In today’s fast-paced investment landscape, choosing the right company to add to your portfolio can be daunting. In this article, I will compare Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA), two giants in the technology and communication sectors. While both companies operate in overlapping markets, they adopt distinct innovation strategies that set them apart. Join me as we explore their strengths and weaknesses to uncover which company may be the more compelling choice for investors like you.

Table of contents

Company Overview

Cisco Systems, Inc. Overview

Cisco Systems, Inc. is a leading player in the technology sector, specializing in Internet Protocol (IP)-based networking and communication solutions. Founded in 1984 and headquartered in San Jose, California, Cisco designs and sells a diverse range of products enhancing connectivity and security across various industries. Its offerings include enterprise routing, switching, and security solutions, as well as collaboration tools like the Webex Suite. Cisco aims to deliver seamless digital experiences for businesses of all sizes and sectors, emphasizing security and reliability in connectivity. With a market capitalization of approximately $300.7B, Cisco is positioned as a critical infrastructure provider in the evolving digital landscape.

Comcast Corporation Overview

Comcast Corporation stands as a multifaceted media and technology company, founded in 1963 and based in Philadelphia, Pennsylvania. The company operates through several segments, including Cable Communications, Media, Studios, Theme Parks, and Sky. Comcast delivers broadband, video, and voice services under its Xfinity brand while also producing content through NBCUniversal’s platforms. It has a strong presence in entertainment with its theme parks and streaming services like Peacock. With a market cap of about $97.4B, Comcast plays a pivotal role in shaping consumer media consumption and connectivity.

Key Similarities and Differences

Both Cisco and Comcast operate in the communication services space, focusing on connectivity and technology solutions. Cisco emphasizes infrastructure and security for businesses, while Comcast provides consumer-oriented services and media content. Their business models differ significantly, with Cisco catering to enterprise needs and Comcast straddling both consumer and business markets through diverse media and communication services.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA) for their most recent fiscal years.

| Metric | CSCO | CMCSA |

|---|---|---|

| Revenue | 56.65B | 123.73B |

| EBITDA | 15.38B | 37.61B |

| EBIT | 12.52B | 22.81B |

| Net Income | 10.18B | 16.19B |

| EPS | 2.56 | 4.17 |

Interpretation of Income Statement

In the latest fiscal year, CSCO reported a slight decline in revenue compared to the previous year, while CMCSA experienced growth. CSCO’s net income also decreased, reflecting margin pressures, whereas CMCSA maintained robust profitability with improved margins. Notably, CSCO’s EBITDA margin has contracted, indicating potential challenges in cost management. Conversely, CMCSA’s strong EBITDA growth suggests effective operational efficiency and revenue generation strategies. Overall, while CMCSA shows positive momentum, CSCO may need to address its declining performance to sustain investor confidence.

Financial Ratios Comparison

The following table presents a comparison of key financial ratios for Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA) as of the latest available data.

| Metric | CSCO | CMCSA |

|---|---|---|

| ROE | 21.73% | 18.92% |

| ROIC | 11.62% | 8.56% |

| P/E | 26.83 | 11.75 |

| P/B | 5.83 | 2.19 |

| Current Ratio | 0.998 | 0.677 |

| Quick Ratio | 0.908 | 0.677 |

| D/E | 0.633 | 1.158 |

| Debt-to-Assets | 24.24% | 36.66% |

| Interest Coverage | 7.38 | 5.64 |

| Asset Turnover | 0.463 | 0.464 |

| Fixed Asset Turnover | 16.59 | 2.04 |

| Payout Ratio | 63.23% | 30.73% |

| Dividend Yield | 2.36% | 3.28% |

Interpretation of Financial Ratios

Cisco exhibits stronger profitability metrics (higher ROE and ROIC), indicating effective capital utilization compared to Comcast. However, Cisco’s higher P/E ratio suggests a premium valuation relative to earnings. Comcast, while having a lower dividend payout ratio, offers a higher dividend yield, appealing to income-focused investors. The concern lies in Comcast’s higher debt ratios, indicating greater leverage and potential risk.

Dividend and Shareholder Returns

Cisco Systems, Inc. (CSCO) maintains a solid dividend policy with a payout ratio of 63% and a dividend yield of 2.36%. The company has consistently increased its dividend per share, demonstrating commitment to returning value to shareholders while ensuring coverage through robust free cash flow. In contrast, Comcast Corporation (CMCSA) has a lower payout ratio of 30% and offers a yield of 2.64%. Both companies engage in share buyback programs, signaling a focus on shareholder value creation. Overall, these strategies appear sustainable for long-term growth.

Strategic Positioning

Cisco Systems, Inc. (CSCO) holds a significant market share in the communication equipment industry, leveraging its extensive portfolio in networking and security solutions. Benchmarking against competitors reveals competitive pressure primarily from emerging tech firms focusing on innovative networking technologies. Meanwhile, Comcast Corporation (CMCSA) maintains a substantial presence in the telecommunications sector, with its diverse services under the Xfinity brand. Both companies face technological disruptions, prompting a need for continuous adaptation to market demands and consumer preferences.

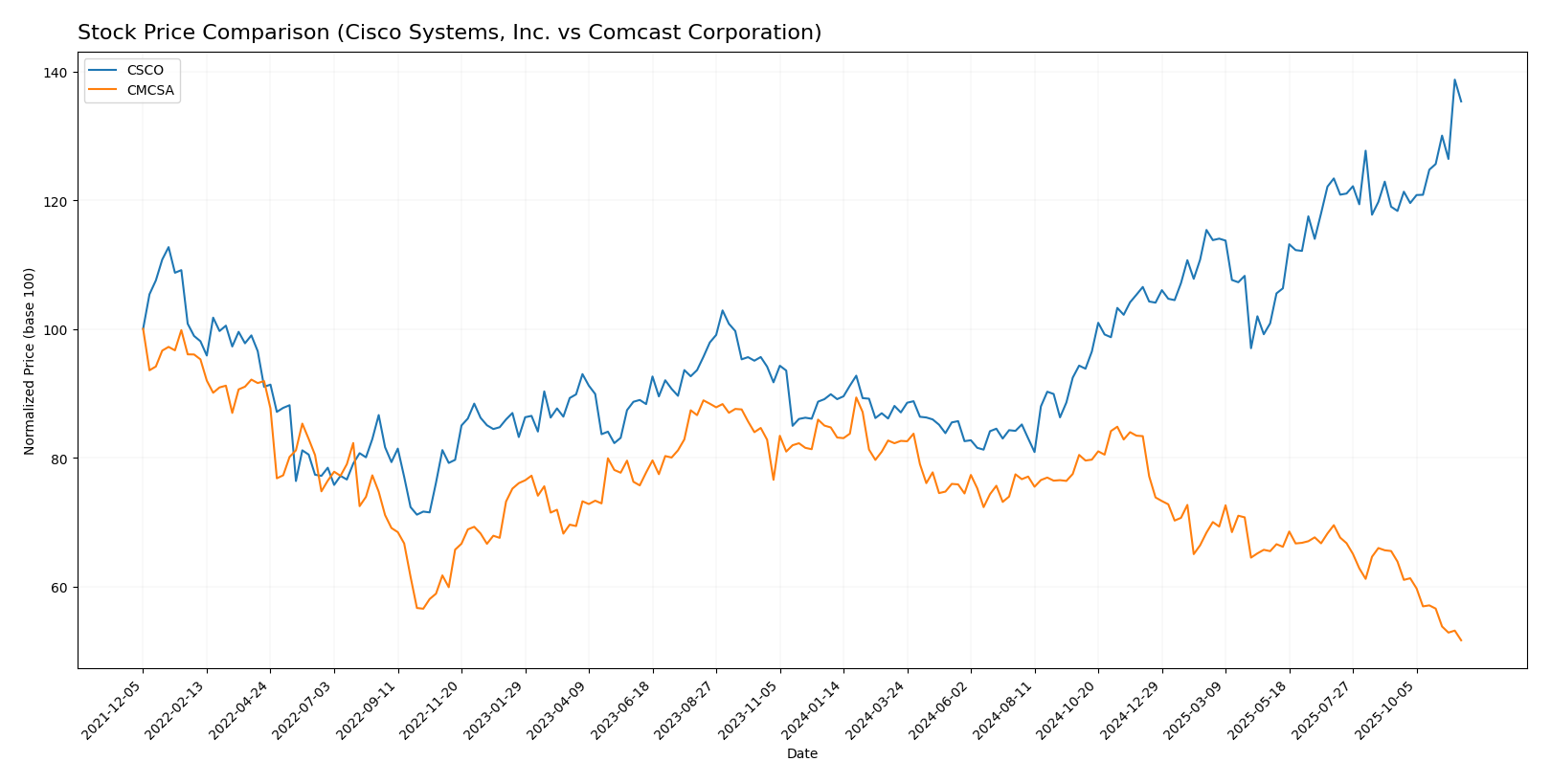

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA) over the past year, highlighting significant trends and performance metrics.

Trend Analysis

Cisco Systems, Inc. (CSCO) has exhibited a remarkable bullish trend over the past year, with a percentage change of +50.62%. The stock has experienced notable acceleration, reaching a high of 78.0 and a low of 45.47. The standard deviation of 8.48 indicates some volatility, but overall, the upward momentum suggests strong investor confidence.

In the recent period from September 7, 2025, to November 23, 2025, CSCO’s percentage change is +13.74%, with a standard deviation of 3.56, reinforcing the bullish outlook. The trend slope of 0.92 indicates a robust upward trajectory.

Comcast Corporation (CMCSA), on the other hand, has faced a bearish trend, reflecting a percentage change of -39.04% over the past year. This decline is characterized by deceleration, with a maximum price of 46.26 and a minimum of 26.73. The standard deviation of 4.37 suggests moderate volatility.

In the recent analysis period from September 7, 2025, to November 23, 2025, CMCSA exhibited a further decrease of -21.17%, with a standard deviation of 2.24. The trend slope of -0.64 indicates a downward trend, compounded by a shift in buyer behavior towards a seller-dominant market.

In summary, while CSCO shows a strong upward trend and increasing buyer dominance, CMCSA is experiencing significant declines and a shift in market sentiment. Investors should consider these dynamics when evaluating potential investments in these stocks.

Analyst Opinions

Recent analyst recommendations for Cisco Systems, Inc. (CSCO) indicate a “Hold” rating, with analysts noting a stable cash flow but concerns regarding its debt-to-equity ratio. Analysts suggest waiting for stronger performance indicators before buying. Conversely, Comcast Corporation (CMCSA) holds an “A” rating, with analysts like Mark Smith emphasizing its strong return on equity and solid growth potential, recommending it as a “Buy.” Overall, the consensus for CSCO is to hold, while CMCSA leans towards a buy for the current year.

Stock Grades

Recent stock ratings provide valuable insights into the performance expectations for Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA). Here’s a closer look at their respective grades.

Cisco Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | maintain | Overweight | 2025-11-13 |

| Morgan Stanley | maintain | Overweight | 2025-11-13 |

| Wells Fargo | maintain | Overweight | 2025-11-13 |

| UBS | maintain | Buy | 2025-11-13 |

| Rosenblatt | maintain | Buy | 2025-11-13 |

| Barclays | maintain | Equal Weight | 2025-11-13 |

| Citigroup | maintain | Buy | 2025-11-13 |

| Evercore ISI Group | maintain | In Line | 2025-11-13 |

| Piper Sandler | maintain | Neutral | 2025-11-13 |

| Melius Research | maintain | Buy | 2025-11-13 |

Comcast Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Neutral | 2025-11-03 |

| Barclays | maintain | Equal Weight | 2025-11-03 |

| Citigroup | maintain | Buy | 2025-11-03 |

| Benchmark | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Bernstein | maintain | Market Perform | 2025-10-31 |

| Scotiabank | maintain | Sector Perform | 2025-10-31 |

| Seaport Global | downgrade | Neutral | 2025-10-31 |

| Evercore ISI Group | maintain | Outperform | 2025-10-31 |

| Keybanc | downgrade | Sector Weight | 2025-10-31 |

In summary, both Cisco and Comcast have received stable grades from reputable grading companies, with Cisco maintaining an “Overweight” sentiment and Comcast seeing a mix of “Buy” and “Neutral” ratings. It’s important to keep an eye on these trends as they can impact future investment decisions.

Target Prices

The target consensus for the following companies reveals valuable insights for potential investors.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cisco Systems, Inc. (CSCO) | 88 | 69 | 76.75 |

| Comcast Corporation (CMCSA) | 41.5 | 28 | 34.59 |

Cisco Systems, Inc. has a target consensus of 76.75, slightly above its current price of 76.065, suggesting a modest upside potential. Comcast Corporation’s consensus of 34.59 indicates a significant gap compared to its current price of 26.741, reflecting stronger growth expectations from analysts.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA) based on the most recent data.

| Criterion | Cisco Systems, Inc. | Comcast Corporation |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 18%) | Moderate (Net Margin: 13%) |

| Innovation | Strong (Focus on tech) | Moderate (Media focus) |

| Global presence | Strong | Moderate |

| Market Share | High in networking | High in media |

| Debt level | Moderate (Debt/Equity: 0.63) | High (Debt/Equity: 1.16) |

Key takeaways reveal that while Cisco excels in profitability, innovation, and global presence, Comcast has a strong market share but is more leveraged. Investors should weigh these factors based on their risk tolerance before making investment decisions.

Risk Analysis

The following table outlines the key risks associated with Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA).

| Metric | Cisco Systems, Inc. | Comcast Corporation |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant market and regulatory risks, particularly Comcast, which operates in a highly competitive and regulated environment. Cisco, while having a lower operational risk, must navigate geopolitical uncertainties, especially given its global presence.

Which one to choose?

When comparing Cisco Systems, Inc. (CSCO) and Comcast Corporation (CMCSA), several factors emerge. CSCO shows a strong gross profit margin of 64.9% and an overall rating of B, while CMCSA, despite its A rating, has lower profitability margins and a bearish stock trend, with a 39% decline in price. Recent trends indicate CSCO’s stock is bullish with a 50.6% price increase, whereas CMCSA is in a deceleration phase.

Investors focused on growth may prefer CSCO due to its favorable margins and stock momentum, while those prioritizing high ratings and potential stability may favor CMCSA. However, be cautious of CMCSA’s higher debt levels and recent performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cisco Systems, Inc. and Comcast Corporation to enhance your investment decisions: