In the dynamic world of non-alcoholic beverages, two companies stand out: Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST). Both giants operate within the same industry, yet they adopt distinct strategies to carve their niches—KDP focuses on a diverse range of packaged beverages and coffee systems, while MNST specializes in energy drinks. As we delve into their innovations, market presence, and growth potential, I invite you to discover which of these companies could be the most compelling addition to your investment portfolio.

Table of contents

Company Overview

Keurig Dr Pepper Inc. Overview

Keurig Dr Pepper Inc. (KDP) is a leading beverage company in the U.S., renowned for its diverse product portfolio, which includes coffee systems, packaged beverages, and beverage concentrates. Founded in 1981 and headquartered in Burlington, Massachusetts, KDP operates through multiple segments, including Coffee Systems, Packaged Beverages, and Latin America Beverages. The company’s mission revolves around providing consumers with innovative, high-quality beverages, ranging from its iconic K-Cup pods to a variety of soft drinks like Dr Pepper and Snapple. With a market cap of approximately $37B, KDP serves a wide range of customers, including retailers, distributors, and end consumers.

Monster Beverage Corporation Overview

Monster Beverage Corporation (MNST) specializes in the development and distribution of energy drinks and related beverages. Established in 1985 and based in Corona, California, the company has carved out a significant niche in the energy drink sector, boasting brands such as Monster Energy and Reign. Its diverse offerings also include ready-to-drink teas, juices, and dairy products. With a market cap of around $71B, MNST is committed to delivering high-energy products that cater to a vibrant consumer base, leveraging innovative marketing strategies to maintain its competitive edge.

Keurig Dr Pepper and Monster Beverage share the non-alcoholic beverage industry but differ significantly in their focus. KDP emphasizes a broader range of beverage types, including coffee and soft drinks, while MNST concentrates on energy drinks. Both companies prioritize innovation and strong branding, but their target markets and product categories diverge considerably.

Income Statement Comparison

The following table provides a comparison of the most recent income statements for Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST), highlighting key metrics that investors should consider.

| Metric | KDP | MNST |

|---|---|---|

| Revenue | 15.35B | 7.49B |

| EBITDA | 3.38B | 2.01B |

| EBIT | 2.65B | 1.93B |

| Net Income | 1.44B | 1.51B |

| EPS | 1.06 | 1.50 |

Interpretation of Income Statement

In the latest fiscal year, KDP experienced a revenue growth to 15.35B, up from 14.81B, while MNST also grew from 7.14B to 7.49B. Despite the growth, KDP’s net income declined from 2.18B to 1.44B, indicating a decrease in profitability due to rising costs and interest expenses. Conversely, MNST’s net income increased to 1.51B, reflecting improved operational efficiency and stable margins. Both companies showcased solid revenue growth, but KDP’s margin pressures may raise concerns about its future profitability, warranting cautious investment considerations.

Financial Ratios Comparison

The table below presents a comparative overview of the most recent revenue and key financial ratios for Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST).

| Metric | KDP | MNST |

|---|---|---|

| ROE | 5.94% | 25.33% |

| ROIC | 4.04% | 22.11% |

| P/E | 30.36 | 36.91 |

| P/B | 1.80 | 7.32 |

| Current Ratio | 0.49 | 4.81 |

| Quick Ratio | 0.33 | 3.97 |

| D/E | 0.71 | 0.00 |

| Debt-to-Assets | 32.33% | 0.00% |

| Interest Coverage | 3.79 | 69.19 |

| Asset Turnover | 0.29 | 0.74 |

| Fixed Asset Turnover | 3.99 | 8.01 |

| Payout Ratio | 82.86% | 0.00% |

| Dividend Yield | 2.73% | 0.00% |

Interpretation of Financial Ratios

KDP exhibits a lower return on equity (ROE) and return on invested capital (ROIC) compared to MNST, indicating weaker profitability. Furthermore, KDP’s current and quick ratios suggest potential liquidity issues, while MNST’s ratios highlight a strong position. However, KDP’s high payout ratio raises concerns about sustainability, especially in relation to its debt levels. Conversely, MNST’s lack of debt and high interest coverage reflect a robust financial health.

Dividend and Shareholder Returns

Keurig Dr Pepper Inc. (KDP) offers a dividend, with a current yield of 2.73% and a payout ratio of approximately 83%. This indicates a commitment to returning value to shareholders, although the high payout ratio raises concerns about sustainability amidst fluctuating cash flows. In contrast, Monster Beverage Corporation (MNST) does not pay dividends, prioritizing reinvestment for growth and strategic acquisitions. However, MNST actively engages in share buybacks, which can enhance shareholder value. Overall, KDP’s dividends reflect a balance of returns, while MNST’s growth-focused strategy may align with long-term shareholder value creation, albeit with inherent risks.

Strategic Positioning

In the non-alcoholic beverage sector, Keurig Dr Pepper Inc. (KDP) holds a significant market share with a diverse product portfolio, including its well-known coffee systems and beverage brands. Meanwhile, Monster Beverage Corporation (MNST) is a leader in the energy drink market, continually innovating its product lines amid competitive pressure and technological advancements. Both companies face challenges from emerging brands and changing consumer preferences, necessitating strategic adaptability to maintain their respective positions in the market.

Stock Comparison

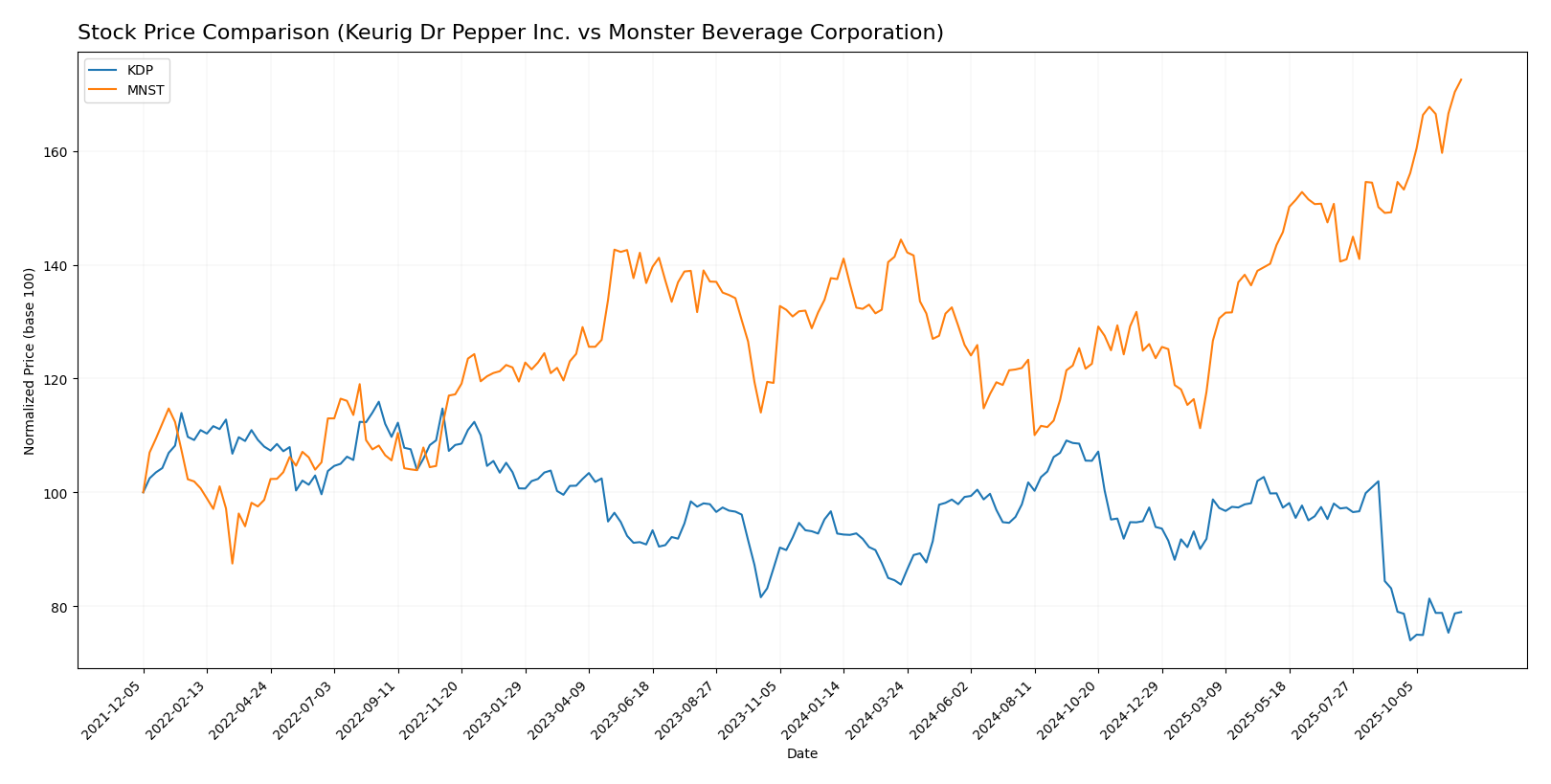

In this section, I will provide a detailed analysis of the stock price movements and trading dynamics of Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST) over the past year, highlighting significant price fluctuations and market behavior.

Trend Analysis

Keurig Dr Pepper Inc. (KDP) Over the past year, KDP has experienced a price change of -18.34%. This decline indicates a bearish trend, characterized by deceleration in price movement. The stock reached a notable high of 37.61 and a low of 25.5 during this period. The standard deviation stands at 2.75, suggesting some volatility in trading. In the recent analysis from September 7, 2025, to November 23, 2025, KDP saw a further decline of 5.03% with a standard deviation of 0.91, reinforcing the bearish sentiment.

Monster Beverage Corporation (MNST) Conversely, MNST has shown a robust performance with a price change of +25.36% over the past year, indicating a bullish trend accompanied by acceleration. The stock recorded a high of 72.22 and a low of 46.06. The standard deviation of 6.23 reflects a higher level of volatility in its price movements. From September 7, 2025, to November 23, 2025, MNST continued its upward trajectory with a 15.63% increase, supported by a standard deviation of 2.99, further confirming bullish market conditions.

Analyst Opinions

Recent analyst recommendations for Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST) have both resulted in a “B” rating, indicating a buy recommendation. Analysts emphasize KDP’s strong discounted cash flow and asset returns, while MNST is noted for its exceptional return on equity. However, both companies have room for improvement in their price-to-earnings ratios. The consensus for 2025 remains a cautious buy, reflecting a balanced view of growth potential and current market conditions.

Stock Grades

In reviewing the latest stock grades for Keurig Dr Pepper Inc. and Monster Beverage Corporation, I found that multiple reputable grading companies have provided consistent ratings.

Keurig Dr Pepper Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2025-10-28 |

| Barclays | maintain | Equal Weight | 2025-10-28 |

| JP Morgan | maintain | Overweight | 2025-10-20 |

| B of A Securities | maintain | Buy | 2025-10-08 |

| Goldman Sachs | maintain | Neutral | 2025-10-02 |

| Wells Fargo | maintain | Overweight | 2025-09-25 |

| Barclays | downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | downgrade | Underperform | 2025-09-22 |

| Piper Sandler | maintain | Overweight | 2025-09-17 |

| Citigroup | maintain | Buy | 2025-09-16 |

Monster Beverage Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2025-11-10 |

| Piper Sandler | maintain | Overweight | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-11-07 |

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Wells Fargo | maintain | Overweight | 2025-11-07 |

| UBS | maintain | Neutral | 2025-11-07 |

| Stifel | maintain | Buy | 2025-10-24 |

| JP Morgan | maintain | Neutral | 2025-10-24 |

| Citigroup | maintain | Buy | 2025-10-09 |

Overall, both companies show a predominance of “maintain” actions across several reputable grading firms, indicating stability in their ratings. Keurig Dr Pepper has experienced some downgrades recently, while Monster Beverage maintains a strong outlook with several “Overweight” ratings. This suggests a cautious but positive sentiment among analysts for both stocks.

Target Prices

The consensus target prices from analysts indicate potential upside for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Keurig Dr Pepper Inc. (KDP) | 41 | 24 | 32.5 |

| Monster Beverage Corporation (MNST) | 81 | 67 | 74.88 |

For Keurig Dr Pepper Inc. (KDP), the current price of 27.21 suggests significant upside potential, with a consensus target of 32.5. In contrast, Monster Beverage Corporation (MNST) is trading at 72.22, close to its consensus target of 74.88, indicating a more stable outlook.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST).

| Criterion | KDP | MNST |

|---|---|---|

| Diversification | Strong coffee and beverage range | Focused on energy drinks |

| Profitability | Net margin: 9.39% | Net margin: 20.14% |

| Innovation | New product lines in coffee | Frequent new flavor launches |

| Global presence | Strong in North America | Expanding internationally |

| Market Share | 8% in non-alcoholic beverages | 39% in energy drinks |

| Debt level | Debt to equity: 0.71 | Debt to equity: 0.06 |

Key takeaways indicate that while KDP has a diversified product range, MNST excels in profitability and market share within energy drinks. Both companies have room for growth in global markets, yet MNST’s lower debt levels present a less risky financial structure.

Risk Analysis

The table below outlines the potential risks associated with investing in Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST).

| Metric | KDP | MNST |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Low | Moderate |

Both companies face moderate operational risks due to supply chain vulnerabilities. Additionally, market volatility could significantly impact MNST due to its higher beta (0.488) compared to KDP (0.362), suggesting greater price fluctuations.

Which one to choose?

When comparing Keurig Dr Pepper Inc. (KDP) and Monster Beverage Corporation (MNST), both companies hold a “B” rating, indicating solid fundamentals. KDP shows a net profit margin of 9.4% with a price-to-earnings ratio of 30.36, while MNST boasts a higher net profit margin of 20.1% and a price-to-earnings ratio of 36.91. Recent stock trends reveal KDP in a bearish phase with a -18.34% change, contrasted by MNST’s bullish growth of +25.36%. Analysts express cautious optimism for both, but MNST appears more attractive for growth-focused investors due to its dynamic upward momentum and superior profit margins.

Investors seeking stability may prefer KDP, while those targeting growth may favor MNST. However, be aware of potential risks such as market dependence and competition affecting both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Keurig Dr Pepper Inc. and Monster Beverage Corporation to enhance your investment decisions: