In today’s competitive semiconductor landscape, two prominent players stand out: Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS). Both companies operate within the same industry, but they take different approaches to innovation and market strategy. ADI focuses on developing integrated circuits and signal processing technologies, while GFS specializes in semiconductor manufacturing. This analysis will explore their strengths and weaknesses, helping you determine which company is the more compelling investment opportunity.

Table of contents

Company Overview

Analog Devices, Inc. Overview

Analog Devices, Inc. (ADI) is a prominent player in the semiconductor industry, specializing in the design and manufacturing of integrated circuits (ICs) that leverage analog, mixed-signal, and digital signal processing technologies. Founded in 1965 and based in Wilmington, Massachusetts, ADI serves a diverse range of markets, including automotive, communications, industrial, and high-end consumer sectors. The company’s innovative products, which include data converters, power management solutions, and high-performance amplifiers, are essential for translating real-world analog signals into digital data and vice versa. With a market capitalization of approximately $115B, ADI is recognized for its commitment to high-quality performance and reliability.

GLOBALFOUNDRIES Inc. Overview

GLOBALFOUNDRIES Inc. (GFS), established in 2009 and headquartered in Malta, New York, operates as a leading semiconductor foundry. The company manufactures a wide array of integrated circuits that power various electronic devices, including microprocessors and mobile application processors. GFS offers comprehensive wafer fabrication services and technologies, positioning itself as a key enabler of modern electronics. With a market capitalization of around $18.8B, GLOBALFOUNDRIES is focused on meeting the increasing demand for semiconductor manufacturing and is critical to the global supply chain.

Key similarities between Analog Devices and GLOBALFOUNDRIES include their operations within the semiconductor industry and their focus on high-performance electronic components. However, while ADI emphasizes integrated circuit design and specific applications across various sectors, GFS primarily operates as a foundry, providing manufacturing services for a broader range of semiconductor products.

Income Statement Comparison

The table below summarizes the most recent income statement figures for Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS), providing a clear comparison of their financial performance.

| Metric | ADI | GFS |

|---|---|---|

| Revenue | 9.43B | 6.75B |

| EBITDA | 4.20B | 1.50B |

| EBIT | 2.10B | -64M |

| Net Income | 1.64B | -265M |

| EPS | 3.30 | -0.48 |

Interpretation of Income Statement

In the most recent year, ADI demonstrated solid revenue of 9.43B and a net income of 1.64B, indicating robust growth despite a slight decline from previous periods. Its EBITDA margin remains strong, reflecting operational efficiency. Conversely, GFS reported a decline in revenue to 6.75B, alongside a net loss of 265M, highlighting challenges in maintaining profitability. The significant drop in EBIT suggests that GFS has encountered increased operational difficulties, impacting its overall financial health. Investors should approach GFS with caution, given its negative earnings and deteriorating margins.

Financial Ratios Comparison

The following table compares key financial metrics for Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS) based on the most recent available data.

| Metric | ADI | GFS |

|---|---|---|

| ROE | 4.65% | -2.46% |

| ROIC | 4.04% | -2.26% |

| P/E | 68.41 | -89.54 |

| P/B | 3.18 | 2.20 |

| Current Ratio | 1.84 | 2.11 |

| Quick Ratio | 1.35 | 1.57 |

| D/E | 0.23 | 0.25 |

| Debt-to-Assets | 0.14 | 0.15 |

| Interest Coverage | 6.31 | -1.48 |

| Asset Turnover | 0.20 | 0.40 |

| Fixed Asset Turnover | 2.76 | 0.82 |

| Payout ratio | 109.80% | 0% |

| Dividend yield | 1.60% | 0% |

Interpretation of Financial Ratios

In comparing ADI and GFS, ADI exhibits stronger financial health with positive ROE and ROIC, indicating effective capital utilization. Conversely, GFS shows negative returns and an alarming interest coverage ratio, reflecting potential solvency concerns. ADI’s lower payout ratio allows for reinvestment into growth, while GFS’s lack of dividends signals less stability. Overall, ADI appears to be the more favorable investment.

Dividend and Shareholder Returns

Analog Devices, Inc. (ADI) maintains a dividend payout ratio of about 50.66% with a growing dividend per share trend, currently yielding approximately 2.13%. Their share buyback initiatives further enhance shareholder returns. Conversely, GLOBALFOUNDRIES Inc. (GFS) does not distribute dividends due to ongoing reinvestment strategies aimed at growth, reflected in their negative net income. They do engage in share buybacks, suggesting a commitment to shareholder value. Overall, ADI’s dividend approach supports sustainable long-term value creation, while GFS’s strategy may align with potential future gains.

Strategic Positioning

Analog Devices, Inc. (ADI) commands a significant market share in the semiconductor industry, particularly in data converters and power management solutions, with a market cap of 115B. In contrast, GLOBALFOUNDRIES Inc. (GFS), with a market cap of 18B, focuses on foundry services, facing intense competitive pressure from established players. Both companies are navigating technological disruptions that demand continuous innovation and adaptation, especially in areas like AI and IoT.

Stock Comparison

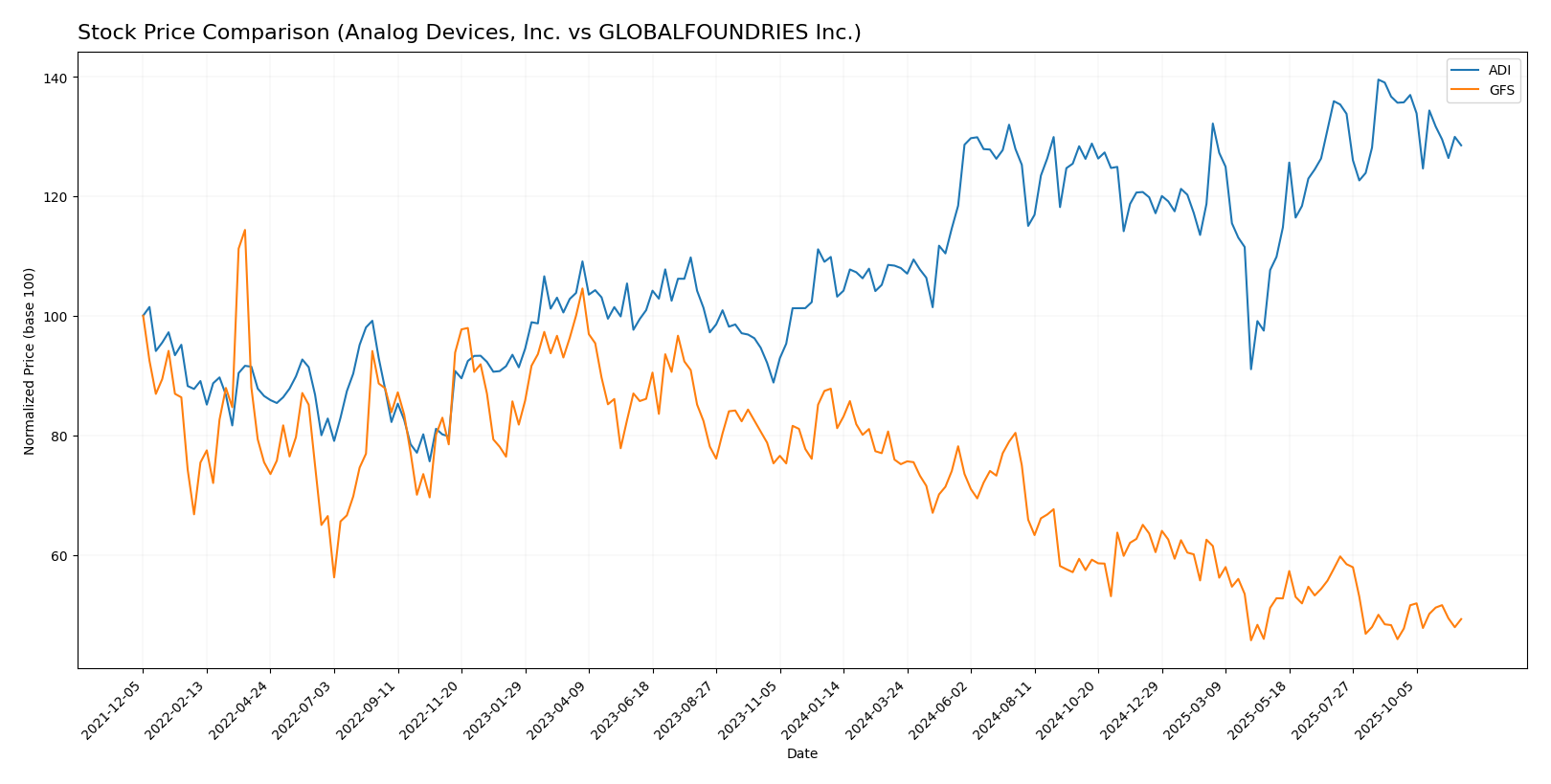

In this section, I will analyze the stock price movements and trading dynamics for Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS) over the past year, highlighting key price changes and trends.

Trend Analysis

Analog Devices, Inc. (ADI) Over the past year, ADI has seen a price change of +17.0%, indicating a bullish trend. The stock has experienced notable fluctuations, with a highest price of 252.2 and a lowest price of 164.6. However, the recent trend from September 7, 2025, to November 23, 2025, shows a price change of -5.97%, reflecting a deceleration in momentum. In terms of volatility, the standard deviation is 7.21, suggesting moderate price variability in this recent time frame.

GLOBALFOUNDRIES Inc. (GFS) In contrast, GFS has experienced a significant price decline of -43.91% over the past year, categorizing it as a bearish trend. The stock’s highest price reached 60.6, with a notable low of 31.54. Recently, however, GFS has shown a slight recovery with a price change of +2.1% from September 7, 2025, to November 23, 2025, indicating a neutral trend. The standard deviation of 1.28 suggests low volatility during this recent period, reflecting a more stable trading environment.

In summary, while ADI demonstrates a bullish long-term trend, its recent performance indicates a pullback. On the other hand, GFS’s overall bearish trend is currently showing signs of stabilization.

Analyst Opinions

Recent analyst recommendations for Analog Devices, Inc. (ADI) are generally positive, with a rating of B. Analysts highlight strong scores in discounted cash flow and return on assets, suggesting solid growth potential. In contrast, GLOBALFOUNDRIES Inc. (GFS) holds a C+ rating, indicating mixed performance, particularly in return on equity and return on assets, which raises caution among investors. Overall, the consensus leans towards a “buy” for ADI and a “hold” for GFS in 2025.

Stock Grades

In the current market landscape, I have gathered trustworthy stock grades for two companies, which can help guide your investment decisions.

Analog Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | maintain | Overweight | 2025-09-30 |

| Needham | maintain | Hold | 2025-08-21 |

| Truist Securities | maintain | Hold | 2025-08-21 |

| Piper Sandler | maintain | Neutral | 2025-08-21 |

| JP Morgan | maintain | Overweight | 2025-08-21 |

| Barclays | maintain | Equal Weight | 2025-08-21 |

| Evercore ISI Group | maintain | Outperform | 2025-08-21 |

| Keybanc | maintain | Overweight | 2025-08-21 |

| Morgan Stanley | maintain | Overweight | 2025-08-21 |

| Wells Fargo | maintain | Equal Weight | 2025-08-21 |

GLOBALFOUNDRIES Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | maintain | Outperform | 2025-11-13 |

| JP Morgan | maintain | Neutral | 2025-11-13 |

| Citigroup | maintain | Neutral | 2025-11-13 |

| Evercore ISI Group | maintain | Outperform | 2025-11-13 |

| B of A Securities | downgrade | Underperform | 2025-10-13 |

| UBS | maintain | Neutral | 2025-08-06 |

| Wedbush | maintain | Outperform | 2025-08-06 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| UBS | maintain | Neutral | 2025-07-28 |

| Citigroup | maintain | Neutral | 2025-07-07 |

Overall, both companies show a consistent trend of maintaining their grades, with Analog Devices receiving mostly “Overweight” and “Hold” ratings, while GLOBALFOUNDRIES has a mix of “Outperform” and “Neutral” grades, with a recent downgrade by B of A Securities. This indicates a generally stable outlook for Analog Devices and a slightly cautious sentiment surrounding GLOBALFOUNDRIES.

Target Prices

The consensus target prices for Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS) reflect positive analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Analog Devices, Inc. | 300 | 235 | 275 |

| GLOBALFOUNDRIES Inc. | 37 | 37 | 37 |

For ADI, the consensus target price of 275 suggests potential upside from the current price of 232.32. Meanwhile, GFS’s consensus matches its current price of 33.99, indicating a stable outlook.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS) based on recent financial data.

| Criterion | Analog Devices, Inc. (ADI) | GLOBALFOUNDRIES Inc. (GFS) |

|---|---|---|

| Diversification | Strong focus on automotive and industrial sectors | Limited product range in semiconductor manufacturing |

| Profitability | Net profit margin: 17.35% | Net profit margin: -3.93% |

| Innovation | High investment in R&D | Moderate innovation focus |

| Global presence | Operates in multiple regions | Primarily US and Europe |

| Market Share | Significant in analog ICs | Growing presence in foundry services |

| Debt level | Low debt-to-equity ratio: 0.23 | Moderate debt-to-equity ratio: 0.25 |

Key takeaways from this analysis indicate that while Analog Devices exhibits strong profitability and a broad market presence, GLOBALFOUNDRIES is still overcoming challenges related to profitability and product diversification. This insight may influence your investment decisions.

Risk Analysis

The following table outlines the key risks associated with Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS) as of the most recent fiscal year.

| Metric | Analog Devices, Inc. | GLOBALFOUNDRIES Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face heightened market and regulatory risks, particularly in the semiconductor sector, which is sensitive to global supply chain disruptions and regulatory changes. Recent geopolitical tensions further exacerbate these concerns, especially for GFS, which operates in a highly competitive and politically charged environment.

Which one to choose?

When comparing Analog Devices, Inc. (ADI) and GLOBALFOUNDRIES Inc. (GFS), ADI shows a stronger performance based on various financial metrics. ADI boasts a gross profit margin of 57.1% and a net profit margin of 17.3%, while GFS has a gross profit margin of only 24.5% with a negative net profit margin. ADI’s P/E ratio of 68.4 indicates high market expectations, but it is backed by solid growth potential, reflected in its recent bullish stock trend. Meanwhile, GFS experiences a bearish trend with a significant price decline of 43.9% over the past year.

For growth-oriented investors, ADI appears favorable due to its strong fundamentals and positive analyst ratings (B rating). Conversely, those seeking stability may consider GFS; however, the company faces risks related to competition and operational challenges in the semiconductor industry.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Analog Devices, Inc. and GLOBALFOUNDRIES Inc. to enhance your investment decisions: