In the competitive landscape of the non-alcoholic beverage industry, two key players stand out: PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST). Both companies are known for their innovative product offerings and robust market presence, yet they target different consumer segments. PepsiCo has a diverse portfolio that includes snacks and beverages, while Monster focuses primarily on energy drinks. This analysis will delve into their respective strategies and performance, helping you determine which company presents the more compelling investment opportunity.

Table of contents

Company Overview

PepsiCo, Inc. Overview

PepsiCo, Inc. (PEP) is a global leader in the food and beverage industry, operating across various segments including Frito-Lay, Quaker Foods, and PepsiCo Beverages. Founded in 1898 and headquartered in Purchase, New York, the company’s mission is to deliver sustainable growth by investing in a healthier future for people and the planet. With a market cap of approximately $200B, PepsiCo manufactures and markets a wide range of beverages and convenient foods, serving consumers through an extensive distribution network. The company emphasizes innovation and sustainability, aiming to reduce its environmental impact while meeting the evolving tastes of consumers.

Monster Beverage Corporation Overview

Monster Beverage Corporation (MNST), founded in 1985 and based in Corona, California, specializes in the development, marketing, and distribution of energy drinks and beverages. The company’s mission focuses on energizing consumers with a diverse portfolio that includes Monster Energy and various strategic brands. With a market cap of around $71B, Monster has carved a significant niche in the beverage sector, leveraging its strong brand identity to reach a wide customer base. The company is dedicated to growth through innovation and strategic partnerships, positioning itself as a leader in the high-energy segment of the beverage market.

Key similarities between PepsiCo and Monster Beverage include their focus on non-alcoholic beverages within the consumer defensive sector and a commitment to innovation. However, they differ significantly in their product offerings; PepsiCo provides a broader range of food and beverages, while Monster concentrates primarily on energy drinks. This distinction influences their market strategies and target demographics.

Income Statement Comparison

Below is a comparative analysis of the most recent income statements for PepsiCo, Inc. and Monster Beverage Corporation, highlighting their financial performance.

| Metric | PepsiCo, Inc. | Monster Beverage Corporation |

|---|---|---|

| Revenue | 91.85B | 7.49B |

| EBITDA | 16.68B | 2.01B |

| EBIT | 12.87B | 1.93B |

| Net Income | 9.58B | 1.51B |

| EPS | 6.98 | 1.50 |

Interpretation of Income Statement

In the latest fiscal year, PepsiCo reported a revenue increase to 91.85B, up from 91.47B the previous year, indicating stable growth. Monster Beverage also exhibited growth, with revenue rising to 7.49B from 7.14B. PepsiCo’s net income improved to 9.58B, reflecting enhanced operational efficiency, while Monster’s net income reached 1.51B, showcasing robust profitability. Both companies maintained solid EBITDA margins, although PepsiCo’s margins are considerably higher, reflecting its market leadership and operational scale. The overall trends suggest that while both companies are growing, PepsiCo continues to demonstrate more substantial financial strength and stability.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for PepsiCo (PEP) and Monster Beverage Corporation (MNST), helping investors assess their relative performance.

| Metric | PEP | MNST |

|---|---|---|

| ROE | 53.09% | 25.33% |

| ROIC | 13.73% | 22.11% |

| P/E | 21.80 | 36.91 |

| P/B | 11.57 | 7.32 |

| Current Ratio | 0.82 | 3.32 |

| Quick Ratio | 0.65 | 2.65 |

| D/E | 2.49 | 0.06 |

| Debt-to-Assets | 0.45 | 0.00 |

| Interest Coverage | 14.02 | 69.19 |

| Asset Turnover | 0.92 | 0.97 |

| Fixed Asset Turnover | 2.93 | 7.16 |

| Payout Ratio | 75.48% | 0.00% |

| Dividend Yield | 3.46% | 0.00% |

Interpretation of Financial Ratios

PepsiCo exhibits a strong return on equity (ROE) and a substantial dividend yield, indicating a solid return to shareholders. However, its high debt-to-equity ratio raises concerns about leverage risks. Conversely, Monster Beverage showcases impressive profitability, with a high ROIC and interest coverage ratio, suggesting effective capital management. The absence of dividends reflects its growth-oriented strategy, which could attract investors looking for capital appreciation. Overall, both companies present unique strengths and risks that warrant careful consideration before investment.

Dividend and Shareholder Returns

PepsiCo (PEP) offers a solid dividend framework with a payout ratio of 75.5%, yielding 3.46%. It has consistently increased its dividend, indicating strong free cash flow coverage. However, potential risks include high payout levels that may limit future growth investments.

In contrast, Monster Beverage (MNST) does not pay dividends, opting to reinvest profits into growth initiatives. This approach aligns with its high-growth strategy, although it engages in share buybacks to return value. Both strategies can support long-term shareholder value, but the choice hinges on individual risk tolerance and investment goals.

Strategic Positioning

PepsiCo (PEP) holds a significant market share in the non-alcoholic beverage sector, leveraging its diverse product range across multiple segments. With a market cap of 200B, it competes strongly against Monster Beverage (MNST), which has a market cap of 71B and focuses on energy drinks. The competitive pressure in this market is heightened by evolving consumer preferences and technological disruptions, pushing both companies to innovate continuously. PepsiCo’s established distribution networks provide a solid advantage, yet Monster’s niche focus allows for rapid growth opportunities.

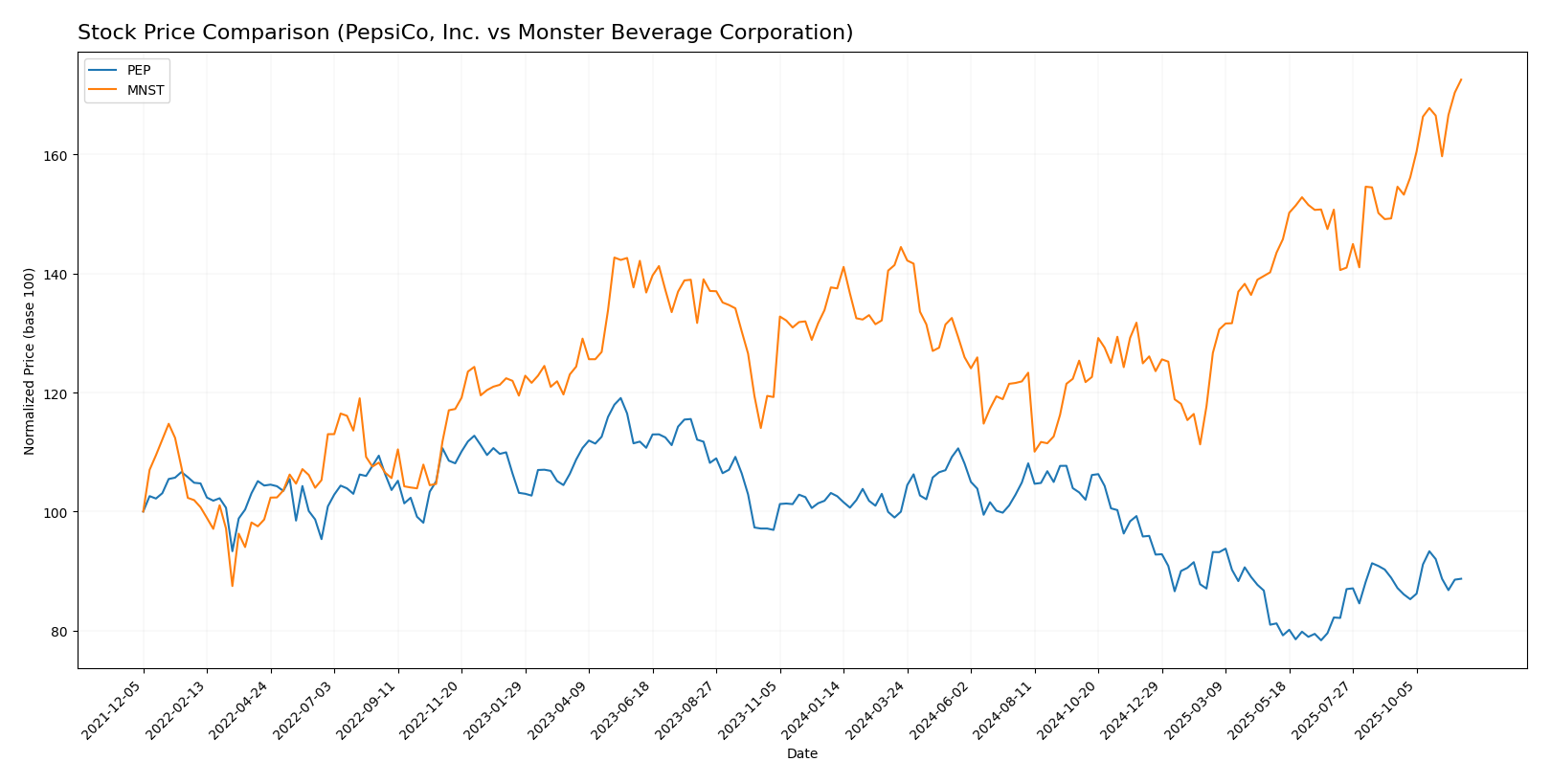

Stock Comparison

In this section, I will analyze the stock price movements of PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST) over the past year, highlighting key dynamics and trends affecting their market performance.

Trend Analysis

PepsiCo, Inc. (PEP) Over the past year, PEP’s stock has experienced a percentage change of -13.98%. This indicates a bearish trend, characterized by notable acceleration. The stock reached a high of 182.19 and a low of 129.07, reflecting significant volatility with a standard deviation of 14.75. In the recent period from September 7, 2025, to November 23, 2025, the stock price fell slightly by 0.2%, with a standard deviation of 3.95, indicating minor fluctuations. The trend slope during this segment is 0.3, suggesting a very mild upward movement.

Monster Beverage Corporation (MNST) Conversely, MNST has enjoyed a robust performance with a percentage change of +25.36% over the past year, marking a bullish trend with signs of acceleration. The stock hit a high of 72.22 and a low of 46.06, with a standard deviation of 6.23, indicating moderate volatility. Recently, from September 7, 2025, to November 23, 2025, MNST’s stock price increased by 15.63%, backed by a standard deviation of 2.99, which implies stable price behavior. The trend slope of 0.78 reinforces the continued upward momentum.

In summary, while PEP faces challenges with its bearish trend, MNST demonstrates strong growth potential, making it a compelling choice for investors considering current market dynamics.

Analyst Opinions

Recent analyst recommendations for PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST) indicate a cautious yet optimistic outlook. For PEP, analysts have assigned a rating of B+, suggesting a “buy” recommendation, supported by strong return on equity and assets. Conversely, MNST holds a B rating, leaning towards “hold,” with concerns over its price-to-earnings ratio. Analysts emphasize the solid fundamentals of both companies but advise careful consideration of market conditions. Overall, the consensus for PEP leans towards buy, while MNST remains neutral.

Stock Grades

In the current market landscape, stock ratings provide valuable insights into investment strategies. Here’s a look at the latest grades for PepsiCo, Inc. and Monster Beverage Corporation.

PepsiCo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | downgrade | Hold | 2025-10-23 |

| Wells Fargo | maintain | Equal Weight | 2025-10-10 |

| JP Morgan | maintain | Neutral | 2025-10-06 |

| Barclays | maintain | Equal Weight | 2025-10-03 |

| Citigroup | maintain | Buy | 2025-09-25 |

| Wells Fargo | maintain | Equal Weight | 2025-09-25 |

| UBS | maintain | Buy | 2025-09-11 |

| RBC Capital | maintain | Sector Perform | 2025-09-03 |

| Barclays | maintain | Equal Weight | 2025-07-21 |

| Citigroup | maintain | Buy | 2025-07-18 |

Monster Beverage Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2025-11-10 |

| Piper Sandler | maintain | Overweight | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-11-07 |

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Wells Fargo | maintain | Overweight | 2025-11-07 |

| UBS | maintain | Neutral | 2025-11-07 |

| Stifel | maintain | Buy | 2025-10-24 |

| JP Morgan | maintain | Neutral | 2025-10-24 |

| Citigroup | maintain | Buy | 2025-10-09 |

Overall, PepsiCo has experienced a downgrade to “Hold” from Freedom Capital Markets, while maintaining grades from other analysts, indicating potential caution among investors. Conversely, Monster Beverage Corporation shows strong support with multiple maintain ratings at “Overweight” and “Buy,” reflecting a positive outlook among analysts.

Target Prices

The consensus target prices from reliable analysts for PepsiCo, Inc. and Monster Beverage Corporation are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| PepsiCo, Inc. (PEP) | 164 | 140 | 150.5 |

| Monster Beverage Corp. (MNST) | 81 | 67 | 74.88 |

The analysts expect PepsiCo, Inc. to reach a consensus target price of 150.5, while its current price of 146.1 indicates slight potential upside. For Monster Beverage Corporation, the consensus target price is 74.88, compared to its current price of 72.22, suggesting modest growth opportunities as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST) based on the most recent data.

| Criterion | PepsiCo, Inc. (PEP) | Monster Beverage Corporation (MNST) |

|---|---|---|

| Diversification | Strong product range across beverages and snacks | Focused on energy drinks, limited diversification |

| Profitability | Net Profit Margin: 10.43% | Net Profit Margin: 20.14% |

| Innovation | Moderate investment in R&D | High emphasis on product innovation |

| Global presence | Operates in over 200 countries | Primarily US & growing international presence |

| Market Share | 31% in non-alcoholic beverages | 25% in energy drink category |

| Debt level | High debt-to-equity ratio: 2.49 | Very low debt-to-equity ratio: 0.06 |

Key takeaways indicate that while PepsiCo has a broad product portfolio and strong global presence, it carries a higher debt load compared to Monster Beverage, which excels in profitability and innovation but lacks diversification.

Risk Analysis

The following table outlines the key risks associated with PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST).

| Metric | PepsiCo (PEP) | Monster Beverage (MNST) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | Low |

| Environmental Risk | High | Moderate |

| Geopolitical Risk | Moderate | Low |

In summary, both companies face market and environmental risks, but PepsiCo is significantly more exposed to environmental challenges. Recently, PepsiCo’s sustainability initiatives have been scrutinized, while Monster’s rapid global expansion increases geopolitical vulnerabilities.

Which one to choose?

When comparing PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST), the fundamental metrics highlight distinct attributes. PEP, with a market cap of $209B, exhibits a strong gross profit margin of 54.5% and a net profit margin of 10.4%. Its stock trend is currently bearish, with a 14% decline over the past year, and analysts rate it B+ overall. Conversely, MNST, valued at $53B, boasts impressive growth with a 25% increase in share price recently, a gross profit margin of 54% and a net profit margin of 20.1%. Analysts rate MNST with a B, indicating solid performance.

For growth-oriented investors, MNST may be preferable due to its bullish momentum and higher profitability ratios. PEP, however, offers stability and a strong dividend yield of 3.46%, making it suitable for income-focused investors.

Be mindful of risks, including competition in both sectors, which could impact future growth and valuation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of PepsiCo, Inc. and Monster Beverage Corporation to enhance your investment decisions: