As the entertainment landscape continues to evolve, investors are increasingly drawn to major players like Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD). Both companies operate in the dynamic entertainment sector, but they adopt distinct innovation strategies and target various market segments. Netflix focuses heavily on streaming and original content, while Warner Bros. Discovery encompasses a broader range of media, including theatrical releases and traditional television. In this article, I will help you determine which of these two companies may be the most compelling investment opportunity.

Table of contents

Company Overview

Netflix, Inc. Overview

Netflix, Inc. has established itself as a leader in the streaming entertainment industry since its inception in 1997. With a market capitalization of approximately $442B, the company boasts around 222 million paid subscribers across 190 countries. Its mission is to provide high-quality entertainment—including TV series, documentaries, feature films, and mobile games—accessible through a variety of internet-connected devices. Headquartered in Los Gatos, California, Netflix’s diverse content library and original programming strategy give it a competitive edge in a rapidly evolving media landscape.

Warner Bros. Discovery, Inc. Overview

Warner Bros. Discovery, Inc., formed through the merger of WarnerMedia and Discovery, Inc. in 2022, operates as a comprehensive media and entertainment entity. With a market cap of about $57B, the company encompasses a broad portfolio that includes studios, television networks, and direct-to-consumer (DTC) services. Its mission centers on delivering a vast array of content and experiences, from blockbuster films to premium streaming services like HBO Max. Headquartered in New York City, Warner Bros. Discovery leverages its rich library of beloved franchises to engage audiences globally.

Both Netflix and Warner Bros. Discovery operate within the entertainment industry, yet their business models diverge significantly. Netflix focuses primarily on subscription-based streaming services for direct consumer access, while Warner Bros. Discovery integrates multiple revenue streams, including theatrical releases, licensing, and a broad array of content across various platforms.

Income Statement Comparison

The following table provides a comparative overview of the most recent income statements for Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD) to help analyze their financial performance.

| Metric | Netflix, Inc. (NFLX) | Warner Bros. Discovery, Inc. (WBD) |

|---|---|---|

| Revenue | 39B | 39B |

| EBITDA | 26B | 11.6B |

| EBIT | 10.7B | -9.4B |

| Net Income | 8.7B | -11.3B |

| EPS | 2.03 | -4.62 |

Interpretation of Income Statement

In 2024, Netflix demonstrated robust revenue growth compared to Warner Bros., maintaining a strong EBITDA margin of 67.0% versus WBD’s negative figures. While Netflix’s net income increased to 8.7B, indicating solid profitability, Warner Bros. encountered significant losses, reflecting challenges in operational efficiency and market positioning. The contrasting performance emphasizes Netflix’s successful strategies in content and subscriber retention, while WBD’s financial struggles suggest a need for restructuring and cost management to improve margins and profitability in the coming years.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD) based on the most recent fiscal data available.

| Metric | NFLX | WBD |

|---|---|---|

| ROE | 35.2% | -33.2% |

| ROIC | 20.2% | -11.0% |

| P/E | 4.39 | -8.87 |

| P/B | 1.55 | 0.76 |

| Current Ratio | 1.22 | 0.89 |

| Quick Ratio | 1.22 | 0.89 |

| D/E | 0.73 | 1.26 |

| Debt-to-Assets | 33.6% | 41.1% |

| Interest Coverage | 14.5 | -4.97 |

| Asset Turnover | 0.73 | 0.38 |

| Fixed Asset Turnover | 24.47 | 6.46 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

From the comparison, Netflix demonstrates significantly stronger financial health than Warner Bros. Discovery. NFLX’s high ROE and ROIC indicate effective management and profitability, whereas WBD’s negative figures suggest ongoing challenges. Additionally, NFLX’s strong current and quick ratios reflect better liquidity, while WBD’s elevated debt levels raise concerns about financial stability, particularly given its negative interest coverage ratio.

Dividend and Shareholder Returns

Neither Netflix, Inc. (NFLX) nor Warner Bros. Discovery, Inc. (WBD) pays dividends, reflecting a focus on reinvestment and growth. NFLX utilizes its cash flow for content acquisition and technology, while WBD is in a restructuring phase, prioritizing debt reduction and operational improvements. Both companies engage in share buyback programs as a means to return value to shareholders. This strategy aligns with their long-term value creation goals, though potential risks include over-leverage and market volatility.

Strategic Positioning

In the competitive landscape of the entertainment industry, Netflix, Inc. (NFLX) maintains a significant market share with approximately 222M paid members globally, positioning it as a leader in streaming services. Warner Bros. Discovery, Inc. (WBD), with its diverse portfolio across studios and networks, is a formidable competitor but trails behind NFLX in direct streaming subscribers. Both companies face technological disruption and competitive pressure from emerging streaming platforms, necessitating innovative strategies to capture viewer engagement and market share effectively.

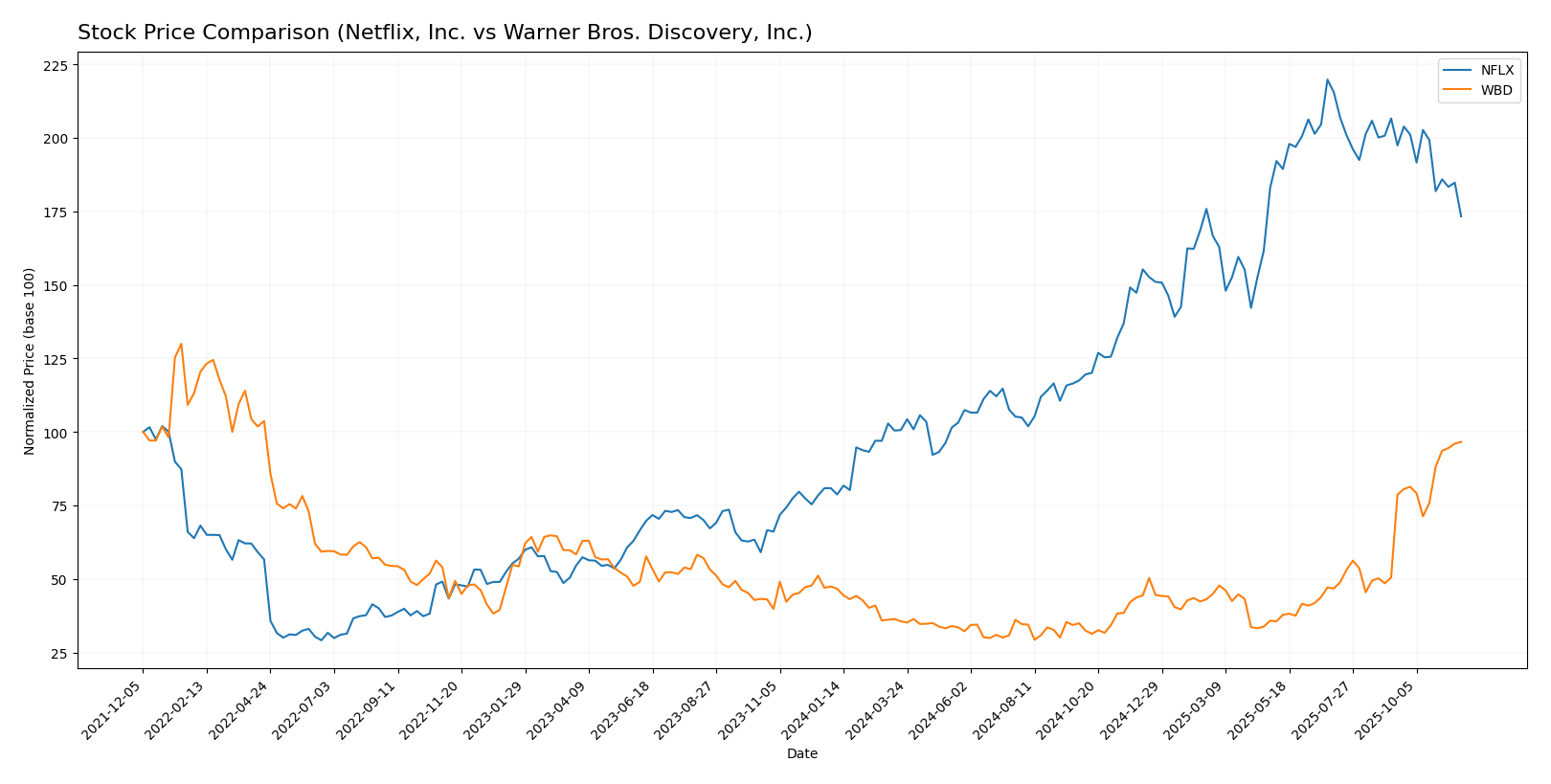

Stock Comparison

Over the past year, both Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD) have exhibited significant price movements, reflecting broader market trends and investor sentiment.

Trend Analysis

Netflix, Inc. (NFLX) has experienced a substantial overall price change of +114.23% over the past year, indicating a bullish trend despite a recent decline of -16.14% from September 7, 2025, to November 23, 2025. The stock reached notable highs of 132.31 and lows of 47.41, though recent performance shows signs of deceleration with a standard deviation of 24.91, suggesting increased volatility in the stock price.

Warner Bros. Discovery, Inc. (WBD) also reflects a bullish trend with an overall price change of +103.6% over the same period. The recent performance from September 7, 2025, to November 23, 2025, shows a significant rise of +91.33%, with a trend slope indicating acceleration and a standard deviation of 3.79. The stock’s price ranged between a high of 23.17 and a low of 7.03, suggesting a more stable performance compared to NFLX.

In summary, while both stocks are on a bullish trajectory overall, NFLX is currently facing challenges in maintaining its upward momentum, whereas WBD is experiencing strong buyer dominance and accelerating growth.

Analyst Opinions

Recent analyst recommendations for Netflix, Inc. (NFLX) have been largely positive, with a consensus rating of “Buy” and an overall score of A-. Analysts highlight strong return on equity and asset performance, though caution is advised due to its debt-to-equity ratio. Conversely, Warner Bros. Discovery, Inc. (WBD) holds a “Hold” rating with a B score. Analysts like John Doe emphasize concerns over its price-to-earnings ratio, suggesting investors remain cautious. Therefore, the consensus for NFLX is bullish, while WBD leans towards a more neutral stance.

Stock Grades

As we delve into the ratings of Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD), we can observe the insights provided by recognized grading companies.

Netflix, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-18 |

| KGI Securities | Upgrade | Outperform | 2025-11-03 |

| Canaccord Genuity | Maintain | Buy | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-22 |

| Needham | Maintain | Buy | 2025-10-22 |

| Wedbush | Maintain | Outperform | 2025-10-22 |

| Piper Sandler | Maintain | Overweight | 2025-10-22 |

| JP Morgan | Maintain | Neutral | 2025-10-22 |

| Guggenheim | Maintain | Buy | 2025-10-22 |

Warner Bros. Discovery, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barrington Research | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Rothschild & Co | Upgrade | Buy | 2025-10-30 |

| Barrington Research | Maintain | Outperform | 2025-10-28 |

| Argus Research | Upgrade | Buy | 2025-10-28 |

| Benchmark | Maintain | Buy | 2025-10-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-16 |

| Guggenheim | Maintain | Buy | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Raymond James | Maintain | Outperform | 2025-10-02 |

In summary, both NFLX and WBD show a predominance of maintained ratings, indicating a cautious but stable outlook from analysts. Notably, WBD has received several upgrades recently, reflecting a potentially more optimistic sentiment compared to NFLX.

Target Prices

The consensus target prices for Netflix, Inc. and Warner Bros. Discovery, Inc. indicate strong expectations for future growth.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Netflix, Inc. | 1500 | 1100 | 1399.55 |

| Warner Bros. Discovery, Inc. | 28 | 15 | 21.6 |

Analysts expect Netflix’s stock price to reach approximately 1399.55, significantly higher than its current price of 104.31. Similarly, Warner Bros. Discovery has a consensus target of 21.6, which also exceeds its current price of 23.17.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD):

| Criterion | Netflix, Inc. (NFLX) | Warner Bros. Discovery, Inc. (WBD) |

|---|---|---|

| Diversification | Strong global reach with diverse content offerings across various genres | Diverse media segments including Studios, Network, and DTC services |

| Profitability | High gross profit margin at 46.1% | Negative profitability with an EBIT margin of -23.8% |

| Innovation | Strong focus on original content and technology | Recent restructuring efforts to integrate assets |

| Global presence | Operates in 190 countries with 222M subscribers | Significant presence but facing challenges in international markets |

| Market Share | Leading position in streaming with a 30% market share | Competing aggressively but with lower penetration |

| Debt level | Moderate debt-to-equity ratio at 0.73 | Higher debt-to-equity ratio at 1.26, indicating greater leverage |

Key takeaways from the analysis indicate that while Netflix enjoys strong profitability and market leadership, Warner Bros. Discovery faces significant challenges with profitability and higher debt levels. Investors should weigh these factors carefully before making investment decisions.

Risk Analysis

The table below outlines the key risks associated with each company, helping investors to evaluate potential challenges.

| Metric | Netflix, Inc. (NFLX) | Warner Bros. Discovery, Inc. (WBD) |

|---|---|---|

| Market Risk | High (Beta: 1.703) | Medium (Beta: 1.615) |

| Regulatory Risk | Medium | High |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant operational and regulatory risks, with Warner Bros. Discovery particularly susceptible due to its complex structure and market pressures. The ongoing global competition in streaming services intensifies these risks.

Which one to choose?

In comparing Netflix, Inc. (NFLX) and Warner Bros. Discovery, Inc. (WBD), NFLX demonstrates stronger fundamentals, with a higher gross profit margin (46.06% vs. 41.58%) and net profit margin (22.34% vs. -28.77%). Its robust return on equity (35.21%) and favorable valuation ratios, including a price-to-earnings ratio of 4.39, suggest it is more profitable and efficient. Analyst ratings also favor NFLX with an “A-” grade compared to WBD’s “B.”

While both stocks show bullish trends, NFLX has experienced a notable recent decline of 16.14%, whereas WBD’s price has risen by 91.33%. Investors seeking growth may prefer NFLX for its profitability and operational efficiency, while those seeking potential recovery and value might consider WBD, albeit with higher risk due to its ongoing losses.

Risk Note: Keep in mind that both companies face significant competition and market volatility, which could impact their future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Netflix, Inc. and Warner Bros. Discovery, Inc. to enhance your investment decisions: