As we navigate the dynamic landscape of the automotive industry, two companies stand out: Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY). Both operate within the consumer cyclical sector but serve distinct niches—Copart focuses on vehicle remarketing through online auctions, while O’Reilly specializes in automotive aftermarket parts. This comparison will delve into their innovations, market strategies, and potential for growth. Join me as we explore which company might be the more intriguing investment opportunity for your portfolio.

Table of contents

Company Overview

Copart, Inc. Overview

Copart, Inc. specializes in online auctions and vehicle remarketing services across various countries, including the U.S., Canada, and several European nations. Founded in 1982 and headquartered in Dallas, Texas, the company utilizes advanced internet auction technology to facilitate the sale of vehicles for insurers, banks, and individuals. With a market capitalization of approximately $39.4B, Copart has established itself as a leader in vehicle processing, offering a variety of services such as salvage estimation, title processing, and vehicle inspection. The company’s innovative approach to vehicle remarketing positions it well within the auto dealership industry.

O’Reilly Automotive, Inc. Overview

O’Reilly Automotive, Inc. operates as a leading retailer and supplier of automotive aftermarket parts and accessories in the U.S. Founded in 1957, it is headquartered in Springfield, Missouri, and boasts a market cap of about $84.9B. O’Reilly offers a wide range of products, from new and remanufactured automotive parts to tools and equipment for both DIY customers and professional service providers. With over 5,700 stores nationwide, the company has built a strong presence in the auto parts industry, emphasizing customer service and sustainable practices, such as battery and oil recycling.

Key Similarities and Differences

Both Copart and O’Reilly operate within the consumer cyclical sector, focusing on the automotive industry but with distinct business models. Copart primarily engages in vehicle auctions and remarketing services, while O’Reilly specializes in retailing automotive parts and accessories. This difference shapes their respective customer bases, with Copart targeting insurance companies and dealers, and O’Reilly focusing on individual consumers and professional mechanics.

Income Statement Comparison

The following table presents a comparison of the income statements for Copart, Inc. and O’Reilly Automotive, Inc. for their most recent fiscal years, highlighting key financial metrics.

| Metric | Copart, Inc. (CPRT) | O’Reilly Automotive, Inc. (ORLY) |

|---|---|---|

| Revenue | 4.65B | 16.71B |

| EBITDA | 2.11B | 3.73B |

| EBIT | 1.90B | 3.27B |

| Net Income | 1.55B | 2.39B |

| EPS | 1.61 | 2.73 |

Interpretation of Income Statement

In the most recent fiscal year, Copart, Inc. experienced significant revenue growth from 4.24B to 4.65B, while O’Reilly Automotive also saw a notable revenue increase from 15.81B to 16.71B. Both companies maintained healthy EBITDA and EBIT margins, with Copart’s margins slightly improving, reflecting efficient cost management. O’Reilly’s net income rose significantly, showcasing strong operational performance. Despite Copart’s impressive growth, O’Reilly’s scale and profitability remain robust, making both companies worthy of consideration for investors focused on strong financial fundamentals.

Financial Ratios Comparison

Below is a comparative analysis of the most recent financial ratios for Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY).

| Metric | Copart, Inc. | O’Reilly Automotive, Inc. |

|---|---|---|

| ROE | 16.90% | -1.74% |

| ROIC | 14.67% | 36.26% |

| P/E | 28.19 | 24.49 |

| P/B | 4.76 | N/A |

| Current Ratio | 8.25 | 0.70 |

| Quick Ratio | 8.19 | 0.09 |

| D/E | 0.011 | -5.78 |

| Debt-to-Assets | 0.010 | 0.531 |

| Interest Coverage | 0 | 14.61 |

| Asset Turnover | 0.46 | 1.14 |

| Fixed Asset Turnover | 1.26 | 2.18 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

In this comparison, Copart demonstrates strong liquidity with a current ratio of 8.25, indicating a solid capacity to cover short-term obligations. However, its high P/E ratio of 28.19 suggests that it may be overvalued relative to its earnings. Conversely, O’Reilly shows impressive operational efficiency, reflected in its asset turnover ratio of 1.14, but its negative ROE indicates significant financial distress. Risk management is crucial when considering these contrasting profiles.

Dividend and Shareholder Returns

Both Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY) do not distribute dividends, reflecting a focus on reinvestment and growth. Copart’s robust free cash flow supports its share buyback program, while O’Reilly’s negative equity and high leverage indicate a cautious approach to shareholder returns. This strategy prioritizes capital allocation for future expansion over immediate payouts, potentially enhancing long-term shareholder value if managed prudently.

Strategic Positioning

In the competitive landscape of the automotive sector, Copart, Inc. (CPRT) holds a significant market share in the vehicle remarketing space, leveraging its online auction platform. In contrast, O’Reilly Automotive, Inc. (ORLY) dominates the automotive aftermarket parts industry with a robust network of 5,759 stores. Both companies face competitive pressures from emerging technologies and market entrants, but their established positions and adaptive strategies help mitigate risks associated with technological disruption.

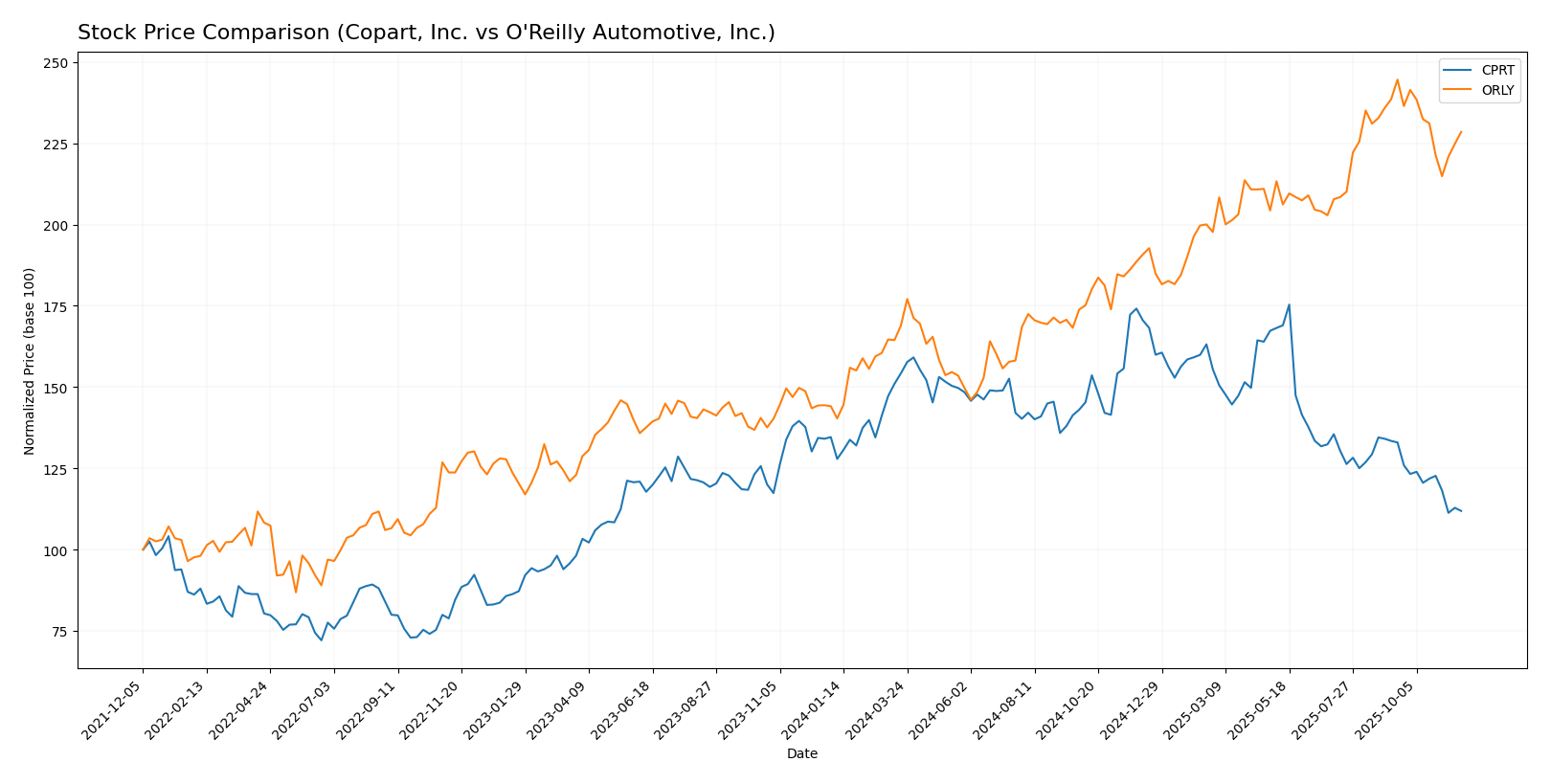

Stock Comparison

In this section, I will analyze the weekly stock price movements of Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY) over the past year, highlighting significant price dynamics and trading behaviors.

Trend Analysis

Copart, Inc. (CPRT)

Over the past year, CPRT has experienced a price change of -16.88%. This decline indicates a bearish trend, corroborated by the recent price analysis showing a -16.14% change. The stock reached a high of 63.84 and a low of 40.51, with a standard deviation of 5.2 suggesting notable volatility in its price movements. The trend is currently in a state of deceleration, indicating a weakening downward momentum.

O’Reilly Automotive, Inc. (ORLY)

In contrast, ORLY has shown a strong performance with a price change of +58.56% over the last year, classifying it as a bullish trend. However, the recent trend analysis indicates a slight decline of -4.21% within the same timeframe. The stock’s price fluctuated between a high of 107.5 and a low of 61.69, with a standard deviation of 12.13 reflecting high volatility. Similar to CPRT, ORLY’s trend is also in deceleration, suggesting a potential softening in growth momentum.

Analyst Opinions

Recent analyst recommendations for Copart, Inc. (CPRT) show a consensus rating of “Buy” with a B+ grade, reflecting strong performance in return on assets and equity, according to analysts. Notably, the firm demonstrates solid growth potential, making it an attractive option for investors. Conversely, O’Reilly Automotive, Inc. (ORLY) holds a B- rating with a consensus to “Hold.” Analysts point to concerns over return on equity and debt levels, suggesting caution despite some solid metrics. Overall, the consensus leans toward a buy for CPRT and a hold for ORLY in 2025.

Stock Grades

In this section, I will provide the latest stock ratings for two companies, Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY), based on reliable data from recognized grading companies.

Copart, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Underweight | 2025-11-21 |

| Baird | maintain | Outperform | 2025-11-21 |

| Stephens & Co. | maintain | Equal Weight | 2025-09-05 |

| HSBC | upgrade | Buy | 2025-09-04 |

| Baird | maintain | Outperform | 2025-07-17 |

| JP Morgan | maintain | Neutral | 2025-05-23 |

| Baird | maintain | Outperform | 2025-02-21 |

| JP Morgan | maintain | Neutral | 2024-11-19 |

| Baird | maintain | Outperform | 2024-09-05 |

| JP Morgan | maintain | Neutral | 2024-04-08 |

O’Reilly Automotive, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2025-10-27 |

| Goldman Sachs | maintain | Buy | 2025-10-24 |

| RBC Capital | maintain | Outperform | 2025-10-24 |

| Morgan Stanley | maintain | Overweight | 2025-10-23 |

| UBS | maintain | Buy | 2025-10-15 |

| Wells Fargo | maintain | Overweight | 2025-10-15 |

| TD Cowen | maintain | Buy | 2025-09-15 |

| Evercore ISI Group | maintain | Outperform | 2025-08-12 |

| Barclays | maintain | Equal Weight | 2025-07-25 |

| Evercore ISI Group | maintain | Outperform | 2025-07-25 |

Overall, the grades for Copart show a mix of maintain actions with a recent upgrade to a Buy from HSBC, indicating cautious optimism. On the other hand, O’Reilly Automotive maintains a consistent outlook with multiple firms reiterating their positive ratings, suggesting a solid market position and investor confidence.

Target Prices

The consensus target prices for Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY) indicate potential upside from their current market prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Copart, Inc. | 62 | 33 | 49 |

| O’Reilly Automotive, Inc. | 121 | 91 | 111.9 |

For Copart, the consensus target of 49 suggests an upside from the current price of 40.73, while O’Reilly’s target of 111.9 indicates significant potential growth from its current price of 100.43. Overall, both companies show favorable analyst expectations.

Strengths and Weaknesses

In this section, I will outline the strengths and weaknesses of Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY) to provide a clear comparison for investors.

| Criterion | Copart, Inc. (CPRT) | O’Reilly Automotive, Inc. (ORLY) |

|---|---|---|

| Diversification | Strong global presence with services across multiple countries. | Focused primarily on the U.S. market with limited international presence. |

| Profitability | High net profit margin of 33.4%. | Lower net profit margin of 14.8%. |

| Innovation | Advanced online auction technology. | Strong product offerings, but less emphasis on tech innovation. |

| Global presence | Operates in 11 countries. | Primarily operates in the U.S. and Mexico. |

| Market Share | 30% in the vehicle auction market. | Significant share in the automotive parts market. |

| Debt level | Very low debt-to-assets ratio of 1.0%. | High debt-to-equity ratio of -5.8%, indicating potential financial leverage concerns. |

Key takeaways: Copart demonstrates stronger profitability and a better global presence compared to O’Reilly. However, O’Reilly has a solid market share in the automotive parts sector, which may appeal to investors looking for stability in a focused market.

Risk Analysis

The table below summarizes the key risks associated with Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY):

| Metric | Copart, Inc. (CPRT) | O’Reilly Automotive, Inc. (ORLY) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

In my analysis, O’Reilly Automotive presents a higher operational risk due to its reliance on consumer spending in a volatile market. Additionally, both companies face moderate market risks, with Copart experiencing fluctuations due to the online auction space.

Which one to choose?

In evaluating Copart, Inc. (CPRT) and O’Reilly Automotive, Inc. (ORLY), CPRT shows stronger fundamentals with a higher gross profit margin of 45.2% compared to ORLY’s 51.2%. However, ORLY’s net income margin is lower at 14.8%, indicating less efficiency in converting revenue to profit. CPRT maintains a solid financial position with a low debt-to-equity ratio of 0.011, while ORLY struggles with a negative book value per share, reflecting financial instability.

Analyst ratings favor CPRT with a grade of B+, while ORLY holds a B-. The stock trend for CPRT is currently bearish, down 16.9%, while ORLY has enjoyed a bullish trend, increasing 58.6% overall.

Investors focused on growth may prefer CPRT for its profitability and stability, while those seeking value might lean towards ORLY’s recent performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Copart, Inc. and O’Reilly Automotive, Inc. to enhance your investment decisions: