Zebra Technologies Corporation is at the forefront of transforming how businesses manage their assets and data, seamlessly integrating advanced technology into everyday operations. Renowned for its innovative solutions in automatic identification and data capture, Zebra empowers industries ranging from healthcare to logistics with tools that enhance efficiency and visibility. As we delve into Zebra’s current market position and growth potential, it is essential to evaluate whether the fundamentals continue to justify its valuation in an evolving technological landscape.

Table of contents

Company Description

Zebra Technologies Corporation (NASDAQ: ZBRA), founded in 1969 and headquartered in Lincolnshire, Illinois, is a leader in the enterprise asset intelligence solutions sector. The company specializes in automatic identification and data capture technologies, offering a diverse range of products including printers, barcode scanners, RFID readers, and rugged mobile computing devices. Operating primarily in retail, manufacturing, logistics, healthcare, and public sectors, Zebra generates substantial revenue through direct sales and a robust network of channel partners. With a market cap of approximately $11.7B, Zebra is strategically positioned to drive innovation in the communication equipment industry, enhancing operational efficiency and visibility for its clients through advanced technology solutions.

Fundamental Analysis

In this section, I will provide a fundamental analysis of Zebra Technologies Corporation, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

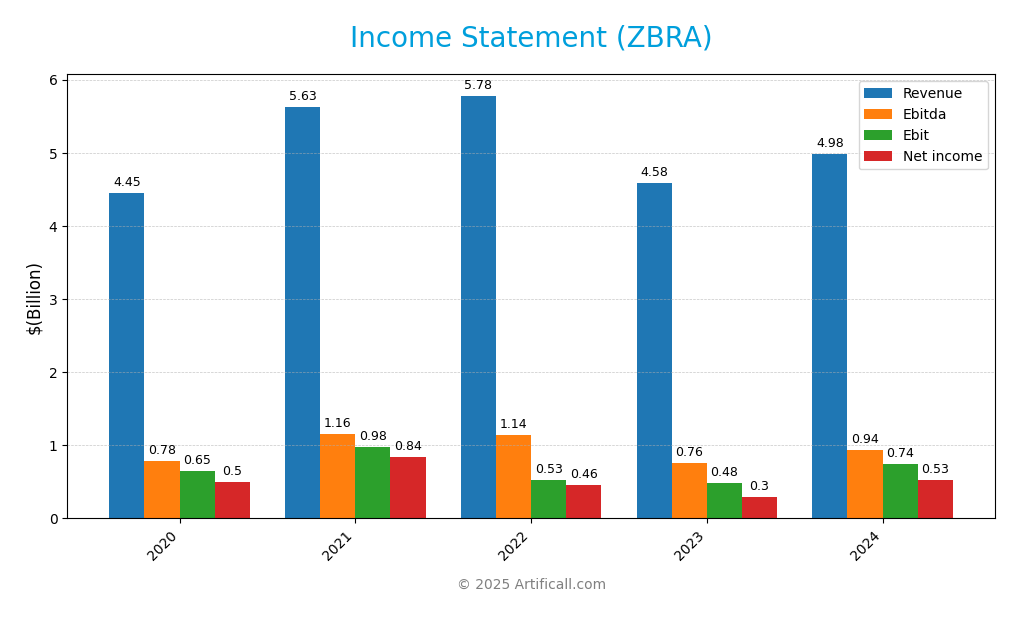

Below is the Income Statement for Zebra Technologies Corporation, showing detailed financial performance over the past few years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.448B | 5.627B | 5.781B | 4.584B | 4.981B |

| Cost of Revenue | 2.445B | 2.999B | 3.157B | 2.461B | 2.568B |

| Operating Expenses | 1.352B | 1.649B | 2.095B | 1.642B | 1.671B |

| Gross Profit | 2.003B | 2.628B | 2.624B | 2.123B | 2.413B |

| EBITDA | 782M | 1.160B | 1.140B | 761M | 937M |

| EBIT | 636M | 973M | 936M | 585M | 765M |

| Interest Expense | 76M | 5M | 60M | 133M | 129M |

| Net Income | 504M | 837M | 463M | 296M | 528M |

| EPS | 9.43 | 15.66 | 8.87 | 5.76 | 10.25 |

| Filing Date | 2021-02-11 | 2022-02-10 | 2023-02-16 | 2024-02-15 | 2025-02-13 |

Interpretation of Income Statement

Over the five-year period, Zebra Technologies has shown fluctuations in its revenue, peaking in 2022 at 5.781B, followed by a decline in 2023 and a modest recovery in 2024 with 4.981B. Net income has similarly experienced ups and downs, with a notable drop in 2023 to 296M, but rebounding to 528M in 2024. The gross profit margin has remained relatively stable, indicating effective cost management. In the most recent year, despite lower revenue compared to 2022, the increase in net income suggests improved operational efficiency and better control over expenses, signaling a potential for recovery and growth moving forward.

Financial Ratios

The following table presents the financial ratios for Zebra Technologies Corporation (ZBRA) over the last few fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.33% | 14.87% | 8.01% | 6.46% | 10.60% |

| ROE | 23.51% | 28.05% | 16.94% | 9.75% | 14.72% |

| ROIC | 14.95% | 18.74% | 10.18% | 7.20% | 9.67% |

| P/E | 40.75 | 38.01 | 28.91 | 47.44 | 37.67 |

| P/B | 9.58 | 10.66 | 4.90 | 4.63 | 5.55 |

| Current Ratio | 0.69 | 0.94 | 0.81 | 1.05 | 1.43 |

| Quick Ratio | 0.41 | 0.67 | 0.44 | 0.54 | 1.03 |

| D/E | 0.65 | 0.38 | 0.86 | 0.80 | – |

| Debt-to-Assets | 26.12% | 38.97% | 31.05% | 33.04% | 29.64% |

| Interest Coverage | 8.57 | 195.80 | 8.82 | 3.62 | 5.75 |

| Asset Turnover | 0.83 | 0.91 | 0.77 | 0.63 | 0.63 |

| Fixed Asset Turnover | 10.88 | 13.96 | 13.32 | 9.59 | 10.55 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Zebra Technologies Corporation (ZBRA) exhibits a mixed financial health profile based on its 2024 ratios. The liquidity position is strong, with a current ratio of 1.43 and a quick ratio of 1.03, indicating sufficient short-term assets to cover liabilities. The solvency ratio stands at 0.16, suggesting moderate leverage, though the debt-to-equity ratio of 0.66 raises some concerns regarding potential financial risk. Profitability metrics are satisfactory; the net profit margin is 10.6%, indicating effective cost management. However, the price-to-earnings ratio of 37.67 may imply overvaluation. Overall, while ZBRA shows solid liquidity and profitability, its financial leverage warrants attention.

Evolution of Financial Ratios

Over the past five years, ZBRA’s financial ratios reflect a gradual decline in profitability and liquidity. The current ratio improved from 0.69 in 2020 to 1.43 in 2024, indicating better short-term asset management, while profit margins have fluctuated, suggesting challenges in sustaining earnings growth.

Distribution Policy

Zebra Technologies Corporation (ZBRA) currently does not pay dividends, focusing instead on reinvesting in growth and innovation. This strategy aligns with its high growth phase, prioritizing R&D and acquisitions to enhance long-term shareholder value. Additionally, ZBRA engages in share buybacks, which can help to support share price and improve earnings per share. Overall, this lack of dividends paired with a buyback strategy appears to support sustainable long-term value creation for shareholders.

Sector Analysis

Zebra Technologies Corporation operates in the Communication Equipment industry, providing asset intelligence solutions. Its competitive advantages include a diverse product portfolio and strong market presence amid various competitors.

Strategic Positioning

Zebra Technologies Corporation (ZBRA) holds a significant market share in the enterprise asset intelligence solutions sector, particularly in automatic identification and data capture. With a strong competitive presence, the company faces pressure from emerging players and traditional manufacturers alike. Technological disruptions, such as advancements in RFID and mobile computing, are reshaping the landscape, compelling Zebra to innovate continuously. The company’s diverse product offerings, including rugged tablets and barcode scanners, position it favorably against competitors while catering to various industries, including healthcare and logistics.

Revenue by Segment

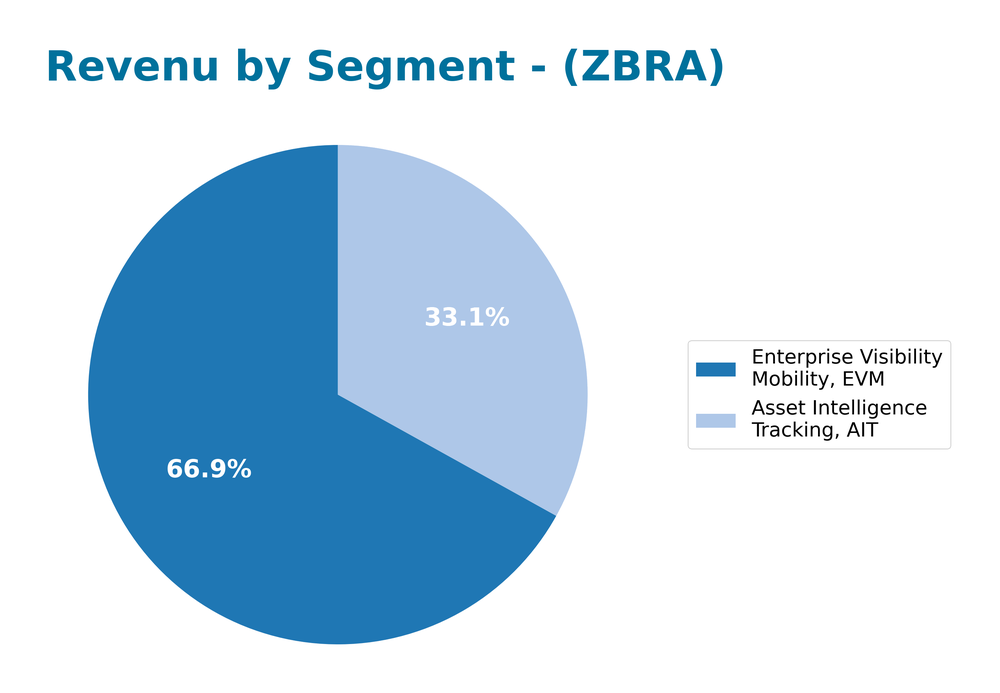

The pie chart below illustrates Zebra Technologies Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the key areas driving the company’s financial performance.

In fiscal year 2024, Zebra Technologies saw revenue primarily from two segments: Asset Intelligence Tracking (AIT) at $1.65B and Enterprise Visibility Mobility (EVM) at $3.33B. Overall, EVM continues to be the stronger revenue driver, while AIT shows a slight decline from the previous year. Notably, EVM’s growth reflects the increasing demand for mobility solutions, despite AIT’s revenue drop indicating potential concentration risks. The slowdown in AIT may warrant closer examination as it could impact future diversification efforts and profitability margins.

Key Products

Zebra Technologies Corporation offers a wide range of products designed to enhance enterprise asset intelligence and data capture solutions. Below is a summary of their key products:

| Product | Description |

|---|---|

| Printers | Designed for producing labels, wristbands, tickets, receipts, and plastic cards. |

| RFID Printers | Encode data into passive RFID transponders for efficient tracking and inventory management. |

| Barcode Scanners | Used for scanning barcodes to streamline operations in various industries including retail and logistics. |

| Rugged Tablets | Enterprise-grade mobile computing devices built for durability in demanding environments. |

| Temperature-Monitoring Labels | Primarily used in vaccine distribution to monitor and ensure proper temperature controls. |

| Real-Time Location Systems | Solutions that track the location of assets and personnel in real-time for enhanced visibility. |

| Workforce Management Solutions | Tools designed to optimize workforce efficiency and task management in various sectors. |

| Cloud-Based Software Subscriptions | Software that provides automated services and analytics through a cloud-based platform. |

These products reflect Zebra’s commitment to providing comprehensive solutions to improve operational efficiency across multiple industries.

Main Competitors

No verified competitors were identified from available data. Zebra Technologies Corporation operates within the automatic identification and data capture solutions industry. Given its market presence, it is estimated to hold a significant market share, demonstrating a strong competitive position in its sector, particularly across various industries like retail, healthcare, and logistics.

Competitive Advantages

Zebra Technologies Corporation (ZBRA) possesses significant competitive advantages through its comprehensive suite of enterprise asset intelligence solutions that cater to diverse industries such as retail, healthcare, and logistics. The company’s strong emphasis on innovation enables it to continually develop advanced products, including RFID technology and mobile computing devices. Looking ahead, Zebra is strategically positioned to expand into emerging markets and enhance its product offerings, particularly in cloud-based solutions and automation. This proactive approach not only solidifies its market presence but also creates new opportunities for revenue growth and customer engagement.

SWOT Analysis

The following SWOT analysis evaluates Zebra Technologies Corporation’s strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Strong market position

- Diverse product offerings

- Robust customer base

Weaknesses

- High dependency on specific sectors

- Limited international presence

- No dividend payouts

Opportunities

- Expansion in emerging markets

- Growth in e-commerce solutions

- Advancements in automation technology

Threats

- Intense industry competition

- Rapid technological changes

- Economic downturns

Overall, the SWOT assessment suggests that while Zebra Technologies has a solid foundation and growth potential, it must strategically address its weaknesses and external threats to enhance its market resilience and capitalize on emerging opportunities.

Stock Analysis

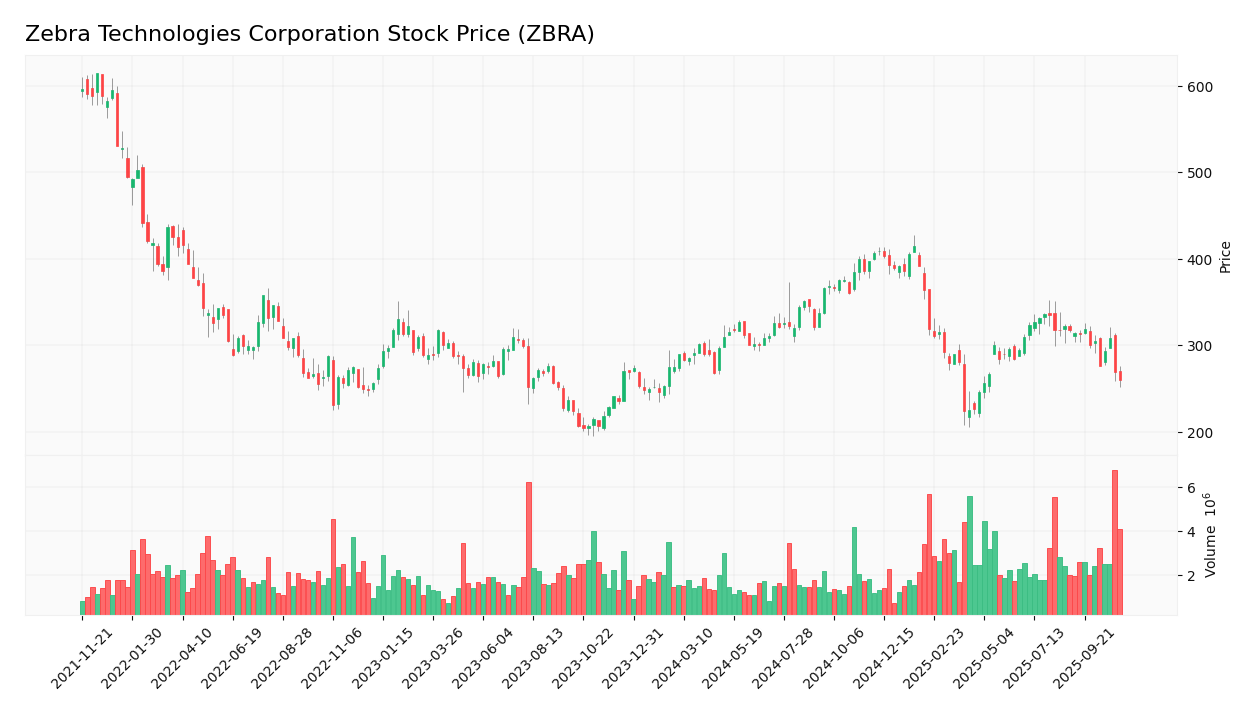

Zebra Technologies Corporation (ZBRA) has experienced significant price movements over the past year, characterized by a notable bearish trend that reflects key trading dynamics and investor sentiment.

Trend Analysis

Over the past year, ZBRA’s stock has seen a percentage change of -15.51%, indicating a bearish trend. The highest price recorded was 414.61, while the lowest was 223.49, suggesting notable volatility with a standard deviation of 46.98. The trend shows signs of deceleration, with a more recent analysis from September 7, 2025, to November 23, 2025, revealing a further decline of -26.41%. This recent movement is accompanied by a trend slope of -7.33, indicating a sustained downward trajectory.

Volume Analysis

In the last three months, ZBRA’s trading volume has totaled approximately 268.7M shares, with buyer volume at 139.2M and seller volume at 127.2M, leading to a slight buyer percentage of 51.79%. The volume trend is increasing, although recent activity suggests a seller-dominant market, with buyer volume at just 10.1M against seller volume of 26.5M. This seller dominance indicates a cautious sentiment among investors, reflecting potential challenges in market participation.

Analyst Opinions

Recent analyst recommendations for Zebra Technologies Corporation (ZBRA) have been predominantly positive, with a consensus rating of “Buy.” Analysts highlight the company’s solid return on equity (4) and return on assets (4), indicating strong operational efficiency. However, concerns about its debt-to-equity ratio (1) and lower scores in price-to-earnings (2) and price-to-book (2) suggest some caution. Notably, analysts from prominent firms have emphasized Zebra’s potential for growth in the tech sector, reinforcing their bullish stance on the stock for 2025.

Stock Grades

Zebra Technologies Corporation (ZBRA) has recently received consistent stock ratings from several reputable grading companies. Here’s a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Hold | 2025-10-29 |

| Barclays | maintain | Overweight | 2025-10-29 |

| Citigroup | maintain | Neutral | 2025-10-29 |

| Citigroup | maintain | Neutral | 2025-10-09 |

| Truist Securities | maintain | Hold | 2025-10-08 |

| Truist Securities | maintain | Hold | 2025-08-06 |

| Needham | maintain | Buy | 2025-08-06 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Barclays | maintain | Equal Weight | 2025-08-05 |

| Baird | maintain | Outperform | 2025-07-14 |

The overall trend indicates a stable outlook for ZBRA, with several analysts maintaining their previous grades, reflecting a cautious optimism in the market. Notably, the presence of both “Buy” and “Overweight” ratings suggests that there are still bullish sentiments among certain analysts, even as others maintain a more neutral or cautious stance.

Target Prices

Zebra Technologies Corporation (ZBRA) has a consensus target price based on reliable analyst data.

| Target High | Target Low | Consensus |

|---|---|---|

| 360 | 331 | 345.5 |

Overall, analysts expect ZBRA’s stock to reach a consensus target price of 345.5, with a range between 331 and 360.

Consumer Opinions

Consumer sentiment surrounding Zebra Technologies Corporation (ZBRA) reflects a balanced mix of appreciation and criticism, indicative of the company’s performance and product offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative solutions that enhance efficiency.” | “Customer service could be more responsive.” |

| “Reliable products with great durability.” | “Pricing is on the higher side.” |

| “User-friendly interfaces make operations seamless.” | “Software updates are often buggy.” |

Overall, consumer feedback highlights Zebra Technologies’ innovative products and reliability as key strengths, while concerns about customer service and pricing remain prevalent weaknesses.

Risk Analysis

In evaluating Zebra Technologies Corporation (ZBRA), I’ve identified several key risks that could impact its performance. Below is a summary of these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in demand for technology solutions | High | High |

| Supply Chain Issues | Disruptions affecting product availability | Medium | High |

| Regulatory Changes | New regulations impacting operations and costs | Medium | Medium |

| Competition | Increased competition from emerging tech companies | High | Medium |

| Cybersecurity Threats | Risks associated with data breaches and hacks | Medium | High |

The most significant risks for ZBRA include market volatility and supply chain issues, both of which can substantially affect revenue and operational efficiency. As technology evolves, staying ahead of competition and managing cybersecurity threats remain critical.

Should You Buy Zebra Technologies Corporation?

Zebra Technologies Corporation has shown a positive net margin of 10.60%, indicating profitability. The company’s total debt stands at 2.36B, which suggests a moderate level of leverage. Over recent periods, the fundamentals have shown fluctuations in revenue and earnings, with a rating of B reflecting a balanced performance in various financial metrics.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The recent seller volume of 26.49M exceeds the buyer volume of 10.05M, indicating a seller-dominant market. Additionally, the stock has experienced a bearish trend with a price change of -15.51% over the overall period. The price-to-earnings ratio of 47.44 suggests that the stock may be overvalued, raising concerns about potential corrections.

Conclusion Given the unfavorable signals, it might be more prudent to wait until market conditions improve and buyer interest returns.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Zebra Technologies (ZBRA): Is the Recent Pullback Creating a Compelling Valuation Opportunity? – Yahoo Finance (Nov 20, 2025)

- Massachusetts Financial Services Co. MA Grows Position in Zebra Technologies Corporation $ZBRA – MarketBeat (Nov 19, 2025)

- First Week of December 19th Options Trading For Zebra Technologies (ZBRA) – Nasdaq (Nov 19, 2025)

- Zebra Technologies to Present at Investor Conferences – Business Wire (Nov 13, 2025)

- Zebra Technologies May Be A 2026 Growth Story (Rating Upgrade) (NASDAQ:ZBRA) – Seeking Alpha (Oct 29, 2025)

For more information about Zebra Technologies Corporation, please visit the official website: zebra.com