In today’s fast-paced investment landscape, I aim to explore two intriguing companies: Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON). Both firms operate within the industrial sector but cater to vastly different markets—Cintas specializes in corporate identity uniforms and related services, while Axon focuses on law enforcement technology and digital evidence management. This comparison will delve into their innovative strategies and market positions, helping you determine which company might be the more compelling addition to your investment portfolio.

Table of contents

Company Overview

Cintas Corporation Overview

Cintas Corporation (CTAS) is a leading provider of corporate identity uniforms and related business services in North America and Latin America. Founded in 1968 and headquartered in Cincinnati, Ohio, Cintas operates through various segments, including Uniform Rental and Facility Services, and First Aid and Safety Services. The company focuses on renting and servicing uniforms, mats, mops, and offering restroom cleaning services, along with first aid and fire protection products. With a robust distribution network, Cintas caters to a diverse clientele, ranging from small businesses to large corporations. As of now, Cintas holds a market capitalization of approximately $75.1B, emphasizing its strong position within the Specialty Business Services sector.

Axon Enterprise, Inc. Overview

Axon Enterprise, Inc. (AXON), established in 1993 and based in Scottsdale, Arizona, specializes in developing and selling conducted energy devices (CEDs), notably under the TASER brand. The company operates through two primary segments: TASER and Software and Sensors. Axon provides law enforcement agencies with hardware and cloud-based software solutions that facilitate the capture, management, and analysis of digital evidence. With a market capitalization of around $42.6B, Axon has positioned itself as a vital player in the Aerospace & Defense sector, leveraging technology to enhance public safety and operational efficiency.

Key similarities and differences

Both Cintas and Axon operate in the industrial sector but cater to different market needs. Cintas focuses on uniforms and facility services, while Axon specializes in law enforcement technology and evidence management solutions. Their business models emphasize customer service and operational efficiency, yet they target distinct customer bases and product offerings that reflect their unique market positions.

Income Statement Comparison

The following table compares the most recent income statements of Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON), highlighting key financial metrics for analysis.

| Metric | Cintas Corporation (CTAS) | Axon Enterprise, Inc. (AXON) |

|---|---|---|

| Market Cap | 75.1B | 42.6B |

| Revenue | 10.34B | 2.08B |

| EBITDA | 2.86B | 437M |

| EBIT | 2.37B | 39M |

| Net Income | 1.81B | 377M |

| EPS | 4.48 | 4.98 |

| Fiscal Year | 2025 | 2024 |

Interpretation of Income Statement

In the most recent year, Cintas Corporation (CTAS) showed a robust revenue increase to 10.34B, up from 9.60B the previous year, indicating a strong demand for its services. Meanwhile, Axon Enterprise (AXON) also demonstrated growth, with revenue rising to 2.08B from 1.56B. CTAS maintained a healthy net income margin, reflecting efficient cost management, while AXON’s margins improved significantly as it moved towards profitability. Overall, both companies exhibited positive revenue trends, though CTAS showed higher stability and profitability relative to AXON, which is still in a growth phase.

Financial Ratios Comparison

Below is a comparison of the most recent financial ratios for Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON).

| Metric | CTAS | AXON |

|---|---|---|

| ROE | 38.69% | 16.20% |

| ROIC | 22.95% | 1.39% |

| P/E | 50.43 | 119.40 |

| P/B | 19.51 | 11.89 |

| Current Ratio | 2.09 | 3.14 |

| Quick Ratio | 1.82 | 2.79 |

| D/E | 0.57 | 0.44 |

| Debt-to-Assets | 27.02% | 20.85% |

| Interest Coverage | 23.34 | 22.79 |

| Asset Turnover | 1.05 | 0.46 |

| Fixed Asset Turnover | 5.51 | 6.59 |

| Payout Ratio | 33.75% | 0.00% |

| Dividend Yield | 0.67% | 0.00% |

Interpretation of Financial Ratios

In comparing these two companies, CTAS exhibits stronger profitability and efficiency ratios, particularly in ROE and ROIC, indicating effective capital utilization. While AXON shows better liquidity ratios, its high P/E suggests overvaluation given its lower profitability metrics. A significant concern for AXON is its lack of dividend payouts, which may indicate cash flow constraints or reinvestment strategies that could affect investor confidence.

Dividend and Shareholder Returns

Cintas Corporation (CTAS) pays dividends with a payout ratio of approximately 33.7%, yielding around 0.77%. The company has consistently increased its dividend per share, supported by healthy free cash flow, although risks like unsustainable distributions should be monitored. Conversely, Axon Enterprise, Inc. (AXON) does not pay dividends, favoring reinvestment in growth and R&D, which aligns with long-term value creation. Both companies engage in share buybacks, enhancing shareholder returns, yet differing strategies necessitate careful evaluation of their long-term sustainability.

Strategic Positioning

Cintas Corporation (CTAS) holds a significant market share in the specialty business services sector, primarily through its uniform rental and facility services. It competes with various players, facing moderate competitive pressure amid technological advancements in service delivery. Meanwhile, Axon Enterprise, Inc. (AXON), a leader in the aerospace and defense industry, navigates increasing competition in law enforcement technology, emphasizing innovation in cloud-based software solutions and hardware. Both companies must continuously adapt to maintain their market positions amidst ongoing technological disruption.

Stock Comparison

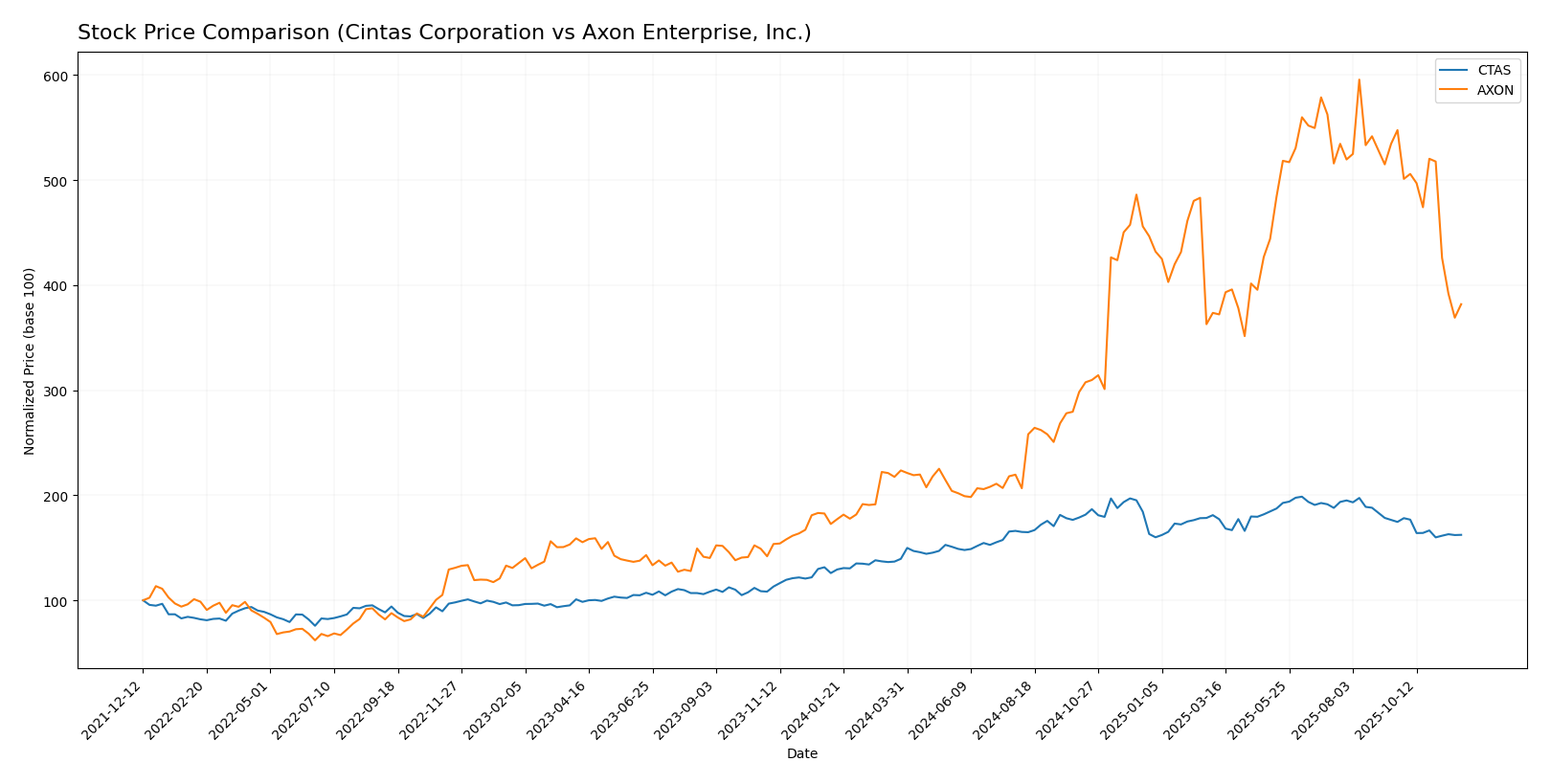

Over the past year, both Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON) have experienced significant price movements, reflecting their respective trading dynamics and investor sentiment.

Trend Analysis

For Cintas Corporation (CTAS), the stock has shown a 28.89% increase over the past year, indicating a bullish trend. Notably, the highest price reached was $227.66, while the lowest was $144.32. However, the recent trend from September 14, 2025, to November 30, 2025, shows a decline of 8.08%, with a trend slope of -1.85, suggesting a deceleration in momentum. The standard deviation during this recent period was 7.61, indicating moderate volatility.

For Axon Enterprise, Inc. (AXON), the stock has experienced a remarkable 121.18% increase over the past year, also reflecting a bullish trend. The stock peaked at $842.50 and dropped to a low of $244.21. In the recent analysis period from September 14, 2025, to November 30, 2025, there was a significant drop of 28.57%, with a steep trend slope of -21.48, highlighting a deceleration in price movement. The standard deviation was quite high at 85.58, indicating considerable volatility.

In summary, while both stocks have shown strong long-term performance, recent trends suggest caution as both have encountered declines in the short term.

Analyst Opinions

Recent analyst recommendations for Cintas Corporation (CTAS) indicate a “Buy” rating, with strengths in return on equity (5) and return on assets (5), suggesting solid financial health. Analysts note its robust cash flow and operational efficiency. On the other hand, Axon Enterprise, Inc. (AXON) has received a “Hold” rating, primarily due to lower scores in debt-to-equity (1) and price-to-earnings (1), which raises concerns about valuation and leverage. The consensus for the current year leans towards a “Buy” for CTAS while maintaining a cautious stance on AXON.

Stock Grades

I have gathered the latest stock grades from reliable grading companies for Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON). Below are the details:

Cintas Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Equal Weight | 2025-11-25 |

| Citigroup | maintain | Sell | 2025-09-26 |

| JP Morgan | maintain | Overweight | 2025-09-25 |

| Wells Fargo | maintain | Equal Weight | 2025-09-25 |

| RBC Capital | maintain | Sector Perform | 2025-09-25 |

| RBC Capital | maintain | Sector Perform | 2025-08-21 |

| Baird | maintain | Neutral | 2025-07-18 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-18 |

| UBS | maintain | Buy | 2025-07-18 |

| Goldman Sachs | maintain | Buy | 2025-07-02 |

Axon Enterprise, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-11-06 |

| Goldman Sachs | maintain | Buy | 2025-11-05 |

| UBS | maintain | Neutral | 2025-11-05 |

| Piper Sandler | maintain | Overweight | 2025-11-05 |

| JMP Securities | maintain | Market Outperform | 2025-09-29 |

| Needham | maintain | Buy | 2025-09-24 |

| B of A Securities | maintain | Buy | 2025-08-06 |

| Craig-Hallum | upgrade | Buy | 2025-08-05 |

| Raymond James | maintain | Outperform | 2025-08-05 |

| UBS | maintain | Neutral | 2025-08-05 |

Overall, both Cintas Corporation and Axon Enterprise have maintained their stock grades recently, indicating stable investor sentiment. Notably, while CTAS shows a mix of maintain and sell ratings, AXON has a stronger outlook with several grades at “Buy” and “Overweight.” This reflects a generally positive market position for AXON compared to CTAS.

Target Prices

A consensus of target prices from analysts indicates promising forecasts for Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cintas Corporation | 206 | 184 | 191.67 |

| Axon Enterprise, Inc. | 900 | 753 | 845.38 |

The analysts anticipate Cintas Corporation’s stock could reach an average of 191.67, slightly above its current price of 186.02. For Axon Enterprise, the consensus target of 845.38 is significantly higher than its current price of 540.14, suggesting strong growth potential.

Strengths and Weaknesses

The following table illustrates the strengths and weaknesses of Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON):

| Criterion | Cintas Corporation (CTAS) | Axon Enterprise, Inc. (AXON) |

|---|---|---|

| Diversification | Strong in various business services | Focused primarily on law enforcement products |

| Profitability | Net margin: 17.53% | Net margin: 11.26% |

| Innovation | Continuous service improvements | Advanced tech in law enforcement |

| Global presence | Operates in North America and Latin America | International reach with law enforcement products |

| Market Share | Significant in corporate identity services | Growing in the public safety sector |

| Debt level | Debt to equity: 0.57 | Debt to equity: 0.44 |

Key takeaways from the analysis show that while Cintas boasts higher profitability and diversification, Axon is recognized for its innovation and growing market presence in a specialized sector. Both companies exhibit manageable debt levels, making them attractive candidates for investment consideration.

Risk Analysis

Below is a summarized overview of the key risks associated with Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON).

| Metric | Cintas Corporation (CTAS) | Axon Enterprise, Inc. (AXON) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Low | Moderate |

In synthesizing the risks, I find that Axon faces significant market and regulatory risks, particularly due to its position in the defense and law enforcement sectors, which are heavily scrutinized. Cintas has a more stable profile but still faces moderate market and regulatory risks.

Which one to choose?

When comparing Cintas Corporation (CTAS) and Axon Enterprise, Inc. (AXON), Cintas shows stronger fundamentals. CTAS boasts a robust gross profit margin of 50% and an impressive net profit margin of 17.5%, while Axon’s gross margin stands at 59.6%, with a lower net margin of 18.1%. In terms of valuation, CTAS has a lower Price-to-Earnings ratio (50.43) compared to AXON’s (119.40), indicating it may be a more reasonable investment relative to earnings. Analysts have rated CTAS with a grade of B, suggesting solid performance potential, whereas AXON received a C+ rating, indicating more cautious prospects.

Investors focused on steady growth and profitability may prefer Cintas, while those looking for higher-risk, high-reward opportunities might consider Axon. However, both companies face industry risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cintas Corporation and Axon Enterprise, Inc. to enhance your investment decisions: