In the competitive landscape of human capital management, two industry leaders stand out: Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX). Both companies specialize in providing cloud-based solutions for payroll, HR, and employee benefits, catering primarily to small and medium-sized businesses. Their market overlap and differing innovation strategies make this comparison particularly intriguing. Join me as we explore which of these two companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Automatic Data Processing, Inc. Overview

Automatic Data Processing, Inc. (ADP) is a leader in cloud-based human capital management (HCM) solutions, primarily serving mid-sized to large businesses. Founded in 1949 and headquartered in Roseland, NJ, ADP operates through two main segments: Employer Services and Professional Employer Organization (PEO). The company offers an extensive range of services including payroll, benefits administration, HR management, and compliance services. With a market cap of $101B, ADP is well-positioned in the staffing and employment services industry, catering to the evolving needs of businesses in a digitized economy.

Paychex, Inc. Overview

Paychex, Inc. is another prominent player in the human capital management space, founded in 1971 and based in Rochester, NY. Paychex focuses on providing integrated HR, payroll, and insurance services specifically for small to medium-sized businesses. The company has a market cap of approximately $39B and offers a diverse array of services, from payroll processing to HR outsourcing and risk management. Paychex emphasizes compliance and regulatory assistance, making it a vital partner for businesses navigating the complex employment landscape.

Key similarities and differences in their business models include both companies offering comprehensive HR and payroll solutions but targeting different market segments. ADP focuses more on larger enterprises, while Paychex is tailored for smaller businesses. Their service offerings also vary in terms of depth and specialization, reflecting their distinct market positions.

Income Statement Comparison

In this section, I will provide a comparison of the income statements for Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX) for the most recent fiscal year, highlighting their financial performance metrics.

| Metric | [Company A: ADP] | [Company B: PAYX] |

|---|---|---|

| Revenue | 20.56B | 5.57B |

| EBITDA | 6.24B | 2.49B |

| EBIT | 5.76B | 2.28B |

| Net Income | 4.08B | 1.66B |

| EPS | 10.02 | 4.60 |

Interpretation of Income Statement

In the most recent fiscal year, ADP experienced a revenue increase to 20.56B, marking a robust growth from previous years. PAYX also showed positive performance with revenue growth to 5.57B. Both companies maintained stable EBITDA and EBIT margins, reflecting operational efficiency. Notably, ADP’s net income reached 4.08B, showcasing strong profitability, while PAYX’s net income of 1.66B indicates solid performance amidst competitive pressures. Overall, both companies appear to be on a growth trajectory, although ADP’s scale and margin strength provide a competitive edge.

Financial Ratios Comparison

The table below presents a comparative overview of the most recent revenue and financial ratios for Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX).

| Metric | ADP | PAYX |

|---|---|---|

| ROE | 66% | 40% |

| ROIC | 25% | 17% |

| P/E | 31 | 34 |

| P/B | 20 | 13 |

| Current Ratio | 1.05 | 1.28 |

| Quick Ratio | 1.05 | 1.28 |

| D/E | 1.46 | 1.22 |

| Debt-to-Assets | 17% | 30% |

| Interest Coverage | 11.87 | 20.95 |

| Asset Turnover | 0.39 | 0.34 |

| Fixed Asset Turnover | 19.97 | 9.68 |

| Payout Ratio | 59% | 87% |

| Dividend Yield | 1.91% | 2.55% |

Interpretation of Financial Ratios

ADP’s ratios indicate a robust performance, particularly with a high ROE and ROIC, suggesting effective capital utilization. However, its higher D/E ratio raises potential concerns around leverage. PAYX, while showing a sound current ratio and lower debt levels, has weaker profitability ratios compared to ADP. Both companies exhibit solid dividend yields, suitable for income-oriented investors.

Dividend and Shareholder Returns

Automatic Data Processing, Inc. (ADP) offers a dividend yield of 1.91% with a payout ratio of 58.8%. The consistent trend indicates a commitment to shareholder returns, supported by a solid free cash flow coverage. Conversely, Paychex, Inc. (PAYX) also pays dividends, yielding 2.55% with a higher payout ratio of 87.4%. While both companies engage in share buybacks, the sustainability of PAYX’s higher payout may pose risks in economic downturns. Ultimately, both companies demonstrate strategies that can support long-term shareholder value creation, albeit with varying degrees of risk.

Strategic Positioning

In the staffing and employment services sector, Automatic Data Processing (ADP) holds a significant market share, benefiting from its extensive portfolio of cloud-based human capital management solutions. With a market cap of $100.7B, ADP faces competitive pressure mainly from Paychex (PAYX), which has a market cap of $39.1B. Both companies are under constant threat from technological disruptions, particularly in automation and AI, which could reshape service delivery in the HR space. As I evaluate their positions, ADP’s broader service range gives it a competitive edge, but ongoing innovation is vital for both to maintain their standings.

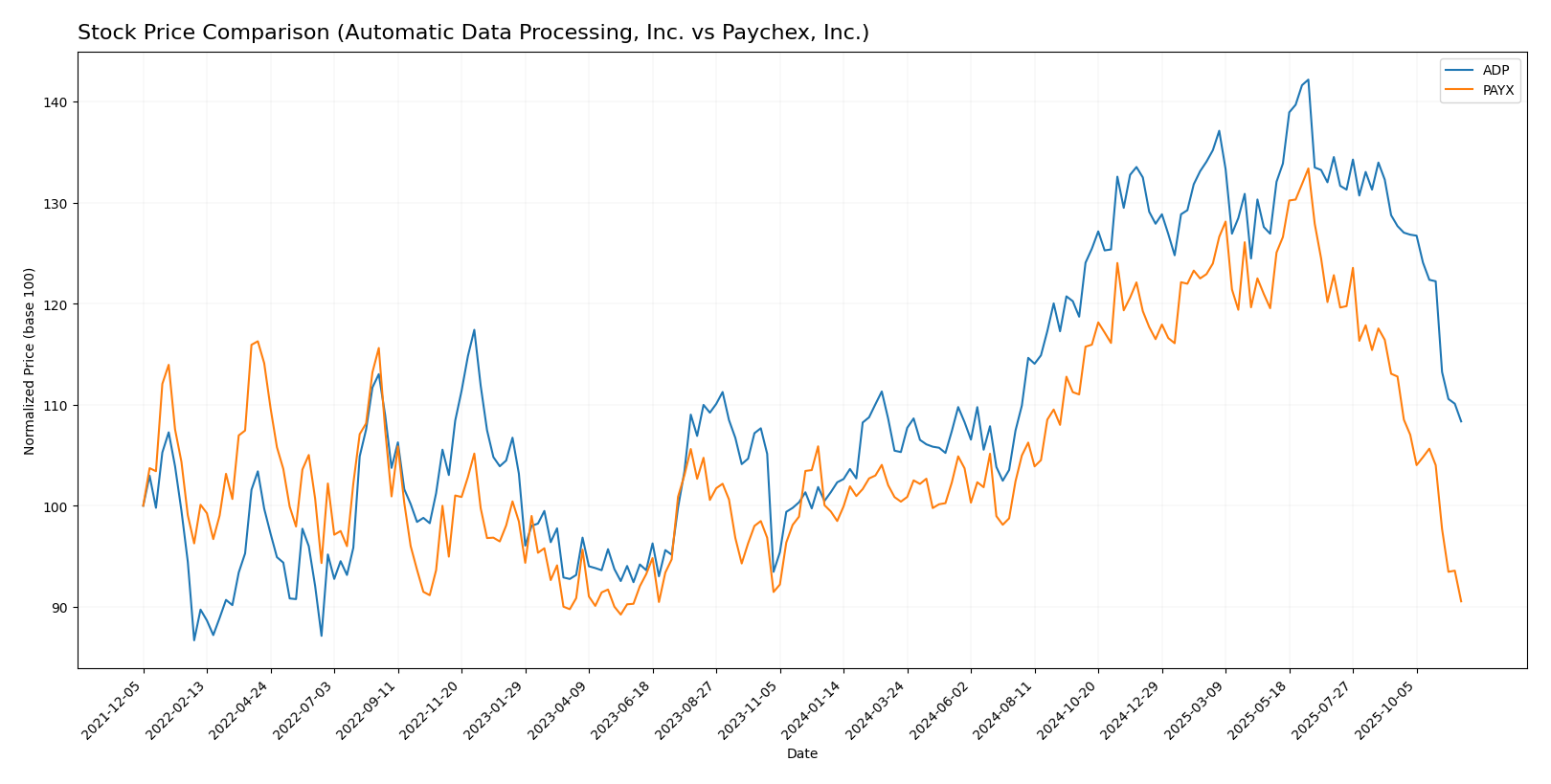

Stock Comparison

Over the past year, Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX) have demonstrated distinct stock price movements and trading dynamics, highlighting varying investor sentiments and market conditions.

Trend Analysis

For ADP, the overall percentage change in stock price over the past year is +6.91%. This indicates a bullish trend, although the trend shows signs of deceleration. The stock has experienced notable highs at 326.81 and lows at 232.97, reflecting a standard deviation of 26.83, which suggests moderate volatility. Recently, from September 7, 2025, to November 23, 2025, the stock declined by -15.85%, with a trend slope of -4.67 and a standard deviation of 17.14, indicating further price instability in this period.

Conversely, PAYX has reported an overall percentage change of -8.94%, marking a bearish trend. The stock has also experienced a deceleration in its price movement, with the highest price at 159.78 and the lowest at 108.46, accompanied by a standard deviation of 12.36. From September 7, 2025, to November 23, 2025, PAYX faced a significant decline of -19.92%, with a trend slope of -2.4 and a standard deviation of 8.6, which indicates a lower level of volatility compared to ADP.

In summary, while ADP is in a bullish phase overall, it is currently facing some downward pressure, whereas PAYX is experiencing a clear bearish trend. Both stocks exhibit deceleration in their respective price movements, warranting careful consideration for investors.

Analyst Opinions

Recent analyst recommendations for both Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX) indicate a consensus rating of “B+.” Analysts highlight strong metrics in return on equity and return on assets, suggesting robust operational efficiency. Both companies have been rated positively due to their solid discounted cash flow scores. However, the lower scores in price-to-earnings and price-to-book ratios present some caution. As of now, the consensus leans towards a “buy” for the current year, reflecting confidence in their growth potential.

Stock Grades

In the current market landscape, it’s crucial to stay informed on the latest stock ratings from reputable grading companies. Here’s a look at the recent grades for Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX).

Automatic Data Processing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

| Stifel | maintain | Hold | 2025-07-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-17 |

| Mizuho | maintain | Outperform | 2025-06-13 |

| UBS | maintain | Neutral | 2025-06-13 |

| RBC Capital | maintain | Sector Perform | 2025-06-05 |

| TD Securities | maintain | Hold | 2025-05-21 |

Paychex, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-10-20 |

| BMO Capital | maintain | Market Perform | 2025-10-01 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-01 |

| Stifel | maintain | Hold | 2025-09-22 |

| UBS | maintain | Neutral | 2025-09-17 |

| Citigroup | maintain | Neutral | 2025-08-21 |

| JP Morgan | maintain | Underweight | 2025-08-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-27 |

| Jefferies | maintain | Hold | 2025-06-26 |

| UBS | maintain | Neutral | 2025-06-26 |

Overall, both ADP and PAYX have received consistent grades with a noticeable emphasis on maintaining their current positions rather than making aggressive moves. The grades reflect a cautious outlook from analysts, suggesting a stable but not overly bullish sentiment in the market for these companies.

Target Prices

The consensus target prices from reliable analysts for the following companies are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Automatic Data Processing, Inc. (ADP) | 290 | 245 | 278.25 |

| Paychex, Inc. (PAYX) | 165 | 128 | 142.56 |

For ADP, the consensus target price of 278.25 suggests a potential upside compared to its current price of 249.06. Meanwhile, PAYX’s consensus of 142.56 also indicates a favorable outlook given its current trading price of 108.46. Overall, analysts expect positive movements for both stocks.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of two companies in the staffing and employment services sector, Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX).

| Criterion | ADP | PAYX |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (20%) | Strong (30%) |

| Innovation | Moderate | High |

| Global presence | Extensive | Limited |

| Market Share | 10% | 5% |

| Debt level | Moderate (17%) | High (30%) |

Key takeaways indicate that while ADP benefits from a broad global presence and high diversification, PAYX excels in profitability and innovation. However, the higher debt level of PAYX may pose a risk for potential investors.

Risk Analysis

In the following table, I outline the key risks associated with Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX).

| Metric | ADP | PAYX |

|---|---|---|

| Market Risk | Moderate | Moderate |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face regulatory risks that could significantly impact their operations, particularly in the evolving labor market landscape. Recent changes in employment laws and tax regulations amplify this concern.

Which one to choose?

When comparing Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX), both companies exhibit strong fundamentals, with similar B+ ratings from analysts. ADP shows a higher gross profit margin (50.8%) and net profit margin (19.8%) compared to PAYX’s gross margin of 72.4% and net margin of 29.7%. However, PAYX has a more favorable current ratio (1.28 vs. 1.05), indicating better liquidity management.

In terms of stock trends, ADP is currently on a bullish trajectory with a 6.91% price change, whereas PAYX reflects a bearish trend with a -8.94% price change. Given these factors, I would recommend ADP for growth-focused investors, while PAYX may appeal to those looking for stability and consistent dividend yields amidst current market fluctuations.

Both companies face risks, including potential market dependence and competition in the payroll services industry.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Automatic Data Processing, Inc. and Paychex, Inc. to enhance your investment decisions: