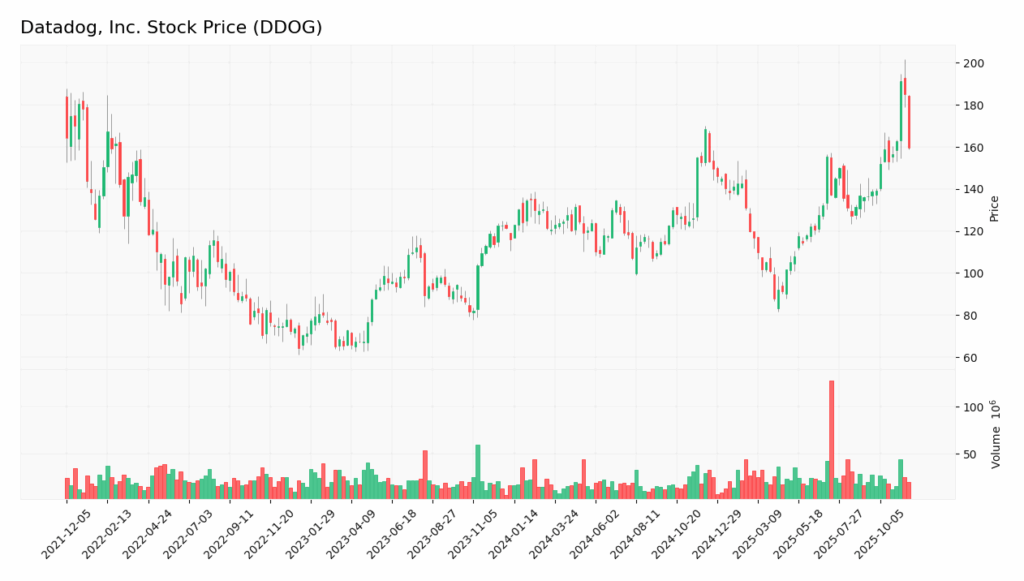

Datadog, Inc. (NASDAQ: DDOG) has experienced a notable decline in its stock price, falling approximately 5% after recent market activities. The primary catalysts for this downturn include heightened competition following Palo Alto Networks’ acquisition of Chronosphere and significant insider selling by executives. Understanding these factors is crucial for investors navigating the current landscape.

Key Facts and Data

In its latest earnings report, Datadog posted earnings per share (EPS) of $0.55 on revenue of $885.65 million, up 28.4% year over year. Despite exceeding analyst expectations, the stock has faced downward pressure, opening at $159.57 and trading at a market capitalization of $55.96 billion. Institutional ownership remains strong at approximately 78.29%, though recent insider selling has raised investor concerns.

| Metric | Value |

|---|---|

| Earnings per Share (EPS) | $0.55 |

| Revenue | $885.65 million |

| Year-over-Year Revenue Growth | 28.4% |

| Market Capitalization | $55.96 billion |

| 52-Week Price Range | $81.63 – $201.69 |

Market and Analyst Reactions

Following Palo Alto Networks’ acquisition announcement, analysts expressed concerns about increased competition in the observability space. Notably, Bank of America suggested that Datadog and its peers must innovate rapidly to maintain their competitive edge. Despite the recent stock decline, analysts remain positive on Datadog, with a consensus target price of $207.38.

Analyst Commentary

Analysts from KeyCorp and Bank of America have raised their price targets for Datadog, reflecting confidence in its long-term prospects despite the recent pressure. KeyCorp set its target at $230.00, while Bank of America adjusted its target to $215.00.

Market Behavior

In the latest trading session, Datadog shares saw significant volatility, fluctuating around $159.57 after opening. The stock’s performance was affected by broader market sentiment toward tech stocks and competitive developments in the industry.

Underlying Reasons Behind the Move

The decline in Datadog’s stock price can be attributed to several key factors. The acquisition of Chronosphere by Palo Alto Networks, aimed at enhancing its AI capabilities, has raised concerns about pricing pressures and market share loss for Datadog. Additionally, the significant insider selling by CEO Olivier Pomel and other executives has contributed to negative investor sentiment.

Financial Drivers

Despite strong financial performance, with a reported EPS of $0.55 and revenue growth of 28.4%, the insider selling has raised questions about executive confidence in the company’s future. Pomel’s sale of 100,754 shares for approximately $18.25 million reflects a strategic divestment that may be interpreted negatively by the market.

Strategic or External Factors

The competitive landscape is evolving, especially with Palo Alto’s acquisition signaling a more aggressive approach in the observability market. Analysts at BMO Capital noted that competitors like Datadog will need to accelerate innovation to remain relevant, further heightening competitive pressures.

Broader Market Context

The recent movement in Datadog’s stock is not isolated; it reflects broader trends within the tech sector, particularly among observability and cloud service providers. Following the acquisition and subsequent market reactions, stocks in similar industries have also come under pressure, indicating sector-wide concerns about valuation and competitive positioning.

What’s Next?

Looking ahead, investors should monitor Datadog’s performance closely as it navigates these competitive challenges. Upcoming earnings reports and product launches will be crucial in determining whether the company can regain investor confidence. Analysts suggest the stock may experience short-term fluctuations but could stabilize if Datadog successfully demonstrates its growth potential.

Short-Term Outlook

In the next few weeks, investors may see continued volatility in Datadog’s stock as market sentiment reacts to new developments and earnings announcements.

Long-Term View

If Datadog can leverage its strong fundamentals and address competitive pressures through innovation, the stock may rebound, as analysts remain cautiously optimistic about its long-term growth trajectory.

Conclusion

Datadog’s recent stock decline is primarily driven by competitive pressures following Palo Alto’s acquisition of Chronosphere and notable insider selling. While analysts maintain a generally positive outlook, the company faces near-term challenges that could affect its stock price. Investors should remain vigilant and consider both the potential risks and rewards associated with Datadog’s future performance.

- https://www.tipranks.com/news/the-fly/datadog-dynatrace-under-pressure-after-palo-alto-buys-rival-thefly

- https://www.marketbeat.com/instant-alerts/filing-cetera-investment-advisers-reduces-stake-in-datadog-inc-ddog-2025-11-21/

- https://www.marketbeat.com/instant-alerts/filing-ensign-peak-advisors-inc-lowers-stock-position-in-datadog-inc-ddog-2025-11-21/

- https://artificall.com/analysis/companies/datadog-inc/