In the rapidly evolving semiconductor industry, two giants stand out: ASML Holding N.V. and Lam Research Corporation. Both companies play crucial roles in the production and fabrication of advanced semiconductor equipment, yet they approach innovation and market strategies differently. ASML focuses on lithography systems, while Lam Research specializes in etch and deposition technologies. As an investor, understanding their distinct advantages and market positions will be essential in determining which company offers the most promising growth potential. Let’s dive deeper into their profiles and see which stock might be the right fit for your portfolio.

Table of contents

Company Overview

ASML Overview

ASML Holding N.V. is a leading player in the semiconductor industry, specializing in advanced equipment systems that enable chipmakers to manufacture high-performance chips. Based in Veldhoven, the Netherlands, ASML is renowned for its cutting-edge lithography systems, including extreme ultraviolet (EUV) lithography, which is crucial for producing the latest generation of semiconductors. With a market capitalization of approximately $375B and a workforce of over 43K employees, ASML operates globally, supplying its technology to major semiconductor manufacturers across Asia, Europe, and North America. The company’s commitment to innovation positions it as a critical enabler in the ongoing digital transformation.

Lam Research Overview

Lam Research Corporation, headquartered in Fremont, California, is another significant entity in the semiconductor equipment sector, focusing on the fabrication of integrated circuits. Founded in 1980, Lam Research offers a diverse portfolio of processing equipment, including systems for plasma etching, chemical vapor deposition, and wafer cleaning technologies. With a market capitalization of around $179B and approximately 18.6K employees, the company serves a global customer base in the semiconductor industry. Lam’s emphasis on developing advanced materials and processes positions it as a vital partner in supporting the industry’s evolution towards smaller, more efficient chips.

Key Similarities and Differences

Both ASML and Lam Research operate in the semiconductor equipment industry, providing critical technologies that underpin chip manufacturing. However, ASML primarily focuses on lithography systems, while Lam Research offers a broader range of processing equipment for various fabrication steps. This distinction highlights ASML’s specialized role in patterning chips versus Lam’s comprehensive approach to semiconductor manufacturing processes.

Income Statement Comparison

Below is a comparison of the most recent income statements for ASML Holding N.V. and Lam Research Corporation, highlighting key financial metrics that can help investors make informed decisions.

| Metric | ASML | Lam Research |

|---|---|---|

| Revenue | 28.26B | 18.44B |

| EBITDA | 10.12B | 6.34B |

| EBIT | 9.21B | 5.96B |

| Net Income | 7.57B | 5.36B |

| EPS | 19.25 | 4.17 |

Interpretation of Income Statement

In the most recent year, ASML demonstrated robust revenue growth, rising from 27.56B in 2023 to 28.26B in 2024. Lam Research also reported an increase in revenue from 14.91B in 2024 to 18.44B in 2025, reflecting a strong demand for semiconductor equipment. ASML’s net income decreased slightly from 7.84B to 7.57B, indicating a potential margin compression, while Lam’s net income growth showed resilience, rising from 5.13B to 5.36B. Overall, both companies exhibit strong financial health, but ASML may face challenges in maintaining margins amidst increasing costs.

Financial Ratios Comparison

Below is a comparative analysis of the financial performance metrics for ASML Holding N.V. (ASML) and Lam Research Corporation (LRCX).

| Metric | ASML | LRCX |

|---|---|---|

| ROE | 41% | 54% |

| ROIC | 25% | 34% |

| P/E | 34.77 | 23.36 |

| P/B | 14.25 | 12.69 |

| Current Ratio | 1.53 | 2.21 |

| Quick Ratio | 0.95 | 1.55 |

| D/E | 0.27 | 0.48 |

| Debt-to-Assets | 10% | 22% |

| Interest Coverage | 56.20 | 33.11 |

| Asset Turnover | 0.58 | 0.86 |

| Fixed Asset Turnover | 3.91 | 7.59 |

| Payout Ratio | 33.84% | 21.45% |

| Dividend Yield | 0.97% | 0.92% |

Interpretation of Financial Ratios

ASML showcases strong profitability with a higher ROE and ROIC, indicating efficient capital use. However, its P/E ratio suggests it may be overvalued compared to LRCX. LRCX excels in asset utilization and lower debt ratios, reflecting solid financial health. Both companies maintain healthy current ratios, yet ASML’s quick ratio raises some liquidity concerns. Overall, while both firms are strong contenders, investors should weigh valuation metrics and liquidity measures carefully.

Dividend and Shareholder Returns

ASML Holding N.V. pays dividends with a payout ratio of approximately 33.8% in 2024, demonstrating a stable trend in dividend per share. The annual yield stands at about 0.97%, supported by strong free cash flow coverage. Lam Research Corporation also distributes dividends, maintaining a lower payout ratio of 21.5% in 2024, reflecting a commitment to reinvestment while providing a yield of around 0.92%. Both companies’ approaches suggest a balanced strategy between rewarding shareholders and sustaining long-term growth.

Strategic Positioning

ASML Holding N.V. holds a dominant market share in advanced lithography systems for semiconductor manufacturing, crucial for producing smaller, more powerful chips. With a market cap of $375B, it faces competitive pressure from Lam Research Corporation, which, with a market cap of $179B, specializes in semiconductor processing equipment. Both companies are poised for technological disruption, driven by advancements in AI and increased demand for semiconductor innovation, highlighting the importance of staying ahead in R&D and production efficiency.

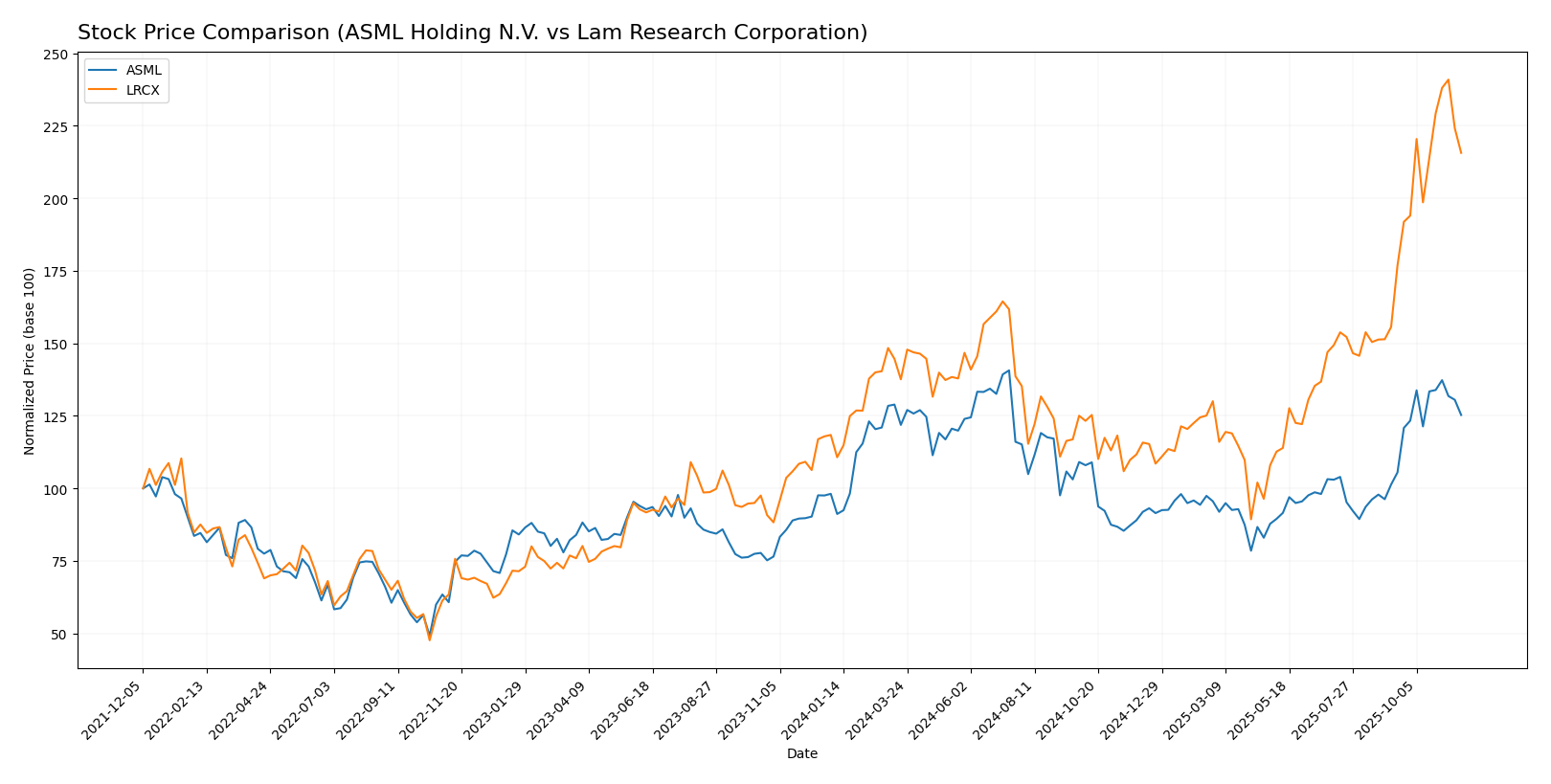

Stock Comparison

In the past year, both ASML Holding N.V. and Lam Research Corporation have demonstrated significant price movements and trading dynamics, with ASML showing a strong bullish trend and Lam Research exhibiting notable gains as well.

Trend Analysis

ASML Holding N.V. (ASML) Over the past year, ASML has experienced a price change of +27.7%, indicating a bullish trend. The stock has shown acceleration in its price movement, reaching a high of 1085.26 and a low of 605.55. The standard deviation of 124.53 suggests a relatively high level of volatility, which may indicate fluctuating investor sentiment. Recent data from September 7, 2025, to November 23, 2025, reveals a price change of +23.65%, further supporting the bullish outlook.

Lam Research Corporation (LRCX) LRCX has performed exceptionally well, showcasing an impressive price change of +82.11% over the past year, categorizing it as a bullish trend as well. The stock also indicates acceleration, with notable highs at 159.35 and lows at 59.09. With a standard deviation of 20.61, the stock has maintained lower volatility compared to ASML. In the recent analysis period from September 7, 2025, to November 23, 2025, LRCX recorded a price change of +38.56%, further emphasizing its strong upward trajectory.

Both companies present compelling investment opportunities, but risk management should be a priority given the inherent market fluctuations.

Analyst Opinions

Recent analyst recommendations for ASML Holding N.V. and Lam Research Corporation both highlight a “B+” rating, indicating a consensus of “buy” for 2025. Analysts emphasize strong metrics in return on equity and return on assets, reflecting solid operational efficiency. The discounted cash flow scores also support this outlook, although concerns about debt levels and price-to-earnings ratios slightly temper enthusiasm. Notable analysts backing these positions include firms like Goldman Sachs and Morgan Stanley, reinforcing the positive sentiment in the semiconductor sector. Overall, the consensus remains bullish for both companies.

Stock Grades

In this section, I present the latest stock grades for ASML Holding N.V. and Lam Research Corporation, as provided by reputable grading companies.

ASML Holding N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2025-10-16 |

| Susquehanna | maintain | Positive | 2025-10-10 |

| JP Morgan | maintain | Overweight | 2025-10-06 |

| UBS | upgrade | Buy | 2025-09-05 |

| Wells Fargo | maintain | Overweight | 2025-07-08 |

| Jefferies | downgrade | Hold | 2025-06-26 |

| Barclays | downgrade | Equal Weight | 2025-06-03 |

| Wells Fargo | maintain | Overweight | 2025-04-17 |

| Susquehanna | maintain | Positive | 2025-04-17 |

| Raymond James | maintain | Strong Buy | 2025-04-16 |

Lam Research Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Stifel | maintain | Buy | 2025-10-23 |

| UBS | maintain | Buy | 2025-10-23 |

| TD Cowen | maintain | Buy | 2025-10-23 |

| Wells Fargo | maintain | Equal Weight | 2025-10-23 |

| JP Morgan | maintain | Overweight | 2025-10-23 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-23 |

| Oppenheimer | maintain | Outperform | 2025-10-23 |

| Mizuho | maintain | Outperform | 2025-10-23 |

| Citigroup | maintain | Buy | 2025-10-23 |

Overall, the grades for both ASML and Lam Research indicate a stable sentiment with a predominance of “Buy” and “Overweight” recommendations. Notably, ASML has seen some recent downgrades, while Lam Research maintains a strong “Buy” position from multiple analysts, signaling robust investor confidence in its future performance.

Target Prices

The consensus target prices from reliable analysts for the selected companies indicate potential upside opportunities.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ASML Holding N.V. | 1200 | 800 | 1045 |

| Lam Research Corp. | 200 | 98 | 156.58 |

For ASML Holding N.V., the consensus target price of 1045 suggests a potential upside from the current price of 966.57. Similarly, Lam Research Corporation’s consensus of 156.58 indicates favorable expectations considering its current price of 142.65.

Strengths and Weaknesses

The following table outlines the key strengths and weaknesses of ASML Holding N.V. and Lam Research Corporation, helping you to evaluate their positions in the semiconductor industry.

| Criterion | ASML Holding N.V. | Lam Research Corporation |

|---|---|---|

| Diversification | High (focus on advanced semiconductor equipment) | Moderate (range of semiconductor processing equipment) |

| Profitability | Strong (Net profit margin: 28%) | Strong (Net profit margin: 29%) |

| Innovation | High (leading in EUV technology) | High (advanced etching and deposition technology) |

| Global presence | Extensive (operating in multiple regions) | Extensive (global sales and service network) |

| Market Share | Leading in lithography equipment | Strong player in etch and deposition markets |

| Debt level | Low (Debt to equity ratio: 0.27) | Moderate (Debt to equity ratio: 0.48) |

Key takeaways from the analysis indicate that both ASML and Lam Research exhibit strong profitability and extensive global presence. However, ASML excels in innovation and has a lower debt level, making it a potentially more stable investment option.

Risk Analysis

Below is a concise overview of the potential risks associated with ASML Holding N.V. and Lam Research Corporation.

| Metric | ASML Holding N.V. | Lam Research Corporation |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and geopolitical risks due to their dependence on global supply chains and fluctuating demand in the semiconductor industry. Recent tensions in international trade may further exacerbate these risks.

Which one to choose?

When comparing ASML Holding N.V. (ASML) and Lam Research Corporation (LRCX), both companies exhibit strong fundamentals. ASML has a market cap of approximately 263B, boasting a net profit margin of 26.8% and a price-to-earnings ratio of 34.77, indicating solid profitability but relatively high valuation. LRCX, on the other hand, has a market cap of around 125B, with a slightly better net profit margin of 29.1% and a lower price-to-earnings ratio of 23.36, suggesting better value for growth-oriented investors.

Both companies are rated B+, reflecting their strong financial health and operational efficiency. However, LRCX has shown a remarkable price increase of 82.11% in the last year, compared to ASML’s 27.7%, indicating a more bullish trend.

Investors focused on growth may prefer LRCX due to its higher recent performance, while those prioritizing stability might find ASML appealing. Both companies face risks related to market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ASML Holding N.V. and Lam Research Corporation to enhance your investment decisions: