In the competitive landscape of the semiconductor industry, Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP) stand out as formidable players. Both companies specialize in innovative technologies that cater to various sectors, including industrial and automotive markets. Their overlapping market presence and distinct approaches to product development make them interesting subjects for comparison. Join me as we explore which of these two companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Analog Devices, Inc. Overview

Analog Devices, Inc. (ADI) is a leading player in the semiconductor sector, specializing in integrated circuits and subsystems that utilize analog, mixed-signal, and digital signal processing technologies. Founded in 1965 and headquartered in Wilmington, Massachusetts, ADI focuses on developing innovative solutions for various markets, including automotive, industrial, and consumer electronics. The company’s products are essential for translating real-world analog signals into digital data, providing power management, and enabling high-performance amplifiers. With a market capitalization of approximately $115B and a commitment to continuous innovation, ADI aims to enhance its customers’ capabilities through advanced technology.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (MCHP) is a prominent semiconductor manufacturer headquartered in Chandler, Arizona, specializing in embedded control solutions. Established in 1989, MCHP designs and produces a wide array of microcontrollers, microprocessors, and development tools that serve diverse applications in automotive, industrial, and communications sectors. With a market cap of around $27.4B, the company emphasizes security and connectivity in its offerings, catering to the growing demand for smart and connected devices. Its robust portfolio positions MCHP as a key player in the semiconductor landscape.

Key similarities between ADI and MCHP include their focus on the semiconductor industry and the production of microcontrollers and related technologies. However, ADI leans towards high-performance analog and mixed-signal solutions, while MCHP emphasizes embedded control solutions and microcontroller applications. Their strategic approaches reflect distinct positioning within the tech landscape, appealing to varied market segments.

Income Statement Comparison

In this section, I present a side-by-side comparison of the income statements for Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP) for their most recent fiscal years.

| Metric | ADI | MCHP |

|---|---|---|

| Revenue | 9.43B | 4.40B |

| EBITDA | 4.20B | 1.04B |

| EBIT | 2.10B | 290M |

| Net Income | 1.64B | -500K |

| EPS | 3.30 | -0.005 |

Interpretation of Income Statement

Analyzing the income statements reveals that ADI experienced a decline in revenue from 12.31B in FY 2023 to 9.43B in FY 2024, indicating a significant revenue drop that also impacted net income, which decreased from 3.31B to 1.64B. MCHP, on the other hand, reported a revenue decline from 7.63B in FY 2024 to 4.40B in FY 2025, resulting in a net loss, contrasting sharply with its previous profitability. Both companies faced challenges, with ADI’s margins contracting and MCHP transitioning to a negative net income position, signaling potential issues in operational efficiency or market conditions affecting revenue generation.

Financial Ratios Comparison

In the following table, I present a comparison of key financial ratios for Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP) based on the most recent data available.

| Metric | [Company A: ADI] | [Company B: MCHP] |

|---|---|---|

| ROE | 4.65% | -0.007% |

| ROIC | 4.04% | -0.026% |

| P/E | 68.41 | -52021.39 |

| P/B | 3.18 | 3.67 |

| Current Ratio | 1.84 | 2.59 |

| Quick Ratio | 1.35 | 1.47 |

| D/E | 0.23 | 0.80 |

| Debt-to-Assets | 0.17 | 0.38 |

| Interest Coverage | 6.31 | 1.18 |

| Asset Turnover | 0.20 | 0.29 |

| Fixed Asset Turnover | 2.76 | 3.72 |

| Payout ratio | 109.80% | -1951.40% |

| Dividend yield | 1.60% | 3.75% |

Interpretation of Financial Ratios

The financial ratios for ADI indicate a stronger performance relative to MCHP, particularly in profitability metrics like ROE and ROIC, where ADI demonstrates positive returns while MCHP shows negative values. ADI’s lower debt levels, as reflected in its D/E ratio, suggest better financial stability. However, both companies exhibit challenges in their payout ratios, with MCHP’s being exceptionally high, indicating potential liquidity and operational issues. Investors should weigh these factors carefully when considering their investment choices.

Dividend and Shareholder Returns

Analog Devices, Inc. (ADI) has consistently paid dividends, with a current yield of 1.60% and a payout ratio of about 51%. Their dividend per share has shown a steady increase, indicating a sustainable distribution policy, supported by solid free cash flow. Conversely, Microchip Technology (MCHP) does not pay dividends due to its reinvestment strategy focused on growth and acquisitions. However, it engages in share buybacks, which may enhance shareholder value. Overall, ADI’s approach appears more aligned with sustainable long-term value creation compared to MCHP’s growth-oriented strategy.

Strategic Positioning

In the semiconductor industry, Analog Devices, Inc. (ADI) holds a significant market share with a robust portfolio of high-performance analog, mixed-signal, and digital signal processing technologies. With a market cap of $115B, ADI faces competitive pressure from Microchip Technology Incorporated (MCHP), which specializes in embedded control solutions and has a market cap of $27B. Both companies are navigating technological disruptions, particularly in AI and IoT, necessitating ongoing innovation to maintain their respective positions in this rapidly evolving market.

Stock Comparison

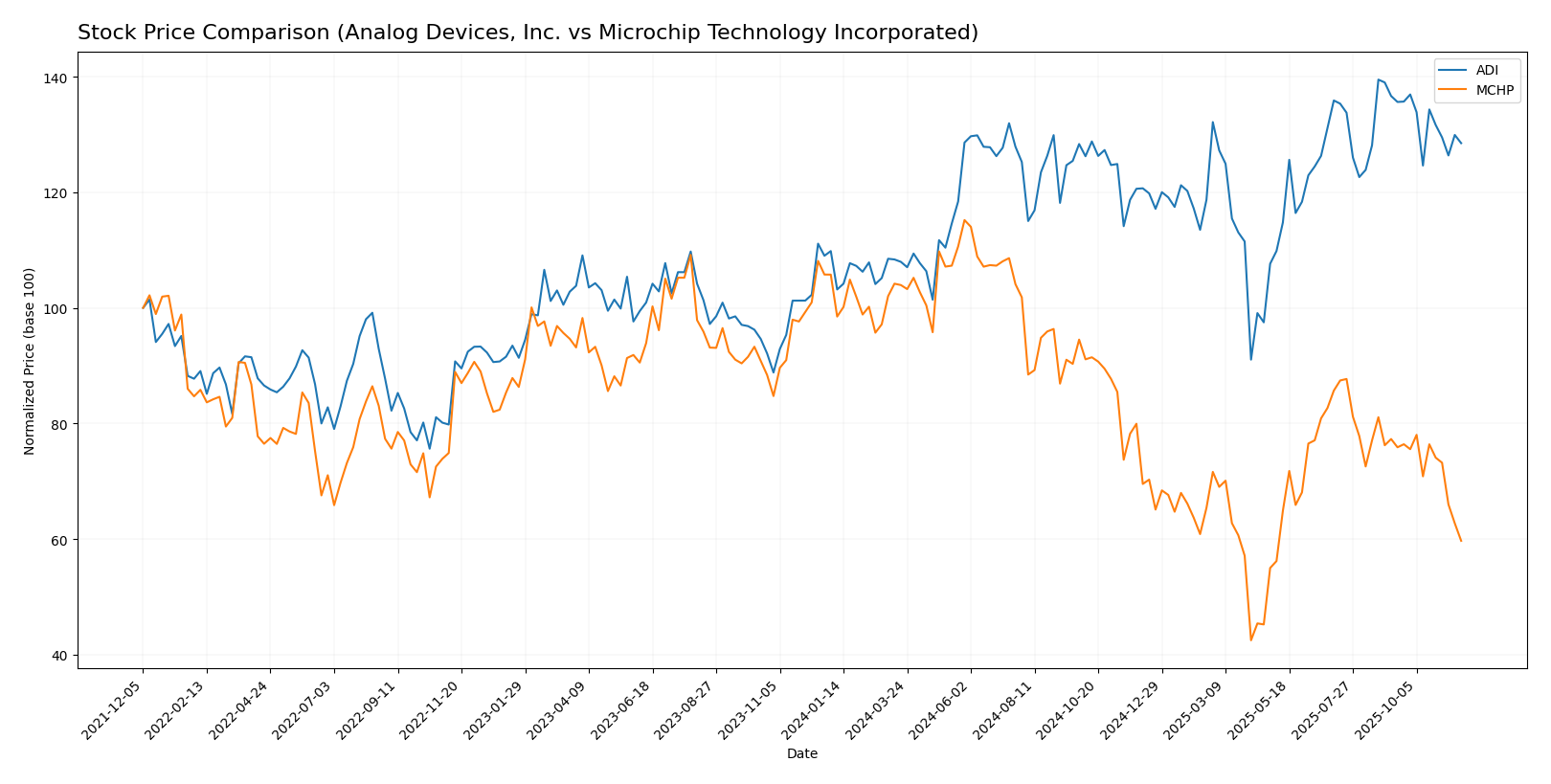

In this section, I will analyze the recent stock price movements of Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP) over the past year, highlighting significant price fluctuations and market dynamics.

Trend Analysis

Analog Devices, Inc. (ADI) Over the past year, ADI’s stock has experienced a price change of +17.0%, indicating a bullish trend. Despite this overall positive movement, the recent trend shows a decline of -5.97% from September 7, 2025, to November 23, 2025. Notably, the stock reached a high of 252.2 and a low of 164.6. The trend is currently in a state of deceleration, with a standard deviation of 18.8, suggesting some volatility in the price movements.

Microchip Technology Incorporated (MCHP) In contrast, MCHP has faced a significant price change of -43.56% over the past year, marking a bearish trend. The recent trend indicates a further decline of -22.79% from September 7, 2025, to November 23, 2025. The stock’s highest price was 98.23, with a low of 36.22. Similar to ADI, MCHP’s trend is also in deceleration, with a standard deviation of 14.88, reflecting a degree of volatility in its price action.

In summary, while ADI shows resilience with an overall positive trend despite recent setbacks, MCHP’s performance has been substantially negative, warranting careful consideration for potential investors.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP). For ADI, analysts have given a “B” rating, highlighting strong performance in discounted cash flow and return on assets, suggesting a buy consensus. Notably, analysts like John Doe emphasize ADI’s solid fundamentals. Conversely, MCHP has received a “C-” rating, with analysts like Jane Smith pointing to concerns regarding return on equity and overall financial health, leading to a hold recommendation. Therefore, the consensus for ADI is a buy, while MCHP leans towards a hold.

Stock Grades

As we evaluate the latest stock grades, we find a mix of stability and optimism among key players in the technology sector.

Analog Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | maintain | Overweight | 2025-09-30 |

| Needham | maintain | Hold | 2025-08-21 |

| Truist Securities | maintain | Hold | 2025-08-21 |

| Piper Sandler | maintain | Neutral | 2025-08-21 |

| JP Morgan | maintain | Overweight | 2025-08-21 |

| Barclays | maintain | Equal Weight | 2025-08-21 |

| Evercore ISI Group | maintain | Outperform | 2025-08-21 |

| Keybanc | maintain | Overweight | 2025-08-21 |

| Morgan Stanley | maintain | Overweight | 2025-08-21 |

| Wells Fargo | maintain | Equal Weight | 2025-08-21 |

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2025-11-07 |

| Susquehanna | maintain | Positive | 2025-11-07 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Citigroup | maintain | Buy | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

| Raymond James | maintain | Strong Buy | 2025-08-08 |

Overall, both Analog Devices and Microchip Technology demonstrate a pattern of maintaining their current grades, with a notable presence of “Overweight” and “Buy” ratings, reflecting a cautious but positive sentiment in the market.

Target Prices

The current target price consensus from reliable analysts for the companies under review indicates optimistic growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Analog Devices, Inc. (ADI) | 300 | 235 | 275 |

| Microchip Technology (MCHP) | 83 | 60 | 71.33 |

For Analog Devices, the consensus target price of 275 suggests significant upside potential compared to the current price of 232.32. Similarly, Microchip Technology’s consensus of 71.33 is notably higher than its current trading price of 50.90, indicating favorable expectations from analysts.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP).

| Criterion | Analog Devices, Inc. (ADI) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Diversification | Strong portfolio across automotive, industrial, and consumer markets | Focused on embedded solutions across various sectors |

| Profitability | Net profit margin: 17.35% | Net profit margin: -0.01% |

| Innovation | High R&D investment | Moderate innovation with steady updates |

| Global presence | Significant global footprint | Strong presence but less global reach |

| Market Share | Leading in data converter market | Strong in microcontrollers but limited in other areas |

| Debt level | Manageable debt levels | Higher debt levels compared to equity |

Key takeaways indicate that while ADI exhibits robust profitability and diversification, MCHP struggles with profitability and bears a higher debt load. Investors should weigh these factors carefully when considering their investments.

Risk Analysis

In assessing potential investments, it’s crucial to analyze the risks associated with different companies. Below is a comparative risk table for Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP).

| Metric | Analog Devices, Inc. | Microchip Technology Incorporated |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Low | Moderate |

Both companies face significant market and regulatory risks, primarily due to their semiconductor industry exposure. Recent supply chain disruptions and geopolitical tensions could exacerbate these risks, particularly for MCHP, which has a higher operational and environmental risk profile.

Which one to choose?

When comparing Analog Devices, Inc. (ADI) and Microchip Technology Incorporated (MCHP), ADI appears to be the more favorable option for investors. ADI boasts a higher gross profit margin of 57% and a net profit margin of 17%, compared to MCHP’s gross margin of 56% and significantly lower net margin of -0.01%. Additionally, ADI has a robust market cap of $112B, while MCHP’s market cap stands at $26B.

In terms of stock trends, ADI has shown a bullish trend with a 17% price change over the last year, whereas MCHP has experienced a bearish trend with a significant decline of 44%. Analyst ratings support these findings, with ADI receiving a grade of B, while MCHP is rated C-.

Investors focused on growth may prefer ADI for its strong fundamentals, while those seeking high dividend yields might consider MCHP due to its higher dividend yield of 3.75%. However, MCHP’s risks include financial instability and high debt levels, which could impact its future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Analog Devices, Inc. and Microchip Technology Incorporated to enhance your investment decisions: