In the competitive landscape of consumer goods, Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC) emerge as key players, each offering a diverse portfolio of snack and food products. Both companies operate within the food sector, showcasing a significant market overlap in their offerings, especially in snacks and packaged foods. Their distinct innovation strategies further set them apart, making this comparison not only relevant but essential for investors. Join me as we explore which of these companies presents a more compelling opportunity for your investment portfolio.

Table of contents

Company Overview

Mondelez International, Inc. Overview

Mondelez International, Inc. operates as a leading global player in the snack food and beverage sector, with a diverse portfolio that includes recognized brands such as Cadbury, Oreo, and Trident. The company is committed to delivering high-quality snacks that cater to various consumer preferences across different regions, including North America, Europe, and Asia. With a market capitalization of approximately $72B and a strong distribution network, Mondelez emphasizes sustainability and innovation in its product offerings. Its mission focuses on creating delicious moments of joy while striving for operational excellence and responsible sourcing.

The Kraft Heinz Company Overview

The Kraft Heinz Company stands as one of the largest food and beverage companies globally, with a broad range of products that encompass condiments, sauces, meals, and snacks. Established through the merger of Kraft Foods and Heinz, the company is headquartered in Pittsburgh and emphasizes quality and value in its offerings. With a market cap of about $29.6B, Kraft Heinz is dedicated to meeting evolving consumer tastes while maintaining a commitment to sustainability and efficiency. Its mission revolves around innovating and improving food for a better life, capturing a wide spectrum of consumer needs.

Key similarities between Mondelez and Kraft Heinz include their focus on consumer packaged goods and their global reach in the food and beverage industry. However, they differ significantly in their product categories, with Mondelez primarily concentrating on snacks and confectionery, while Kraft Heinz emphasizes condiments, sauces, and meal products.

Income Statement Comparison

The following table compares the income statements of Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC) for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Mondelez International, Inc. (MDLZ) | The Kraft Heinz Company (KHC) |

|---|---|---|

| Revenue | 36.44B | 25.85B |

| EBITDA | 8.07B | 2.72B |

| EBIT | 6.77B | 1.77B |

| Net Income | 4.61B | 2.74B |

| EPS | 3.44 | 2.27 |

Interpretation of Income Statement

In the most recent fiscal year, Mondelez experienced robust revenue growth to 36.44B, up from 36.02B the previous year, while Kraft Heinz saw a decline from 26.64B to 25.85B. Both companies showed stability in EBITDA margins; however, KHC’s margin decline is concerning, given its lower revenue. MDLZ’s net income decreased slightly from 4.96B to 4.61B, indicating pressure on profitability, while KHC’s net income remained stable at 2.74B, but the drop in revenue raises questions about future performance. This analysis suggests a cautious approach to KHC, while MDLZ retains a positive outlook despite minor setbacks.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial ratios between Mondelez International (MDLZ) and The Kraft Heinz Company (KHC) for the fiscal year 2024.

| Metric | MDLZ | KHC |

|---|---|---|

| ROE | 17.12% | 5.78% |

| ROIC | 9.44% | 6.61% |

| P/E | 17.37 | 13.53 |

| P/B | 2.97 | 0.75 |

| Current Ratio | 0.68 | 1.06 |

| Quick Ratio | 0.48 | 0.59 |

| D/E | 0.68 | 0.40 |

| Debt-to-Assets | 26.82% | 22.50% |

| Interest Coverage | 12.49 | 5.01 |

| Asset Turnover | 0.53 | 0.29 |

| Fixed Asset Turnover | 3.56 | 3.61 |

| Payout ratio | 50.94% | 70.37% |

| Dividend yield | 2.93% | 5.23% |

Interpretation of Financial Ratios

In comparing MDLZ and KHC, MDLZ shows stronger profitability metrics, indicated by a higher ROE and ROIC, suggesting efficient use of equity and capital. KHC maintains a healthier current ratio, indicating better short-term liquidity. However, KHC has a significantly lower P/B ratio, implying potential undervaluation. Nevertheless, KHC’s higher debt-to-equity ratio raises concerns about leverage and financial risk, particularly given the lower interest coverage ratio. Investors should weigh these factors carefully when considering investment opportunities in these companies.

Dividend and Shareholder Returns

Mondelez International, Inc. (MDLZ) has a solid dividend strategy, with a payout ratio of 51% and a current annual yield of 2.93%, indicating healthy cash flow management. The company also engages in share buybacks, which can enhance shareholder value. Conversely, The Kraft Heinz Company (KHC) offers a higher yield of 5.20% with a payout ratio of 70%, though its cash flow coverage poses some risks. Both companies demonstrate commitment to shareholder returns, supporting long-term value creation.

Strategic Positioning

Mondelez International, Inc. (MDLZ) holds a strong position in the snack food market, with a market cap of $71.96B and a diverse product portfolio that includes well-known brands like Oreo and Cadbury. The Kraft Heinz Company (KHC), with a market cap of $29.57B, competes in the packaged foods sector, focusing on condiments and dairy products. Both companies face competitive pressure from emerging brands and must continuously innovate to stay relevant amidst technological disruptions in production and distribution. As an investor, I recommend monitoring their market shares and product innovations closely.

Stock Comparison

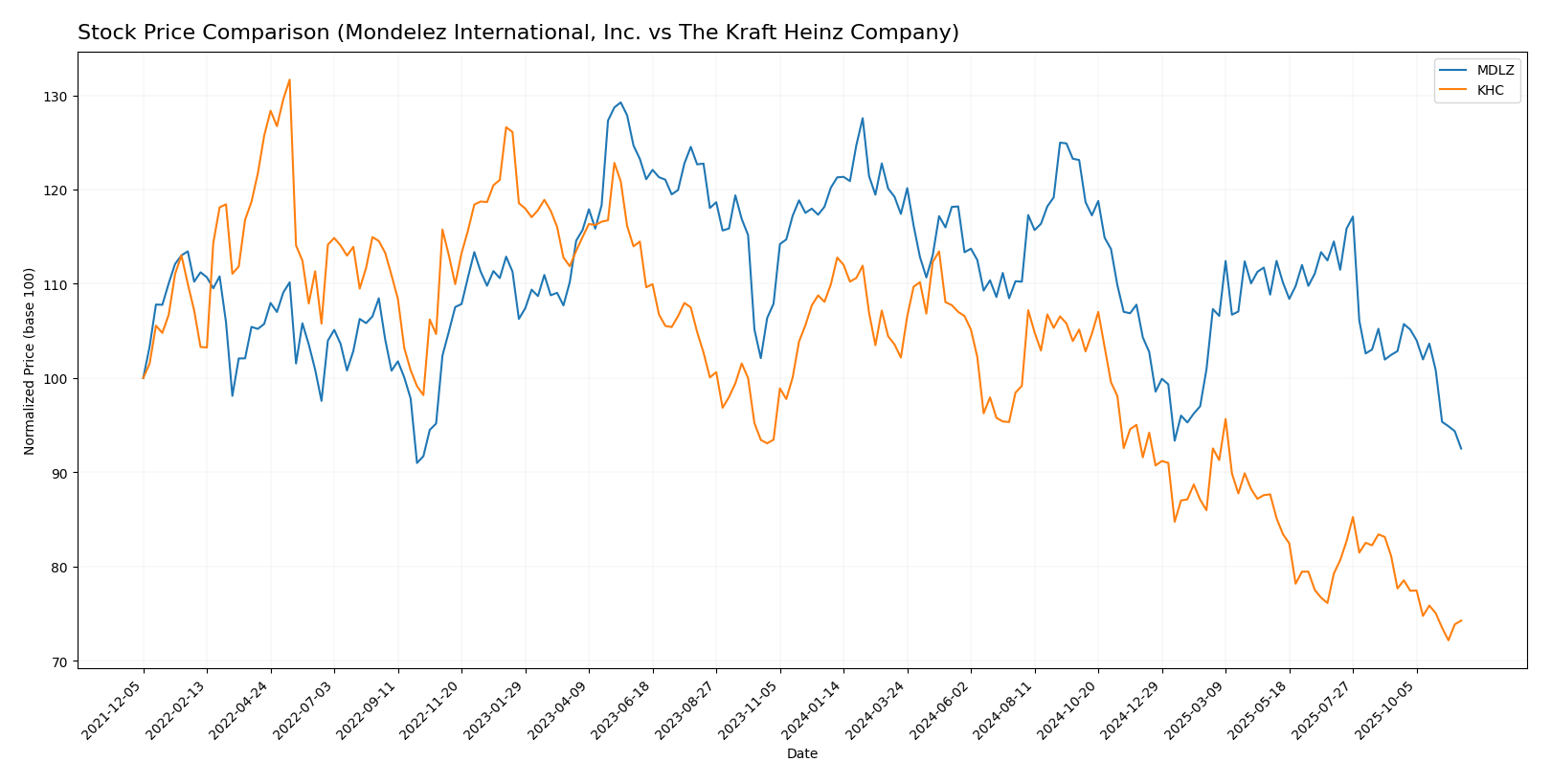

In this section, I will evaluate the stock performance of Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC) over the past year, highlighting key price movements and trading dynamics.

Trend Analysis

For Mondelez International, Inc. (MDLZ), the stock has experienced a percentage change of -23.03% over the past year, indicating a bearish trend. Notably, the stock reached a high of 76.87 and a low of 55.75, with the trend showing signs of deceleration. The recent period analysis reveals a further decline of -9.7% from September 7, 2025, to November 23, 2025, with a standard deviation of 2.7, suggesting some volatility in the short term.

In contrast, The Kraft Heinz Company (KHC) has seen a more pronounced decline, with a percentage change of -32.45% over the same period, also indicating a bearish trend. The stock’s highest price was 38.16, while the lowest was 24.28. The trend is similarly decelerating, and the recent analysis shows an -8.46% decrease during the recent period from September 7, 2025, to November 23, 2025, with a standard deviation of 0.82, reflecting a more stable but negative price movement.

Both companies are facing significant downward pressures, which investors should consider when evaluating potential investment opportunities.

Analyst Opinions

Recent analyst recommendations for Mondelez International, Inc. (MDLZ) indicate a consensus “Buy” rating, with a strong discounted cash flow score of 5, highlighting its solid growth potential. Analysts praise its robust return on equity and asset scores. Conversely, The Kraft Heinz Company (KHC) has a “Hold” rating, with its overall score at 2, primarily due to lower returns on equity and assets, despite a good price-to-book score. Analysts like those from major firms emphasize the need for cautious investment in KHC while favoring MDLZ for growth opportunities.

Stock Grades

In this section, I present the latest stock grades for two notable companies in the food and beverage sector, Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC).

Mondelez International, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-10 |

| Barclays | maintain | Overweight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-29 |

| Bernstein | maintain | Outperform | 2025-10-29 |

| Stifel | maintain | Buy | 2025-10-29 |

| B of A Securities | maintain | Buy | 2025-10-29 |

| Mizuho | maintain | Outperform | 2025-10-29 |

| RBC Capital | maintain | Outperform | 2025-10-29 |

| Piper Sandler | maintain | Neutral | 2025-10-29 |

| Wells Fargo | maintain | Overweight | 2025-10-29 |

The Kraft Heinz Company Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2025-10-31 |

| UBS | maintain | Neutral | 2025-10-30 |

| Piper Sandler | maintain | Neutral | 2025-10-30 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| JP Morgan | maintain | Neutral | 2025-10-30 |

| TD Cowen | maintain | Hold | 2025-10-30 |

| Evercore ISI Group | maintain | In Line | 2025-10-30 |

| Mizuho | maintain | Neutral | 2025-10-28 |

| UBS | maintain | Neutral | 2025-10-08 |

| Morgan Stanley | upgrade | Equal Weight | 2025-09-03 |

Overall, the stock grades for MDLZ indicate a strong consensus among analysts, with many maintaining their positive outlook, while KHC shows a mixture of neutral and equal weight ratings, reflecting a more cautious sentiment. Investors should consider these trends as they evaluate their positions in these stocks.

Target Prices

The consensus target prices for Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC) indicate positive growth potential for both stocks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Mondelez International, Inc. | 84 | 63 | 69.82 |

| The Kraft Heinz Company | 28 | 24 | 26 |

For MDLZ, the target consensus of 69.82 suggests a significant upside from its current price of 55.75, while KHC’s consensus of 26 indicates potential growth from its current price of 24.98. Overall, analysts expect both companies to perform well in the coming months.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC).

| Criterion | Mondelez International, Inc. (MDLZ) | The Kraft Heinz Company (KHC) |

|---|---|---|

| Diversification | Strong portfolio across snacks | Diverse food product range |

| Profitability | Net margin: 12.7% | Net margin: 10.7% |

| Innovation | Consistent product development | Moderate innovation |

| Global presence | Operates in 160+ countries | Strong presence in North America and Europe |

| Market Share | Leading in snack categories | Strong in condiments and sauces |

| Debt level | Debt to equity: 0.68 | Debt to equity: 0.40 |

Key takeaways reveal that while MDLZ excels in innovation and global presence, KHC demonstrates strong market share and lower debt levels, making both companies compelling investment options depending on your risk tolerance and portfolio strategy.

Risk Analysis

In this section, I will outline the key risks associated with Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC) to help you assess potential investments.

| Metric | Mondelez International, Inc. | The Kraft Heinz Company |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | High | Moderate |

Both companies face several risks, with Kraft Heinz showing higher exposure to market and regulatory challenges. Mondelez is positioned better operationally, with lower overall risks. Given the current economic climate and ongoing geopolitical tensions, investors should remain cautious and prioritize risk management strategies in their investment decisions.

Which one to choose?

In evaluating Mondelez International, Inc. (MDLZ) and The Kraft Heinz Company (KHC), MDLZ emerges as the more favorable option for investors. MDLZ holds a higher market cap of $80B compared to KHC’s $37B, and demonstrates superior financial health with a B+ rating versus KHC’s B-. MDLZ’s gross profit margin stands at 39.12%, reflecting robust profitability. In contrast, KHC’s gross profit margin is lower at 34.70%, indicating potential challenges in cost management.

Analyst opinions suggest MDLZ has more consistent earnings growth, while KHC struggles with higher debt levels, reflected in its debt-to-equity ratio of 0.40 compared to MDLZ’s 0.68. Both companies face risks inherent to the consumer goods sector, including competition and supply chain disruptions.

Recommendation: Investors seeking growth may prefer MDLZ, while those leaning towards value may still consider KHC for its high dividend yield of 5.20%.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Mondelez International, Inc. and The Kraft Heinz Company to enhance your investment decisions: