In the rapidly evolving landscape of cloud security, two companies stand out: Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS). Both firms operate in the software infrastructure industry, offering innovative solutions for businesses seeking to enhance their online security and performance. As they target similar markets and embrace cutting-edge technologies, their strategies and growth potential warrant a detailed comparison. Join me as we explore which of these companies presents the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Cloudflare, Inc. Overview

Cloudflare, Inc. (NYSE: NET) is a leading provider of cloud services, focusing on security and performance solutions for businesses globally. Founded in 2009 and headquartered in San Francisco, California, Cloudflare’s mission is to help build a better Internet by delivering an integrated suite of security solutions, including firewalls, bot management, and DDoS protection. The company also provides performance enhancements such as content delivery and optimization services. With a market capitalization of approximately 69B and a workforce of 4,400 employees, Cloudflare is well-positioned to serve a diverse range of industries, including technology, healthcare, and financial services.

Zscaler, Inc. Overview

Zscaler, Inc. (NASDAQ: ZS) is a prominent cloud security company that specializes in providing secure access to applications and data in the cloud. Established in 2007 and based in San Jose, California, Zscaler’s mission is to simplify security in the cloud era. Its primary offerings include Zscaler Internet Access and Zscaler Private Access, which facilitate secure connections for users and devices alike. With a market cap of around 44.6B and a staff of 7,348, Zscaler is a key player in sectors such as financial services, healthcare, and telecommunications, aiming to enhance user experience and reduce security risks.

Key Similarities and Differences

Both Cloudflare and Zscaler operate in the cloud security space, focusing on providing robust security solutions for businesses. However, Cloudflare emphasizes a broader array of integrated performance solutions alongside security, while Zscaler specializes in secure access to applications, underscoring its focus on cloud-only environments. This distinction highlights their unique approaches within the same industry.

Income Statement Comparison

The following table presents a comparative analysis of the income statements for Cloudflare, Inc. and Zscaler, Inc. for their most recent fiscal year.

| Metric | Cloudflare, Inc. | Zscaler, Inc. |

|---|---|---|

| Revenue | 1.67B | 2.67B |

| EBITDA | 62M | 112M |

| EBIT | -66M | -9M |

| Net Income | -79M | -41M |

| EPS | -0.23 | -0.27 |

Interpretation of Income Statement

In the most recent fiscal year, Cloudflare reported revenues of 1.67B, reflecting significant growth from the previous year’s 1.30B. Despite this, the company continues to face challenges with a net loss of 79M. Zscaler, on the other hand, achieved revenues of 2.67B, also up from 2.17B, but reported a net loss of 41M. Both companies are navigating a landscape of increasing revenues while struggling with profitability, highlighting the importance of managing operational expenses effectively. The slight improvement in EBITDA margins suggests a potential for better cost management, yet further analysis is required to understand the sustainability of this growth amidst ongoing losses.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent revenue and financial ratios for Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS).

| Metric | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| ROE | -7.53% | -2.31% |

| ROIC | -6.61% | -7.21% |

| P/E | -466.54 | -1063.01 |

| P/B | 35.14 | 24.51 |

| Current Ratio | 2.86 | 1.94 |

| Quick Ratio | 2.86 | 1.94 |

| D/E | 1.40 | 0.99 |

| Debt-to-Assets | 44.32% | 27.98% |

| Interest Coverage | -29.78 | -13.49 |

| Asset Turnover | 0.51 | 0.42 |

| Fixed Asset Turnover | 2.63 | 4.22 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Both Cloudflare and Zscaler exhibit negative ROE and ROIC, indicating operational challenges. Cloudflare shows a higher current and quick ratio, suggesting better liquidity. However, both companies have high P/E ratios, reflecting investor skepticism about future earnings. Zscaler demonstrates better efficiency with a higher fixed asset turnover but faces notable debt levels. Investors should be cautious due to the negative margins and potential risks in leveraging.

Dividend and Shareholder Returns

Neither Cloudflare, Inc. (NET) nor Zscaler, Inc. (ZS) pays dividends as of 2025, reflecting a focus on reinvesting capital for growth rather than returning cash to shareholders. Both companies are in high-growth phases, prioritizing R&D and expansion, which can enhance long-term shareholder value. However, they engage in share buyback programs, which may support share price appreciation. This strategy, while potentially beneficial, carries risks if not balanced with sustainable operational performance. Overall, their approaches indicate a commitment to value creation, albeit with inherent volatility.

Strategic Positioning

In the competitive landscape of cloud services, Cloudflare (NET) and Zscaler (ZS) are significant players, each capturing distinct market segments within the software infrastructure industry. Cloudflare holds a market cap of $69B, providing integrated cloud-based security solutions across various platforms, while Zscaler, valued at $45B, specializes in cloud security for SaaS applications. Both companies face competitive pressure from emerging technologies and established players, which necessitates constant innovation to maintain their market share and adapt to technological disruptions.

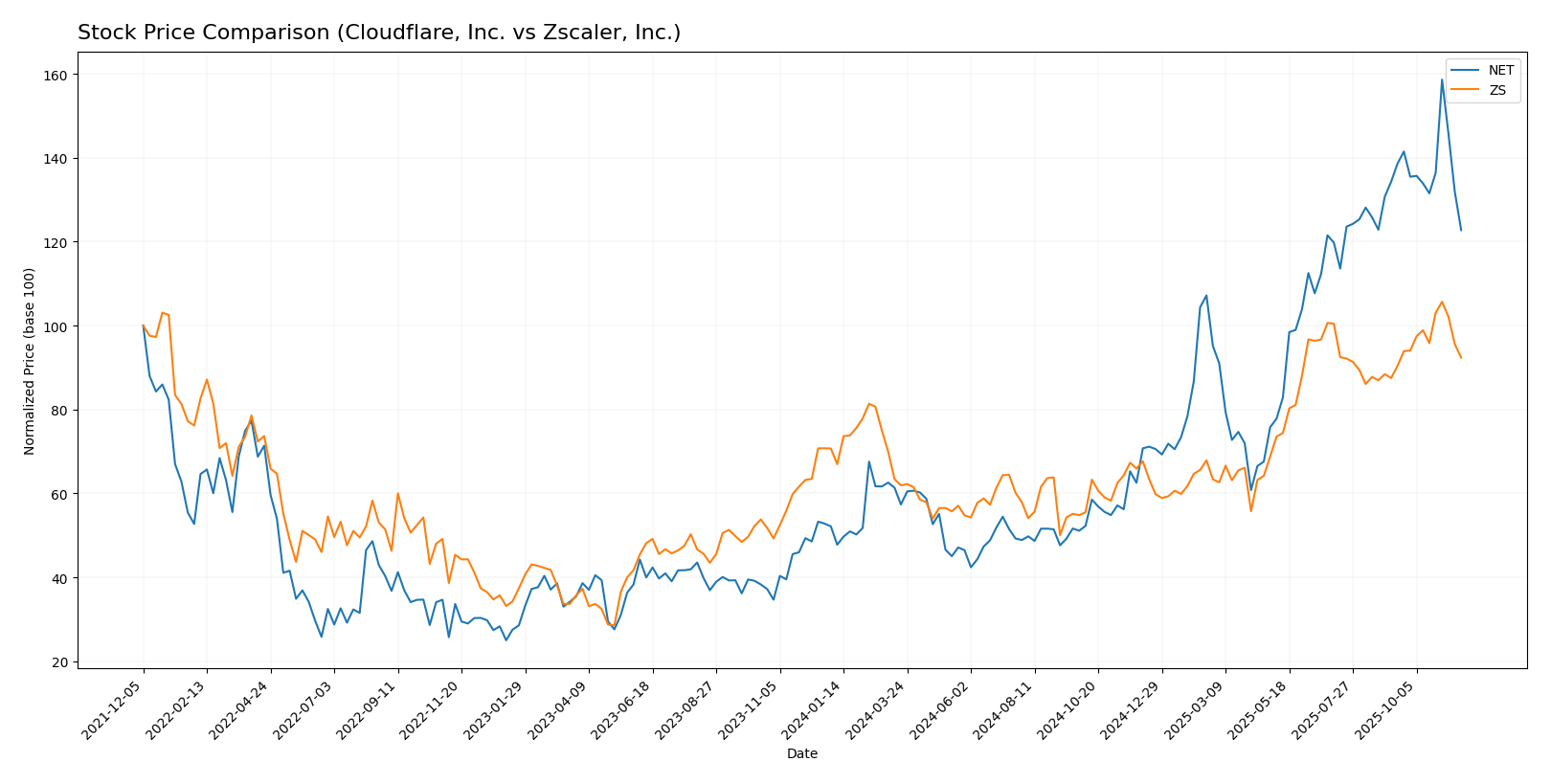

Stock Comparison

In this section, I will analyze the stock price movements of Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) over the past year, highlighting key price dynamics and trading behaviors.

Trend Analysis

Cloudflare, Inc. (NET) has experienced a remarkable price change of +135.43% over the past year. Despite this bullish trend, the recent analysis indicates a price drop of -8.59% from September 7, 2025, to November 23, 2025. This recent trend shows a slight deceleration with a trend slope of -0.23. The stock reached a high of 253.3 and a low of 67.69 during the year, while the standard deviation of 51.19 suggests significant volatility.

Zscaler, Inc. (ZS) has also shown a strong annual price increase of +30.63%, maintaining a bullish trend. Recently, it recorded a positive change of +5.55% over the same period (September 7, 2025, to November 23, 2025), indicating acceleration with a trend slope of 2.52. The stock has fluctuated between a high of 331.14 and a low of 156.78, with a standard deviation of 47.41, highlighting a moderate level of price variability.

In summary, while both stocks exhibit a bullish overall trend, NET’s recent performance suggests caution due to its declining price, whereas ZS shows resilience with continued positive momentum.

Analyst Opinions

Recent analyst recommendations for Cloudflare, Inc. (NET) indicate a cautious stance with a rating of D+, suggesting to hold or sell due to low performance metrics across various financial indicators. Zscaler, Inc. (ZS) has a better outlook with a C- rating, although still not strong enough for a buy recommendation. Analysts highlight concerns about growth sustainability and profitability. Overall, the consensus for NET leans towards a sell, while ZS is more neutral, reflecting a hold position in the current year.

Stock Grades

I have reviewed the stock grades for two companies, Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS), and I found reliable grading data from recognized companies. Here’s a detailed overview of their current ratings.

Cloudflare, Inc. (NET) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | maintain | Buy | 2025-11-10 |

| Citigroup | maintain | Buy | 2025-11-03 |

| Susquehanna | maintain | Neutral | 2025-11-03 |

| Piper Sandler | maintain | Neutral | 2025-10-31 |

| RBC Capital | maintain | Outperform | 2025-10-31 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-31 |

| UBS | maintain | Neutral | 2025-10-31 |

| Mizuho | maintain | Outperform | 2025-10-31 |

| Scotiabank | maintain | Sector Perform | 2025-10-31 |

| Citizens | maintain | Market Outperform | 2025-10-31 |

Zscaler, Inc. (ZS) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-18 |

| Mizuho | maintain | Neutral | 2025-11-17 |

| Morgan Stanley | maintain | Overweight | 2025-11-13 |

| Barclays | maintain | Overweight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

| RBC Capital | maintain | Outperform | 2025-10-02 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

| JMP Securities | maintain | Market Outperform | 2025-09-03 |

| Evercore ISI Group | maintain | Outperform | 2025-09-03 |

| Needham | maintain | Buy | 2025-09-03 |

Overall, both companies show a strong sentiment from analysts, with multiple “Buy” and “Outperform” ratings. This suggests positive confidence in their performance moving forward, although some maintain a more cautious stance with “Neutral” ratings. As always, I recommend considering these grades in conjunction with other market factors before making investment decisions.

Target Prices

The current target price consensus for the two companies is as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 220 | 256 |

| Zscaler, Inc. | 350 | 300 | 326.13 |

Analysts have a positive outlook on both Cloudflare and Zscaler, with target prices significantly higher than their current trading prices of 196.12 for Cloudflare and 288.70 for Zscaler, indicating potential growth opportunities.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) based on recent performance indicators.

| Criterion | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong | Strong |

| Global presence | Strong | Strong |

| Market Share | Increasing | Increasing |

| Debt level | Moderate | Low |

Key takeaways indicate that while both companies show strong innovation and global presence, they are facing challenges with profitability. Zscaler has a lower debt level compared to Cloudflare, which may be favorable for risk-averse investors.

Risk Analysis

In the following table, I outline the key risks associated with Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS), based on the most recent evaluations.

| Metric | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market and operational risks due to their reliance on cloud services and cybersecurity sectors. Recent regulatory changes in data privacy could intensify compliance costs, particularly for Zscaler, which already has a high regulatory risk profile.

Which one to choose?

In comparing Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS), both companies operate in the cybersecurity sector, but their financial metrics and market positions present distinct profiles. Cloudflare shows a gross profit margin of 77.3% but struggles with negative profit margins and a D+ rating, indicating heightened risk. Conversely, Zscaler boasts a slightly lower gross profit margin of 77.5% but a C- rating, suggesting better overall financial health. Zscaler has demonstrated a bullish stock trend with a 30.6% price increase, while Cloudflare’s price change is more volatile, albeit with a greater overall gain of 135.4% in the past year.

Investors focusing on sustainable growth may prefer Zscaler for its relatively stronger financial metrics and market stability, whereas those willing to accept higher risk for potential significant returns might lean toward Cloudflare. Be mindful of industry risks such as intense competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cloudflare, Inc. and Zscaler, Inc. to enhance your investment decisions: