In the rapidly evolving landscape of technology, two companies stand out for their innovative approaches: Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI). Both operate within the realm of artificial intelligence, data analytics, and decision support systems, making them prime candidates for comparison. With significant market overlap and differing strategies, I aim to explore which of these firms presents a more compelling investment opportunity. Join me as we delve into their strengths and weaknesses to identify the more intriguing choice for your portfolio.

Table of contents

Company Overview

Palantir Technologies Inc. Overview

Palantir Technologies Inc. specializes in developing software platforms that cater primarily to the intelligence community, aiding in counterterrorism efforts both domestically and internationally. Founded in 2003 and headquartered in Denver, Colorado, the company offers products such as Palantir Gotham for data analysis and operational planning, and Palantir Foundry, which serves as a central operating system for organizational data. Palantir’s commitment to enhancing data-driven decision-making has positioned it as a critical player in the intelligence and defense sectors, with a market capitalization of approximately $375B, reflecting its robust presence in the technology industry.

BigBear.ai Holdings, Inc. Overview

BigBear.ai Holdings, Inc. operates within the artificial intelligence and machine learning sectors, focusing on decision support solutions. The company, headquartered in Columbia, Maryland, is segmented into Cyber & Engineering and Analytics, providing consulting services in cloud engineering, cybersecurity, and big data analytics. With a market cap of about $2.2B, BigBear.ai emphasizes real-time decision-making capabilities through its advanced analytical solutions, making it a growing contender in the information technology services space.

Key similarities between Palantir and BigBear.ai lie in their emphasis on data and technology-driven solutions. However, while Palantir primarily serves the intelligence community, BigBear.ai offers a broader consulting service across various sectors, focusing on both cybersecurity and analytics. This distinction shapes their respective market positions and growth strategies.

Income Statement Comparison

The following table provides a comprehensive comparison of the income statements for Palantir Technologies Inc. and BigBear.ai Holdings, Inc. for the most recent fiscal year available.

| Metric | Palantir Technologies Inc. | BigBear.ai Holdings, Inc. |

|---|---|---|

| Revenue | 2.87B | 158M |

| EBITDA | 342M | -258M |

| EBIT | 310M | -270M |

| Net Income | 462M | -296M |

| EPS | 0.21 | -1.27 |

Interpretation of Income Statement

In the latest fiscal year, Palantir showcased a solid revenue growth of approximately 29% from the previous year, marking a significant recovery in its net income, which reached 462M. The company improved its margins, reflecting effective cost management. Conversely, BigBear.ai demonstrated a slight revenue increase but continued to face substantial operating losses, resulting in a net income deficit of 296M. The negative EBITDA indicates ongoing challenges in operational efficiency, which investors should monitor closely. Overall, while Palantir is on a growth trajectory, BigBear.ai remains under pressure, highlighting differing prospects for investors.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent revenue and financial ratios for Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI).

| Metric | PLTR | BBAI |

|---|---|---|

| ROE | 9.24% | 69.22% |

| ROIC | 5.47% | -32.02% |

| P/E | 368.20 | -4.04 |

| P/B | 34.01 | -279.90 |

| Current Ratio | 5.96 | 0.46 |

| Quick Ratio | 5.96 | 0.46 |

| D/E | 0.05 | -39.42 |

| Debt-to-Assets | 3.77% | 42.59% |

| Interest Coverage | NA | -1.78 |

| Asset Turnover | 0.45 | 0.46 |

| Fixed Asset Turnover | 11.92 | 14.61 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Palantir’s ratios exhibit strong fundamentals, particularly with a high current ratio (5.96), suggesting robust liquidity. However, its P/E ratio (368.20) indicates overvaluation concerns. BigBear.ai, while showing a high ROE (69.22%), presents significant risks with negative profitability metrics (P/E and interest coverage ratios). The heavy debt load (D/E of -39.42) raises red flags about sustainability. Investors should approach BBAI with caution, favoring PLTR for a more stable investment.

Dividend and Shareholder Returns

Palantir Technologies Inc. (PLTR) does not pay dividends, reflecting a reinvestment strategy aimed at growth and innovation. The company focuses on share buybacks, which can enhance shareholder value if executed judiciously. In contrast, BigBear.ai Holdings, Inc. (BBAI) also refrains from dividend payments, primarily due to negative net income and a high growth phase, prioritizing reinvestment over immediate returns. Both companies’ strategies indicate a potential for long-term value creation, contingent on successful execution of their growth plans.

Strategic Positioning

In the competitive landscape of AI-driven software solutions, Palantir Technologies Inc. (PLTR) holds a significant market share, leveraging its advanced platforms for government and enterprise clients. With a market cap of $375B, it faces increasing competitive pressure from emerging players like BigBear.ai Holdings, Inc. (BBAI), which, despite a smaller market cap of $2.2B, offers innovative decision-support solutions. Both companies are navigating technological disruptions as AI evolves, requiring ongoing adaptation to stay ahead in the market.

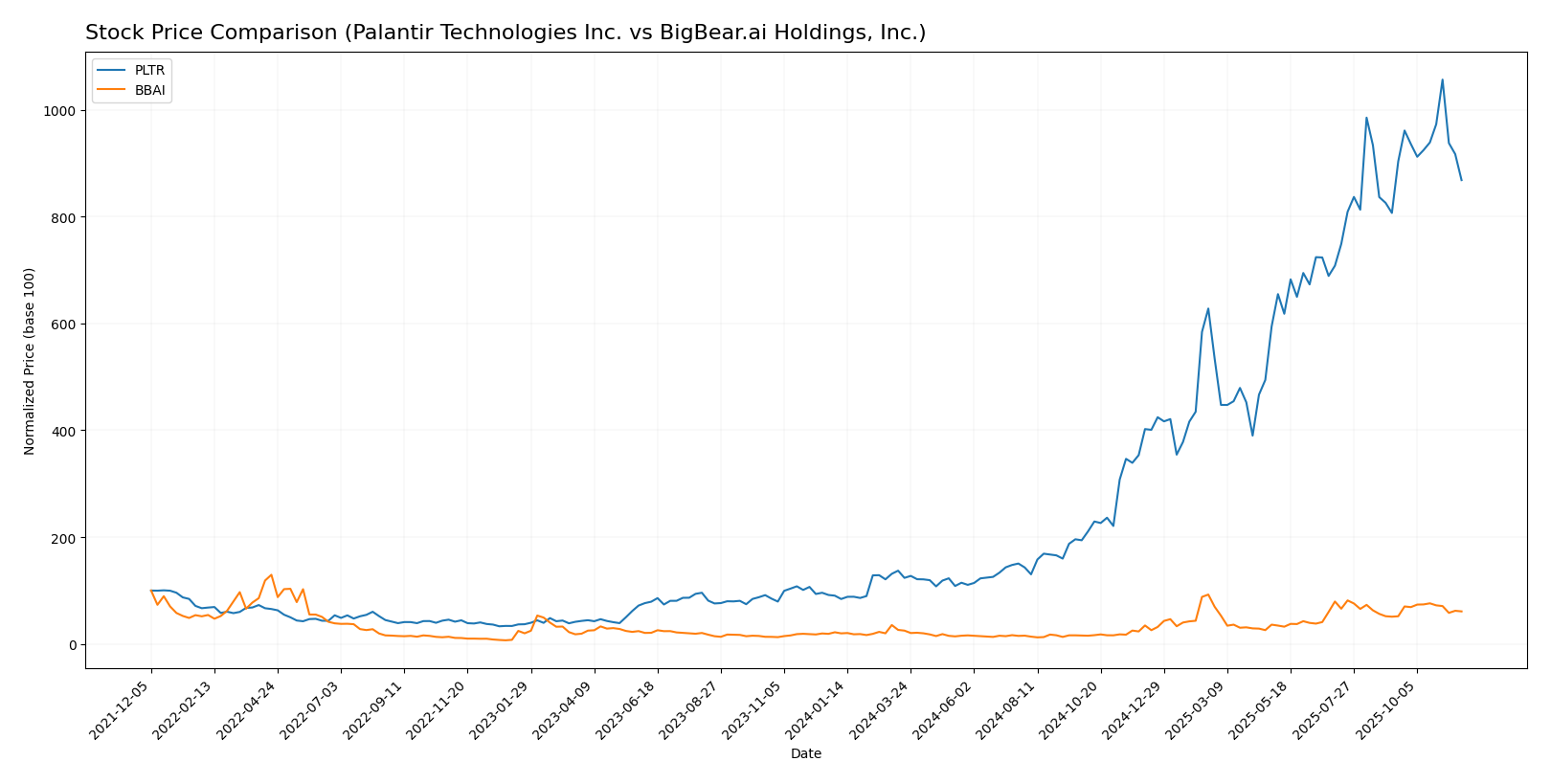

Stock Comparison

This section provides a comparative analysis of the weekly stock price movements for Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI) over the past year, highlighting significant price dynamics and overall trading trends.

Trend Analysis

Palantir Technologies Inc. (PLTR) Over the past year, PLTR has exhibited a remarkable price change of +859.67%. This substantial increase reflects a strong bullish trend; however, the acceleration of this trend is currently in a deceleration phase. The stock has seen notable highs at 200.47 and lows at 15.98, with a standard deviation of 57.21 indicating some volatility. Recently, from September 7, 2025, to November 23, 2025, the price change was +7.62% with a standard deviation of 10.83, suggesting a stable trend despite slight fluctuations.

BigBear.ai Holdings, Inc. (BBAI) BBAI has experienced a price change of +177.87% over the past year, also indicating a bullish trend. Similar to PLTR, this trend is characterized by deceleration. The stock recorded highs of 9.02 and lows of 1.21, with a lower standard deviation of 2.12, which points to less volatility compared to PLTR. In the recent period from September 7, 2025, to November 23, 2025, BBAI’s price change was +19.41% with a standard deviation of 0.82, further confirming its steady upward momentum.

In summary, both stocks are on a bullish trajectory, with PLTR showing more significant price movements and volatility compared to BBAI.

Analyst Opinions

Recent analyst recommendations for Palantir Technologies Inc. (PLTR) show a consensus rating of “Buy” with an overall score of 3. Analysts highlight strong return on assets (5) and equity (4) as key strengths, despite a lower price-to-earnings score (1). In contrast, BigBear.ai Holdings, Inc. (BBAI) has been rated “Sell” with a score of C-, reflecting concerns over its weak performance indicators across multiple metrics. Analysts like those from major firms emphasize caution regarding BBAI’s financial health, underscoring the risks involved.

Stock Grades

As we assess the latest stock grades from reputable sources, I aim to provide you with up-to-date insights for your investment decisions.

Palantir Technologies Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Baird | maintain | Neutral | 2025-11-04 |

| B of A Securities | maintain | Buy | 2025-11-04 |

| Piper Sandler | maintain | Overweight | 2025-11-04 |

| Mizuho | maintain | Neutral | 2025-11-04 |

| DA Davidson | maintain | Neutral | 2025-11-04 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-04 |

| Goldman Sachs | maintain | Neutral | 2025-11-04 |

| UBS | maintain | Neutral | 2025-11-04 |

| RBC Capital | maintain | Underperform | 2025-11-04 |

BigBear.ai Holdings, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | maintain | Buy | 2025-07-01 |

| Cantor Fitzgerald | maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-07 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | maintain | Overweight | 2024-08-21 |

| HC Wainwright & Co. | maintain | Buy | 2024-08-02 |

Overall, both Palantir and BigBear.ai have maintained their current grades, reflecting a stable outlook from analysts. Palantir shows a mixed response with some neutral and overweight ratings, while BigBear.ai continues to receive strong buy recommendations, indicating positive investor sentiment.

Target Prices

The consensus target prices for Palantir Technologies Inc. and BigBear.ai Holdings, Inc. reveal varied expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 215 | 160 | 196.09 |

| BigBear.ai Holdings, Inc. | 7 | 7 | 7 |

For Palantir, the consensus target price of 196.09 indicates optimism compared to its current price of 163.96. Meanwhile, BigBear.ai’s target price remains steady at 7, aligning closely with its market performance of 5.96.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI) based on recent data.

| Criterion | Palantir Technologies Inc. | BigBear.ai Holdings, Inc. |

|---|---|---|

| Diversification | Strong focus on AI-driven software solutions | Limited product range focused on AI and analytics |

| Profitability | High gross profit margin (80.2%) | Low gross profit margin (28.6%) |

| Innovation | Leading edge in AI technology | Emerging player in AI technology |

| Global presence | Established global operations | Primarily US-focused |

| Market Share | Significant in government contracts | Smaller market share in AI sector |

| Debt level | Low debt-to-equity ratio (0.048) | High debt-to-equity ratio (-39.42) |

Key takeaways: Palantir demonstrates strong profitability and global presence with minimal debt, making it a robust investment option. In contrast, BigBear.ai faces challenges with profitability and high debt levels, indicating higher risk.

Risk Analysis

In the following table, I outline the key risks associated with two companies, Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI).

| Metric | Palantir Technologies Inc. | BigBear.ai Holdings, Inc. |

|---|---|---|

| Market Risk | High (Beta: 1.477) | Very High (Beta: 3.186) |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks, with BigBear.ai exhibiting higher volatility and regulatory concerns. Recent market fluctuations have emphasized the need for robust risk management strategies, especially in the context of rising interest rates and geopolitical tensions.

Which one to choose?

In comparing Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI), the fundamentals suggest that PLTR is more favorable for investors. PLTR boasts a strong gross profit margin of 80.2%, while BBAI’s gross margin stands at only 28.6%. Moreover, PLTR has a significantly better return on equity (9.2) compared to BBAI’s return on equity of 69.2, despite BBAI’s higher debt levels and negative margins. Stock trends indicate a bullish sentiment for both companies, but PLTR has seen a larger price increase of 859.67% over the past year. Analyst ratings are also telling; PLTR has a rating of B, while BBAI is rated C-.

Investors focused on growth may prefer PLTR for its solid fundamentals and trending performance, whereas those prioritizing speculative opportunities might find BBAI appealing, albeit with higher risks related to its financial instability and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Palantir Technologies Inc. and BigBear.ai Holdings, Inc. to enhance your investment decisions: