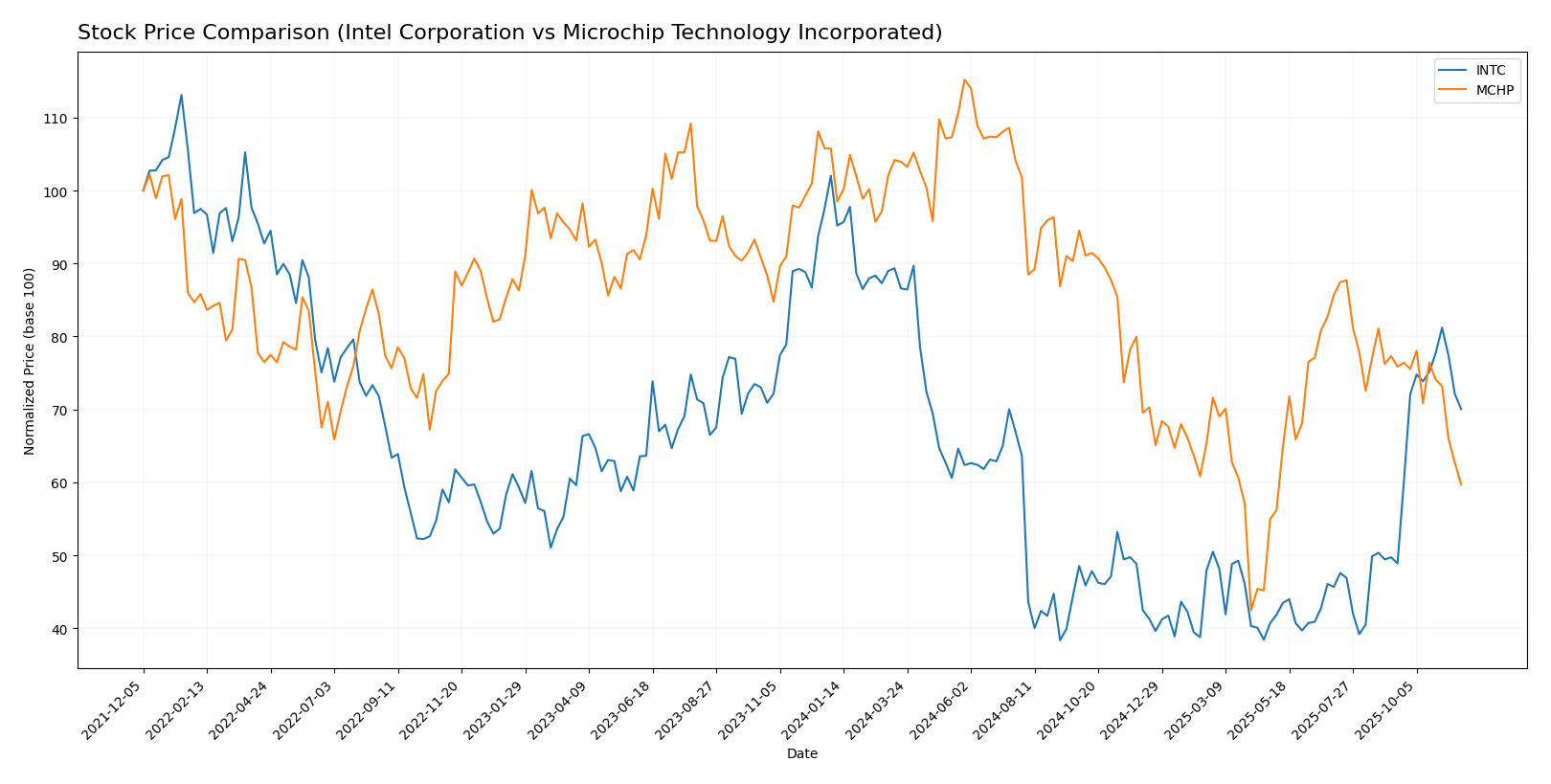

In this section, I will analyze the stock price movements of Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP) over the past year, providing insights into their trading dynamics and performance trends.

Trend Analysis

For Intel Corporation (INTC), the overall trend shows a price change of -31.34% over the past year, indicating a bearish trend with accelerated price decline. The stock has experienced notable volatility, with a standard deviation of 8.72. The highest price reached was 50.25, while the lowest was 18.89.

In the recent analysis period from September 7, 2025, to November 23, 2025, INTC saw a price change of +40.87%, suggesting a positive shift in sentiment and a bullish trend. The standard deviation during this period was 5.06, indicating lower volatility than the overall trend.

For Microchip Technology Incorporated (MCHP), the overall trend reflects a significant price change of -43.56% over the past year, also categorizing it as bearish, but with a decelerating trend. This stock has experienced higher volatility, with a standard deviation of 14.88. The price ranged from a high of 98.23 to a low of 36.22.

During the recent analysis period from September 7, 2025, to November 23, 2025, MCHP’s price change was -22.79%, reflecting continued bearish sentiment, but at a decelerating rate with a standard deviation of 4.99.

In summary, while INTC shows signs of recovery in the short term, MCHP remains under pressure with no immediate signs of reversal. This analysis emphasizes the importance of considering both short-term and long-term trends when making investment decisions.

Analyst Opinions

Recent analyst recommendations for Intel Corporation (INTC) indicate a cautious stance, with a rating of C+ primarily due to moderate performance in return on assets and equity. Analysts suggest a hold position, reflecting concerns over competitive pressures. On the other hand, Microchip Technology Incorporated (MCHP) has a lower rating of C-, leading analysts to recommend a sell due to weak performance metrics across several financial ratios. Overall, the consensus for INTC leans towards a hold, while MCHP is viewed as a sell for the current year.

Stock Grades

In the current market landscape, stock ratings provide valuable insights into the performance expectations for key companies. Below, I present the latest grades for Intel Corporation and Microchip Technology Incorporated.

Intel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2025-11-04 |

| Barclays | Maintain | Equal Weight | 2025-10-27 |

| Mizuho | Maintain | Neutral | 2025-10-24 |

| Wedbush | Maintain | Neutral | 2025-10-24 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-24 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-24 |

| Truist Securities | Maintain | Hold | 2025-10-24 |

| Rosenblatt | Maintain | Sell | 2025-10-24 |

| JP Morgan | Maintain | Underweight | 2025-10-24 |

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2025-11-07 |

| Susquehanna | Maintain | Positive | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Raymond James | Maintain | Strong Buy | 2025-08-08 |

Overall, both Intel and Microchip have maintained their standing with several “Buy” and “Hold” ratings, indicating a stable outlook amidst varying assessments. Notably, Microchip shows a stronger trend with multiple firms listing it as a “Buy,” suggesting positive investor sentiment.

Target Prices

The current target consensus for Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP) indicates positive growth potential for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intel Corporation (INTC) | 52 | 20 | 35.22 |

| Microchip Technology Incorporated (MCHP) | 83 | 60 | 71.33 |

Intel’s target consensus suggests a potential upside from its current price of 34.5, while Microchip’s consensus indicates a favorable outlook compared to its price of 50.9. Both companies show promising analyst expectations.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP) based on their most recent performance data.

| Criterion | Intel Corporation (INTC) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Diversification | Moderate – Focused on semiconductors and AI solutions | High – Offers a wide range of embedded solutions |

| Profitability | Low – Negative net profit margin (-0.35) | Moderate – Positive net profit margin (0.27) |

| Innovation | Strong – Significant investment in AI and advanced chips | Moderate – Focus on smart embedded solutions |

| Global presence | Extensive – Operations in multiple countries | Extensive – Strong presence in Americas, Europe, and Asia |

| Market Share | 15% in the semiconductor market | 3% in the microcontroller market |

| Debt level | Moderate – Debt to equity ratio (0.47) | High – Debt to equity ratio (0.80) |

Key takeaways: Intel faces profitability challenges, while Microchip boasts better margins and a diversified product offering. Both companies have a solid global presence but differ significantly in their market shares and debt levels.

Risk Analysis

In this section, I provide a comparative risk analysis for Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP) based on the latest data.

| Metric | INTC | MCHP |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | High |

| Operational Risk | High | Medium |

| Environmental Risk | Medium | Medium |

| Geopolitical Risk | High | Medium |

Both companies face significant market and operational risks, particularly due to high competition and fluctuations in demand for semiconductor products. Intel’s ongoing restructuring efforts and Microchip’s regulatory scrutiny pose additional challenges, emphasizing the need for careful risk management in investing decisions.

Which one to choose?

When comparing Intel Corporation (INTC) and Microchip Technology Incorporated (MCHP), Intel demonstrates a more favorable financial position with a market cap of $87B and a recent return to profitability with a net income of $1.69B in 2023. In contrast, Microchip’s financials show a more volatile trend, with a current market cap of $26B and a recent net loss. Intel’s ratings of C+ suggests a stronger overall score compared to MCHP’s rating of C-. However, both companies are facing bearish trends, with INTC down 31.34% and MCHP down 43.56% over the past year.

Investors focused on growth may prefer Intel due to its potential for recovery, while those prioritizing stability might consider Microchip’s strong gross profit margins, albeit with caution regarding its recent performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Intel Corporation and Microchip Technology Incorporated to enhance your investment decisions: