In today’s dynamic technology landscape, Adobe Inc. and Figma, Inc. emerge as pivotal players in the software industry. Adobe, a stalwart in digital media and experience solutions, contrasts with Figma, an innovative force in collaborative design tools. Their overlapping market focus on enhancing user experience through cutting-edge applications makes this comparison particularly intriguing. As we delve deeper, I will help you discern which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Adobe Inc. Overview

Adobe Inc. is a leading diversified software company, primarily known for its innovative solutions in digital media and digital experience management. Founded in 1982 and headquartered in San Jose, California, Adobe operates through three key segments: Digital Media, Digital Experience, and Publishing and Advertising. Its flagship product, Creative Cloud, empowers content creators with tools for design, video editing, and more. Additionally, the Digital Experience segment offers a comprehensive platform for brands to enhance customer engagement through analytics and commerce, catering to a wide range of professionals, from marketers to data scientists. Adobe’s strong market position is reflected in its impressive market cap of $132.77B.

Figma, Inc. Overview

Founded in 2012 and based in San Francisco, Figma, Inc. specializes in collaborative design tools for user interface development. With a market cap of $17.21B, Figma has gained traction for its browser-based platform that streamlines the product development process for design and development teams. The product suite includes Figma Design, Dev Mode, FigJam, and Figma Slides, all tailored to facilitate collaboration and efficiency. The company’s innovative approach to design tools positions it as a significant player in the software application industry, appealing to a modern workforce that values collaboration and speed.

Both companies operate within the technology sector, focusing on software solutions, yet they cater to different aspects of the design and content creation process. Adobe’s broader portfolio includes a diverse range of services, whereas Figma emphasizes real-time collaboration in design, highlighting a key difference in their business models.

Income Statement Comparison

The following table compares the income statements of Adobe Inc. and Figma, Inc. for the most recent fiscal year, highlighting key financial metrics.

| Metric | Adobe Inc. | Figma, Inc. |

|---|---|---|

| Revenue | 21.5B | 749M |

| EBITDA | 7.96B | -86.97M |

| EBIT | 7.10B | -87.74M |

| Net Income | 5.56B | 286M |

| EPS | 12.44 | 0.59 |

Interpretation of Income Statement

In 2024, Adobe Inc. demonstrated robust growth with a revenue increase to 21.5B, marking a significant rise from the previous year. In contrast, Figma, Inc. saw a substantial revenue increase to 749M, yet still operates at a loss with a negative EBITDA of -86.97M. Adobe’s net income improved to 5.56B, reflecting strong operational efficiency and margin stability. Conversely, Figma’s net income turned positive at 286M, indicating a recovering performance despite its challenges. Overall, Adobe’s growth trajectory remains strong, while Figma shows signs of improvement but still faces hurdles in profitability.

Financial Ratios Comparison

The table below summarizes the latest financial metrics for Adobe Inc. (ADBE) and Figma, Inc. (FIG), allowing for a clear comparison of their financial health.

| Metric | Adobe Inc. (ADBE) | Figma, Inc. (FIG) |

|---|---|---|

| ROE | 39.42% | -55.29% |

| ROIC | 25.41% | -59.27% |

| P/E | 41.49 | N/A |

| P/B | 16.35 | 39.10 |

| Current Ratio | 1.07 | 3.66 |

| Quick Ratio | 1.07 | 3.66 |

| D/E | 0.43 | 0.02 |

| Debt-to-Assets | 20.03% | 1.61% |

| Interest Coverage | 41.10 | N/A |

| Asset Turnover | 0.71 | 0.42 |

| Fixed Asset Turnover | 9.70 | 49.88 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Adobe’s ratios indicate strong financial health, particularly with a robust ROE of 39.42% and a manageable debt-to-equity ratio of 0.43. In contrast, Figma shows concerning figures, notably negative returns on equity and invested capital, coupled with a very high P/B ratio of 39.10, suggesting overvaluation. Figma’s current ratio is favorable at 3.66, indicating good liquidity, but the overall financial performance raises significant red flags regarding its sustainability.

Dividend and Shareholder Returns

Adobe Inc. (ADBE) does not pay dividends, reflecting a strategy focused on reinvestment for growth. The company has consistently allocated resources towards innovation and product development, which can enhance long-term shareholder value. Additionally, Adobe does not engage in share buybacks, further emphasizing its commitment to reinvestment.

On the other hand, Figma, Inc. also does not distribute dividends due to negative net income and a high growth phase. This approach is aimed at prioritizing research and development while building market presence. However, Figma has not reported share buybacks either.

In both cases, the lack of dividend distributions aligns with a strategy aimed at sustainable long-term growth, albeit with inherent risks associated with their growth trajectories.

Strategic Positioning

In the competitive landscape of design and software tools, Adobe Inc. (ADBE) holds a significant market share, primarily through its flagship Creative Cloud, which remains the go-to solution for content creators. Figma, Inc. (FIG), recently going public in 2025, has carved out a niche with its collaborative interface design tools, appealing to teams seeking efficient workflows. Both companies face increasing competitive pressure as technological disruption accelerates, with innovations in AI and collaboration reshaping user expectations and operational capabilities. As such, investors should consider these dynamics when evaluating their positions in these stocks.

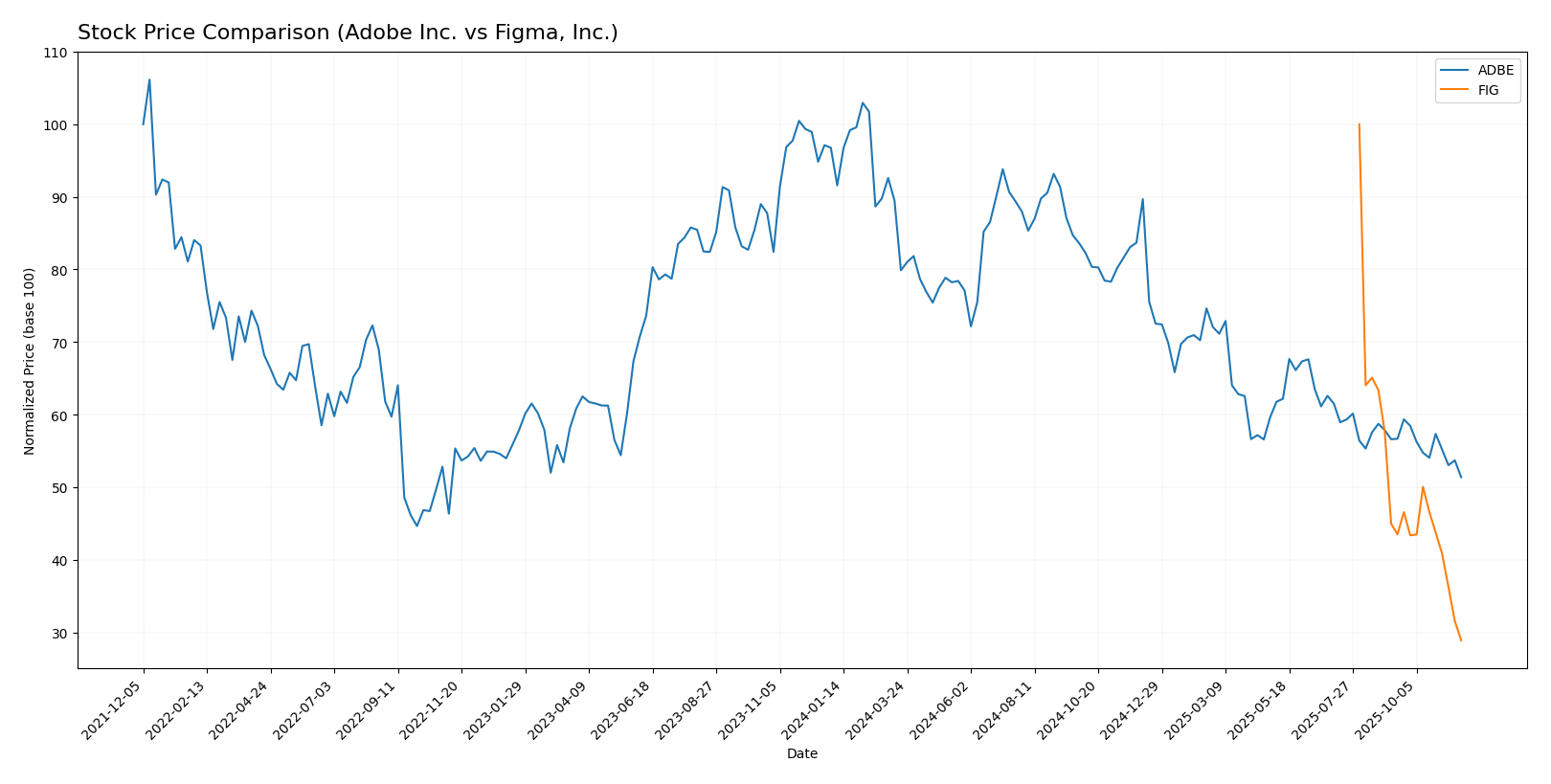

Stock Comparison

In this section, I will compare the stock performance of Adobe Inc. (ADBE) and Figma, Inc. (FIG) over the past year, highlighting significant price movements and trading dynamics.

Trend Analysis

Adobe Inc. (ADBE)

- Percentage Change (12 months): -46.91%

- Trend Direction: Bearish

- Notable High/Low Prices: Highest price of 634.76 and lowest price of 316.73

- Acceleration Status: Deceleration

- Volatility: Standard deviation of 84.12 indicates high volatility in the price movements.

- Recent Trend (from 2025-09-07 to 2025-11-23):

- Percentage Change: -9.24%

- Trend Slope: -3.06

- Standard Deviation: 13.68

Figma, Inc. (FIG)

- Percentage Change (12 months): -71.1%

- Trend Direction: Bearish

- Notable High/Low Prices: Highest price of 122.0 and lowest price of 35.26

- Acceleration Status: Acceleration

- Volatility: Standard deviation of 19.7 reflects moderate volatility.

- Recent Trend (from 2025-09-07 to 2025-11-23):

- Percentage Change: -35.73%

- Trend Slope: -1.58

- Standard Deviation: 7.37

In summary, both ADBE and FIG are exhibiting bearish trends, with significant price declines over the past year. ADBE shows signs of deceleration, while FIG is experiencing acceleration in its downward trajectory.

Analyst Opinions

Recent analyst recommendations indicate a cautious outlook for both Adobe Inc. (ADBE) and Figma, Inc. (FIG). Analysts have assigned a “B+” rating to Adobe, suggesting a strong buy due to its robust return on equity and assets. On the other hand, Figma received a “B-” rating, indicating a hold, primarily due to its weaker return on equity metrics. The consensus for Adobe is a buy, while Figma leans towards a hold as analysts weigh its growth potential against current market conditions.

Stock Grades

In the current market landscape, let’s explore the recent stock ratings for two prominent companies: Adobe Inc. and Figma, Inc.

Adobe Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | downgrade | Equal Weight | 2025-09-24 |

| JMP Securities | maintain | Market Perform | 2025-09-12 |

| BMO Capital | maintain | Outperform | 2025-09-12 |

| DA Davidson | maintain | Buy | 2025-09-12 |

| Piper Sandler | maintain | Overweight | 2025-09-12 |

| Evercore ISI Group | maintain | Outperform | 2025-09-12 |

| Barclays | maintain | Overweight | 2025-09-12 |

| TD Cowen | maintain | Hold | 2025-09-12 |

| RBC Capital | maintain | Outperform | 2025-09-12 |

| UBS | maintain | Neutral | 2025-09-12 |

Figma, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Neutral | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-06 |

| Wells Fargo | maintain | Equal Weight | 2025-11-05 |

| Wells Fargo | maintain | Equal Weight | 2025-09-04 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-04 |

| RBC Capital | maintain | Sector Perform | 2025-09-04 |

In summary, Adobe has seen a recent downgrade from Morgan Stanley while maintaining several strong ratings from other firms. Figma, on the other hand, remains stable with most analysts opting to maintain their grades, reflecting a neutral sentiment in the market.

Target Prices

The current target consensus for both Adobe Inc. (ADBE) and Figma, Inc. (FIG) indicates optimistic growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Adobe Inc. | 500 | 280 | 420 |

| Figma, Inc. | 80 | 48 | 63.75 |

Analysts expect Adobe’s stock to reach a consensus of 420, significantly above its current price of 317.18. Figma, on the other hand, has a consensus target of 63.75, which suggests considerable upside potential from its current valuation of 35.31.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Adobe Inc. (ADBE) and Figma, Inc. (FIG) based on the most recent data.

| Criterion | Adobe Inc. (ADBE) | Figma, Inc. (FIG) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (25.9% net margin) | Negative (-0.98% net margin) |

| Innovation | High | High |

| Global presence | Extensive | Limited |

| Market Share | Significant | Growing |

| Debt level | Low (20%) | Very low (2%) |

In summary, Adobe boasts strong profitability and a broad global presence, while Figma shows potential for growth despite current losses. Investors should weigh these factors carefully when considering investments.

Risk Analysis

The table below outlines the various risks associated with Adobe Inc. and Figma, Inc., providing a comparative view of their risk profiles.

| Metric | Adobe Inc. (ADBE) | Figma, Inc. (FIG) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Low | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Medium |

In summary, Adobe faces moderate market and regulatory risks, while Figma exhibits higher operational risk as it navigates its recent IPO and market entry. The tech industry remains sensitive to rapid changes and competition, making risk management vital for both companies.

Which one to choose?

In analyzing Adobe Inc. (ADBE) and Figma, Inc. (FIG), the fundamentals favor Adobe. ADBE has a robust gross profit margin of 89% and an impressive net profit margin of 26%. Its price-to-earnings (P/E) ratio of 41.5 suggests that investors may be anticipating future growth despite its high valuation. In contrast, Figma reported negative margins and a P/E ratio of -70.7, indicating potential financial instability.

Analyst ratings show ADBE receiving a “B+” grade, while FIG is rated “B-.” ADBE’s stock trend is bearish, but it demonstrates resilience with a market cap of $231B. FIG’s trend is also bearish, with a market cap of $117B, but its high valuation ratios raise concerns.

Investors focused on growth may prefer Adobe, while those seeking high-risk, high-reward opportunities might consider Figma, albeit with caution due to its financial challenges.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Adobe Inc. and Figma, Inc. to enhance your investment decisions: