In the dynamic landscape of technology, Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR) stand out as influential players in their respective fields. While Micron specializes in semiconductors, focusing on memory and storage solutions, MicroStrategy excels in enterprise analytics software. This comparison is vital as both companies are navigating innovation strategies within overlapping tech markets. Join me as I delve into their strengths and opportunities, helping you determine which company could be the most appealing addition to your investment portfolio.

Table of contents

Company Overview

Micron Technology, Inc. Overview

Micron Technology, Inc. (MU) is a leader in the semiconductor industry, specializing in memory and storage solutions. Founded in 1978 and based in Boise, Idaho, Micron designs and manufactures a diverse range of products, including DRAM, NAND, and NOR memory technologies. With a robust presence in markets such as cloud computing, mobile devices, and automotive applications, Micron operates through four distinct business units. The company’s commitment to innovation and quality positions it as a pivotal player in an increasingly data-driven world, empowering various sectors with high-performance memory solutions.

MicroStrategy Incorporated Overview

MicroStrategy Incorporated (MSTR) is a prominent provider of enterprise analytics software, delivering insights through its comprehensive platform. Established in 1989 and headquartered in Tysons Corner, Virginia, MicroStrategy offers a suite of tools for data visualization, reporting, and analytics, catering to diverse industries including finance, healthcare, and telecommunications. The company’s emphasis on empowering organizations with actionable data insights has solidified its reputation as a key player in the software application sector, enabling clients to enhance decision-making and operational efficiency.

Key similarities between Micron and MicroStrategy include their foundation in technology and a focus on addressing market needs through innovative solutions. However, their business models diverge significantly; Micron is centered on semiconductor manufacturing, while MicroStrategy specializes in software analytics and enterprise solutions.

Income Statement Comparison

The following table provides a comparison of key income statement metrics for Micron Technology, Inc. and MicroStrategy Incorporated for the most recent fiscal year.

| Metric | Micron Technology, Inc. | MicroStrategy Incorporated |

|---|---|---|

| Revenue | 37.38B | 0.46B |

| EBITDA | 18.49B | -1.85B |

| EBIT | 10.14B | -1.87B |

| Net Income | 8.54B | -1.17B |

| EPS | 7.65 | -6.06 |

Interpretation of Income Statement

In 2025, Micron Technology demonstrated robust revenue growth, increasing from 25.11B in 2024 to 37.38B, reflecting strong demand in its sector. Conversely, MicroStrategy faced ongoing challenges, generating only 0.46B in revenue, a decline from 0.50B in the prior year. Micron’s net income surged to 8.54B, showcasing effective cost management and improved margins, while MicroStrategy reported a net loss of 1.17B, indicating persistent operational difficulties. Overall, Micron’s performance highlights substantial recovery and profitability, whereas MicroStrategy’s financial instability calls for caution among investors.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent revenue and key financial ratios for Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR).

| Metric | Micron Technology, Inc. | MicroStrategy Incorporated |

|---|---|---|

| ROE | 15.76% | -6.40% |

| ROIC | 12.12% | -4.38% |

| P/E | 15.94 | -20.12 |

| P/B | 2.51 | -4.19 |

| Current Ratio | 2.52 | 0.71 |

| Quick Ratio | 1.79 | 0.71 |

| D/E | 0.28 | 1.04 |

| Debt-to-Assets | 0.18 | 0.47 |

| Interest Coverage | 20.69 | -2.35 |

| Asset Turnover | 0.45 | 0.10 |

| Fixed Asset Turnover | 0.79 | 5.73 |

| Payout ratio | 6.11% | 0% |

| Dividend yield | 0.38% | 0% |

Interpretation of Financial Ratios

Micron Technology (MU) displays strong financial health with solid profitability metrics, reflected in its ROE and ROIC, while maintaining manageable debt levels. Conversely, MicroStrategy (MSTR) shows significant financial distress, with negative returns and high debt ratios, raising concerns about its sustainability. Investors should exercise caution when considering MSTR due to its poor performance indicators.

Dividend and Shareholder Returns

Micron Technology, Inc. (MU) has a modest dividend yield of 0.38% with a payout ratio of 6.1%, indicating a sustainable approach to shareholder returns. The company also engages in share buybacks, enhancing shareholder value. In contrast, MicroStrategy Incorporated (MSTR) does not pay dividends, focusing instead on reinvesting for growth amid ongoing operating losses. While MSTR’s strategy may align with long-term growth, it poses risks to immediate shareholder returns. Overall, MU’s distribution strategy appears more supportive of sustainable long-term value creation.

Strategic Positioning

Micron Technology, Inc. (MU) holds a significant market share in the semiconductor industry, particularly in memory and storage solutions, with a market cap of approximately 231B. Competitive pressure is intense, especially from emerging players and established giants. Conversely, MicroStrategy Incorporated (MSTR) is carving out its niche in the software analytics sector, with a market cap of around 49B. Both companies face technological disruptions that could reshape their respective markets, necessitating a keen focus on innovation and adaptability.

Stock Comparison

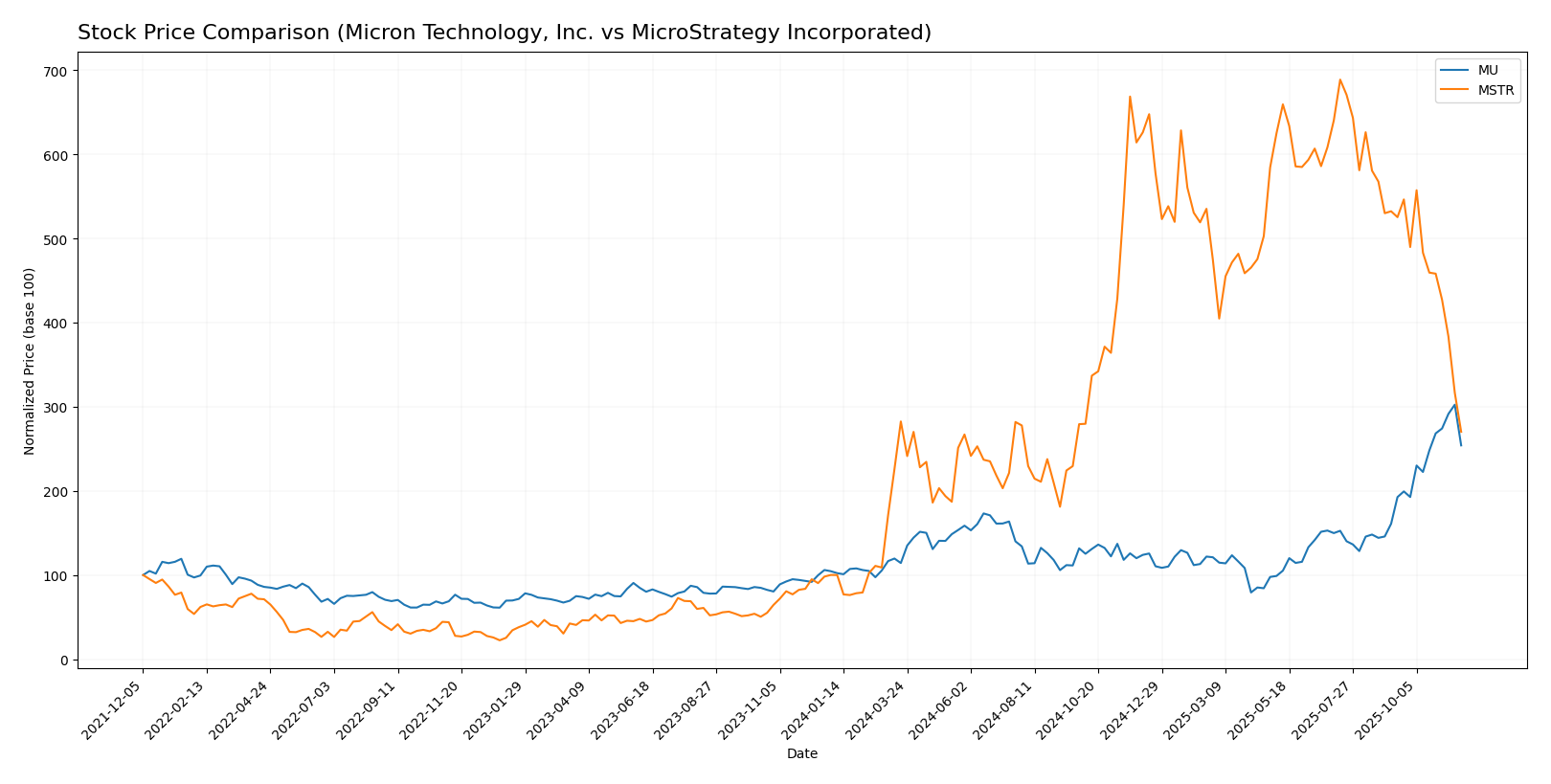

Over the past year, both Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR) have experienced significant price movements, reflecting diverse trading dynamics that warrant close analysis.

Trend Analysis

Micron Technology, Inc. (MU) has demonstrated a remarkable price change of +142.99% over the past year. This strong bullish trend indicates acceleration, with recent highs reaching 246.83 and lows of 64.72. The stock shows a standard deviation of 35.04, suggesting moderate volatility in its trading patterns. In the recent period from September 7, 2025, to November 23, 2025, MU’s stock price increased by +57.85%, with a trend slope of 9.15, reflecting a continuation of positive momentum.

MicroStrategy Incorporated (MSTR), on the other hand, has seen a price change of +169.95% over the past year, marking a bullish trend despite a recent downturn. The stock’s recent performance from September 7, 2025, to November 23, 2025, indicates a significant decline of -49.24%, accompanied by a trend slope of -14.42, which points to deceleration. Notably, MSTR has experienced a high of 434.58 and a low of 48.10, with a standard deviation of 114.52, highlighting considerable volatility in its price movements.

In summary, while MU maintains a strong upward trajectory, MSTR’s recent performance suggests caution due to its sharp decline.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR). Analysts have rated MU with a “B+” and a consensus buy, highlighting strong return on assets (5) and return on equity (4). In contrast, MSTR received a “C,” suggesting a hold, primarily due to its low scores in return metrics (1). Analysts like those at FMP emphasize MU’s solid fundamentals, while cautioning against MSTR’s current financial challenges. Overall, the consensus for MU is buy, while MSTR leans toward hold.

Stock Grades

In this section, I present the latest stock ratings from reputable grading companies for two notable companies: Micron Technology, Inc. and MicroStrategy Incorporated.

Micron Technology, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-11-20 |

| Rosenblatt | Maintain | Buy | 2025-11-17 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Mizuho | Maintain | Outperform | 2025-10-28 |

| Citigroup | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Mizuho | Maintain | Outperform | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-16 |

| Citigroup | Maintain | Buy | 2025-10-16 |

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | Upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-03 |

| Canaccord Genuity | Maintain | Buy | 2025-11-03 |

| BTIG | Maintain | Buy | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-31 |

| Wells Fargo | Downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | Maintain | Buy | 2025-09-16 |

| Canaccord Genuity | Maintain | Buy | 2025-08-26 |

| Mizuho | Maintain | Outperform | 2025-08-11 |

Overall, Micron Technology maintains a strong set of grades with consistent “Buy” and “Overweight” ratings, indicating confidence from analysts. In contrast, MicroStrategy has shown a notable upgrade to “Neutral,” reflecting a shift in sentiment, while some maintained “Buy” recommendations suggest cautious optimism.

Target Prices

The current consensus target prices from analysts reflect a strong outlook for both Micron Technology, Inc. and MicroStrategy Incorporated.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Micron Technology, Inc. (MU) | 275 | 135 | 201.93 |

| MicroStrategy Incorporated (MSTR) | 705 | 175 | 478.5 |

For Micron Technology, the target consensus of 201.93 suggests potential upside from its current price of 207.37, while MicroStrategy’s consensus of 478.5 indicates substantial growth potential compared to its current price of 170.5. These targets show a generally positive sentiment among analysts for both companies.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR) based on the most recent data:

| Criterion | Micron Technology, Inc. (MU) | MicroStrategy Incorporated (MSTR) |

|---|---|---|

| Diversification | Strong product range in semiconductors across various sectors | Limited focus on analytics software |

| Profitability | Net profit margin: 22.84% | Negative net profit margin: -2.52% |

| Innovation | Ongoing investment in R&D | Focus on software enhancements |

| Global presence | Significant global market share | Limited market penetration |

| Market Share | Leading position in memory solutions | Niche player in analytics |

| Debt level | Moderate debt-to-equity ratio: 0.28 | High debt-to-equity ratio: 1.04 |

Key takeaways from this analysis indicate that Micron Technology enjoys strong profitability and innovation capabilities due to its diverse product range, while MicroStrategy faces challenges with profitability and market presence.

Risk Analysis

In evaluating potential investments, it is crucial to understand the associated risks. Below is a comparative risk analysis of two companies, Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR), focusing on various risk metrics.

| Metric | Micron Technology (MU) | MicroStrategy (MSTR) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, but MicroStrategy is particularly vulnerable due to its high debt levels and volatile operational performance. For instance, MSTR’s net profit margin was -2.5% in 2024, reflecting ongoing struggles.

In summary, while both companies have their challenges, I advise cautious consideration of MicroStrategy due to its high-risk profile.

Which one to choose?

When comparing Micron Technology, Inc. (MU) and MicroStrategy Incorporated (MSTR), Micron generally shows stronger fundamentals. With a market cap of 136B and a robust net profit margin of 22.8%, its B+ rating reflects solid performance metrics, including a price-to-earnings (P/E) ratio of 15.94. In contrast, MicroStrategy’s C rating highlights challenges, given its high valuation with a P/E ratio of -47.8 and a recent price decline of 49.24%. Analysts favor Micron for long-term growth, particularly due to its bullish stock trend and promising future prospects.

Investors focused on growth may prefer Micron for its stability and profitability. Conversely, those seeking high-risk, high-reward opportunities might consider MicroStrategy, keeping in mind its significant volatility.

Specific risks for both companies include competition in the semiconductor and analytics industries, market dependence, and potential supply chain disruptions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Micron Technology, Inc. and MicroStrategy Incorporated to enhance your investment decisions: