In the ever-evolving landscape of communication technology, Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC) stand out as key players, each with distinct approaches to customer engagement and communication solutions. Twilio, a leader in cloud communications, empowers developers with robust APIs, while AudioCodes specializes in advanced solutions for unified communications and VoIP networks. Both companies operate within overlapping markets, driven by innovation and a focus on enhancing user experiences. In this article, I will help you determine which of these companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Twilio Inc. Overview

Twilio Inc. is a leading provider of cloud communications solutions, enabling businesses to enhance customer engagement through its robust platform. Founded in 2008 and headquartered in San Francisco, California, Twilio offers a comprehensive suite of application programming interfaces (APIs) that facilitate voice, messaging, video, and email capabilities within software applications globally. With a market capitalization of approximately $19B and a dynamic presence in the Internet Content & Information sector, the company aims to empower developers to create highly interactive customer experiences. Twilio’s mission focuses on simplifying the integration of communication channels, positioning itself as a critical player in the evolving digital landscape.

AudioCodes Ltd. Overview

Incorporated in 1992 and based in Lod, Israel, AudioCodes Ltd. specializes in advanced communication solutions for the digital workplace. The company, with a market cap of around $259M, provides a wide range of products, including session border controllers, VoIP network routing solutions, and Microsoft Teams integration services. AudioCodes emphasizes unified communications and voice AI technologies, catering primarily to telecommunications and networking industries. Its mission is to streamline communication processes for businesses, thereby enhancing productivity and operational efficiency in an increasingly digital environment.

Key Similarities and Differences

Both Twilio and AudioCodes focus on communication solutions but serve different market segments. Twilio’s strength lies in its developer-centric API offerings for broad customer engagement, while AudioCodes emphasizes tailored solutions for enterprise communications and VoIP technologies. This distinction highlights their unique approaches to addressing communication challenges within the digital economy.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC) for the most recent fiscal year, highlighting their financial performance.

| Metric | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Revenue | 4.46B | 242.18M |

| EBITDA | 136.47M | 21.07M |

| EBIT | -88.61M | 17.19M |

| Net Income | -109.40M | 15.31M |

| EPS | -0.66 | 0.51 |

Interpretation of Income Statement

In the most recent fiscal year, Twilio experienced a revenue increase to 4.46B, but still reported a net loss of 109.40M, indicating ongoing challenges in profitability despite growth. Conversely, AudioCodes showed a slight decrease in revenue to 242.18M but successfully maintained profitability with a net income of 15.31M. Notably, Twilio’s EBITDA margin remains under pressure, while AudioCodes demonstrated a stable operating performance with improved margins. Overall, Twilio’s growth trajectory raises concerns about sustainability, while AudioCodes appears to be managing its costs effectively, leading to consistent profitability.

Financial Ratios Comparison

In this section, I provide a comparative overview of the most recent financial ratios for Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC). The metrics include various profitability, liquidity, and leverage ratios, which are essential for assessing the companies’ financial health.

| Metric | TWLO | AUDC |

|---|---|---|

| ROE | -1.38% | 7.98% |

| ROIC | -0.55% | 6.60% |

| P/E | -163.92 | 19.21 |

| P/B | 2.25 | 1.53 |

| Current Ratio | 4.20 | 2.09 |

| Quick Ratio | 4.20 | 1.69 |

| D/E | 0.14 | 0.19 |

| Debt-to-Assets | 11.25% | 10.85% |

| Interest Coverage | 0 | 58.08 |

| Asset Turnover | 0.45 | 0.72 |

| Fixed Asset Turnover | 18.24 | 4.05 |

| Payout ratio | 0 | 71.16% |

| Dividend yield | 0% | 3.70% |

Interpretation of Financial Ratios

Twilio’s financial ratios indicate persistent struggles, particularly reflected in negative ROE and P/E ratios, which raise concerns about profitability and valuation. On the other hand, AudioCodes presents a more favorable picture, with solid profitability and a stable dividend yield. However, the debt levels are slightly higher compared to TWLO, which could signal potential risks. Investors should weigh these factors carefully before making decisions.

Dividend and Shareholder Returns

Twilio Inc. (TWLO) does not pay dividends, reflecting its focus on reinvestment for growth amid negative net income. The company’s share buyback program may enhance shareholder value but carries risks of unsustainable repurchases due to ongoing losses. Conversely, AudioCodes Ltd. (AUDC) offers a dividend yield of 3.7% with a payout ratio of approximately 71%, indicating a commitment to returning value to shareholders while maintaining adequate coverage by free cash flow. Overall, AudioCodes’ approach appears to support sustainable long-term value creation, whereas Twilio’s strategy may require careful monitoring.

Strategic Positioning

Twilio Inc. (TWLO) holds a significant market share in the cloud communications space, driven by its robust platform that integrates voice, messaging, and video capabilities. With a market cap of $19B, it faces competitive pressure from emerging technologies and rivals like AudioCodes Ltd. (AUDC), which specializes in communication equipment and software solutions. AudioCodes, valued at $259M, is also adapting to technological disruptions in unified communications, highlighting the dynamic nature of this market. As both companies navigate these challenges, their strategies will be crucial in maintaining their competitive positions.

Stock Comparison

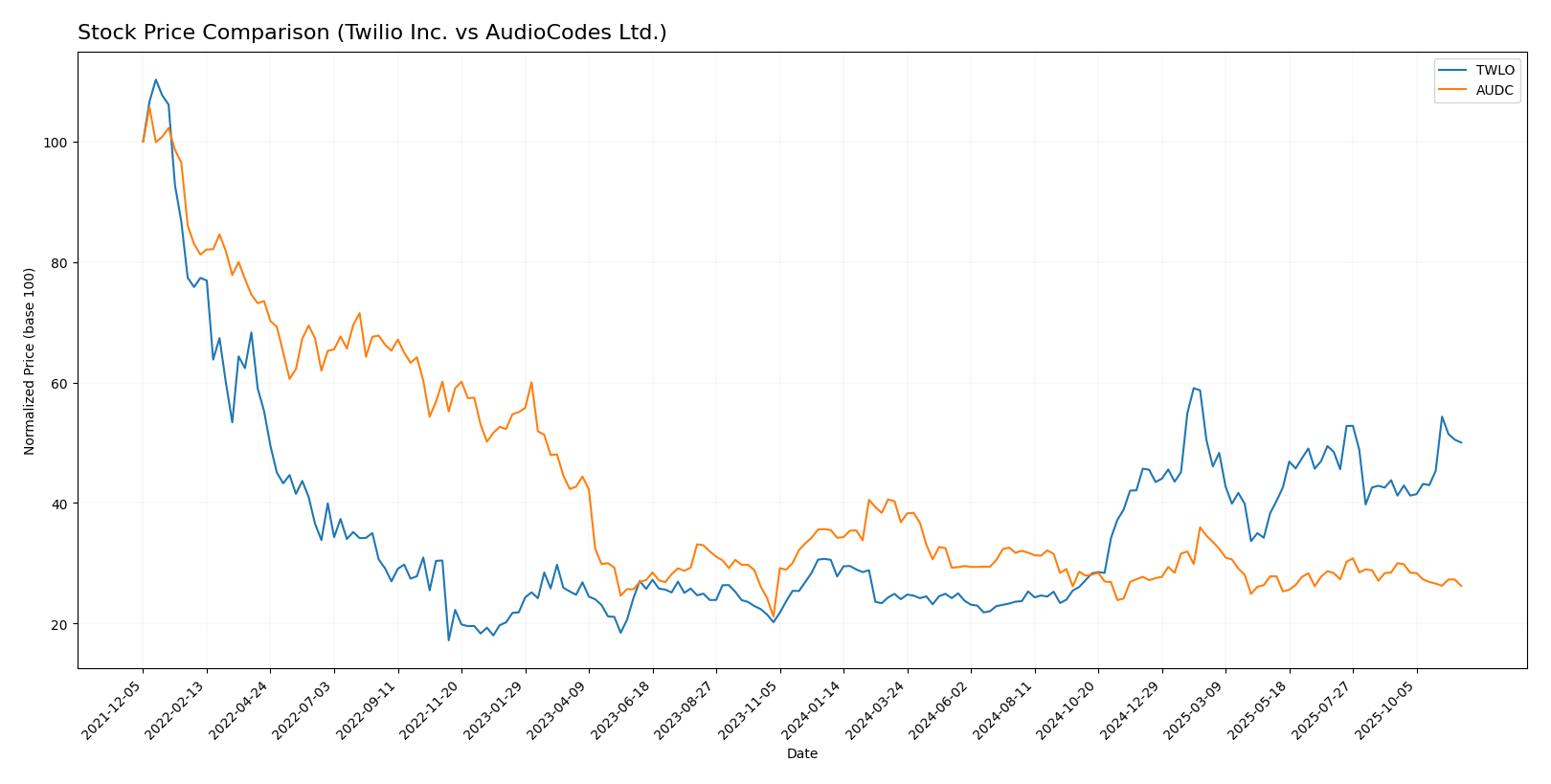

In assessing the dynamics of Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC), the past year has illustrated significant price movements and trading behaviors that warrant careful examination.

Trend Analysis

Twilio Inc. (TWLO) has experienced a remarkable price change of 63.66% over the past year. This significant increase indicates a bullish trend characterized by acceleration. The stock reached a high of 146.58 and a low of 54.24, demonstrating notable volatility with a standard deviation of 26.49. In the recent period from September 7, 2025, to November 23, 2025, the price rose by 14.26%, with a standard deviation of 10.93, reinforcing the bullish outlook.

Conversely, AudioCodes Ltd. (AUDC) has faced a challenging year, with a price change of -26.1% indicating a bearish trend and deceleration. The stock’s highest price was 13.79, while the lowest was 8.12, reflecting a lower volatility with a standard deviation of 1.28. Recently, from September 7, 2025, to November 23, 2025, AUDC declined by 7.76%, coupled with a standard deviation of 0.41, further confirming the bearish sentiment.

In summary, TWLO shows strong upward momentum, while AUDC continues to struggle in the current market environment.

Analyst Opinions

Recent analyst recommendations for Twilio Inc. (TWLO) indicate a cautious stance with a rating of B-. Analysts highlight concerns over its price-to-earnings score, suggesting a hold approach for now. In contrast, AudioCodes Ltd. (AUDC) has received a more favorable rating of A-, with strong scores across key metrics, indicating a consensus buy recommendation. Analysts favor its solid return on equity and cash flow, making it an attractive option for investors in 2025. Overall, the consensus appears to lean toward a buy for AUDC while holding TWLO.

Stock Grades

In the current market landscape, stock ratings provide valuable insights for investors. Below are the grades for Twilio Inc. and AudioCodes Ltd.

Twilio Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Buy | 2025-10-31 |

| Keybanc | maintain | Overweight | 2025-10-31 |

| Rosenblatt | maintain | Buy | 2025-10-31 |

| Stifel | maintain | Hold | 2025-10-31 |

| Wells Fargo | maintain | Overweight | 2025-10-31 |

| Needham | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Hold | 2025-10-31 |

| B of A Securities | maintain | Underperform | 2025-10-31 |

| Mizuho | maintain | Outperform | 2025-10-31 |

| Piper Sandler | maintain | Overweight | 2025-10-31 |

AudioCodes Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | maintain | Buy | 2025-05-07 |

| Needham | maintain | Buy | 2025-02-05 |

| Barclays | maintain | Underweight | 2025-02-05 |

| Needham | maintain | Buy | 2025-01-21 |

| Barclays | maintain | Underweight | 2024-11-07 |

| Needham | maintain | Buy | 2024-11-07 |

| Needham | maintain | Buy | 2024-07-31 |

| Needham | maintain | Buy | 2024-05-09 |

| Barclays | maintain | Underweight | 2024-05-08 |

| Barclays | maintain | Underweight | 2024-02-07 |

Overall, Twilio Inc. shows a mix of strong buy and overweight ratings from reputable firms, indicating stable confidence in its performance. In contrast, AudioCodes Ltd. maintains a consistent buy rating from Needham, but is viewed as underweight by Barclays, suggesting a cautious approach may be warranted.

Target Prices

The current consensus target prices for Twilio Inc. and AudioCodes Ltd. suggest positive growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Twilio Inc. | 156 | 120 | 143.22 |

| AudioCodes Ltd. | 24 | 14 | 19 |

Twilio’s consensus target price indicates an upside potential from its current price of 124.00, while AudioCodes shows room for growth from its price of 8.88, reflecting optimism among analysts.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC) based on the most recent data.

| Criterion | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low | Moderate |

| Innovation | High | Moderate |

| Global presence | High | Moderate |

| Market Share | Moderate | Low |

| Debt level | Low | Moderate |

Key takeaways indicate that while Twilio demonstrates strong innovation and global presence, it struggles with profitability and market share. Conversely, AudioCodes shows a more favorable debt level and higher diversification but has lower profitability and market share.

Risk Analysis

Below is a summary of the key risks associated with the two companies, Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC).

| Metric | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Low |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Twilio faces significant market and operational risks due to its high reliance on cloud communication services and competitive pressures. In contrast, AudioCodes shows a more stable operational profile with lower regulatory risks and a solid market position, evidenced by its A- rating. Caution is advised when investing in high-risk environments.

Which one to choose?

When comparing Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC), several factors emerge. Twilio has shown impressive revenue growth, with a projected FY2024 revenue of $4.46B, but its profitability remains a challenge, reflected in its negative net profit margins of -2.4%. In contrast, AudioCodes reported a smaller revenue of $242M for FY2024, but it boasts a positive net income margin of 6.3%, highlighting its profitability.

In terms of analyst ratings, TWLO has a grade of B-, while AUDC has a superior A-. Price trends also favor TWLO, showing a bullish pattern with a price increase of 63.7%. However, AUDC is in a bearish trend with a decline of 26.1%.

Investors focusing on growth may gravitate towards TWLO, while those prioritizing stability and profitability might find AUDC more appealing. Notably, TWLO faces risks related to competition and high debt levels, while AUDC is more stable but has lower growth potential.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Twilio Inc. and AudioCodes Ltd. to enhance your investment decisions: