In the ever-evolving landscape of the non-alcoholic beverage industry, two prominent players stand out: Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP). Both companies are not only leaders in their market segments but also share a commitment to innovation and sustainability. This comparison will delve into their strategies, market reach, and financial health, helping you, the investor, determine which company presents the most compelling opportunity for your portfolio.

Table of contents

Company Overview

CCEP Overview

Coca-Cola Europacific Partners PLC (CCEP) is a leading bottler for The Coca-Cola Company, focusing on the production, distribution, and sale of a diverse range of non-alcoholic beverages across Europe. Established in 1986 and based in Uxbridge, UK, CCEP’s mission is to refresh people and inspire moments of optimism and happiness through its extensive portfolio, which includes renowned brands such as Coca-Cola, Fanta, Sprite, and Monster Energy. With a market capitalization of approximately $41B, CCEP serves around 600M consumers, emphasizing sustainability and innovation in its operations.

KDP Overview

Keurig Dr Pepper Inc. (KDP) is a prominent beverage company based in Burlington, Massachusetts, specializing in a variety of beverage products. Founded in 1981, KDP operates through multiple segments, including Coffee Systems and Packaged Beverages, catering to both retail and foodservice markets. With a market capitalization around $37B, KDP’s mission is to offer a wide range of beverages that enhance the everyday moments of consumers, featuring brands such as Dr Pepper, Snapple, and Keurig. The company is recognized for its innovative coffee systems and extensive distribution network.

Both companies share a focus on non-alcoholic beverages and operate within the consumer defensive sector. However, CCEP primarily focuses on bottling and distribution, while KDP emphasizes a diverse product range that includes coffee systems and packaged beverages. This difference in business model highlights CCEP’s role as a bottler compared to KDP’s multifaceted beverage offerings.

Income Statement Comparison

The following table provides an overview of the income statements for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) for the most recent fiscal year, highlighting their financial performance metrics.

| Metric | CCEP | KDP |

|---|---|---|

| Revenue | 20.44B | 15.35B |

| EBITDA | 3.27B | 3.38B |

| EBIT | 2.34B | 2.65B |

| Net Income | 1.42B | 1.44B |

| EPS | 3.08 | 1.06 |

Interpretation of Income Statement

In 2024, CCEP experienced a revenue increase of 12.9% compared to the previous year, while KDP’s revenue grew by 2.9%. CCEP’s net income showed a decline of 15.4%, influenced by rising operational costs, indicating margin pressure. Conversely, KDP’s net income stability suggests efficient cost management despite lower revenue growth. Both companies maintain solid EBITDA margins, but CCEP’s performance reflects a need for strategic adjustments to enhance profitability, while KDP’s moderate growth highlights a robust operational framework amid competitive pressures.

Financial Ratios Comparison

The following table presents a comparison of key financial ratios between Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP). This analysis will help you gauge their financial health and performance.

| Metric | CCEP | KDP |

|---|---|---|

| ROE | 17% | 6% |

| ROIC | 6.5% | 4% |

| P/E | 24.1 | 30.4 |

| P/B | 4.0 | 1.8 |

| Current Ratio | 0.81 | 0.49 |

| Quick Ratio | 0.62 | 0.33 |

| D/E | 1.33 | 0.71 |

| Debt-to-Assets | 36% | 28% |

| Interest Coverage | 8.8 | 3.8 |

| Asset Turnover | 0.66 | 0.29 |

| Fixed Asset Turnover | 3.18 | 4.00 |

| Payout ratio | 64% | 82% |

| Dividend yield | 2.66% | 2.45% |

Interpretation of Financial Ratios

In comparing CCEP and KDP, CCEP exhibits stronger profitability and asset efficiency, evident in its higher ROE and asset turnover. However, KDP demonstrates a lower debt-to-equity ratio, indicating better leverage management. CCEP’s current and quick ratios suggest a more robust liquidity position. It’s crucial to consider these factors according to your risk tolerance and investment strategy when making decisions.

Dividend and Shareholder Returns

Coca-Cola Europacific Partners PLC (CCEP) has consistently paid dividends, currently yielding 2.66% with a payout ratio of approximately 64%. This indicates a commitment to returning value to shareholders, although caution is warranted regarding its reliance on free cash flow for sustainability. Meanwhile, Keurig Dr Pepper Inc. (KDP) does not pay dividends, opting instead to reinvest in growth. KDP’s share buyback program suggests a focus on enhancing shareholder value over time. Overall, both strategies can contribute to long-term value creation, albeit through different approaches.

Strategic Positioning

Coca-Cola Europacific Partners PLC (CCEP) holds a significant market share in the non-alcoholic beverage sector, competing directly with Keurig Dr Pepper Inc. (KDP). With a market cap of approximately 41B for CCEP and 37B for KDP, both companies face competitive pressures from evolving consumer preferences and technological disruptions in beverage production and distribution. CCEP’s diverse product lineup enhances its resilience, while KDP’s focus on coffee systems and packaged beverages positions it uniquely within the market. As investor sentiment shifts, monitoring these dynamics is crucial for strategic investment decisions.

Stock Comparison

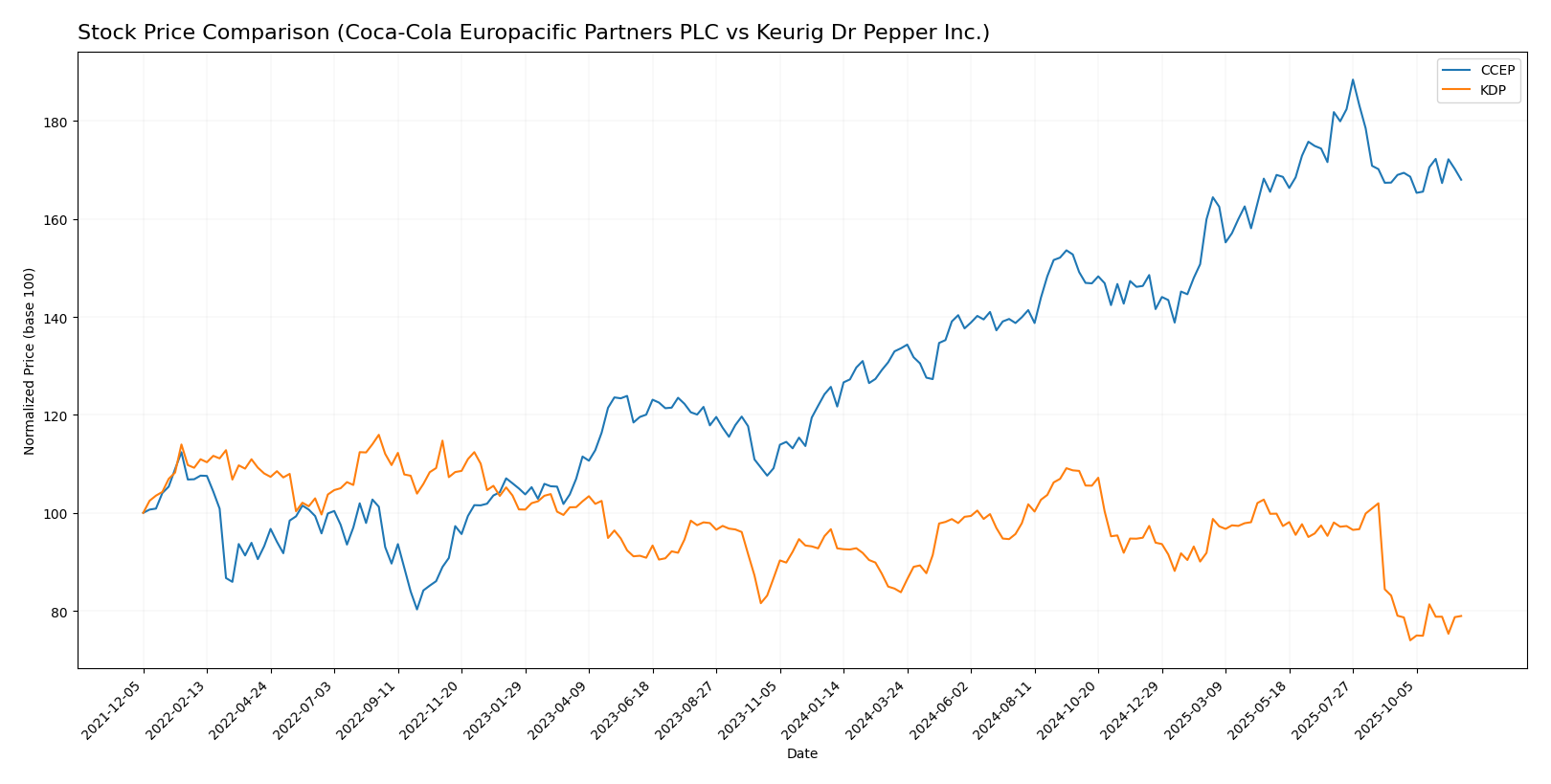

In this section, I will analyze the weekly stock price movements of Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) over the past year, focusing on significant price changes and trading dynamics.

Trend Analysis

Coca-Cola Europacific Partners PLC (CCEP) has experienced a 33.64% increase in stock price over the past year, indicating a bullish trend. The highest price reached was 100.04, while the lowest was 64.61. The acceleration status shows deceleration, suggesting a slowing rate of price increase. The stock has exhibited a standard deviation of 8.81, indicating moderate volatility in its price movements.

In the recent period from September 7, 2025, to November 23, 2025, the stock’s price change was 0.35%, maintaining a neutral trend with a trend slope of 0.1.

Keurig Dr Pepper Inc. (KDP), on the other hand, has seen a 18.34% decline in its stock price over the past year, marking a bearish trend. The stock reached a high of 37.61 and a low of 25.5. Similar to CCEP, KDP is also experiencing deceleration in its trend, with a standard deviation of 2.75, reflecting lower volatility compared to CCEP.

In the recent period from September 7, 2025, to November 23, 2025, KDP’s price changed by -5.03%, which indicates a bearish trend with a trend slope of -0.04.

In summary, CCEP appears to be on a positive trajectory, while KDP is struggling with negative price momentum, presenting a contrasting investment outlook for these two companies.

Analyst Opinions

Recent analyst recommendations indicate a cautious stance on Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP). CCEP holds a B+ rating, with analysts praising its strong discounted cash flow and return metrics, suggesting a buy for growth-oriented investors. In contrast, KDP has a B rating, reflecting solid fundamentals but a more tempered outlook. The consensus for 2025 leans slightly towards a buy for CCEP, while KDP is viewed as a hold, balancing potential and risks in the current market environment.

Stock Grades

Recent analysis has shown stock ratings for two notable companies, Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP). Below are the reliable grades from recognized grading companies.

Coca-Cola Europacific Partners PLC Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-08-08 |

| Barclays | maintain | Overweight | 2025-07-15 |

| UBS | maintain | Buy | 2025-07-02 |

| Barclays | maintain | Overweight | 2025-05-01 |

| UBS | maintain | Buy | 2025-04-30 |

| Barclays | maintain | Overweight | 2025-04-11 |

| Barclays | maintain | Overweight | 2025-03-27 |

| Barclays | maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | maintain | Outperform | 2025-02-18 |

| UBS | maintain | Buy | 2025-02-17 |

Keurig Dr Pepper Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2025-10-28 |

| Barclays | maintain | Equal Weight | 2025-10-28 |

| JP Morgan | maintain | Overweight | 2025-10-20 |

| B of A Securities | maintain | Buy | 2025-10-08 |

| Goldman Sachs | maintain | Neutral | 2025-10-02 |

| Wells Fargo | maintain | Overweight | 2025-09-25 |

| Barclays | downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | downgrade | Underperform | 2025-09-22 |

| Piper Sandler | maintain | Overweight | 2025-09-17 |

| Citigroup | maintain | Buy | 2025-09-16 |

Overall, both CCEP and KDP maintain a generally positive outlook with multiple grades indicating “Overweight” and “Buy.” However, KDP has shown some volatility with recent downgrades to “Equal Weight” and “Underperform,” suggesting a cautious approach may be prudent for investors.

Target Prices

The consensus target prices for the companies analyzed indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coca-Cola Europacific Partners | 98 | 46.22 | 74.69 |

| Keurig Dr Pepper Inc. | 41 | 24 | 32.5 |

For Coca-Cola Europacific Partners (CCEP), the consensus target price of 74.69 suggests a potential downside from the current price of 89.19. Meanwhile, Keurig Dr Pepper (KDP) has a target consensus of 32.5, indicating a favorable outlook compared to its current price of 27.21.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP).

| Criterion | CCEP | KDP |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Moderate (Net Margin: 6.9%) | High (Net Margin: 14.7%) |

| Innovation | Moderate | High |

| Global presence | Strong | Moderate |

| Market Share | High | Moderate |

| Debt level | Moderate (Debt/Equity: 1.33) | Low (Debt/Equity: 0.71) |

Key takeaways from this analysis indicate that KDP excels in profitability and innovation with a lower debt level, making it a strong contender in the market. In contrast, CCEP has a robust global presence but faces challenges in profitability.

Risk Analysis

Below is a summary of potential risks associated with Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP).

| Metric | CCEP | KDP |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | High | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant regulatory and environmental risks, particularly in light of increasing global scrutiny on sustainability and health regulations. The beverage industry is highly competitive, impacting market positions and profitability.

Which one to choose?

When comparing Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP), CCEP appears more favorable for investment. CCEP has a stronger gross profit margin of 36% compared to KDP’s 55%, yet its net profit margin of 6.9% is lower than KDP’s 9.4%. CCEP’s price-to-earnings ratio is 24.1, while KDP stands at a higher 30.4, suggesting a better valuation for CCEP. Analysts rate CCEP with a B+ and target a bullish price trend, while KDP has a B rating with a bearish outlook.

Investors focused on growth may prefer CCEP due to its improving stock trend, while those prioritizing current performance might lean towards KDP despite its recent downturn.

However, both companies face risks from market competition and supply chain challenges.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc. to enhance your investment decisions: