In the fast-evolving tech landscape, Snowflake Inc. (SNOW) and Teradata Corporation (TDC) stand out as key players in the data management sector. Both companies provide innovative solutions for data analytics, but they cater to different market needs and customer bases. While Snowflake focuses on a cloud-based data platform for a wide array of industries, Teradata emphasizes enterprise analytics with a strong multi-cloud strategy. As we delve into this comparison, I aim to help you determine which of these companies could be the most compelling addition to your investment portfolio.

Table of contents

Company Overview

Snowflake Inc. Overview

Snowflake Inc. is a leading provider of cloud-based data platforms, facilitating data consolidation and driving business insights across various industries. Founded in 2012 and headquartered in Bozeman, Montana, Snowflake’s Data Cloud enables organizations to build data-driven applications and share information seamlessly. With a market capitalization of approximately $86B as of October 2023, the company has positioned itself as a vital player in the technology sector, particularly in software applications. The innovative platform serves diverse clients, empowering them to harness their data effectively.

Teradata Corporation Overview

Teradata Corporation, established in 1979 and based in San Diego, California, specializes in connected multi-cloud data platforms for enterprise analytics. Through its flagship product, Teradata Vantage, the company offers comprehensive solutions that integrate data sources and support clients’ cloud migration journeys. With a market cap of around $2.6B, Teradata serves various sectors, including financial services and healthcare, providing critical consulting services to enhance clients’ analytical capabilities. Despite its smaller size relative to Snowflake, Teradata remains a key player in the software infrastructure space.

Key similarities between Snowflake and Teradata include their focus on data analytics and cloud-based solutions, catering to enterprises in various sectors. However, Snowflake emphasizes a more application-centric approach, while Teradata offers broader consulting services and infrastructure support, highlighting differences in their business models.

Income Statement Comparison

The following table summarizes the income statement metrics for Snowflake Inc. and Teradata Corporation, providing a clear view of their financial performance for the most recent fiscal year.

| Metric | Snowflake Inc. (SNOW) | Teradata Corporation (TDC) |

|---|---|---|

| Revenue | 3.63B | 1.75B |

| EBITDA | -1.10B | 293M |

| EBIT | -1.28B | 193M |

| Net Income | -1.29B | 114M |

| EPS | -3.86 | 1.18 |

Interpretation of Income Statement

In the most recent fiscal year, Snowflake reported a revenue increase to 3.63B, up from 2.81B the previous year, yet its net income remained negative at -1.29B, reflecting ongoing investment pressures. In contrast, Teradata’s revenue decreased slightly to 1.75B from 1.83B, but it achieved a net income of 114M, indicating a robust operating margin. The contrasting performance highlights Snowflake’s growth challenges against Teradata’s stable profitability, suggesting a cautious approach for investors considering these stocks.

Financial Ratios Comparison

The following table compares key financial ratios for Snowflake Inc. (SNOW) and Teradata Corporation (TDC) based on the most recent data available.

| Metric | Snowflake Inc. | Teradata Corporation |

|---|---|---|

| ROE | -43% | 86% |

| ROIC | -25% | 17% |

| P/E | -47 | 70 |

| P/B | 20.13 | 22.58 |

| Current Ratio | 1.75 | 0.81 |

| Quick Ratio | 1.75 | 0.79 |

| D/E | 0.90 | 4.33 |

| Debt-to-Assets | 30% | 34% |

| Interest Coverage | -528 | 7.21 |

| Asset Turnover | 0.40 | 1.03 |

| Fixed Asset Turnover | 5.53 | 9.07 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Snowflake Inc. displays a concerning negative return on equity (ROE) and return on invested capital (ROIC), indicating inefficiencies in generating profits. Conversely, Teradata showcases a strong ROE, reflecting effective profit generation. Snowflake’s high P/B ratio suggests overvaluation, while Teradata’s lower ratios indicate better value. The disparity in interest coverage raises red flags for Snowflake, pointing to potential liquidity risks. Investors should weigh these factors carefully when making portfolio decisions.

Dividend and Shareholder Returns

Snowflake Inc. (SNOW) does not pay dividends, reflecting its focus on growth and reinvestment strategies, as indicated by negative net income and significant capital expenditures. However, SNOW engages in share buybacks, which can enhance shareholder value by reducing the total share count. Conversely, Teradata Corporation (TDC) also refrains from dividend payments, prioritizing R&D and acquisitions instead. Both companies’ approaches suggest a commitment to long-term value creation, albeit with inherent risks in maintaining financial stability during high-investment phases.

Strategic Positioning

In the competitive landscape of data platforms, Snowflake Inc. (SNOW) holds a significant market share with a market capitalization of approximately 86B. Its innovative cloud-based solutions enable businesses to consolidate and analyze data effectively. Meanwhile, Teradata Corporation (TDC), with a market cap of about 2.6B, faces competitive pressure as it positions itself as a multi-cloud analytics provider. Both companies contend with rapid technological disruptions, necessitating continuous adaptation to maintain their market relevance.

Stock Comparison

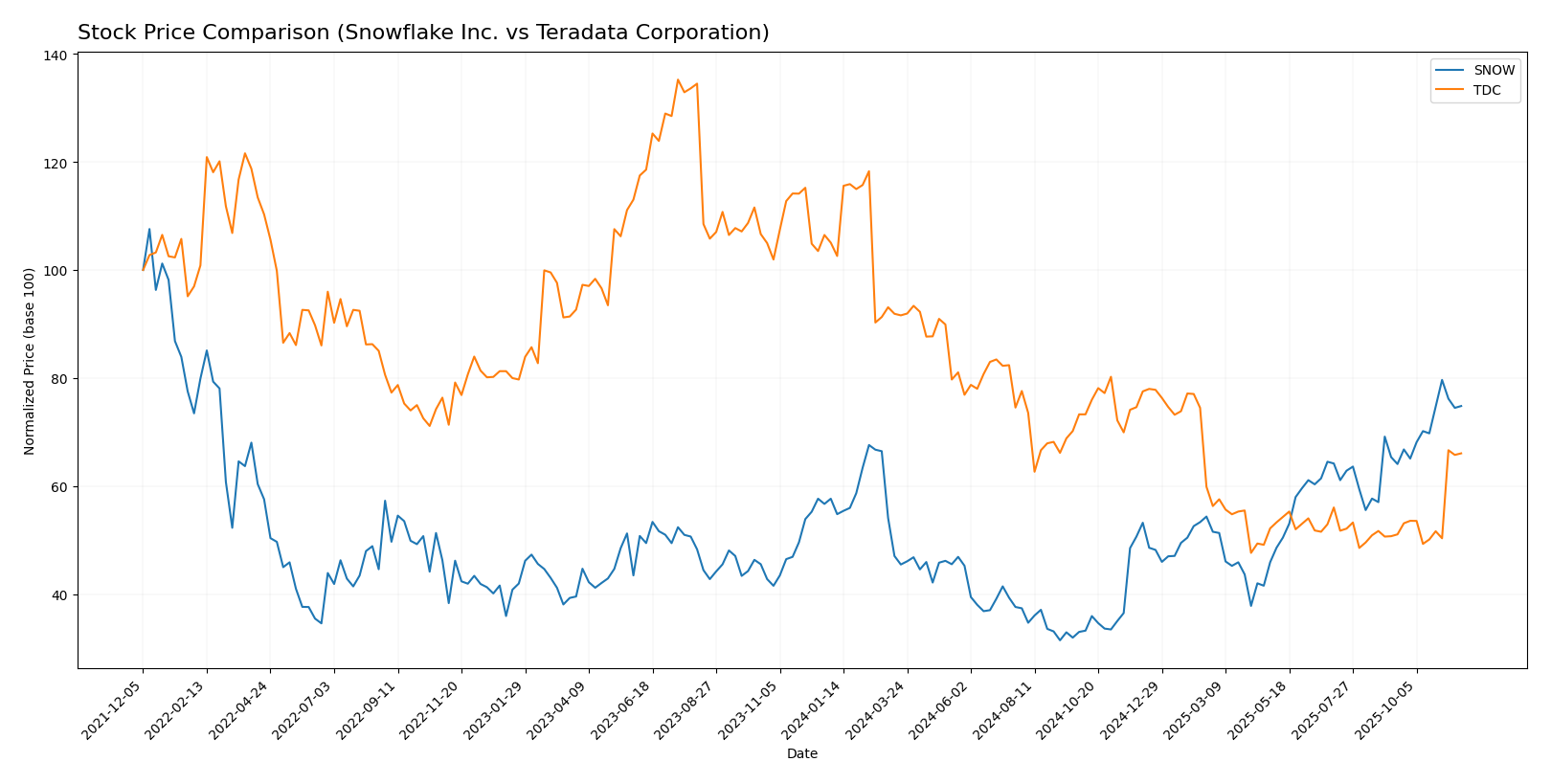

In analyzing the stock price movements of Snowflake Inc. (SNOW) and Teradata Corporation (TDC) over the past year, we can observe significant price fluctuations and trading dynamics that provide insights into their respective market performances.

Trend Analysis

Snowflake Inc. (SNOW) has experienced a notable price change of +29.74% over the past year, indicating a bullish trend. The stock has shown acceleration in its upward movement, with a highest price of 274.88 and a lowest price of 108.56. The standard deviation of 41.87 suggests considerable volatility in its price movement.

In the recent period from September 7, 2025, to November 23, 2025, SNOW recorded a price change of +14.46% with a standard deviation of 16.8, further supporting the bullish trend alongside a trend slope of 4.29.

Teradata Corporation (TDC), on the other hand, has reported a price change of -37.12% over the past year, leading to a bearish trend. The stock has also shown acceleration in its decline, with a highest price of 48.99 and a lowest price of 19.73. The standard deviation of 7.41 indicates less volatility compared to SNOW.

In the recent analysis period from September 7, 2025, to November 23, 2025, TDC experienced a price change of +30.22%, but this variation does not alter the overall bearish trend established over the year. The trend slope is relatively flat at 0.54, suggesting limited momentum in the recent price recovery.

In summary, while SNOW is on a strong upward trajectory, TDC remains constrained by a significant overall decline, despite recent gains.

Analyst Opinions

Recent analyst recommendations show a mixed outlook for the two companies. For Snowflake Inc. (SNOW), analysts have rated it a C-, indicating a cautious stance due to concerns over its low scores in return on equity and overall financial performance. In contrast, Teradata Corporation (TDC) has received a B+ rating, with analysts like those from Wells Fargo praising its strong return on equity and discounted cash flow metrics. The consensus for TDC is a buy, while SNOW leans towards a hold for the current year.

Stock Grades

I have gathered the latest stock grades for two companies: Snowflake Inc. (SNOW) and Teradata Corporation (TDC). Below are the detailed ratings provided by reputable grading companies.

Snowflake Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-11-17 |

| B of A Securities | Maintain | Buy | 2025-11-17 |

| BTIG | Maintain | Buy | 2025-11-12 |

| JMP Securities | Maintain | Market Outperform | 2025-10-28 |

| Wedbush | Maintain | Outperform | 2025-10-20 |

| Rosenblatt | Maintain | Buy | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-08 |

| Macquarie | Maintain | Neutral | 2025-08-28 |

| Scotiabank | Maintain | Sector Outperform | 2025-08-28 |

| Mizuho | Maintain | Outperform | 2025-08-28 |

Teradata Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | Maintain | Market Perform | 2025-03-18 |

| JMP Securities | Maintain | Market Perform | 2025-02-13 |

| RBC Capital | Maintain | Sector Perform | 2025-02-12 |

Overall, both companies show a strong tendency to maintain their grades, with Snowflake Inc. receiving consistent “Outperform” and “Buy” ratings from various analysts. Teradata Corporation has also seen an upgrade to “Market Outperform,” indicating a positive shift in investor sentiment. These trends suggest a stable outlook for both stocks in the near term.

Target Prices

For Snowflake Inc. (SNOW), analysts have a consensus target price indicating a moderate upside potential, while Teradata Corporation (TDC) has a solid target consensus reflecting its current market position.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 215 | 264.69 |

| Teradata Corporation | 24 | 24 | 24 |

The target consensus for Snowflake Inc. is 264.69, which suggests it is currently slightly undervalued compared to its stock price of 257.32. Conversely, Teradata Corporation’s target consensus matches its stock price of 27.38, indicating stability in expectations.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Snowflake Inc. (SNOW) and Teradata Corporation (TDC) based on the most recent data.

| Criterion | Snowflake Inc. (SNOW) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Moderate | Moderate |

| Profitability | Negative margins | Positive margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Established |

| Debt level | Low | High |

The key takeaways indicate that while Snowflake demonstrates strong innovation and global presence, it struggles with profitability. On the other hand, Teradata shows solid profitability but carries a higher debt level, which may pose risks for investors.

Risk Analysis

In this section, I will outline the potential risks associated with two companies, Snowflake Inc. and Teradata Corporation, to assist investors in making informed decisions.

| Metric | Snowflake Inc. | Teradata Corporation |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | Low |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Low |

The most significant risks are market and operational risks for Snowflake Inc., given its high beta of 1.085, indicating higher volatility compared to the market. Teradata faces moderate risks primarily in market dynamics.

Which one to choose?

When comparing Snowflake Inc. (SNOW) and Teradata Corporation (TDC), both companies operate in the data management sector but present different investment profiles. Snowflake’s gross profit margin stands at 66.5%, yet it struggles with net losses, reflected in a net profit margin of -35.5%. In contrast, Teradata has a more stable performance, reporting a net profit margin of 6.5% and a solid rating of B+, suggesting better overall health.

From a trend perspective, Snowflake’s stock shows a bullish trend with a notable 29.7% increase over the past year, while Teradata has experienced a bearish decline of 37.1%. Investors focused on growth may prefer Snowflake for its potential upside, while those prioritizing stability and income might favor Teradata.

Risks include competition in the data sector and Snowflake’s high valuation relative to its earnings.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Snowflake Inc. and Teradata Corporation to enhance your investment decisions: