In the fast-evolving semiconductor industry, Texas Instruments Incorporated (TXN) and Analog Devices, Inc. (ADI) stand out as prominent players. Both companies engage in designing, manufacturing, and selling semiconductors, yet they employ distinct innovation strategies and target different market segments. With overlapping interests in power management and signal processing, this comparison unveils their competitive edges and growth trajectories. Join me as we explore which company presents the most compelling opportunity for investors in today’s market landscape.

Table of contents

Company Overview

Texas Instruments Incorporated Overview

Texas Instruments (TXN) is a leading designer and manufacturer of semiconductors, particularly known for its analog and embedded processing solutions. Established in 1930 and headquartered in Dallas, Texas, the company serves a diverse range of industries, including automotive, industrial, and personal electronics. TXN’s robust portfolio includes power management products, microcontrollers, and digital signal processors, which are essential for modern electronic devices. With a market capitalization of approximately $145B, Texas Instruments continues to innovate in the semiconductor space, focusing on high-performance solutions that manage power and process signals efficiently.

Analog Devices, Inc. Overview

Analog Devices (ADI), founded in 1965 and based in Wilmington, Massachusetts, specializes in integrated circuits that bridge the gap between the analog and digital worlds. The company focuses on high-performance analog, mixed-signal, and digital signal processing technologies. ADI’s offerings include data converters, power management ICs, and sensors, catering primarily to the automotive, industrial, and communications sectors. With a market cap around $115B, Analog Devices is dedicated to advancing its technology to enable smarter, more efficient systems across various applications.

Key Similarities and Differences

Both Texas Instruments and Analog Devices operate within the semiconductor industry, focusing on analog and embedded processing solutions. However, their business models differ slightly; TXN emphasizes a broader range of power management and embedded products, while ADI places a strong focus on data conversion and high-performance signal processing technologies. This distinction shapes their respective market strategies and target audiences.

Income Statement Comparison

Below is a comparison of the most recent income statements for Texas Instruments (TXN) and Analog Devices (ADI) for the fiscal year 2024.

| Metric | TXN | ADI |

|---|---|---|

| Revenue | 15.64B | 9.43B |

| EBITDA | 7.54B | 4.20B |

| EBIT | 5.96B | 2.10B |

| Net Income | 4.80B | 1.64B |

| EPS | 5.24 | 3.30 |

Interpretation of Income Statement

In 2024, Texas Instruments reported a revenue of 15.64B, a decline from 17.52B in the prior year, reflecting broader industry challenges. Net income also fell to 4.80B from 6.51B, indicating tighter margins. Analog Devices, on the other hand, saw a reduction in revenue from 12.30B to 9.43B, with net income decreasing to 1.64B from 3.31B. Both companies experienced pressure on margins, with TXN’s EBITDA margin slightly better at 48.2% compared to ADI’s 44.5%. This suggests a need for strategic adjustments to maintain profitability amid fluctuating market conditions.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial metrics for Texas Instruments (TXN) and Analog Devices (ADI), focusing on key revenue and ratios that can impact investment decisions.

| Metric | TXN | ADI |

|---|---|---|

| ROE | 28.39% | 4.65% |

| ROIC | 14.75% | 4.04% |

| P/E | 35.63 | 68.41 |

| P/B | 10.12 | 3.18 |

| Current Ratio | 4.12 | 1.84 |

| Quick Ratio | 2.88 | 1.35 |

| D/E | 0.80 | 0.23 |

| Debt-to-Assets | 38.29% | 16.60% |

| Interest Coverage | 10.76 | 6.31 |

| Asset Turnover | 0.44 | 0.20 |

| Fixed Asset Turnover | 1.38 | 2.76 |

| Payout Ratio | 99.92% | 109.80% |

| Dividend Yield | 2.80% | 1.60% |

Interpretation of Financial Ratios

The analysis reveals that Texas Instruments demonstrates a stronger financial position with higher ROE, ROIC, and asset turnover compared to Analog Devices. However, ADI has a lower debt-to-equity ratio, indicating a more conservative leverage position. The high P/E ratio for ADI raises concerns about its valuation relative to earnings, while TXN’s payout ratio suggests a commitment to returning value to shareholders. Overall, TXN appears to be the more stable investment choice at this time, but ADI’s growth potential could also be attractive if managed well.

Dividend and Shareholder Returns

Texas Instruments (TXN) maintains a robust dividend strategy with a payout ratio of approximately 99.92% and an annual dividend yield of 2.8%. This high payout raises concerns regarding sustainability, especially given its reliance on free cash flow. In contrast, Analog Devices (ADI), while also paying dividends with a yield of 2.1%, has a lower payout ratio of 50.7%, allowing more flexibility for growth investments. Both companies engage in share buybacks, which can enhance shareholder value, but careful monitoring of their respective payout policies is crucial for long-term sustainability.

Strategic Positioning

In the semiconductor sector, Texas Instruments (TXN) holds a significant market share with its strong focus on analog and embedded processing products, while Analog Devices (ADI) excels in mixed-signal and digital signal processing technologies. Both companies face competitive pressure from emerging players and ongoing technological disruptions, particularly in power management and high-performance computing. As they adapt to market changes, their ability to innovate and leverage their established market positions will be crucial for sustaining growth and profitability.

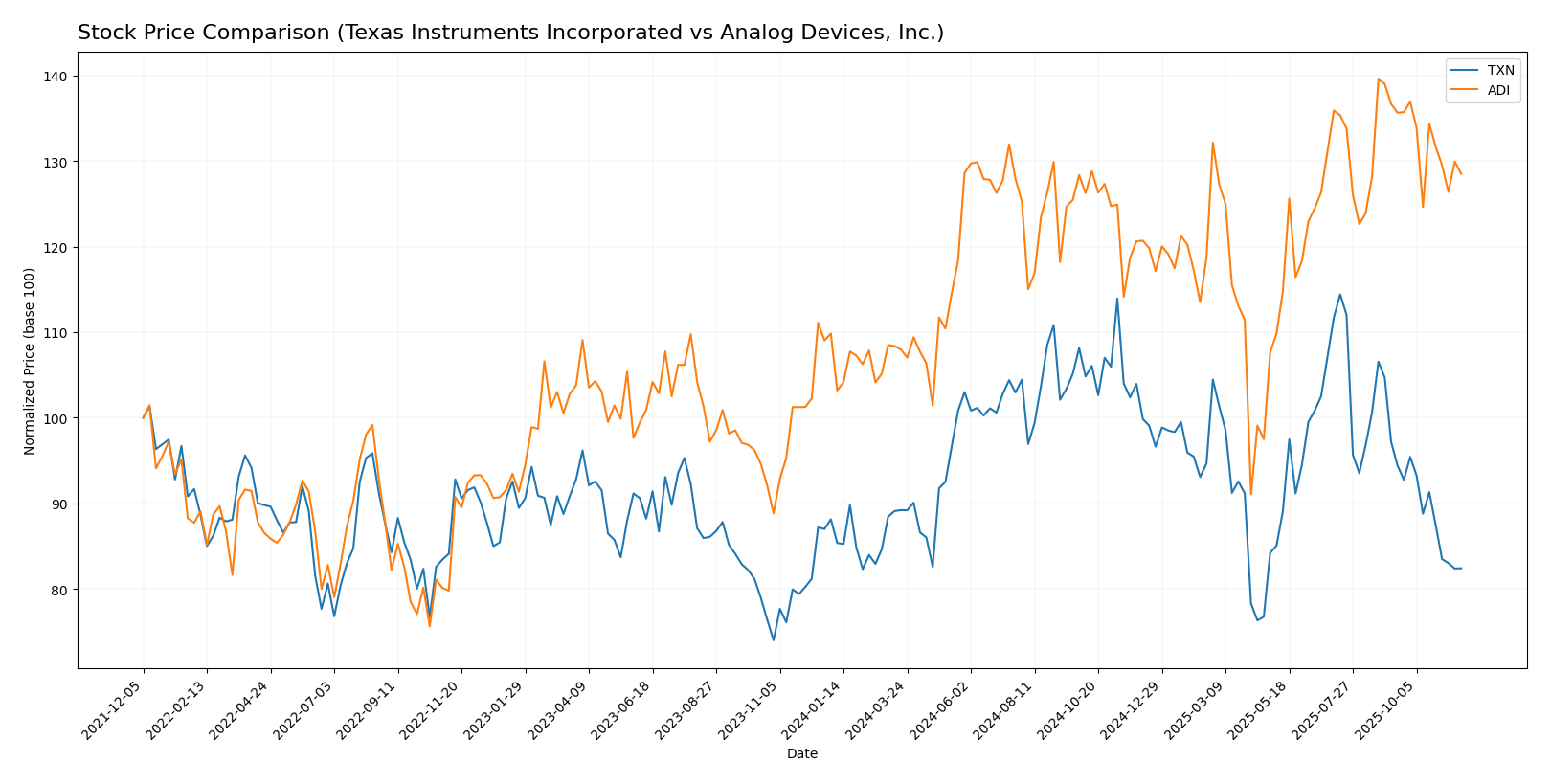

Stock Comparison

In this section, I will analyze the weekly stock price movements of Texas Instruments Incorporated (TXN) and Analog Devices, Inc. (ADI) over the past year, highlighting key price dynamics and trends.

Trend Analysis

Texas Instruments Incorporated (TXN) Over the past year, TXN’s stock has experienced a price change of -6.49%, indicating a bearish trend. The stock reached a high of 221.25 and a low of 147.6, showing notable price volatility with a standard deviation of 16.86. The recent trend from September 7, 2025, to November 23, 2025, further reflects a decline of -15.18%, with a trend slope of -2.79, suggesting deceleration in the downward movement.

Analog Devices, Inc. (ADI) In comparison, ADI’s stock has gained 17.0% over the past year, demonstrating a bullish trend. The price fluctuations ranged from a high of 252.2 to a low of 164.6, with a standard deviation of 18.8 indicating notable volatility. However, the recent trend from September 7, 2025, to November 23, 2025, shows a decline of -5.97%, with a trend slope of -1.52, indicating deceleration in its upward momentum.

In summary, while ADI maintains a positive annual performance, both stocks are currently showing short-term negative trends, with TXN facing more significant declines. Caution is advised for investors considering positions in these equities.

Analyst Opinions

Recent analyst recommendations for Texas Instruments (TXN) and Analog Devices (ADI) indicate a consensus rating of “Buy” for both companies. Analysts note TXN’s robust return on equity and strong asset management as key strengths, while highlighting the company’s solid overall score of 3. Similarly, ADI has received favorable reviews for its discounted cash flow performance and efficient asset utilization, also achieving a score of 3. Notable analysts have expressed confidence in both stocks, suggesting they offer attractive growth potential for investors in 2025.

Stock Grades

In the current market environment, it’s essential to review the latest stock grades from reputable grading companies to make informed investment decisions. Here’s the latest grading data for two notable companies in the semiconductor sector.

Texas Instruments Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-22 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-22 |

| Goldman Sachs | Maintain | Buy | 2025-10-22 |

| JP Morgan | Maintain | Overweight | 2025-10-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-22 |

| Stifel | Maintain | Hold | 2025-10-22 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Mizuho | Downgrade | Underperform | 2025-10-20 |

Analog Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Hold | 2025-08-21 |

| Truist Securities | Maintain | Hold | 2025-08-21 |

| Piper Sandler | Maintain | Neutral | 2025-08-21 |

| JP Morgan | Maintain | Overweight | 2025-08-21 |

| Barclays | Maintain | Equal Weight | 2025-08-21 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-21 |

| Keybanc | Maintain | Overweight | 2025-08-21 |

| Morgan Stanley | Maintain | Overweight | 2025-08-21 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-21 |

Overall, the grades for both Texas Instruments and Analog Devices indicate a generally positive outlook, with multiple firms maintaining strong ratings such as “Buy” and “Overweight.” However, Texas Instruments has seen a recent downgrade from Mizuho, suggesting a cautious approach may be warranted.

Target Prices

The consensus target prices from analysts for the following companies indicate strong growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Texas Instruments (TXN) | 245 | 145 | 190.45 |

| Analog Devices (ADI) | 300 | 235 | 275 |

Analysts expect Texas Instruments to reach a consensus price of 190.45, while Analog Devices has a higher consensus of 275. With current stock prices at 159.4 for TXN and 232.32 for ADI, both companies present attractive upside potential based on analyst expectations.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Texas Instruments Incorporated (TXN) and Analog Devices, Inc. (ADI) based on the most recent data.

| Criterion | Texas Instruments (TXN) | Analog Devices (ADI) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Strong (30.68% net margin) | Moderate (26.94% net margin) |

| Innovation | High | High |

| Global presence | Strong | Strong |

| Market Share | 18% | 10% |

| Debt level | Moderate (38.29% debt to assets) | Low (14.37% debt to assets) |

Key takeaways include Texas Instruments’ strong profitability and market share, while Analog Devices excels in diversification and maintains a lower debt level, indicating a more robust financial position.

Risk Analysis

In this section, I provide a summary of the key risks associated with Texas Instruments Incorporated (TXN) and Analog Devices, Inc. (ADI) to help you make informed investment decisions.

| Metric | Texas Instruments (TXN) | Analog Devices (ADI) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face moderate market and regulatory risks, with ADI showing higher exposure to market fluctuations and geopolitical tensions. Recent semiconductor shortages have emphasized supply chain vulnerabilities, impacting operational efficiency and market stability.

Which one to choose?

When comparing Texas Instruments (TXN) and Analog Devices (ADI), I observe that both companies carry a “B” rating, indicating solid fundamentals. TXN boasts a higher gross profit margin of 58.1% compared to ADI’s 57.1%, but ADI has demonstrated stronger revenue growth recently. TXN’s debt-to-equity ratio is more conservative at 0.80, while ADI stands at 0.23, suggesting lower leverage and risk. Over the past year, TXN has experienced a bearish trend with a price decrease of 6.49%, while ADI has been bullish with a 17% increase.

For growth-focused investors, ADI may be more appealing due to its recent performance. Conversely, conservative investors may prefer TXN for its lower debt levels and profitability margins. However, both companies face industry risks, including competition and supply chain challenges.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Texas Instruments Incorporated and Analog Devices, Inc. to enhance your investment decisions: