In the rapidly evolving semiconductor industry, NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS) stand out as key players, each with distinct market strategies and product offerings. While NXP focuses on a diverse range of semiconductor solutions for automotive and IoT applications, GLOBALFOUNDRIES specializes in cutting-edge wafer fabrication services for various electronic devices. This analysis will help investors discern which company presents a more compelling opportunity for their portfolios.

Table of contents

Company Overview

NXP Semiconductors N.V. Overview

NXP Semiconductors N.V. is a leading provider of semiconductor solutions with a strong focus on automotive, industrial, and Internet of Things (IoT) applications. Headquartered in Eindhoven, Netherlands, NXP boasts a diverse product portfolio that includes microcontrollers, application processors, wireless connectivity solutions, and security controllers. With a market capitalization of approximately $48.16B, the company leverages its expertise to deliver innovative solutions to original equipment manufacturers and contract manufacturers across the globe. NXP’s strong emphasis on quality and security positions it as a trusted partner in the semiconductor industry, particularly in the rapidly evolving automotive space.

GLOBALFOUNDRIES Inc. Overview

GLOBALFOUNDRIES Inc. operates as a prominent semiconductor foundry, specializing in the manufacturing of integrated circuits essential for various electronic devices. Founded in 2009 and based in Malta, New York, the company focuses on producing a wide array of semiconductor devices, including microprocessors and mobile application processors. With a market capitalization of around $18.82B, GLOBALFOUNDRIES is pivotal in the semiconductor supply chain, providing advanced wafer fabrication services and technologies. Its commitment to innovation and customer collaboration enables it to serve a diverse clientele in the technology sector.

Key Similarities and Differences

Both NXP Semiconductors and GLOBALFOUNDRIES operate within the semiconductor industry, yet they adopt distinct business models. NXP emphasizes product development and innovation for specific applications, particularly in automotive and IoT segments, while GLOBALFOUNDRIES focuses on foundry services, manufacturing chips for various clients. This fundamental difference shapes their market strategies and customer relationships, making them complementary players in the semiconductor ecosystem.

Income Statement Comparison

The following table compares the income statements of NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS) for the most recent fiscal year, providing insight into their financial performance.

| Metric | NXP Semiconductors (NXPI) | GLOBALFOUNDRIES (GFS) |

|---|---|---|

| Revenue | 12.61B | 6.75B |

| EBITDA | 4.42B | 1.50B |

| EBIT | 3.50B | -64M |

| Net Income | 2.51B | -265M |

| EPS | 9.84 | -0.48 |

Interpretation of Income Statement

In the latest fiscal year, NXP Semiconductors demonstrated solid revenue of 12.61B, but a slight decline from the previous year’s 13.28B. Despite this, net income remained strong at 2.51B, showcasing effective cost management with stable margins. On the other hand, GLOBALFOUNDRIES faced challenges, reporting a decrease in revenue to 6.75B and a net loss of 265M, indicating ongoing struggles in profitability. Their operating loss of 64M suggests that they need to improve operational efficiency to enhance margins in the coming years.

Financial Ratios Comparison

The following table compares key financial ratios for NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS) based on the most recent data.

| Metric | NXPI | GFS |

|---|---|---|

| ROE | 27.33% | -2.46% |

| ROIC | 12.91% | -2.26% |

| P/E | 21.13 | -89.54 |

| P/B | 5.78 | 2.20 |

| Current Ratio | 2.36 | 2.11 |

| Quick Ratio | 1.60 | 1.57 |

| D/E | 1.18 | 0.22 |

| Debt-to-Assets | 0.45 | 0.15 |

| Interest Coverage | 8.59 | -1.48 |

| Asset Turnover | 0.52 | 0.40 |

| Fixed Asset Turnover | 3.86 | 0.82 |

| Payout ratio | 41.35% | 0% |

| Dividend yield | 1.96% | 0% |

Interpretation of Financial Ratios

In comparing NXPI and GFS, NXPI shows significantly stronger financial health, reflected in its positive ROE and ROIC, indicating effective management of equity and capital investments. GFS, on the other hand, demonstrates negative profitability metrics, raising concerns about its operational efficiency and financial sustainability. The high debt-to-equity ratio of NXPI suggests leverage, but its robust interest coverage ratio mitigates immediate risks. Overall, investors should exercise caution with GFS due to its negative margins.

Dividend and Shareholder Returns

NXP Semiconductors (NXPI) offers a dividend with a payout ratio of 41.4%, reflecting a sustainable annual yield of 1.96%. The trend shows steady dividend growth, supported by strong free cash flow. In contrast, GLOBALFOUNDRIES (GFS) does not pay dividends, focusing instead on reinvestment for growth, as evidenced by negative net income. Both companies engage in share buybacks, suggesting a commitment to shareholder returns. Overall, NXP’s approach appears more aligned with sustainable long-term value creation compared to GFS’s growth-centric strategy.

Strategic Positioning

NXP Semiconductors (NXPI) holds a significant share in the automotive and IoT sectors, leveraging its diverse semiconductor portfolio. Meanwhile, GLOBALFOUNDRIES (GFS) focuses on foundry services, catering to a broad range of electronic applications. Both companies face competitive pressure from rapidly advancing technologies and industry giants. With a combined market cap of approximately $67B, they must continuously innovate to maintain their positions amid technological disruptions and evolving market demands.

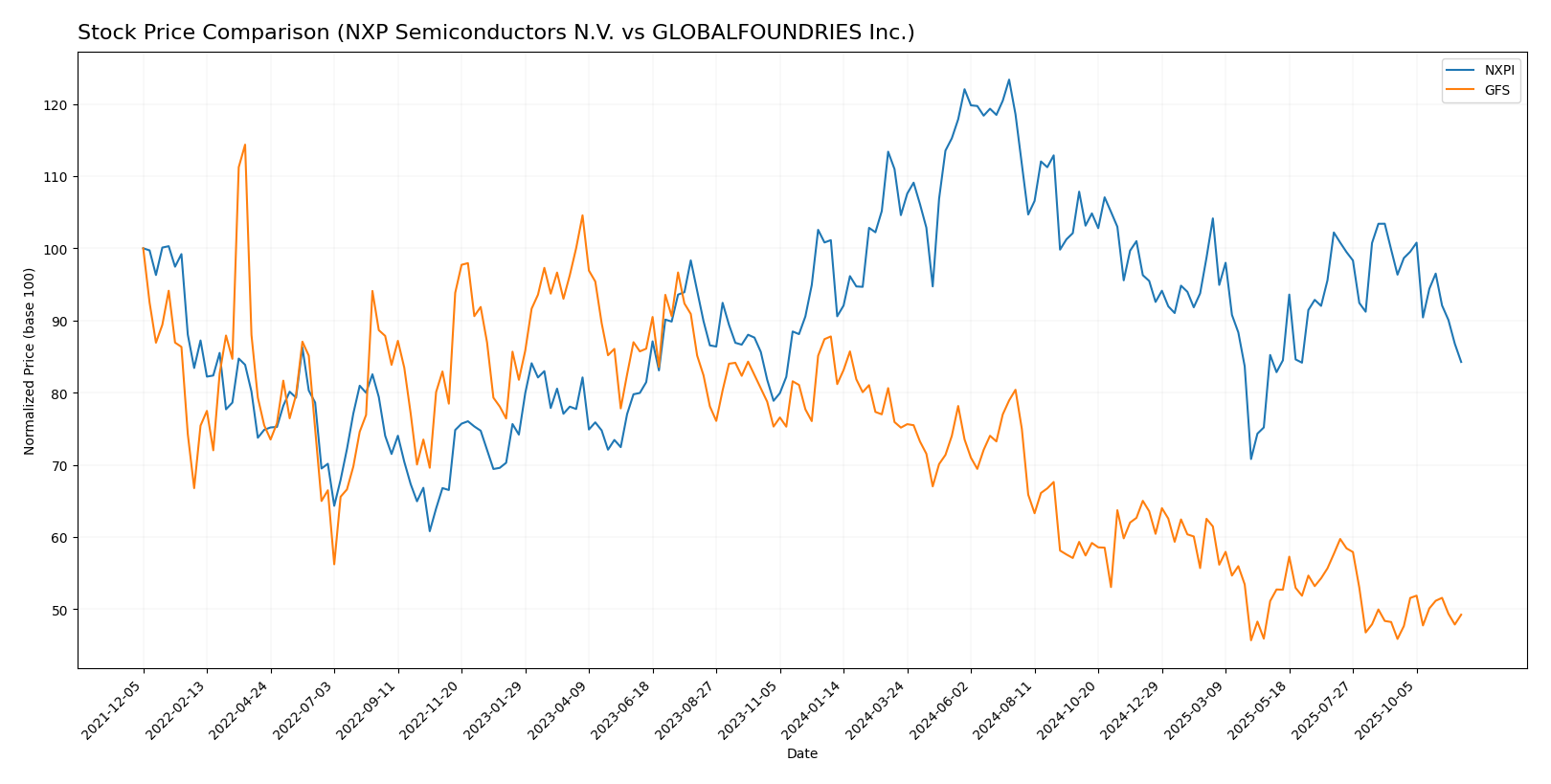

Stock Comparison

In the past year, both NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS) have displayed notable price movements, with each company experiencing unique trading dynamics that merit careful examination.

Trend Analysis

For NXP Semiconductors N.V. (NXPI), the price has decreased by -16.69% over the past year. This indicates a bearish trend, characterized by a deceleration in price movements. The stock reached a high of 280.19 and a low of 160.81 during this period. The standard deviation of 24.41 suggests a significant level of volatility.

In the recent analysis period from September 7, 2025, to November 23, 2025, NXPI experienced a price drop of -15.61%, with a standard deviation of 11.78, reflecting ongoing volatility in its trading behavior.

Conversely, GLOBALFOUNDRIES Inc. (GFS) has seen a substantial decline of -43.91% over the past year, also indicating a bearish trend. This decline has been marked by an acceleration in price downtrend, with price fluctuations between a high of 60.6 and a low of 31.54. The standard deviation of 7.56 suggests a lower level of volatility compared to NXPI.

In the recent period from September 7, 2025, to November 23, 2025, GFS showed a slight recovery with a 2.1% increase, but this is insufficient to change the overall bearish sentiment. The trend slope of 0.1 indicates stagnation, while the standard deviation of 1.28 suggests low volatility in this brief uptick.

In summary, both stocks are under bearish pressure, with NXPI showing signs of deceleration and GFS in a state of acceleration in its downward trend. As always, I recommend exercising caution and considering risk management strategies when evaluating these stocks for potential inclusion in your portfolio.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for key semiconductor stocks. For NXP Semiconductors (NXPI), analysts have assigned a “Buy” rating, highlighting strong performance metrics, particularly in return on equity and discounted cash flow scores. Conversely, GLOBALFOUNDRIES (GFS) has received a “Hold” rating, with concerns over lower return on equity and assets. The consensus for NXPI is a buy, while GFS stands at a hold, suggesting caution for investors considering either of these stocks for their portfolios.

Stock Grades

As we assess the latest stock ratings, I have gathered reliable grades from well-known grading companies for two companies: NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS).

NXP Semiconductors N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-10-29 |

| Truist Securities | maintain | Buy | 2025-10-29 |

| JP Morgan | maintain | Neutral | 2025-07-23 |

| Wells Fargo | maintain | Overweight | 2025-07-23 |

| Truist Securities | maintain | Buy | 2025-07-23 |

| Susquehanna | maintain | Neutral | 2025-07-23 |

| Barclays | maintain | Overweight | 2025-07-22 |

| Needham | maintain | Buy | 2025-07-22 |

| Cantor Fitzgerald | maintain | Overweight | 2025-07-22 |

| Stifel | maintain | Hold | 2025-07-18 |

GLOBALFOUNDRIES Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | maintain | Outperform | 2025-11-13 |

| JP Morgan | maintain | Neutral | 2025-11-13 |

| Citigroup | maintain | Neutral | 2025-11-13 |

| Evercore ISI Group | maintain | Outperform | 2025-11-13 |

| B of A Securities | downgrade | Underperform | 2025-10-13 |

| UBS | maintain | Neutral | 2025-08-06 |

| Wedbush | maintain | Outperform | 2025-08-06 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| UBS | maintain | Neutral | 2025-07-28 |

| Citigroup | maintain | Neutral | 2025-07-07 |

Overall, the grades for NXPI show a stable outlook with several companies maintaining their ratings, while GFS presents a mixed picture with some maintaining outperform ratings but also facing a downgrade from B of A Securities. Investors should consider these insights when making decisions about their portfolios.

Target Prices

A consensus of target prices indicates the potential future performance of the stocks of NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NXP Semiconductors | 280 | 215 | 247.75 |

| GLOBALFOUNDRIES | 37 | 37 | 37 |

Analysts expect NXP Semiconductors’ stock to reach an average of 247.75, significantly higher than its current price of 191.35. For GLOBALFOUNDRIES, the consensus target matches its current price of 33.99, indicating stable expectations.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS).

| Criterion | NXP Semiconductors (NXPI) | GLOBALFOUNDRIES (GFS) |

|---|---|---|

| Diversification | High (varied product lines) | Moderate (focused on foundry services) |

| Profitability | Strong (net margin 21%+) | Weak (net margin negative) |

| Innovation | High (robust R&D investment) | Moderate (some new technologies) |

| Global presence | Extensive (operates in multiple countries) | Limited (primarily U.S. and Europe) |

| Market Share | Significant (strong position in semiconductors) | Growing but smaller share in foundries |

| Debt level | Moderate (debt to equity ratio 1.18) | Low (debt to equity ratio 0.22) |

Key takeaways from this analysis indicate that while NXP Semiconductors shows strong profitability and innovation, GLOBALFOUNDRIES is more conservative in its debt management but has room for improvement in profitability and market share.

Risk Analysis

In the table below, I outline key risks associated with NXP Semiconductors N.V. (NXPI) and GLOBALFOUNDRIES Inc. (GFS).

| Metric | NXP Semiconductors (NXPI) | GLOBALFOUNDRIES (GFS) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Low | High |

| Environmental Risk | Medium | Medium |

| Geopolitical Risk | High | High |

Both companies face substantial market and geopolitical risks, primarily due to their operations in the semiconductor industry, which is highly sensitive to global supply chain disruptions and regulatory changes. Recent tensions in trade relations have heightened these risks significantly.

Which one to choose?

When comparing NXP Semiconductors (NXPI) and GLOBALFOUNDRIES (GFS), the fundamentals suggest that NXPI has a stronger position. NXPI’s gross profit margin stands at 56.4%, significantly higher than GFS’s 28.4%. NXPI also boasts a net profit margin of 19.9%, while GFS reports a net loss margin of -3.9%. In terms of analyst ratings, NXPI is rated a “B” with a solid overall score, while GFS holds a “C+” rating.

Investors prioritizing growth might lean towards NXPI, given its better profitability ratios and market sentiment, while those seeking a more speculative opportunity may consider GFS, which could have potential upside if it turns around its financials. Keep in mind that both companies face industry risks, including competition and supply chain issues.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NXP Semiconductors N.V. and GLOBALFOUNDRIES Inc. to enhance your investment decisions: