In the dynamic landscape of industrial technology, Honeywell International Inc. (HON) and Emerson Electric Co. (EMR) stand out as two formidable players. Both companies operate within the industrial sector, focusing on automation, control solutions, and advanced manufacturing processes. Their overlapping markets and innovative strategies make them intriguing candidates for investors seeking growth opportunities. In this article, I will analyze which of these companies presents a more compelling investment case for you.

Table of contents

Company Overview

Honeywell International Inc. Overview

Honeywell International Inc. (Ticker: HON) is a diversified technology and manufacturing company with a robust global presence. Its mission is to create a safer, more sustainable world by leveraging advanced technology across various sectors, including aerospace, building technologies, performance materials, and safety solutions. With a market cap of approximately 121B, Honeywell continues to innovate in areas such as automation and energy efficiency, catering to a wide range of industries from aviation to healthcare. Their commitment to sustainability is evident in their products and services designed to reduce environmental impact while enhancing operational performance.

Emerson Electric Co. Overview

Emerson Electric Co. (Ticker: EMR) is a leading technology and engineering company that provides essential solutions for industrial, commercial, and residential markets. Headquartered in Saint Louis, Missouri, Emerson’s mission is to empower customers through innovative automation and control solutions, ensuring efficiency and reliability. With a market cap of around 72B, Emerson operates across two primary segments: Automation Solutions and Commercial & Residential Solutions, offering a diverse range of products such as process control systems and HVAC technologies. Their focus on customer-centric solutions drives their success in various sectors, including oil and gas, food and beverage, and residential heating.

Key Similarities and Differences

Both Honeywell and Emerson operate within the industrial sector, emphasizing technology and innovation in their business models. Honeywell has a broader range of offerings spanning multiple industries and focuses heavily on sustainability. In contrast, Emerson’s strengths lie in its specialized automation solutions and HVAC products, catering more specifically to industrial and residential needs.

Income Statement Comparison

In this section, I present a comparative analysis of the income statements for Honeywell International Inc. and Emerson Electric Co. based on the most recent fiscal year data.

| Metric | Honeywell International Inc. | Emerson Electric Co. |

|---|---|---|

| Revenue | 38.5B | 18.0B |

| EBITDA | 9.6B | 4.9B |

| EBIT | 8.3B | 3.2B |

| Net Income | 5.7B | 2.3B |

| EPS | 8.76 | 4.06 |

Interpretation of Income Statement

Over the recent fiscal year, Honeywell saw a revenue increase to 38.5B, up from 36.6B the previous year, reflecting a consistent growth trend. Emerson also demonstrated growth, with revenue rising to 18.0B from 17.5B. Honeywell’s EBITDA margin improved slightly, indicating better operational efficiency, while Emerson maintained stable margins despite fluctuations in costs. Notably, Honeywell’s net income rose to 5.7B, showcasing strong profitability, whereas Emerson’s net income reached 2.3B, demonstrating resilience in a competitive market.

Financial Ratios Comparison

Below is a comparative table of the most recent financial ratios for Honeywell International Inc. (HON) and Emerson Electric Co. (EMR):

| Metric | Honeywell (HON) | Emerson (EMR) |

|---|---|---|

| ROE | 30.64% | 11.30% |

| ROIC | 10.48% | 4.62% |

| P/E | 25.77 | 32.42 |

| P/B | 7.90 | 3.66 |

| Current Ratio | 1.31 | 0.88 |

| Quick Ratio | 1.01 | 0.65 |

| D/E | 1.73 | 0.65 |

| Debt-to-Assets | 42.85% | 31.26% |

| Interest Coverage | 7.44 | 9.44 |

| Asset Turnover | 0.51 | 0.43 |

| Fixed Asset Turnover | 6.22 | 6.28 |

| Payout ratio | 50.87% | 51.98% |

| Dividend yield | 1.97% | 1.60% |

Interpretation of Financial Ratios

Honeywell’s ratios indicate a strong return on equity (ROE) and return on invested capital (ROIC), reflecting efficient management and profitability. In contrast, Emerson’s ratios reveal a weaker financial position with higher debt levels and lower profitability metrics. The current ratio for Honeywell suggests good short-term financial health, while Emerson’s current ratio indicates potential liquidity concerns. Overall, Honeywell appears to be a more stable option, though both companies have their strengths and weaknesses.

Dividend and Shareholder Returns

Honeywell International Inc. (HON) maintains a robust dividend policy, with a current yield of 1.97% and a payout ratio of approximately 50.9%. The company has demonstrated a consistent dividend per share trend, indicating a commitment to returning value to shareholders through dividends and share buybacks.

Conversely, Emerson Electric Co. (EMR) also pays dividends, currently yielding 1.92% with a payout ratio of 61.03%. Despite a higher payout ratio, both companies engage in share buybacks, which can enhance shareholder value. This dual approach of dividends and buybacks suggests a sustainable strategy for long-term value creation for shareholders.

Strategic Positioning

Honeywell International Inc. (HON) holds a significant market share in diversified technology and manufacturing, with a market cap of 121B. Its broad product portfolio offers resilience against competitive pressure and technological disruptions. Emerson Electric Co. (EMR), valued at 72B, focuses on automation and control solutions, facing intense competition in a rapidly evolving sector. Both companies are well-positioned, but ongoing innovation and adaptability will be crucial in maintaining their market standings.

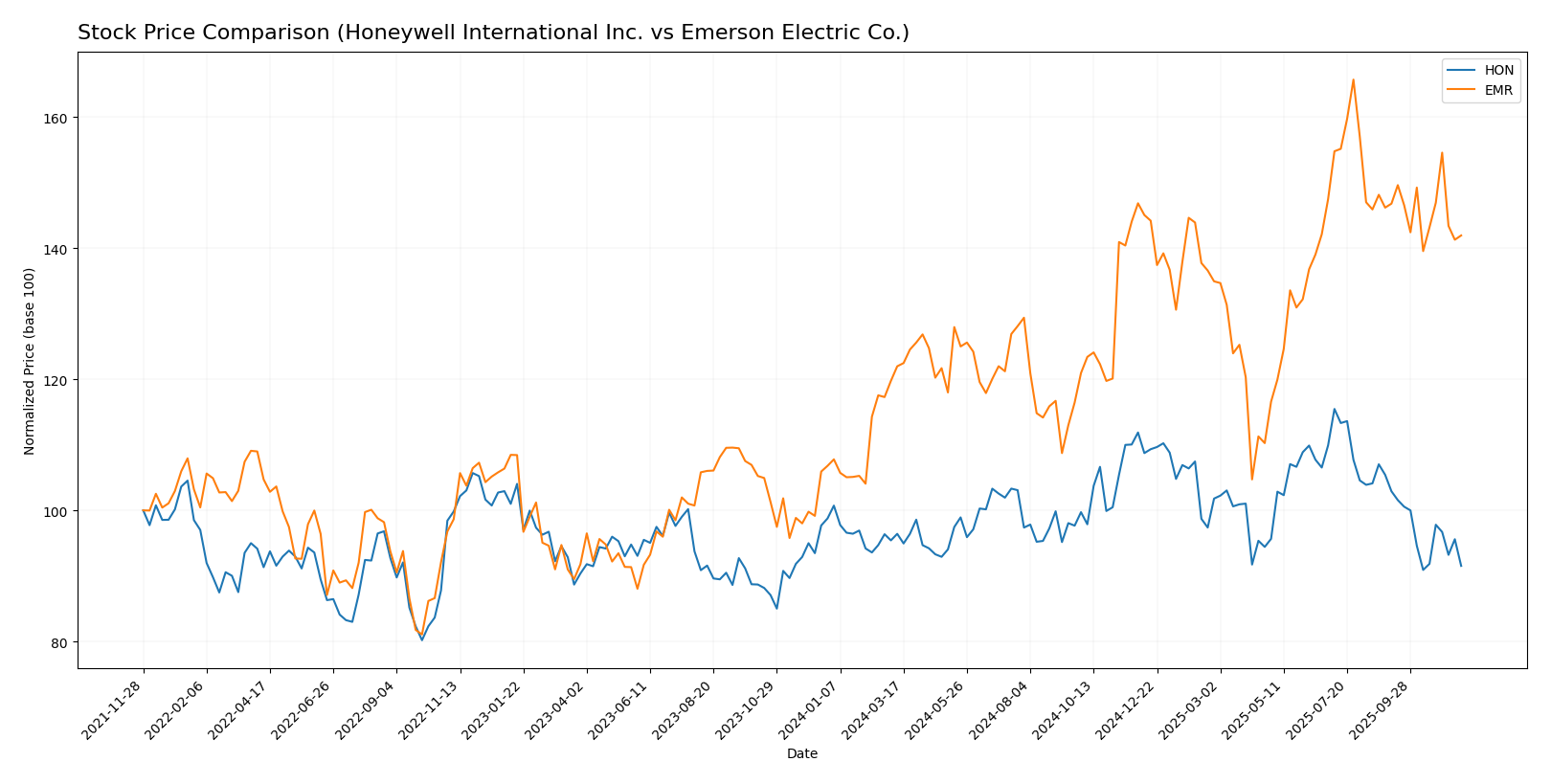

Stock Comparison

In this section, I will analyze the weekly stock price movements of Honeywell International Inc. (HON) and Emerson Electric Co. (EMR) over the past year, highlighting key price dynamics and trading behaviors.

Trend Analysis

For Honeywell International Inc. (HON), the stock has experienced a percentage change of -9.13% over the past year, indicating a bearish trend. Notably, the highest price reached was 240.4, while the lowest price was 189.29. The trend is characterized by deceleration, and the standard deviation of 12.03 suggests moderate volatility.

In the recent period from September 7, 2025, to November 23, 2025, the stock further declined by -11.05%. The standard deviation during this timeframe is 8.28, reinforcing the presence of volatility, with a trend slope of -1.72.

For Emerson Electric Co. (EMR), the stock has shown a robust percentage change of +31.69% over the past year, reflecting a bullish trend. The stock peaked at 149.63 and dipped to a low of 93.98. The acceleration status is noted as deceleration, and a standard deviation of 12.89 indicates some volatility within the price movements.

However, in the recent period from September 7, 2025, to November 23, 2025, EMR experienced a slight decline of -3.3%. The standard deviation for this recent period is 3.71, with a trend slope of -0.29, suggesting a relatively stable price environment.

In conclusion, while HON is facing bearish conditions with notable declines, EMR remains bullish overall, albeit with recent fluctuations indicating potential caution for short-term investors.

Analyst Opinions

Recent analyst recommendations indicate a cautious yet optimistic outlook for Honeywell International Inc. (HON), receiving a “B+” rating. Analysts highlight strong return on equity and assets as key strengths, suggesting a buy consensus for 2025. In contrast, Emerson Electric Co. (EMR) holds a “B” rating, with analysts recommending a hold, pointing to stable performance but lower scores in price-to-earnings and book value metrics. Overall, the consensus favors buying HON while EMR suggests a more conservative approach.

Stock Grades

Let’s take a closer look at the recent stock grades for Honeywell International Inc. and Emerson Electric Co. to understand how analysts view these companies.

Honeywell International Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | downgrade | Underperform | 2025-11-18 |

| TD Cowen | maintain | Buy | 2025-11-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-28 |

| Wells Fargo | maintain | Equal Weight | 2025-10-27 |

| RBC Capital | upgrade | Outperform | 2025-10-27 |

| JP Morgan | maintain | Neutral | 2025-10-24 |

| RBC Capital | maintain | Sector Perform | 2025-10-24 |

| Barclays | maintain | Overweight | 2025-10-24 |

| JP Morgan | maintain | Neutral | 2025-10-15 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

Emerson Electric Co. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-11-10 |

| Barclays | maintain | Equal Weight | 2025-11-06 |

| RBC Capital | maintain | Outperform | 2025-11-06 |

| JP Morgan | maintain | Neutral | 2025-10-15 |

| Wells Fargo | downgrade | Equal Weight | 2025-10-06 |

| Barclays | upgrade | Equal Weight | 2025-08-07 |

| Stephens & Co. | maintain | Equal Weight | 2025-07-16 |

| Citigroup | maintain | Buy | 2025-07-14 |

| Barclays | maintain | Underweight | 2025-07-09 |

| B of A Securities | maintain | Buy | 2025-07-02 |

In summary, Honeywell has seen a mix of downgrades and upgrades, indicating a cautious outlook from some analysts while others remain optimistic. Emerson Electric’s grades reflect a stable sentiment, with most firms maintaining their positions, suggesting a more consistent performance in the market.

Target Prices

The consensus target prices from analysts indicate strong potential upside for both Honeywell International Inc. and Emerson Electric Co.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Honeywell International Inc. | 258 | 230 | 244.2 |

| Emerson Electric Co. | 135 | 135 | 135 |

Honeywell’s target consensus suggests significant upside potential compared to its current price of 190.57, while Emerson’s consensus aligns closely with its current price of 128.17, indicating stable expectations from analysts.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Honeywell International Inc. (HON) and Emerson Electric Co. (EMR) based on the most recent data.

| Criterion | Honeywell (HON) | Emerson (EMR) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (14.8% net profit margin) | Moderate (12.7% net profit margin) |

| Innovation | High | Moderate |

| Global presence | Extensive | Strong |

| Market Share | Significant | Growing |

| Debt level | Moderate (Debt to equity ratio: 1.73) | Low (Debt to equity ratio: 0.65) |

Key takeaways: Honeywell demonstrates strong profitability and innovation, while Emerson shows lower debt levels and is expanding its market share. Both companies, however, have distinct strengths that may appeal to different investors.

Risk Analysis

In this section, I present a comprehensive analysis of the key risks associated with Honeywell International Inc. (HON) and Emerson Electric Co. (EMR).

| Metric | Honeywell International Inc. (HON) | Emerson Electric Co. (EMR) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Medium | Medium |

| Geopolitical Risk | High | Medium |

Both companies face notable risks. Market volatility and regulatory changes are particularly impactful, especially for HON with its global operations. Geopolitical tensions can further complicate these dynamics. Investors should closely monitor these factors as they can significantly affect performance.

Which one to choose?

In evaluating Honeywell International Inc. (HON) and Emerson Electric Co. (EMR), I find significant differences in their financial metrics and market performance. Honeywell exhibits a higher gross profit margin of 38.34% versus Emerson’s 52.84%, yet Honeywell has a lower debt-to-equity ratio at 1.73 compared to Emerson’s 0.65, indicating stronger financial stability. Recent trends show Honeywell in a bearish phase with a -9.13% price change, while Emerson has enjoyed a bullish trend, up 31.69%. Analysts rate Honeywell a B+ while Emerson holds a B, suggesting a slight edge for Honeywell in overall quality.

For growth-focused investors, Emerson may be attractive due to its recent price momentum, while those valuing stability might prefer Honeywell. However, both companies face risks including market volatility and competitive pressures.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Honeywell International Inc. and Emerson Electric Co. to enhance your investment decisions: