In the rapidly evolving semiconductor industry, two key players stand out: Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC). Both companies are integral in providing advanced manufacturing solutions, yet they approach innovation and market strategy differently. With overlapping markets and a shared commitment to technological advancement, I will explore their strengths and weaknesses. By the end of this analysis, you’ll discover which of these companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Applied Materials, Inc. Overview

Applied Materials, Inc. is a leading provider of manufacturing equipment, services, and software for the semiconductor and display industries. Founded in 1967 and headquartered in Santa Clara, California, the company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. Its technology portfolio includes advanced manufacturing equipment that enables the fabrication of semiconductor chips and displays. With a robust market presence in regions such as the U.S., China, and Taiwan, Applied Materials plays a critical role in driving innovation within the technology sector. As of now, it boasts a market capitalization of approximately $178.45B, reflecting its significant influence in the semiconductor landscape.

KLA Corporation Overview

KLA Corporation specializes in process control and yield management solutions for the semiconductor and electronics industries. Established in 1975 and headquartered in Milpitas, California, KLA operates through four segments: Semiconductor Process Control, Specialty Semiconductor Process, PCB, Display and Component Inspection, and Other. The company is renowned for its cutting-edge products, including wafer inspection tools and defect management solutions, which enhance manufacturing efficiency. With a market cap of around $144.15B, KLA is pivotal in the semiconductor supply chain, providing essential technologies that support the industry’s advancement.

Key similarities between Applied Materials and KLA Corporation include their focus on the semiconductor industry and their roles in providing critical technology solutions. However, while Applied Materials emphasizes manufacturing equipment and services, KLA concentrates on process control and yield management solutions, reflecting distinct approaches to supporting semiconductor production.

Income Statement Comparison

The following table compares the recent income statements of Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC) for the fiscal year 2025.

| Metric | AMAT | KLAC |

|---|---|---|

| Revenue | 28.37B | 12.16B |

| EBITDA | 9.65B | 5.34B |

| EBIT | 9.54B | 4.95B |

| Net Income | 6.99B | 4.06B |

| EPS | 8.71 | 30.53 |

Interpretation of Income Statement

In 2025, Applied Materials reported a revenue increase to 28.37B, up from 27.18B in 2024, reflecting a solid growth trajectory. Meanwhile, KLA’s revenue rose to 12.16B, an improvement from 9.81B in the previous year, indicating a robust demand in their sector. Both companies maintained favorable margins, with AMAT’s net income reaching 6.99B, demonstrating effective cost management despite rising expenses. KLA achieved a remarkable EPS of 30.53, underscoring its profitability. Overall, the performance for both companies in the most recent year highlights strong growth, with AMAT showing consistent revenue increases and KLA benefiting from significant margin improvements.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial ratios for Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC) as of the most recent fiscal year. This data can aid in assessing their financial health and investment potential.

| Metric | AMAT | KLAC |

|---|---|---|

| ROE | 34.3% | 86.6% |

| ROIC | 22.0% | 38.1% |

| P/E | 26.8 | 29.3 |

| P/B | 9.2 | 25.4 |

| Current Ratio | 2.61 | 2.62 |

| Quick Ratio | 1.87 | 1.83 |

| D/E | 0.32 | 1.30 |

| Debt-to-Assets | 18.1% | 37.9% |

| Interest Coverage | 30.8 | 17.2 |

| Asset Turnover | 0.78 | 0.76 |

| Fixed Asset Turnover | 6.15 | 9.70 |

| Payout Ratio | 19.3% | 22.3% |

| Dividend Yield | 0.72% | 0.76% |

Interpretation of Financial Ratios

The analysis shows that AMAT has a robust return on equity (ROE) and return on invested capital (ROIC), indicating efficient use of equity and capital. However, KLAC’s significantly higher ROE and ROIC suggest stronger profitability and capital efficiency. Both companies maintain healthy current and quick ratios, ensuring good liquidity. AMAT’s lower debt ratios indicate a more conservative capital structure compared to KLAC, which could imply less financial risk. However, KLAC’s high interest coverage ratio reflects its capability to meet debt obligations effectively.

Dividend and Shareholder Returns

Applied Materials, Inc. (AMAT) offers a consistent dividend, with a payout ratio of approximately 19% and a dividend yield around 0.72%. The company also engages in share buybacks, enhancing shareholder value. Conversely, KLA Corporation (KLAC) has a higher payout ratio of about 28% and a yield of 0.76%, alongside active repurchase programs. Both companies appear to support sustainable long-term value creation through balanced capital returns and strong cash flow management.

Strategic Positioning

In the semiconductor market, Applied Materials, Inc. (AMAT) holds a significant market share, leveraging its diverse product offerings across manufacturing equipment and services, achieving a market cap of $178.5B. Meanwhile, KLA Corporation (KLAC), valued at $144.2B, specializes in process control solutions, facing competitive pressure from emerging technologies and increased demand for advanced semiconductor applications. Both companies must navigate potential technological disruptions while maintaining their leadership positions in a rapidly evolving industry landscape.

Stock Comparison

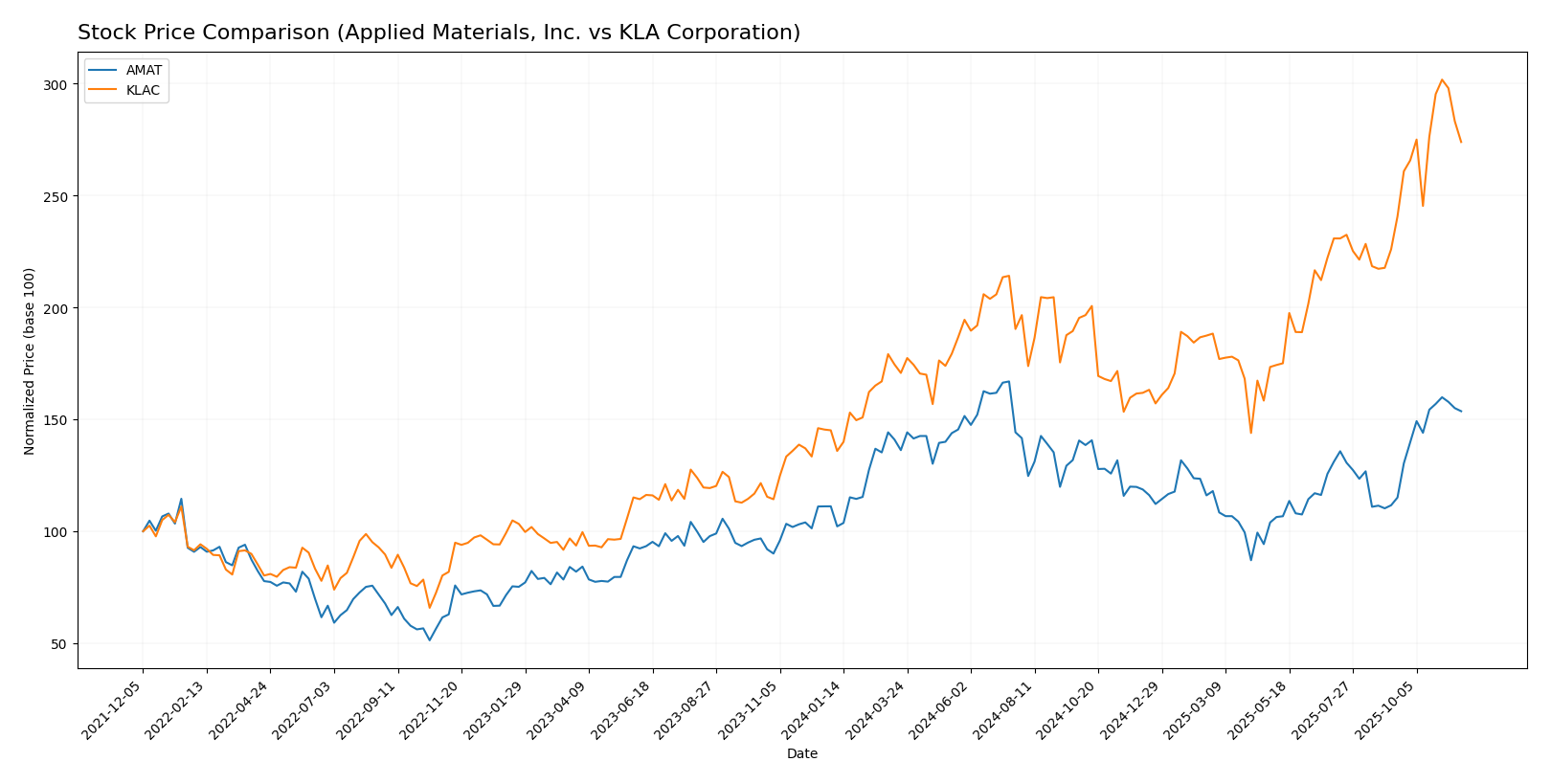

Over the past year, both Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC) have exhibited significant price movements, reflecting dynamic trading environments and investor sentiment.

Trend Analysis

Applied Materials, Inc. (AMAT) has experienced a remarkable price change of 38.22% over the past year, indicating a bullish trend. The stock has shown acceleration, with notable highs of $243.4 and lows of $126.95. The standard deviation of 25.89 suggests some volatility in its price movements, reinforcing the importance of risk management in trading decisions.

In a more recent analysis from September 7, 2025, to November 23, 2025, the price change was 37.64% with a standard deviation of 23.22, and a trend slope of 5.85, indicating continued upward momentum.

KLA Corporation (KLAC) has also displayed impressive performance, with a price change of 88.74% over the past year, also indicating a bullish trend. The stock’s acceleration is evident, with highs reaching $1208.74 and lows of $544.31. The significant standard deviation of 144.91 points to a higher level of volatility, necessitating careful consideration of market conditions.

In its recent trend from September 7, 2025, to November 23, 2025, KLAC recorded a 21.22% price change, with a standard deviation of 90.99 and a trend slope of 20.19, further affirming its upward trajectory.

Both stocks present compelling opportunities, yet their volatility underscores the need for strategic risk management when considering additions to your investment portfolio.

Analyst Opinions

Recent analyses indicate a mixed sentiment for Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC). AMAT holds a B+ rating with analysts emphasizing its strong return on equity and assets, although concerns about its debt-to-equity ratio persist. In contrast, KLAC received a B rating, praised for similar financial strengths but facing challenges in valuation metrics. Overall, the consensus for both companies leans towards a cautious buy for AMAT and a hold for KLAC, reflecting a balanced approach to investment in the semiconductor sector for 2025.

Stock Grades

I have analyzed the latest stock grades for Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC), providing insights into their current investment recommendations.

Applied Materials, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | maintain | Buy | 2025-11-14 |

| Morgan Stanley | maintain | Overweight | 2025-11-14 |

| B. Riley Securities | maintain | Buy | 2025-11-14 |

| Wells Fargo | maintain | Overweight | 2025-11-14 |

| Citigroup | maintain | Buy | 2025-11-14 |

| Mizuho | maintain | Neutral | 2025-11-14 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-14 |

| Craig-Hallum | downgrade | Hold | 2025-11-14 |

| JP Morgan | maintain | Overweight | 2025-11-14 |

| Stifel | maintain | Buy | 2025-11-11 |

KLA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-10-31 |

| Goldman Sachs | maintain | Neutral | 2025-10-30 |

| TD Cowen | maintain | Hold | 2025-10-30 |

| Needham | maintain | Buy | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

The overall trend in grades for both companies indicates a strong buy sentiment, with several analysts maintaining positive outlooks. Notably, the presence of multiple “Overweight” and “Buy” ratings suggests that both AMAT and KLAC are well-positioned in their respective markets, although caution should always be exercised given varying analyst opinions.

Target Prices

The current consensus target prices for Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC) reflect positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Applied Materials, Inc. | 290 | 205 | 246.09 |

| KLA Corporation | 1400 | 1154 | 1286.29 |

For AMAT, the consensus target price of 246.09 is above the current stock price of 224.01, indicating a potential upside. Similarly, KLAC, with a consensus of 1286.29, shows significant potential compared to its current price of 1097.12.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC) based on recent financial data.

| Criterion | Applied Materials, Inc. (AMAT) | KLA Corporation (KLAC) |

|---|---|---|

| Diversification | Strong product range across semiconductors and displays | Diverse solutions for semiconductor process control |

| Profitability | Net profit margin: 24.67% | Net profit margin: 33.41% |

| Innovation | High R&D investment | Leading in yield management solutions |

| Global presence | Operations in multiple countries | Global reach in semiconductor markets |

| Market Share | Significant in semiconductor equipment | Strong in process control sector |

| Debt level | Debt-to-equity ratio: 0.32 | Debt-to-equity ratio: 1.30 |

Key takeaways show that while KLA Corporation excels in profitability and has a diverse range of solutions, Applied Materials, Inc. offers robust diversification and innovation in its product offerings. Managing debt levels will be crucial for both companies moving forward.

Risk Analysis

In the table below, I outline key risks associated with Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC), focusing on the most relevant metrics for investors.

| Metric | Applied Materials, Inc. (AMAT) | KLA Corporation (KLAC) |

|---|---|---|

| Market Risk | High volatility due to semiconductor demand fluctuations | High volatility in semiconductor cycle |

| Regulatory Risk | Increasing scrutiny on technology exports | Compliance with global regulations |

| Operational Risk | Supply chain disruptions affecting production | Dependence on specific technology sectors |

| Environmental Risk | Pressure to adopt sustainable practices | Environmental compliance costs |

| Geopolitical Risk | Risks associated with US-China trade relations | Vulnerabilities to international trade policies |

Both companies face significant market risks, particularly from the volatile semiconductor industry. Recent geopolitical tensions and regulatory scrutiny further complicate the operational landscape. Investors must be aware of these dynamics as they could heavily influence stock performance.

Which one to choose?

When comparing Applied Materials, Inc. (AMAT) and KLA Corporation (KLAC), both companies showcase strong fundamentals, but they differ significantly in key metrics. AMAT has a market cap of $187.4B with a net profit margin of 24.67%, while KLAC, valued at $119.2B, boasts a higher net profit margin of 33.41%. However, AMAT shows a more favorable price-to-earnings ratio (P/E of 26.78 vs. KLAC’s 29.34), indicating potentially better valuation for growth investors. Analysts rate AMAT at B+ and KLAC at B.

For growth-oriented investors, AMAT appears favorable due to its lower valuation metrics and robust cash flow yields. Conversely, those prioritizing stability may lean towards KLAC, given its superior margins and returns on equity.

Risk factors include market dependence and competition that could affect both companies’ future growth.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Applied Materials, Inc. and KLA Corporation to enhance your investment decisions: