In the highly competitive semiconductor industry, Lam Research Corporation (LRCX) and KLA Corporation (KLAC) stand out as key players driving innovation and technology advancement. Both companies specialize in equipment and solutions vital for semiconductor manufacturing, making them direct competitors with overlapping markets. Their distinct approaches to innovation and growth strategies are worth examining. In this article, I will help you determine which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Lam Research Corporation Overview

Lam Research Corporation (LRCX) specializes in designing and manufacturing semiconductor processing equipment essential for the fabrication of integrated circuits. Founded in 1980 and headquartered in Fremont, California, the company offers various products, including systems for film deposition, etching, and wafer cleaning, catering to the global semiconductor industry. With a market capitalization of $179.17B, Lam Research has positioned itself as a key player in semiconductor technology, emphasizing innovation and efficiency in its product offerings. The company operates in a highly competitive sector and continues to drive advancements that enhance production capabilities for clients worldwide.

KLA Corporation Overview

KLA Corporation (KLAC), incorporated in 1975 and based in Milpitas, California, is a leading provider of process control and yield management solutions for the semiconductor and electronics industries. The company’s diverse portfolio spans multiple segments, including semiconductor process control and PCB inspection, underscoring its comprehensive approach to ensuring product quality and yield optimization. With a market capitalization of $144.15B, KLA has established itself as a critical partner in the semiconductor manufacturing ecosystem, offering solutions that enhance operational efficiencies and reduce costs for its clients.

Key Similarities and Differences

Both Lam Research and KLA Corporation operate within the semiconductor industry and focus on improving manufacturing processes through advanced technology. However, Lam Research primarily emphasizes equipment for film deposition and etching, while KLA specializes in process control and yield management solutions. This distinction highlights their complementary roles in the semiconductor supply chain, catering to different stages of production.

Income Statement Comparison

Below is a comparison of the recent income statements for Lam Research Corporation and KLA Corporation, highlighting their financial performance metrics for the fiscal year 2025.

| Metric | Lam Research (LRCX) | KLA Corporation (KLAC) |

|---|---|---|

| Revenue | 18.44B | 12.16B |

| EBITDA | 6.34B | 5.34B |

| EBIT | 5.96B | 4.95B |

| Net Income | 5.36B | 4.06B |

| EPS | 4.17 | 30.53 |

Interpretation of Income Statement

In 2025, Lam Research reported significant revenue growth, increasing from 14.91B in 2024 to 18.44B, reflecting a robust demand for its semiconductor equipment. The net income also rose to 5.36B, showcasing an improved net margin compared to previous years. KLA Corporation experienced similar growth, with revenue climbing from 9.81B in 2024 to 12.16B, while net income reached 4.06B. Overall, both companies demonstrated strong operational performance, with stable or improving margins, indicating effective cost management strategies amidst a competitive landscape.

Financial Ratios Comparison

The following table provides a comparative analysis of key financial metrics and ratios for Lam Research Corporation (LRCX) and KLA Corporation (KLAC) based on the most recent data.

| Metric | LRCX | KLAC |

|---|---|---|

| ROE | 54.33% | 86.56% |

| ROIC | 33.00% | 38.11% |

| P/E | 23.36 | 29.34 |

| P/B | 12.69 | 25.39 |

| Current Ratio | 2.21 | 2.62 |

| Quick Ratio | 1.55 | 1.83 |

| D/E | 0.48 | 1.30 |

| Debt-to-Assets | 22.28% | 37.89% |

| Interest Coverage | 33.11 | 17.16 |

| Asset Turnover | 0.86 | 0.76 |

| Fixed Asset Turnover | 7.59 | 9.70 |

| Payout ratio | 21.45% | 22.27% |

| Dividend yield | 0.92% | 0.76% |

Interpretation of Financial Ratios

Both companies demonstrate strong returns on equity (ROE) and invested capital (ROIC), with KLAC showing superior performance in both metrics. LRCX has a lower price-to-earnings (P/E) ratio, indicating potentially better value relative to earnings, but its higher debt-to-equity (D/E) ratio suggests greater leverage. The interest coverage ratio is notably higher for LRCX, indicating a stronger ability to cover interest expenses, which is a crucial consideration for risk management. Overall, investors should weigh these factors, considering their risk tolerance and investment strategy.

Dividend and Shareholder Returns

Lam Research Corporation (LRCX) pays a dividend with a payout ratio of 21.45%, yielding approximately 0.92%. The dividend per share has shown a consistent upward trend, supported by healthy free cash flow. They also engage in share buybacks, enhancing shareholder value. KLA Corporation (KLAC) similarly pays dividends with a payout ratio of 22.77% and a yield of 0.68%, alongside share repurchase programs. Both companies demonstrate sustainable distributions that contribute to long-term shareholder value.

Strategic Positioning

In the semiconductor market, Lam Research Corporation (LRCX) and KLA Corporation (KLAC) are two key players with significant market presence. LRCX holds a market cap of approximately 179B, while KLAC stands at around 144B. Both companies face competitive pressure from emerging technologies and rivals, necessitating continuous innovation. LRCX specializes in semiconductor processing equipment, while KLAC focuses on process control and yield management solutions, positioning them strategically to capitalize on technological advancements in the sector.

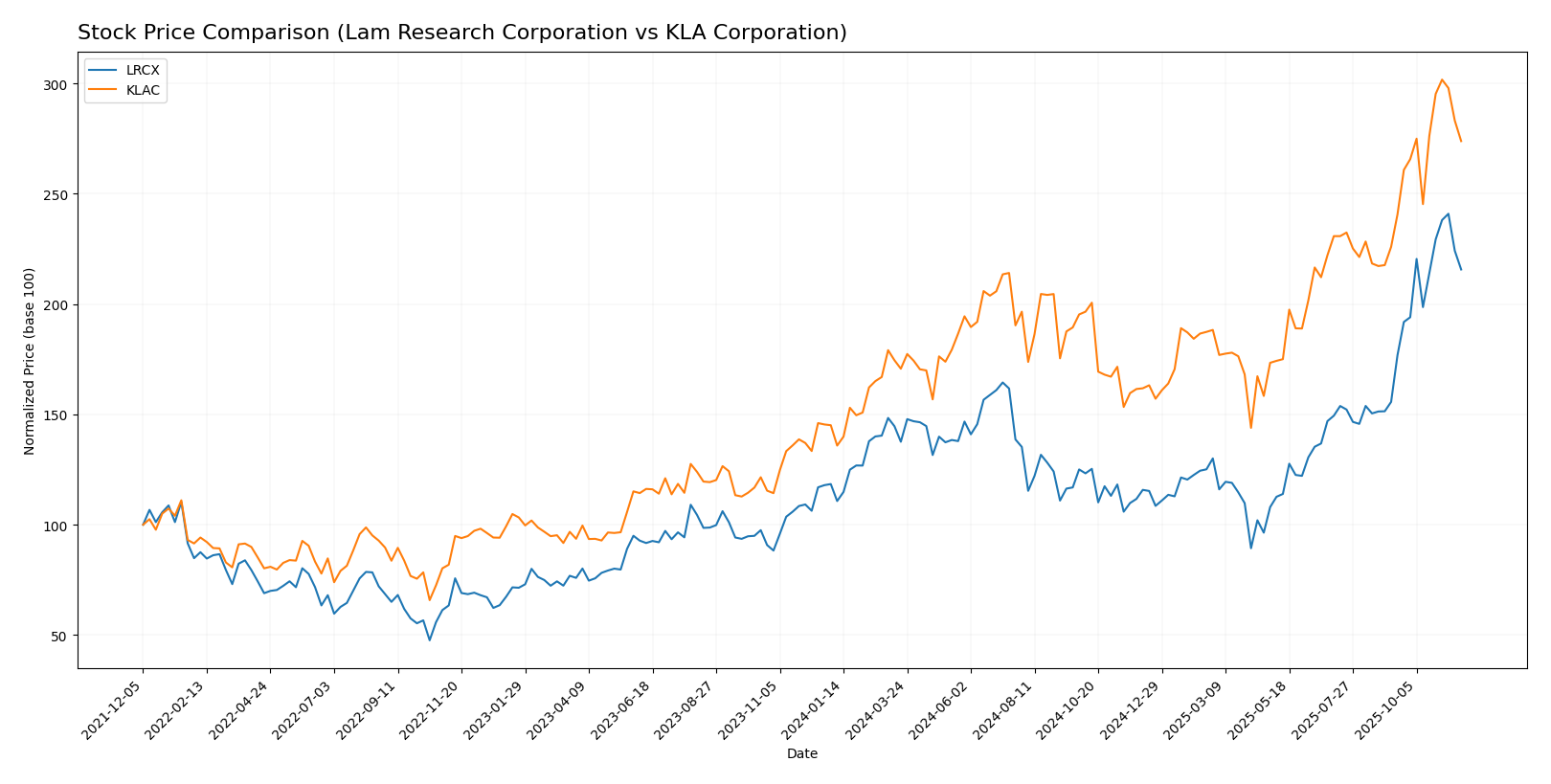

Stock Comparison

Over the past year, Lam Research Corporation (LRCX) and KLA Corporation (KLAC) have demonstrated significant price movements, showcasing compelling trading dynamics that investors should closely monitor.

Trend Analysis

For Lam Research Corporation (LRCX), the percentage change over the past year is +82.11%, indicating a bullish trend. The stock has shown acceleration in its upward movement, with a notable high of 159.35 and a low of 59.09. The standard deviation of 20.61 suggests moderate volatility in price movements.

In the recent period from September 7, 2025, to November 23, 2025, LRCX recorded a price change of +38.56%, further reinforcing its bullish trajectory.

On the other hand, KLA Corporation (KLAC) experienced a price change of +88.74% over the past year, also reflecting a bullish trend. This stock has similarly shown acceleration, with a high of 1208.74 and a low of 544.31. The standard deviation of 144.91 indicates higher volatility compared to LRCX.

From September 7, 2025, to November 23, 2025, KLAC’s recent price change was +21.22%, confirming its strong bullish momentum.

Both companies exhibit robust trends, but investors should be mindful of the varying levels of volatility present in KLAC’s stock.

Analyst Opinions

Recent recommendations for Lam Research Corporation (LRCX) indicate a solid “B+” rating, with analysts highlighting strong returns on equity and assets, despite some concerns regarding debt levels. KLA Corporation (KLAC) received a “B” rating, praised for its robust profitability metrics as well. Analysts generally suggest a cautious approach, leaning towards a “hold” consensus for both stocks in the current year. This reflects a balanced outlook, considering market volatility and the respective strengths of each company.

Stock Grades

In the current market landscape, stock ratings can offer valuable insights for investors. Here, I present the latest grades for Lam Research Corporation and KLA Corporation.

Lam Research Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Stifel | maintain | Buy | 2025-10-23 |

| UBS | maintain | Buy | 2025-10-23 |

| TD Cowen | maintain | Buy | 2025-10-23 |

| Wells Fargo | maintain | Equal Weight | 2025-10-23 |

| JP Morgan | maintain | Overweight | 2025-10-23 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-23 |

| Oppenheimer | maintain | Outperform | 2025-10-23 |

| Mizuho | maintain | Outperform | 2025-10-23 |

| Citigroup | maintain | Buy | 2025-10-23 |

KLA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-10-31 |

| Goldman Sachs | maintain | Neutral | 2025-10-30 |

| TD Cowen | maintain | Hold | 2025-10-30 |

| Needham | maintain | Buy | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

Overall, both Lam Research and KLA Corporation maintain strong ratings from multiple grading companies, indicating a generally positive outlook. Notably, both companies have numerous “Buy” and “Outperform” ratings, suggesting confidence in their future performance.

Target Prices

The current consensus target prices for Lam Research Corporation (LRCX) and KLA Corporation (KLAC) are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lam Research Corporation (LRCX) | 200 | 98 | 156.58 |

| KLA Corporation (KLAC) | 1400 | 1154 | 1286.29 |

For LRCX, the consensus target price of 156.58 suggests a potential upside from the current price of 142.65. Meanwhile, KLAC’s consensus of 1286.29 indicates significant room for growth compared to its current trading price of 1097.12. Overall, analysts show a positive outlook for both companies within the semiconductor sector.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Lam Research Corporation (LRCX) and KLA Corporation (KLAC) based on the most recent data.

| Criterion | Lam Research (LRCX) | KLA Corporation (KLAC) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Strong (33.41% net margin) | Strong (33.41% net margin) |

| Innovation | High | High |

| Global presence | Strong | Strong |

| Market Share | Significant | Significant |

| Debt level | Moderate (22.28% debt to assets) | High (37.89% debt to assets) |

Key takeaways highlight that both companies demonstrate strong profitability and innovation. However, KLA has a higher level of diversification, while Lam Research has a more favorable debt level, which may indicate better financial stability.

Risk Analysis

The following table outlines the key risks associated with Lam Research Corporation (LRCX) and KLA Corporation (KLAC) for the current year.

| Metric | LRCX | KLAC |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | High | High |

Both companies face significant market and regulatory risks, particularly in the semiconductor sector, which is experiencing heightened scrutiny and volatility due to geopolitical tensions and supply chain disruptions.

Which one to choose?

In comparing Lam Research Corporation (LRCX) and KLA Corporation (KLAC), both companies exhibit strong fundamentals, but they cater to slightly different aspects of the semiconductor industry. LRCX shows a gross profit margin of 48.7% and net profit margin of 29.1%, while KLAC boasts a higher gross profit margin of 62.3% and a net profit margin of 33.4%. In terms of valuation, LRCX has a price-to-earnings ratio of 23.36 versus KLAC’s 29.34, indicating LRCX may be more attractively priced relative to its earnings.

Analyst ratings reflect a B+ for LRCX and a B for KLAC, suggesting a slightly more favorable outlook for LRCX among experts. Additionally, LRCX’s stock trend is bullish with an 82.1% price increase over the past year, compared to KLAC’s 88.7%.

For growth-focused investors, LRCX appears favorable due to its lower valuation metrics and solid earnings growth potential. Conversely, investors prioritizing high margins might prefer KLAC.

Risks include competition and cyclical market dependence for both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Lam Research Corporation and KLA Corporation to enhance your investment decisions: