In the fast-paced world of technology, Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL) stand out as key players in the semiconductor sector. Both companies are leveraging innovative strategies to capture market share and drive growth, making them prime candidates for comparison. With overlapping product offerings and a shared focus on networking and storage solutions, investors must carefully assess their strengths and weaknesses. Join me as we explore which of these two companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Broadcom Inc. Overview

Broadcom Inc. (AVGO) is a leading global technology company headquartered in San Jose, California. With a market capitalization of approximately $1.6T, Broadcom specializes in the design and supply of semiconductor and infrastructure software solutions. The company operates through four primary segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, and Industrial & Other. Broadcom’s diverse product portfolio includes devices pivotal to various sectors, such as networking, telecommunications, and data centers. The firm employs around 37,000 individuals and is known for its robust innovation in the semiconductor space, catering to a wide range of applications from smartphones to industrial automation.

Marvell Technology, Inc. Overview

Marvell Technology, Inc. (MRVL) is a significant player in the semiconductor industry, with a market capitalization of approximately $67B. Based in Wilmington, Delaware, Marvell designs and develops a variety of analog and digital integrated circuits. Its offerings include advanced Ethernet solutions, storage controllers, and application processors, supporting diverse technologies like SSDs and network infrastructure. With a workforce of about 7,000 and operations spanning several countries, Marvell is recognized for its commitment to innovation, particularly in high-performance storage and networking solutions.

Key Similarities and Differences

Both Broadcom and Marvell operate within the semiconductor industry, focusing on similar technological solutions. However, Broadcom has a broader market presence with a more extensive product range covering various sectors, while Marvell specializes more in storage and networking technologies. This specialization allows Marvell to cater to niche markets effectively, setting it apart from Broadcom’s diversified approach.

Income Statement Comparison

The following table compares the most recent income statements of Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL) for a clear view of their financial performance.

| Metric | Broadcom Inc. (AVGO) | Marvell Technology, Inc. (MRVL) |

|---|---|---|

| Revenue | 51.57B | 5.77B |

| EBITDA | 23.88B | 0.65B |

| EBIT | 13.87B | -0.71B |

| Net Income | 5.90B | -0.89B |

| EPS | 1.27 | -1.02 |

Interpretation of Income Statement

In recent performance, Broadcom demonstrated strong revenue growth, increasing from 35.82B in 2023 to 51.57B in 2024. However, Marvell has shown a decline, with its revenue slightly increasing from 5.51B in 2024 to 5.77B in 2025, yet it remains unprofitable with a net loss of 0.89B. Broadcom’s EBITDA margin was robust at 46%, indicating effective cost management and profitability. Conversely, Marvell’s negative EBIT highlights operational challenges. The contrasting performances emphasize the need for careful consideration when investing, as Broadcom exhibits strong fundamentals, while Marvell struggles to return to profitability.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial ratios for Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL) based on the most recent fiscal data.

| Metric | Broadcom Inc. (AVGO) | Marvell Technology, Inc. (MRVL) |

|---|---|---|

| ROE | 8.71% | -6.59% |

| ROIC | 5.57% | -3.88% |

| P/E | 133.17 | -110.37 |

| P/B | 11.60 | 7.27 |

| Current Ratio | 1.17 | 1.54 |

| Quick Ratio | 1.07 | 1.03 |

| D/E | 0.998 | 0.32 |

| Debt-to-Assets | 40.79% | 21.50% |

| Interest Coverage | 3.41 | -3.80 |

| Asset Turnover | 0.31 | 0.29 |

| Fixed Asset Turnover | 20.46 | 5.56 |

| Payout Ratio | 166.48% | -23.45% |

| Dividend Yield | 1.25% | 0.21% |

Interpretation of Financial Ratios

Broadcom demonstrates strong profitability and efficiency with a positive return on equity (ROE) and return on invested capital (ROIC), although its high P/E ratio indicates market expectations of future growth. Conversely, Marvell’s negative ROE and profitability ratios raise concerns about its financial health, particularly with a high debt-to-equity ratio and poor interest coverage. Investors should exercise caution when considering Marvell as it may pose higher risks in the current market.

Dividend and Shareholder Returns

Broadcom Inc. (AVGO) maintains a robust dividend strategy, with a dividend yield of 1.25% and a payout ratio of 166%. This indicates a reliance on free cash flow, although the high payout raises sustainability concerns. Additionally, AVGO engages in share buybacks, enhancing shareholder value.

In contrast, Marvell Technology, Inc. (MRVL) does not currently pay dividends, reflecting a focus on reinvestment and growth amid ongoing challenges, such as negative net income. While MRVL also participates in share buybacks, this strategy aligns with long-term value creation, provided operational performance improves. Thus, AVGO’s dividends and MRVL’s growth strategy both reflect distinct paths toward shareholder value.

Strategic Positioning

Broadcom (AVGO) commands a substantial market share in the semiconductor sector, leveraging its extensive portfolio across various segments, including wired and wireless communications. With a market cap of 1.6T, it faces competitive pressure primarily from Marvell (MRVL), which has a market cap of 67B and focuses on analog and mixed-signal solutions. Both companies are under technological disruption as they adapt to rapid advancements in AI and cloud computing, influencing their strategic positioning and market dynamics.

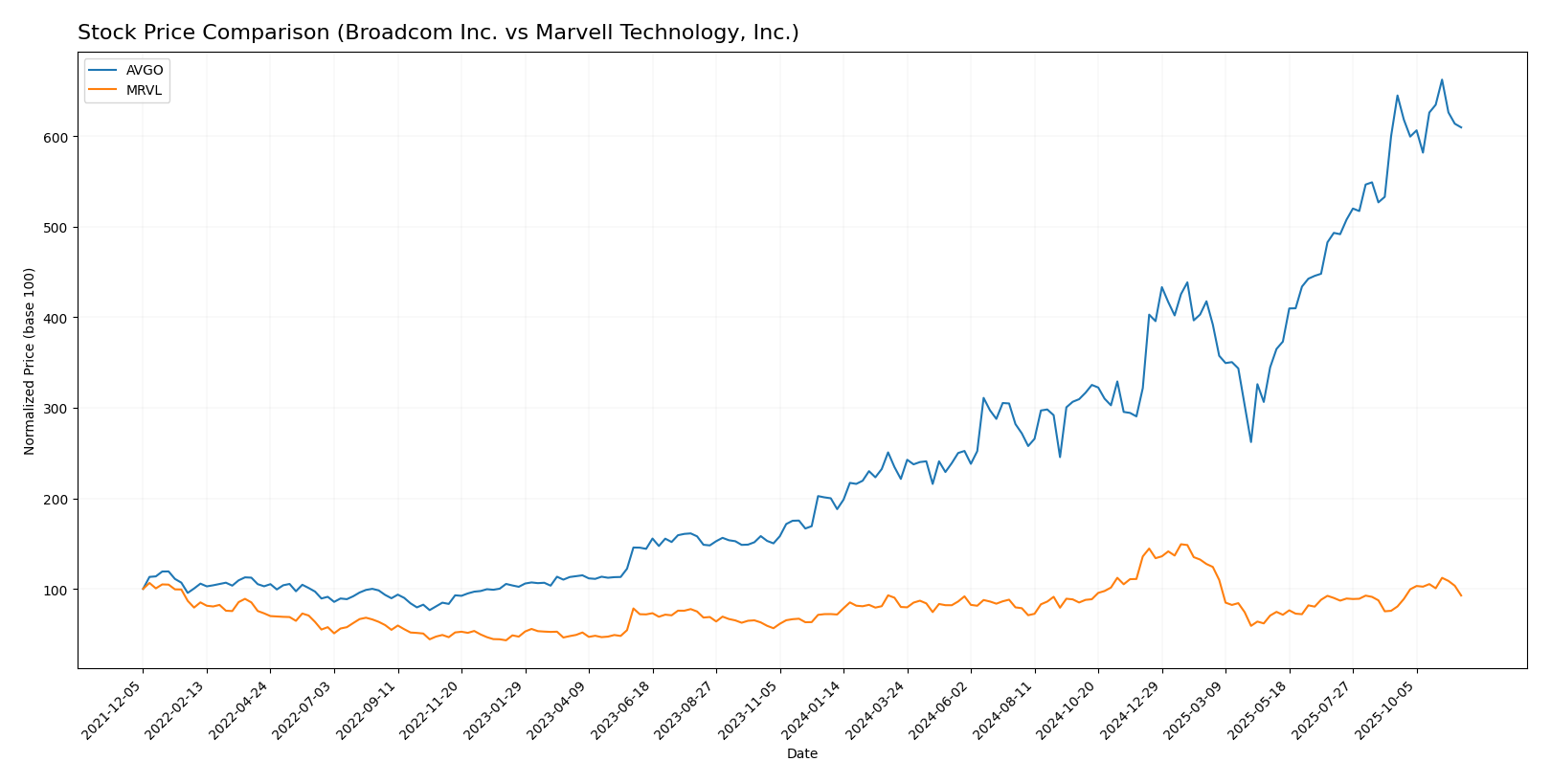

Stock Comparison

In the past year, Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL) have exhibited significant price movements and trading dynamics, reflecting varying levels of investor interest and market conditions.

Trend Analysis

For Broadcom Inc. (AVGO), the overall percentage change over the past year is an impressive +204.76%. This indicates a bullish trend; however, the trend is experiencing deceleration. The highest price observed was 369.63, while the lowest was 104.93, showcasing notable volatility with a standard deviation of 71.95. Recently, AVGO has shown a marginal price change of +1.59% from September 7, 2025, to November 23, 2025, with a standard deviation of 11.72.

In contrast, Marvell Technology, Inc. (MRVL) has experienced a percentage change of +28.42% over the same period, also indicating a bullish trend with acceleration. The stock reached a high of 124.76 and a low of 49.43, with a standard deviation of 16.57. Recently, MRVL’s price has surged by +22.3%, reflecting strong momentum during the period from September 7, 2025, to November 23, 2025, and a standard deviation of 8.91.

Both stocks demonstrate robust upward trends, with AVGO showcasing strong overall performance and MRVL exhibiting accelerating momentum in a shorter timeframe.

Analyst Opinions

Recent analyst recommendations for Broadcom Inc. (AVGO) indicate a “Buy” rating, reflecting strong performance in return on equity and assets, as highlighted by analysts who appreciate its robust financial health. In contrast, Marvell Technology, Inc. (MRVL) has received a “Hold” rating, as analysts express concerns over lower return metrics despite a decent cash flow score. Currently, the consensus leans towards “Buy” for AVGO, while MRVL remains a cautious “Hold.”

Stock Grades

In this section, I present the latest stock ratings for Broadcom Inc. and Marvell Technology, Inc., based on reliable grade data from reputable grading companies.

Broadcom Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-10-21 |

| UBS | maintain | Buy | 2025-10-14 |

| Morgan Stanley | maintain | Overweight | 2025-10-14 |

| Deutsche Bank | maintain | Buy | 2025-10-14 |

| Citigroup | maintain | Buy | 2025-10-14 |

| Barclays | maintain | Overweight | 2025-10-14 |

| Keybanc | maintain | Overweight | 2025-09-30 |

| Mizuho | maintain | Outperform | 2025-09-12 |

| Argus Research | maintain | Buy | 2025-09-08 |

| Oppenheimer | maintain | Outperform | 2025-09-05 |

Marvell Technology, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Neutral | 2025-11-18 |

| Barclays | downgrade | Equal Weight | 2025-10-20 |

| UBS | maintain | Buy | 2025-10-13 |

| Oppenheimer | maintain | Outperform | 2025-10-10 |

| TD Cowen | downgrade | Hold | 2025-10-01 |

| Deutsche Bank | maintain | Buy | 2025-09-25 |

| Needham | maintain | Buy | 2025-09-25 |

| Evercore ISI Group | maintain | Outperform | 2025-08-29 |

| B of A Securities | downgrade | Neutral | 2025-08-29 |

| Benchmark | maintain | Buy | 2025-08-29 |

Overall, Broadcom maintains strong ratings across multiple firms, indicating confidence in its performance. In contrast, Marvell has experienced some downgrades, particularly from Barclays and TD Cowen, suggesting a more cautious outlook for the stock.

Target Prices

The following target prices are based on reliable analyst data for Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Broadcom Inc. | 460 | 295 | 401.73 |

| Marvell Technology, Inc. | 121 | 75 | 95.88 |

Analysts expect Broadcom’s stock to reach a consensus target price of 401.73, which suggests a significant upside from its current price of 340.2. For Marvell, the consensus target of 95.88 indicates potential growth from its current trading price of 77.45.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL) based on the latest available data.

| Criterion | Broadcom Inc. (AVGO) | Marvell Technology, Inc. (MRVL) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong margins (39.3%) | Negative margins (-15.3%) |

| Innovation | High | Moderate |

| Global presence | Extensive | Moderate |

| Market Share | Leading | Growing |

| Debt level | Moderate (40.8%) | Low (21.5%) |

Key takeaways indicate that Broadcom exhibits strong profitability and a robust global presence, while Marvell struggles with profitability but shows potential for growth in market share.

Risk Analysis

The following table outlines the key risks associated with Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL).

| Metric | Broadcom Inc. (AVGO) | Marvell Technology, Inc. (MRVL) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | High | Moderate |

In summary, both companies face significant market and operational risks, with Marvell experiencing higher volatility and operational challenges. Recent downturns in profit margins, especially for MRVL, signal potential instability amidst evolving market conditions.

Which one to choose?

When comparing Broadcom Inc. (AVGO) and Marvell Technology, Inc. (MRVL), the fundamentals and overall performance suggest that AVGO stands out as the more robust investment. Broadcom has demonstrated a solid gross profit margin of 63% and a net profit margin of 11%, alongside a strong rating of B from analysts. In contrast, Marvell’s margins are significantly lower, with negative profitability metrics, resulting in a C rating.

AVGO’s stock trend has been bullish with a price increase of 204.76% over the past year, while MRVL’s growth was more modest at 28.42%. Furthermore, AVGO’s financial ratios, notably a favorable debt-to-equity ratio of 1, indicate better risk management compared to MRVL’s 0.32.

Investors focused on growth may prefer AVGO, while those prioritizing potential turnaround opportunities might consider MRVL. However, both companies face risks related to competition and market dependence, particularly in the semiconductor sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Broadcom Inc. and Marvell Technology, Inc. to enhance your investment decisions: