In today’s competitive technology landscape, Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT) are two notable players that provide innovative solutions for customer engagement and relationship management. While Salesforce focuses on comprehensive CRM applications, Verint specializes in customer engagement analytics and workforce optimization. Both companies operate within the software industry but target different aspects of customer interaction. In this article, I will help you determine which company may offer more intriguing investment opportunities for your portfolio.

Table of contents

Company Overview

Salesforce, Inc. Overview

Salesforce, Inc. (CRM) is a leader in customer relationship management (CRM) technology, providing a comprehensive platform that connects companies with their customers. Founded in 1999 and headquartered in San Francisco, Salesforce empowers businesses through its Customer 360 platform, which facilitates seamless interactions across various touchpoints. The company offers a suite of services, including sales, service, marketing, and analytics solutions, enabling organizations to deliver personalized customer experiences at scale. With a market capitalization of approximately $216B, Salesforce has positioned itself as a vital tool for companies seeking to enhance customer engagement and optimize their operations.

Verint Systems Inc. Overview

Verint Systems Inc. (VRNT) specializes in customer engagement solutions, focusing on enhancing customer experiences through innovative software applications. Established in 1994 and based in Melville, New York, Verint provides tools for workforce optimization, customer interaction analytics, and engagement orchestration. With a market capitalization of around $1.22B, Verint leverages advanced technologies such as AI and automation to help organizations excel in customer service and compliance. Its commitment to delivering actionable insights strengthens its position in the customer engagement software market.

Key Similarities and Differences

Both Salesforce and Verint operate within the technology sector but differ in their focus areas. Salesforce primarily offers a broad range of CRM solutions, while Verint concentrates on customer engagement and workforce optimization. Their complementary services can be strategically integrated, giving organizations a comprehensive approach to managing customer relationships and enhancing service delivery.

Income Statement Comparison

The following table provides a comparison of key income metrics for Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT) for the most recent fiscal year.

| Metric | Salesforce, Inc. (CRM) | Verint Systems Inc. (VRNT) |

|---|---|---|

| Revenue | 37.9B | 909.2M |

| EBITDA | 11.1B | 158.0M |

| EBIT | 7.7B | 108.5M |

| Net Income | 6.2B | 82.3M |

| EPS | 6.44 | 1.05 |

Interpretation of Income Statement

In the most recent year, Salesforce demonstrated robust growth with a revenue increase to 37.9B, reflecting a significant rise from the previous year’s 34.9B. This growth was accompanied by an increase in net income from 4.1B to 6.2B, resulting in improved margins. Conversely, Verint’s revenue remained relatively stable with slight fluctuations, showing a small decrease from 910.4M to 909.2M. Their net income also reflects moderate stability at 82.3M, showcasing a resilience in their operating performance despite the challenging market conditions. Overall, Salesforce displays stronger growth and margin improvement compared to Verint, which suggests a more favorable investment opportunity in CRM.

Financial Ratios Comparison

In this section, I present a comparative analysis of the key financial ratios for Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT). This will help in assessing their performance and stability.

| Metric | Salesforce, Inc. (CRM) | Verint Systems Inc. (VRNT) |

|---|---|---|

| ROE | 10.13% | 6.22% |

| ROIC | 7.91% | 4.79% |

| P/E | 53.04 | 19.17 |

| P/B | 5.37 | 1.19 |

| Current Ratio | 1.06 | 1.12 |

| Quick Ratio | 1.06 | 1.09 |

| D/E | 0.20 | 0.34 |

| Debt-to-Assets | 0.12 | 0.20 |

| Interest Coverage | 0 | 10.50 |

| Asset Turnover | 0.37 | 0.40 |

| Fixed Asset Turnover | 7.03 | 11.96 |

| Payout ratio | 24.80% | 24.41% |

| Dividend yield | 0.47% | 1.27% |

Interpretation of Financial Ratios

The financial ratios indicate that CRM has a higher P/E and P/B ratio than VRNT, suggesting market expectations of growth. However, VRNT shows a better interest coverage ratio, indicating stronger ability to meet interest obligations. CRM’s lower debt ratios imply better financial stability, but the high P/E raises concerns about overvaluation. Overall, both companies have strengths and weaknesses, and potential investors should consider these factors carefully before making decisions.

Dividend and Shareholder Returns

Salesforce, Inc. (CRM) pays a dividend of $1.60 per share, with a payout ratio of approximately 25%, reflecting a sustainable distribution supported by robust free cash flow. However, caution is warranted regarding potential risks of excessive repurchases.

Conversely, Verint Systems Inc. (VRNT) implements a reinvestment strategy, paying a modest dividend of $0.32 per share and a payout ratio near 24%. The company focuses on growth and R&D, which may align with long-term shareholder value creation, despite lower immediate returns.

In summary, both companies demonstrate a commitment to shareholder returns, which supports sustainable value creation, albeit with differing strategies.

Strategic Positioning

Salesforce, Inc. (CRM) holds a dominant position in the customer relationship management (CRM) market, boasting a market cap of $216B and a robust ecosystem with its Customer 360 platform. In comparison, Verint Systems Inc. (VRNT) focuses on customer engagement solutions, with a significantly smaller market cap of $1.22B. While Salesforce faces competitive pressure from emerging SaaS platforms, Verint must navigate a landscape characterized by increasing demand for AI-driven customer insights and automation technologies. Both companies must remain vigilant against technological disruptions that could reshape the industry.

Stock Comparison

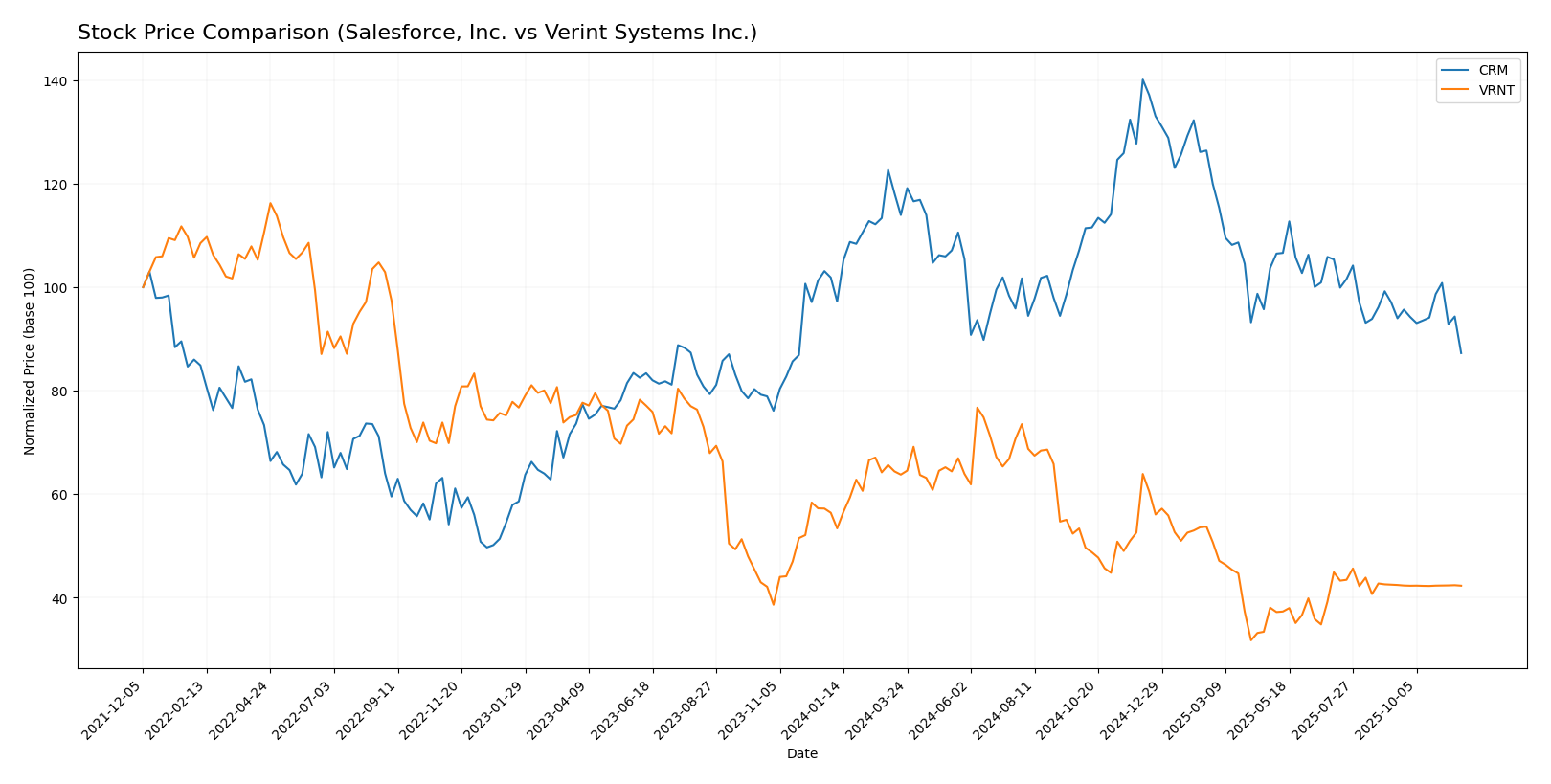

In analyzing the stock price movements of Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT) over the past year, notable trends have emerged, reflecting the dynamics of their respective trading environments.

Trend Analysis

For Salesforce, Inc. (CRM), the overall price change over the past year is -14.36%, indicating a bearish trend. The stock has demonstrated a deceleration in its price movement, with notable highs of 361.99 and lows of 225.34. The standard deviation of 31.09 suggests a significant level of volatility in the stock’s price.

In the recent period from September 7, 2025, to November 23, 2025, CRM has experienced a price change of -10.14%, and the standard deviation is 8.3, indicating a decrease in volatility compared to the overall trend.

Conversely, for Verint Systems Inc. (VRNT), the overall price change is -25.03%, also reflecting a bearish trend, but with an acceleration in the downward price movement. The highest price recorded was 36.78, with a low of 15.2. The standard deviation of 5.52 indicates lower volatility compared to CRM.

In the recent period, VRNT shows a slight decline of -0.47%, with an extremely low standard deviation of 0.03, suggesting very stable price behavior during this timeframe.

Both stocks are currently in bearish trends, with CRM showing deceleration and VRNT experiencing acceleration in price declines.

Analyst Opinions

Recent analyst recommendations for Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT) both indicate a “B+” rating, suggesting a cautious optimism. Analysts highlight CRM’s solid discounted cash flow and asset returns, while VRNT excels in price-to-book ratio and discounted cash flow metrics. Analysts recommend a hold for both stocks, citing market uncertainties. The general consensus leans towards a hold rather than a strong buy or sell, indicating that investors should carefully assess their risk tolerance before making decisions.

Stock Grades

As we delve into the current stock grades, it’s essential to assess how analysts view these companies moving forward.

Salesforce, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-17 |

| B of A Securities | maintain | Buy | 2025-11-17 |

| JMP Securities | maintain | Market Outperform | 2025-10-17 |

| DA Davidson | maintain | Neutral | 2025-10-16 |

| Wedbush | maintain | Outperform | 2025-10-16 |

| Piper Sandler | maintain | Overweight | 2025-10-16 |

| Macquarie | maintain | Neutral | 2025-10-16 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-16 |

| Needham | maintain | Buy | 2025-10-16 |

| Stifel | maintain | Buy | 2025-10-09 |

Verint Systems Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | downgrade | Sector Perform | 2025-08-26 |

| Needham | downgrade | Hold | 2025-08-25 |

| Rosenblatt | downgrade | Neutral | 2025-08-25 |

| Needham | maintain | Buy | 2025-06-05 |

| Wedbush | maintain | Outperform | 2025-06-05 |

| Needham | maintain | Buy | 2025-04-25 |

| Wedbush | maintain | Outperform | 2025-03-28 |

| Needham | maintain | Buy | 2025-03-27 |

| RBC Capital | maintain | Outperform | 2025-03-27 |

| Evercore ISI Group | maintain | In Line | 2025-03-27 |

Overall, Salesforce, Inc. maintains a strong position with consistent “Outperform” and “Buy” ratings from multiple reputable firms, indicating confidence in its performance. In contrast, Verint Systems Inc. has seen recent downgrades, suggesting a shift in analyst sentiment that warrants caution for potential investors.

Target Prices

Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT) have reliable target price forecasts from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Salesforce, Inc. | 404 | 350 | 383 |

| Verint Systems Inc. | 20.5 | 20.5 | 20.5 |

Salesforce has a target consensus of 383, significantly higher than its current price of 225.49, indicating a strong upside potential. Verint’s target consensus aligns with its current price of 20.265, suggesting a more stable outlook without substantial growth expectation.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT).

| Criterion | Salesforce, Inc. (CRM) | Verint Systems Inc. (VRNT) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 16.35%) | Moderate (Net Margin: 9.05%) |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Leading | Niche |

| Debt level | Low (Debt/Assets: 11.73%) | Moderate (Debt/Assets: 19.58%) |

In summary, Salesforce shines with strong profitability and global presence, whereas Verint offers moderate performance in these areas but operates in a niche market. Understanding these factors can guide investment decisions.

Risk Analysis

The following table summarizes the key risks associated with Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT):

| Metric | Salesforce, Inc. (CRM) | Verint Systems Inc. (VRNT) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

Both companies face significant market risks due to fluctuating customer demand and competition. Salesforce’s operational risk is heightened by potential integration challenges with its broad product offerings, while Verint may experience operational difficulties due to its reliance on technology infrastructure.

Which one to choose?

When comparing Salesforce, Inc. (CRM) and Verint Systems Inc. (VRNT), both companies present appealing attributes for investors. CRM boasts a market cap of 329B and a solid net profit margin of 16.4%, alongside a robust gross profit margin of 77.2%. In contrast, VRNT has a market cap of 1.58B with a net profit margin of 9.1% and a gross profit margin of 71.3%.

The price-to-earnings ratio for CRM is notably high at 53, suggesting potential overvaluation, while VRNT’s ratio is more reasonable at 19.2. Analysts rate both companies at B+, indicating a favorable outlook. However, CRM shows a bearish trend with a price change of -14.4%, while VRNT’s trend is even more pronounced at -25.0%.

Investors focused on growth may prefer CRM for its higher profitability, while those prioritizing value may find VRNT’s lower valuation appealing.

Risks include competition in the tech sector and overall market dependence impacting both companies’ performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Salesforce, Inc. and Verint Systems Inc. to enhance your investment decisions: