Anfield Energy Inc. is at the forefront of the industrial materials sector, transforming the landscape of energy production with its focus on critical minerals like vanadium and uranium. With a commitment to exploration and sustainable development, this company is not just a player but a game-changer in the mining industry. Known for its innovative approaches and dedication to quality, Anfield is poised for growth. As we delve into the investment analysis, it’s essential to consider whether the current market valuation reflects the company’s true potential and fundamentals.

Table of contents

Company Description

Anfield Energy Inc. (ticker: AEC) is a Canadian company headquartered in Burnaby, BC, focused on the exploration, evaluation, development, and production of mineral properties, particularly in the United States. Founded in 1989, Anfield primarily targets vanadium, uranium, and gold deposits, positioning itself as a niche player within the Industrial Materials sector. With a market capitalization of approximately $101M, Anfield is actively trading on the NASDAQ Global Select. The company, which employs a small team of five individuals, is committed to leveraging its expertise to enhance resource extraction and sustainability. Through innovation and strategic partnerships, Anfield aims to significantly contribute to the evolving landscape of the energy materials industry.

Fundamental Analysis

In this section, I will analyze Anfield Energy Inc.’s income statement, financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

Income Statement

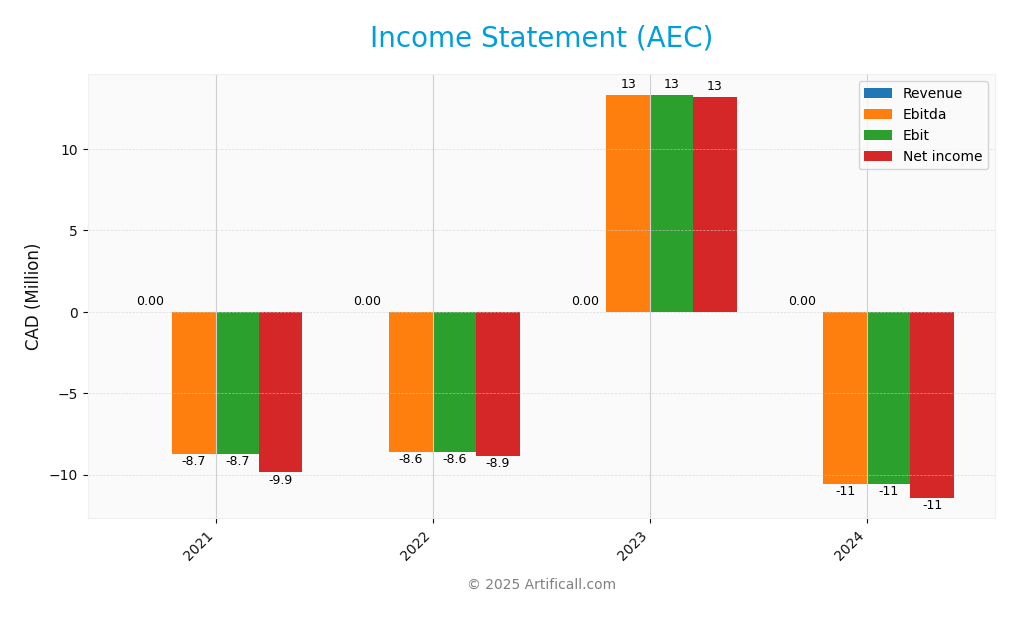

The following table presents Anfield Energy Inc.’s income statement highlights over the past four fiscal years, showcasing key financial metrics essential for evaluating the company’s performance.

| Financial Metric | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Revenue | 0 | 0 | 0 | 0 |

| Cost of Revenue | 0 | 0 | 3.82K | 3.88K |

| Operating Expenses | 6.96M | 9.11M | 11.22M | 11.35M |

| Gross Profit | 0 | 0 | -3.82K | -3.88K |

| EBITDA | -8.73M | -8.58M | 13.32M | -10.58M |

| EBIT | -8.73M | -8.58M | 13.32M | -10.58M |

| Interest Expense | 1.14M | 0.28M | 0.14M | 0.86M |

| Net Income | -9.86M | -8.86M | 13.18M | -11.45M |

| EPS | -3.00 | -1.50 | 1.50 | -0.75 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2024-12-31 |

Interpretation of Income Statement

Over the four-year period, Anfield Energy Inc. has consistently reported zero revenue, with significant fluctuations in net income. Notably, in 2023, the company achieved a remarkable net income of 13.18M CAD, which sharply contrasted with the losses observed in previous years. However, 2024 saw a return to negative net income at -11.45M CAD, indicating potential challenges in sustaining profitability. Operating expenses have remained elevated, suggesting a lack of operational efficiency. Overall, while 2023 showcased an extraordinary performance, the decline in 2024 raises concerns about the company’s ability to maintain momentum going forward.

Financial Ratios

Below is a summary of key financial ratios for Anfield Energy Inc. over the last few fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 0% | 0% | 0% | 0% |

| ROE | – | – | 26.57% | -25.51% |

| ROIC | – | 0% | -15.05% | -14.53% |

| P/E | -214.17 | -5.28 | 5.38 | -8.57 |

| P/B | -4.23 | 3.18 | 1.43 | 2.19 |

| Current Ratio | 0.22 | 19.99 | 6.51 | 0.32 |

| Quick Ratio | 0.22 | 19.99 | 6.51 | 0.32 |

| D/E | 0 | 0 | 0.05 | 0.21 |

| Debt-to-Assets | 0% | 0% | 3.59% | 11.60% |

| Interest Coverage | 0 | 0 | -79.69 | -13.18 |

| Asset Turnover | 0 | 0 | 0 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Anfield Energy Inc. (AEC) using its 2024 financial ratios reveals significant concerns regarding its financial health. The current ratio stands at 0.318, indicating poor liquidity, as it is below the ideal benchmark of 1.0. Similarly, the quick ratio mirrors this weakness. The solvency ratio is negative at -0.326, suggesting that AEC has more liabilities than assets, which raises serious red flags for solvency. Profitability ratios are dismal, with net profit margin at 0, indicating no profit generation. Additionally, the company’s debt ratios, such as debt-to-assets at 0.116, show some financial leverage, but the interest coverage ratio of -13.185 signals potential difficulties in meeting interest obligations. Overall, the ratios depict a weak financial position with multiple areas of concern.

Evolution of Financial Ratios

Over the past five years, AEC’s financial ratios have shown a dramatic decline. The current ratio fell from approximately 20.0 in 2022 to 0.318 in 2024, reflecting a significant deterioration in liquidity. Meanwhile, the solvency ratio shifted from positive to negative, indicating increasing financial distress.

Distribution Policy

Anfield Energy Inc. (AEC) does not pay dividends, reflecting its strategic focus on reinvestment for growth during a high-growth phase. The company has not achieved positive net income, which limits its ability to distribute profits to shareholders. While AEC engages in share buybacks, these actions may not necessarily support long-term value creation given the current financial pressures. Caution is warranted as this strategy could impact future capital allocation.

Sector Analysis

Anfield Energy Inc. operates within the Industrial Materials sector, focusing on the exploration and production of vanadium, uranium, and gold. It faces competition from various mining companies while leveraging its specialized expertise.

Strategic Positioning

Anfield Energy Inc. (AEC) has carved out a niche in the industrial materials sector, primarily focusing on the exploration and production of vanadium, uranium, and gold. Currently, it holds a market cap of approximately 101M, with a stock price of 6.44. Although the company has potential due to rising commodity prices, it faces competitive pressure from larger industry players and technological advancements in mining techniques. The volatility of its stock, indicated by a beta of 2.47, suggests a higher risk profile, making it essential for investors to weigh potential rewards against inherent risks.

Key Products

Anfield Energy Inc. is engaged in the exploration and production of various mineral properties. Below is a table highlighting their key products:

| Product | Description |

|---|---|

| Vanadium | A strategic metal used primarily in steel production and energy storage systems. |

| Uranium | Focused on exploration for uranium deposits, vital for nuclear energy generation. |

| Gold | Engaged in the evaluation and development of gold resources in its mining portfolio. |

Main Competitors

No verified competitors were identified from available data. Anfield Energy Inc. holds a market capitalization of approximately 101M and operates within the industrial materials sector, focusing on the exploration and production of mineral properties, primarily vanadium, uranium, and gold. Given its niche in the exploration of these minerals in the United States, Anfield Energy is positioned as a specialized player, albeit in a competitive landscape that includes larger, more established firms in the same sector.

Competitive Advantages

Anfield Energy Inc. (AEC) exhibits several competitive advantages in the exploration and production of mineral properties, particularly in vanadium, uranium, and gold. Its strong position in the Basic Materials sector, coupled with a market cap of approximately $101M, provides a solid foundation for growth. The company’s commitment to innovation and sustainability opens up opportunities in emerging markets for clean energy solutions. As demand for these critical resources increases, Anfield’s strategic initiatives and potential new product developments could significantly enhance its market presence and profitability in the coming years.

SWOT Analysis

This SWOT analysis provides a structured overview of Anfield Energy Inc. (AEC) to help inform investment decisions.

Strengths

- Strong market position

- Diverse mineral exploration

- Experienced management team

Weaknesses

- Low employee count

- No recent dividends

- High beta volatility

Opportunities

- Growing demand for vanadium

- Expansion into uranium sector

- Potential for strategic partnerships

Threats

- Regulatory risks

- Market competition

- Commodity price fluctuations

The overall SWOT assessment indicates that while Anfield Energy has notable strengths and opportunities, it must navigate significant weaknesses and threats. A balanced strategy focusing on leveraging strengths while addressing vulnerabilities is essential for sustainable growth and risk management.

Stock Analysis

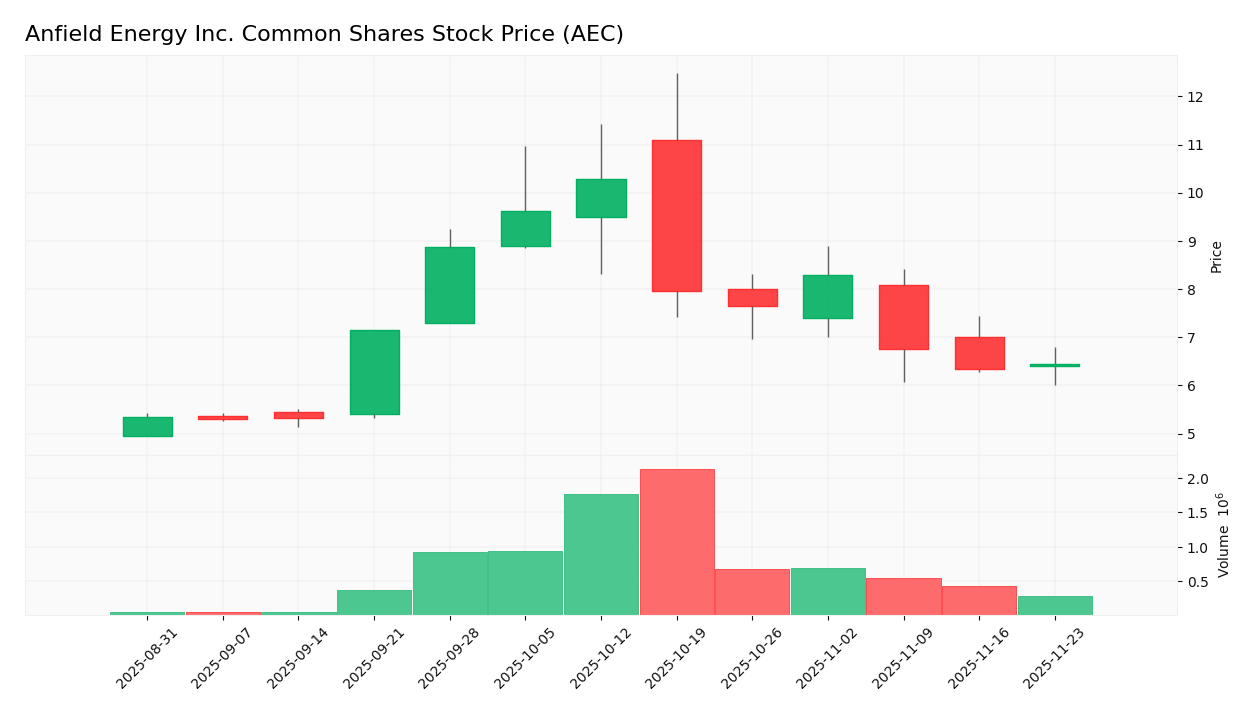

In the past year, Anfield Energy Inc. (AEC) has demonstrated significant price movements, culminating in a notable bullish trend that reflects investor confidence and market dynamics.

Trend Analysis

Over the past year, AEC has experienced a price change of +20.37%. This percentage change indicates a bullish trend, despite a noted deceleration in acceleration over the same period. The stock has seen highs of 10.29 and lows of 5.3, suggesting a healthy trading range. The standard deviation of 1.57 indicates moderate volatility, which is typical for stocks within this sector.

Volume Analysis

In analyzing trading volumes over the last three months, we observe that total volume reached approximately 8.93M, with buyer volume at 5.04M and seller volume at 3.85M. This data suggests that market activity has been slightly buyer-driven, as indicated by a buyer dominance percentage of 56.7%. Furthermore, the volume trend is increasing, reflecting positive investor sentiment and heightened market participation.

Analyst Opinions

Recent analyst evaluations for Anfield Energy Inc. (AEC) suggest a cautious stance. The overall rating stands at “C,” indicating a hold recommendation. Analysts cite concerns about the company’s weak performance in key financial metrics, including return on equity and assets, which scored low at 1. However, the price-to-book ratio received a favorable score of 5, suggesting potential value. Given these mixed signals, the consensus leans towards holding rather than buying or selling at this time.

Stock Grades

No verified stock grades were available from recognized analysts for Anfield Energy Inc. (AEC). This lack of reliable grading data suggests caution for investors considering this stock, although it may still have potential based on its market position or other qualitative factors.

Target Prices

No verified target price data is available from recognized analysts for Anfield Energy Inc. This indicates a lack of consensus in the market regarding the stock’s future performance, suggesting caution for potential investors.

Consumer Opinions

Consumer sentiment surrounding Anfield Energy Inc. (AEC) reveals a mix of enthusiasm and concern, reflecting the complexities of the energy market.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative approach to energy solutions.” | “Concerns about long-term sustainability.” |

| “Strong commitment to community engagement.” | “Stock volatility has been worrying.” |

| “Impressive growth in renewable projects.” | “Customer service needs improvement.” |

Overall, consumer feedback highlights Anfield Energy’s innovative strategies and community involvement as key strengths, while concerns about stock volatility and customer service are recurring weaknesses.

Risk Analysis

In assessing Anfield Energy Inc. (Ticker: AEC), it’s vital to understand the potential risks that could affect investment outcomes. The following table outlines key risks associated with this company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in energy prices affecting revenue. | High | High |

| Regulatory Risk | Changes in environmental regulations impacting operations. | Medium | High |

| Operational Risk | Risks related to the efficiency of energy production. | Medium | Medium |

| Financial Risk | Volatility in cash flow and access to capital. | High | Medium |

| Geopolitical Risk | Political instability in regions of operation. | Low | High |

The most significant risks for AEC are market and regulatory risks, given the current volatility in energy markets and ongoing regulatory scrutiny, which could profoundly impact the company’s financial performance.

Should You Buy Anfield Energy Inc. Common Shares?

Anfield Energy Inc. currently shows a negative net margin of -100%, indicating unprofitability. The company has a total debt of approximately 6.62M CAD against total equity of about 87.54M CAD, resulting in a low debt-to-equity ratio of 0.206. The overall rating for Anfield Energy is C, suggesting a cautious outlook.

Favorable signals There are no favorable signals present based on the provided data.

Unfavorable signals The company has a negative net margin of -100%, which suggests unprofitability. Additionally, the long-term trend is classified as bullish, but the acceleration status indicates deceleration, which may imply potential weakness in momentum. Furthermore, the recent seller volume of 3.84M exceeds the buyer volume of 5.04M, indicating a lack of buyer interest in the stock.

Conclusion Considering the presence of unfavorable signals, it might be prudent to wait for more positive indicators before making any investment decisions regarding Anfield Energy Inc.

Additional Resources

- Anfield Energy Inc. Reports Financial Activities and Strategic Developments Amid Positive Uranium Market Trends – TipRanks (Nov 14, 2025)

- Anfield Receives Approval to List on NASDAQ – GlobeNewswire (Sep 17, 2025)

- enCore Energy Announces Filing of Early Warning Report – PR Newswire (Jun 20, 2025)

- Uranium Energy Corp Increases Holdings in Anfield Energy – Stock Titan (Jun 20, 2025)

- Anfield Energy Prepares for NASDAQ Listing with Share Consolidation – TipRanks (Jul 30, 2025)

For more information about Anfield Energy Inc. Common Shares, please visit the official website: anfieldenergy.com