In the evolving landscape of the travel industry, two giants stand out: Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR). While both companies operate within the travel sector, they represent different approaches to hospitality—Airbnb focuses on a peer-to-peer marketplace for unique stays, while Marriott offers traditional hotel accommodations. With differing innovation strategies and market overlaps, this analysis will help investors determine which company may provide the most promising opportunities moving forward. Join me as we explore their potential.

Table of contents

Company Overview

Airbnb, Inc. Overview

Airbnb, Inc. is a leading platform in the travel services industry, connecting hosts with guests seeking unique accommodations and experiences worldwide. Founded in 2007 and headquartered in San Francisco, California, Airbnb operates primarily through its online marketplace, which allows individuals to list their private rooms, homes, or vacation properties for booking. With a market cap of approximately $70.7B, Airbnb has revolutionized the way people travel by offering a diverse range of lodging options and experiences beyond traditional hotels. The company’s mission focuses on fostering a sense of belonging for travelers and hosts alike, making travel more accessible and personalized.

Marriott International, Inc. Overview

Marriott International, Inc. is a global leader in the lodging industry, operating, franchising, and licensing a vast array of hotel properties and resorts. Founded in 1927, Marriott is headquartered in Bethesda, Maryland, and boasts a market cap of around $79.4B. The company manages over 7,989 properties under 30 brands, including luxury options like The Ritz-Carlton and JW Marriott, as well as more budget-friendly offerings. Marriott’s mission emphasizes quality service and guest satisfaction, aiming to create memorable travel experiences for business and leisure travelers worldwide.

Key similarities and differences in their business models include Airbnb’s peer-to-peer marketplace approach, which allows individual hosts to monetize their spaces, versus Marriott’s traditional hotel management and franchising model that focuses on standardized services and brand loyalty. While both companies operate within the travel sector, their strategies and target markets differ significantly.

Income Statement Comparison

The following table outlines the income statements for Airbnb, Inc. and Marriott International, Inc. for the most recent fiscal year, providing insights into their financial performance.

| Metric | Airbnb, Inc. (ABNB) | Marriott International, Inc. (MAR) |

|---|---|---|

| Revenue | 11.10B | 25.10B |

| EBITDA | 2.62B | 4.34B |

| EBIT | 2.55B | 3.85B |

| Net Income | 2.65B | 2.38B |

| EPS | 4.19 | 8.36 |

Interpretation of Income Statement

In 2024, Airbnb experienced significant revenue growth of approximately 12% compared to the previous year, while Marriott’s revenue also increased by about 5.8%. Despite the challenges, both companies maintained healthy EBITDA margins, with Airbnb slightly improving its EBIT margin. However, Airbnb’s net income decreased compared to 2023, indicating potential cost pressures or investments impacting profitability. Marriott, on the other hand, showed stable net income, reflecting effective cost management amidst rising revenues. This analysis suggests that while both companies are performing well overall, investors should monitor Airbnb for potential volatility in profit margins.

Financial Ratios Comparison

In the following table, I present a comparison of the most recent financial ratios for Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR). This analysis should help you assess their financial health relative to each other.

| Metric | ABNB | MAR |

|---|---|---|

| ROE | 31.48% | -79.38% |

| ROIC | 18.69% | 15.07% |

| P/E | 31.36 | 22.05 |

| P/B | 9.87 | -99.69 |

| Current Ratio | 1.69 | 0.40 |

| Quick Ratio | 1.69 | 0.40 |

| D/E | 0.27 | -18.71 |

| Debt-to-Assets | 10.95% | 49.70% |

| Interest Coverage | 0.00 | 6.84 |

| Asset Turnover | 0.53 | 0.96 |

| Fixed Asset Turnover | 38.15 | 9.37 |

| Payout Ratio | 0.00 | 19.04% |

| Dividend Yield | 0.00% | 0.86% |

Interpretation of Financial Ratios

The financial ratios reveal distinct strengths and weaknesses for both companies. ABNB boasts a strong ROE and quick ratio, indicating efficient use of equity and good short-term liquidity. In contrast, MAR shows a troubling negative ROE and a low current ratio, suggesting financial distress. While ABNB does not pay dividends, MAR offers a modest yield, which could appeal to income-focused investors. However, the significant debt levels at MAR raise concerns over sustainability.

Dividend and Shareholder Returns

Airbnb, Inc. (ABNB) does not pay dividends, opting instead to reinvest earnings into growth opportunities, reflecting a high-growth strategy. This aligns with their focus on expanding market presence. However, they do not currently engage in share buybacks, which could have provided additional shareholder returns.

In contrast, Marriott International, Inc. (MAR) offers a dividend with a payout ratio of approximately 28.7% and a yield of 0.86%. They also execute share buybacks, demonstrating a balanced approach to returning value to shareholders. This combination supports sustainable long-term shareholder value creation for MAR, while ABNB’s strategy remains focused on growth potential.

Strategic Positioning

In the competitive landscape of the travel services sector, Airbnb, Inc. (ABNB) holds a significant market share with its innovative platform connecting hosts and guests. As of now, it competes closely with Marriott International, Inc. (MAR), which dominates the lodging segment with a vast portfolio of over 7,900 properties. Both companies face competitive pressure from emerging platforms and traditional lodging establishments, as technological disruptions continue to reshape consumer preferences in travel and accommodation. Risk management remains crucial as market dynamics evolve.

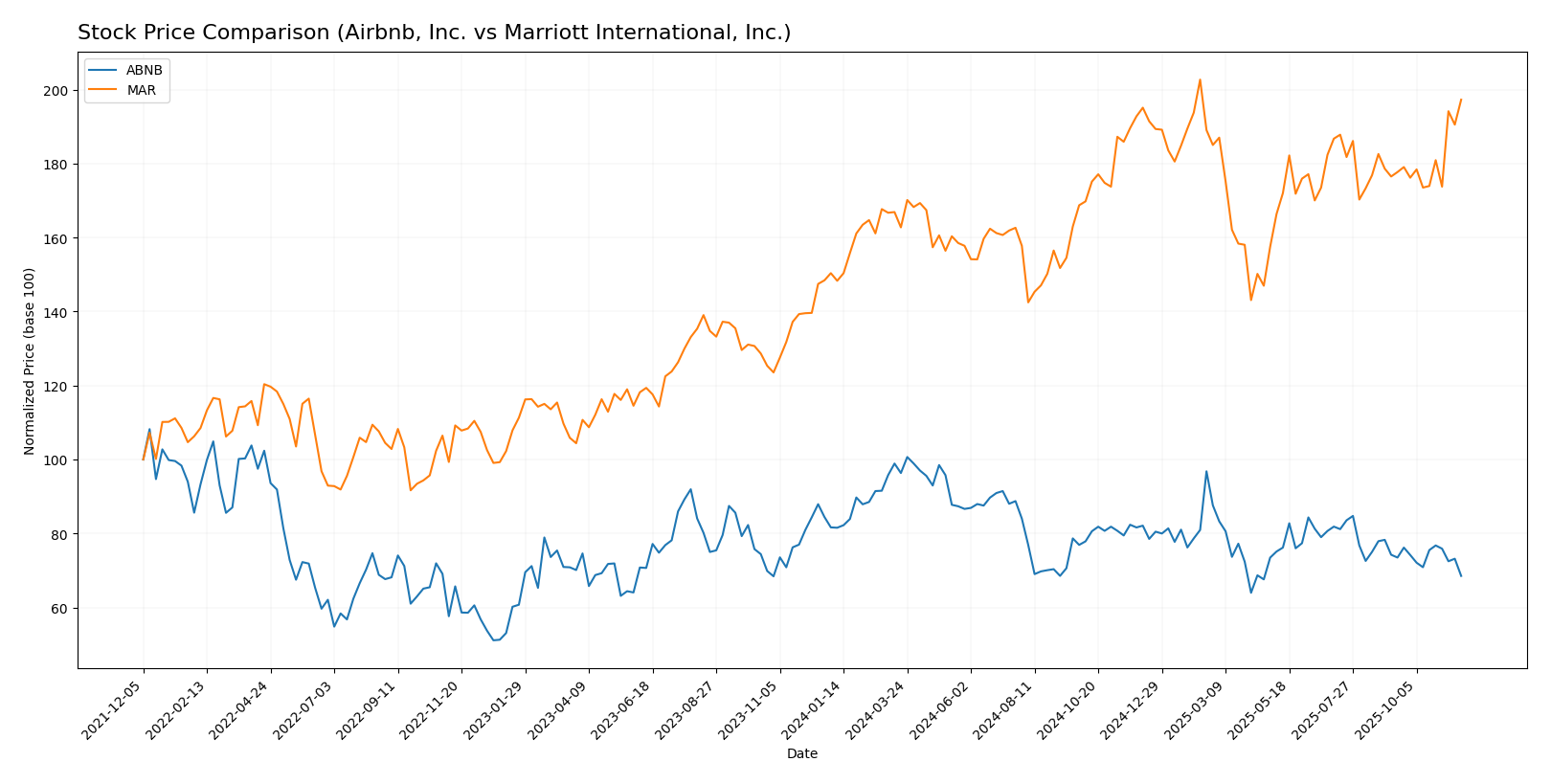

Stock Comparison

In this section, I will analyze the weekly stock price movements of Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR) over the past year, highlighting key price dynamics and trends.

Trend Analysis

For Airbnb, Inc. (ABNB), the stock has experienced a significant decline of -16.07% over the past year. This bearish trend indicates a deceleration in price movements, with a notable standard deviation of 13.59, reflecting increased volatility. The stock reached a high of 167.86 and a low of 106.66 during this period, suggesting that while the price has fluctuated, the overall direction remains negative.

In the recent trend analysis (from September 7, 2025, to November 23, 2025), ABNB’s price has decreased by -7.71% with a standard deviation of 3.83. This further confirms the bearish sentiment, with a trend slope of -0.38, indicating further price contraction.

Conversely, Marriott International, Inc. (MAR) shows a strong bullish trend with a 31.19% increase over the past year. This upward movement is characterized by acceleration, as indicated by a standard deviation of 20.99, suggesting significant volatility but overall positive momentum. MAR achieved a peak price of 303.97 and a low of 213.67, showcasing robust price growth.

In the recent analysis period (also from September 7, 2025, to November 23, 2025), MAR’s stock saw an 11.76% increase, with a standard deviation of 11.87. The trend slope of 2.33 further supports the bullish outlook, indicating accelerating price gains.

In summary, while ABNB faces persistent challenges reflected in its bearish trend, MAR stands out with a solid upward trajectory, making it a more favorable option for investors looking for growth opportunities.

Analyst Opinions

Recent analyst recommendations show a mixed sentiment toward Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR). Analysts rate ABNB with an “A-” and an overall score of 4, suggesting a strong buy due to its high return on equity and assets, although its debt-to-equity and price metrics are less favorable. In contrast, MAR holds a “B-” rating with an overall score of 2, indicating a hold position, mainly due to lower return metrics. The consensus for ABNB is a buy, while MAR leans toward a hold for the current year.

Stock Grades

In the current market landscape, both Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR) have received consistent evaluations from reputable grading companies. Here’s a look at their recent stock grades:

Airbnb, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Underweight | 2025-11-07 |

| Wedbush | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Underweight | 2025-11-07 |

| UBS | maintain | Neutral | 2025-11-07 |

| BTIG | maintain | Neutral | 2025-11-07 |

| UBS | maintain | Neutral | 2025-10-24 |

| Keybanc | maintain | Sector Weight | 2025-10-23 |

| BTIG | maintain | Neutral | 2025-10-07 |

| Truist Securities | maintain | Sell | 2025-09-03 |

| JMP Securities | maintain | Market Perform | 2025-08-11 |

Marriott International, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2025-11-05 |

| BMO Capital | maintain | Market Perform | 2025-11-05 |

| Morgan Stanley | maintain | Overweight | 2025-10-22 |

| Baird | maintain | Neutral | 2025-10-21 |

| Barclays | maintain | Equal Weight | 2025-10-03 |

| Truist Securities | maintain | Hold | 2025-09-03 |

| Baird | maintain | Neutral | 2025-08-20 |

| BMO Capital | maintain | Market Perform | 2025-08-06 |

| Baird | maintain | Neutral | 2025-07-16 |

| Truist Securities | maintain | Hold | 2025-05-30 |

Overall, the grades for both companies indicate a cautious outlook, with many firms maintaining their previous evaluations rather than making significant upgrades or downgrades. This trend suggests a stable but uncertain market position for both Airbnb and Marriott, and investors should consider these insights carefully when making portfolio decisions.

Target Prices

Currently, I have reliable target price data for both Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Airbnb, Inc. | 165 | 105 | 137.43 |

| Marriott International, Inc. | 327 | 274 | 295.5 |

The consensus target prices suggest that Airbnb has a potential upside with a target consensus of 137.43 compared to its current price of 114.26. Meanwhile, Marriott is also expected to perform positively, with a target consensus of 295.5 against its current price of 295.84.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR) based on their recent financial data.

| Criterion | Airbnb, Inc. (ABNB) | Marriott International, Inc. (MAR) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | High (24% net margin) | Moderate (9% net margin) |

| Innovation | Strong (tech-driven) | Moderate (traditional models) |

| Global presence | Expanding | Extensive |

| Market Share | Growing | Leading |

| Debt level | Low (11% debt to assets) | High (58% debt to assets) |

Key takeaways indicate that while Airbnb boasts strong profitability and innovation, Marriott maintains a robust global presence and market share despite higher debt levels. Investors should weigh these factors carefully when considering investments in either company.

Risk Analysis

The table below outlines the key risks associated with Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR).

| Metric | Airbnb, Inc. (ABNB) | Marriott International, Inc. (MAR) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | High | Moderate |

Both companies face significant risks, particularly in market volatility and operational challenges. The travel industry is sensitive to economic downturns and geopolitical tensions, which can greatly impact performance.

Which one to choose?

In comparing Airbnb, Inc. (ABNB) and Marriott International, Inc. (MAR), the financial fundamentals reveal distinct profiles. Airbnb has demonstrated a robust gross profit margin of 83.08% and a commendable net profit margin of 23.85%, which indicate strong operational efficiency. Conversely, Marriott’s margins are significantly lower, with a gross profit margin of 20.32% and a net profit margin of 9.46%. While both companies have shown varying stock trends, ABNB has recently faced a bearish trend with a price change of -16.07%, while MAR has enjoyed a bullish trend with a price increase of 31.19%.

Analyst ratings reflect this divergence: ABNB holds an ‘A-‘ rating compared to MAR’s ‘B-‘, suggesting a stronger overall performance for Airbnb. However, potential investors must consider risks such as competition and market dependence in both sectors.

Recommendation: Investors focused on growth may prefer Airbnb for its higher margins and strong profitability metrics, while those prioritizing stability may lean towards Marriott, which has shown consistent revenue growth.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Airbnb, Inc. and Marriott International, Inc. to enhance your investment decisions: